Evolution's Q3 2025: Quarter in Review

End of the beginning

“Evolution remains the product leader in Live Casino and its sales have just declined year-on-year for the first time. Guess the year!”

Evolution has reached a point in its growth story that I wouldn’t have originally expected it to reach before late 2030s at the earliest.

