Hacksaw AB

Great business with a challenging future

Hacksaw Gaming is an RNG game supplier to online casinos. As an iGaming industry outsider, I first got my attention on Hacksaw when Evolution’s Todd Haushalter spoke admirably of the studio in a conversation.

The company is publicly listing today. You just need to have a quick look at its prospectus, and Hacksaw’s basic financials scream for further attention.

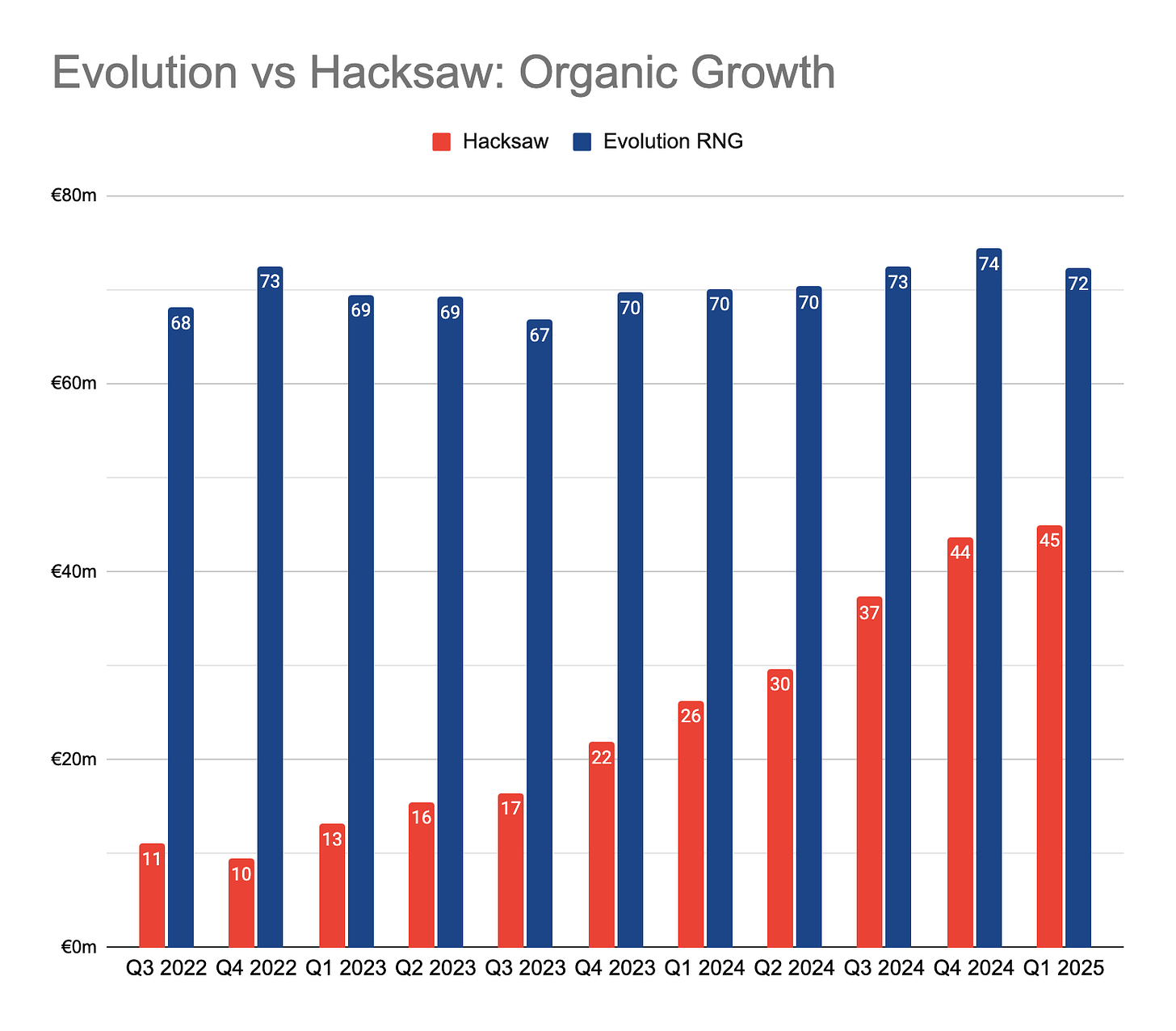

Hacksaw’s quarterly growth definitely reminds of a younger Evolution AB.

Moreover, Hacksaw manages this growth at higher margins than Evolution ever had. Hacksaw operates at an EBITDA margin of 86% (Evolution’s all-time-high: 71%, now at 66%), an operating margin of 84% (EVO ATH: 64%, now 58%) and net income margin of 80% (EVO ATH: 60%, now 49%).

Regardless of sector, there aren’t many companies in the world with such figures.

How to surpass a clumsy giant

While Evolution was on an acquisition spree of RNG studios that peaked by the time of their acquisitions, Hacksaw was operating on a beast mode developing its tech platform and games portfolio.

The resulting growth (or lack thereof) after the completion of Evolution’s acquisitions tells you which approach has succeeded.

Hacksaw has already reached more than 60% of Evolution’s RNG revenues. How long will it take before it’s the bigger RNG supplier?

Business Model

Hacksaw generates 96% of its revenues from slot games, with the rest coming from niche products of instant win games and scratch cards.

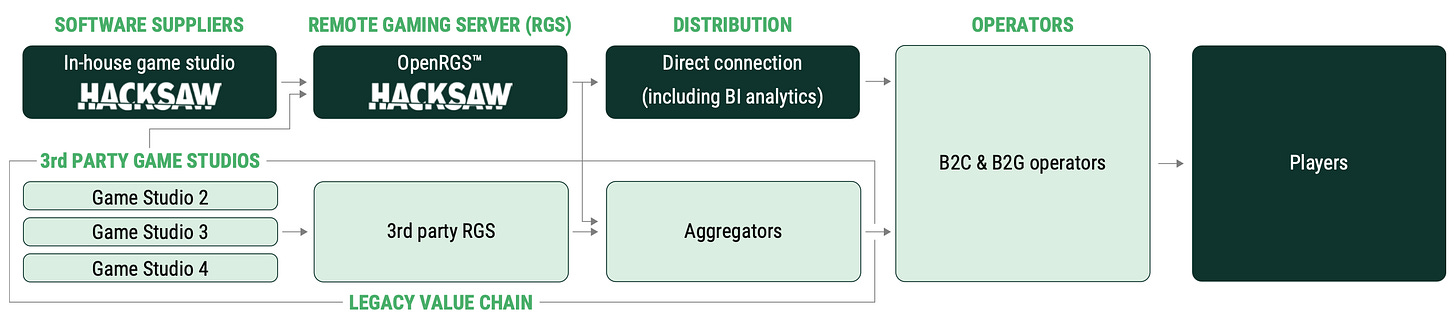

It is impossible to understand Hacksaw’s story without mentioning RGS, its tech platform. The company seems to have operated with a great engineering discipline and centralized all of its game development on top of a common development library, runtime environment and distribution platform. For the Evolution shareholders out there, RGS is akin to One-Stop-Shop on steroids. Unlike OSS, RGS does not only unify integration for the operators but it also unifies game development, as such that an older game can be easily updated with a newly developed feature or customized to new regulations thanks to a common standard tech platform. In its prospectus, Hacksaw defines itself as “first and foremost a [sic] RGS platform as opposed to a game studio”.

Segments

Hacksaw’s sales come in two segments:

In-house game studios (the company operates two internal studios) that develop games on top of RGS and earn a take-rate from the GGR they generate for the online casino operators. On average, this segment is launching 4 new games per month and generates 95% of Hacksaw’s system GGR (and a similar majority of its revenues).

OpenRGS, where third-party game studios develop and release games using Hacksaw’s signature tech platform (currently one game per month). Hacksaw earns a commission from the revenues these third-party games generate. (Take rate on take rate, if you will.)

Customers

Hacksaw’s games reach 9 million players via 3,000+ operator brands, 1,000+ of which connect via aggregators.

Hacksaw’s top-5 customer concentration seems to be trending down towards 51%, while Evolution’s (with 11 times as much sales) concentration is rising to 46%.

Games

With a small team of less than 80 developers, Hacksaw has been releasing a commendable amount of games compared to the much larger Evolution.

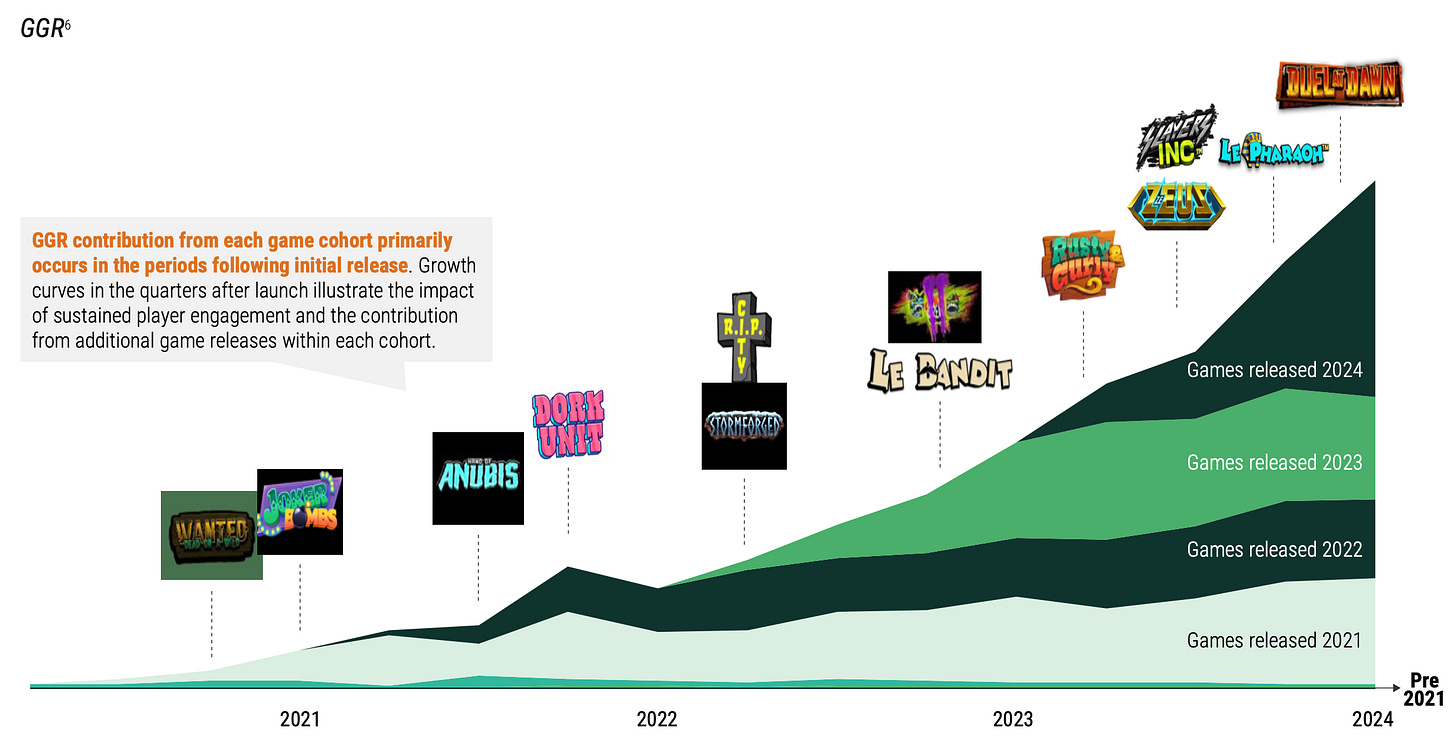

But, the real difference in game quality shows itself in the below cohort chart of Hacksaw’s game releases.

Each generation’s successful games seem to retain their activity base for years (with no sign of a limit on their lifetime yet), while new successful games keep coming out with additional and durable revenue streams. (I can’t help but wonder how such a graph would look for Evolution’s RNG games, where the company keeps coming out with hundreds of games without a growth in the overall segment.)

By measuring the above chart, we can also have a guess on how Hacksaw’s “mid- to high single digits” take rate may have evolved.

As customers’ GGRs grow substantially, it is common for suppliers to apply discounted take rates. It seems that Hacksaw only needed a slight reduction and kept its take rate rather steady over the last few years.

The company’s top game accounted for 14% of bet volume, and the top-5 games accounted for 38%.

Profitability

There are a few factors that explain Hacksaw’s unusually high margins, compared to Evolution as a yardstick.

Personnel

Live Casino games and RNG games come with a variety of different advantages over each other. One obvious advantage of running an RNG game studio is that you don’t need a lot of employees and, therefore, fixed costs. An RNG game needs to be developed once and doesn’t need dedicated employees during its lifetime, whereas a Live Casino game can only be run by a team of studio personnel.

Hacksaw builds its average game with a team of just 2 developers in 22 weeks. Once a game is developed, there isn’t any significant cost to keep it running. For an externally developed game, any commission comes as pure profits.

This helps explain how Hacksaw generates 12% of Evolution’s profits with an organization that is less than 1% of Evolution’s size.

Re-investment needs

RNG games’ lack of physical studio means that Hacksaw does not need to re-invest significantly. Any capital investment is mostly just capitalized developer work time used to build the IP. So, Hacksaw’s CapEx percentage of revenues is almost at half of Evolutions’s.

Furthermore, management claims that all CapEx investments are made for expansion rather than maintenance. How many companies do you know where Operating Cash Flow (less leases thanks to IFRS) is equal to Free Cash Flow?

Taxes

Despite being registered in Sweden, Hacksaw is operationally based in Malta and guides for a 5% tax rate, a level Evolution used to enjoy.

Although I am not a tax expert, I assume that Hacksaw may continue to keep such low tax rates as long as it doesn’t cross the 750 million euro revenue threshold of Pillar II (more than 4x from today’s levels).

Cash

High-margin and asset-light, Hacksaw has been a cash generation machine for its shareholders.

Outlook

The company sees many growth opportunities:

Successful game releases (thanks to its “push-and-pull” player loyalty strategy)

RGS flywheel: more games and better analytics → more value for operators → more distribution → more third-party developers

Expand game portfolio from signature high-volatility to medium/low volatility games

Acquire new operators as customers (Target: 10 new customer/jurisdiction per month)

Regulated market openings

New verticals (lotteries & live casino)

Geographically, North America seems to be regarded as the largest growth market for slots.

Finally, Hacksaw sets ambitious financial targets for the 3+ years horizon:

Revenue growth over 30%

Operating margins above 80%

75% of profits returned as dividends and buybacks

Risks

Immediate Risk: Slowdown

Hacksaw’s growth seems to have hit a plateau in the first 2 months of its current quarter.

If revenues end up growing “45-50 percent year-on-year” in Q2 2025 as management expects, Hacksaw may be currently facing a quarter-on-quarter revenue decline.

This obviously makes the timing of the IPO more curious.

Medium-term Risk: Regulatory Backlash

Hacksaw geo-blocks US-sanctioned countries. Moreover, the company also has its Chief Compliance Officer and its Chief Legal Officer report directly to the CEO. (A hierarchy that Evolution has only recently established.)

However, Hacksaw may have some regulatory oversights that have caused Evolution plenty of headaches in the recent past.

Due Diligence

Although Hacksaw does due diligence checks on its direct customers, the company seems to avoid the responsibility of checking its indirect customers.

Hacksaw already estimates that 1/3rd of its revenues come from aggregators who re-sell Hacksaw games to other operators. As Hacksaw’s size and visibility increases, I think that it is likely that the company will discover that not checking its indirect operators is not viable anymore.

I also found it curious that the company’s discussion of due-diligence criteria do not mention the operators’ licensing status, as far as I can tell.

Black Markets

Hacksaw estimates that only 12% of its revenue come from regulated markets via locally licensed operators. This figure is not directly comparable to Evolution’s share of regulated markets (currently at 45%), since Evolution counts all revenues from regulated jurisdictions including not locally licensed operators into their figure. (Hacksaw counts just the white market, while Evolution counts white and black markets combined.)

However, given that North America makes up 15% and Europe makes up 55% of Hacksaw’s revenues, Hacksaw may have substantial dependence on local black markets.

Again, as Hacksaw’s size and visibility increases, the company may find itself in the crosshairs of regulators, just as Evolution recently did.

Long-term Risk: Ultra-Commoditization

Unlike in Live Casino, there are already tens of thousands of slot games in the market.

Some commoditization of slot games could be helpful for Hacksaw, as it would make its efficient tech platform a bigger difference maker for its internal games as well as for third-party licensees. However, beyond a certain point, the future trends could challenge Hacksaw’s profit growth:

Insourcing: Many big operators already have their in-house slot studios.

Piracy: Unlike Live Casino, it is technically much simpler and already prevalent to pirate slot games. If and when Hacksaw’s games present a big enough profit pool in an unregulated market, what is going to stop the piracy?

Generative AI

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thank you

Interesting work. Well done.

Do you see more long term opportunities in this one than in Evolution?

Hi Abi, I was checking on Hacksaw and today looked a bit more, a little update,

- Q2 increased 53% YOY and Q3 increased +39% YOY. You were mentioning about Q2 slowdown but it went well it seems.

- I see a slight margin compression, but the company said, "primarily relates to the success of third-party studios and increased commercial activities.". OpenRGS is growing.

- Hacksaw’s total game portfolio is now 268 titles, a 46% increase from the previous year. During Q3 2025, the company launched 12 new in-house developed games and 15 titles from third-party studios.

- They are trying to grow more on regulated markets. After Q2 they have a Growing US Footprint and also Latin America.

- They invested in Kitsune Studios, but with an option to increase its stake over time. Instead of making a massive, speculative acquisition (like Evolution's deals), Hacksaw goes with a caution.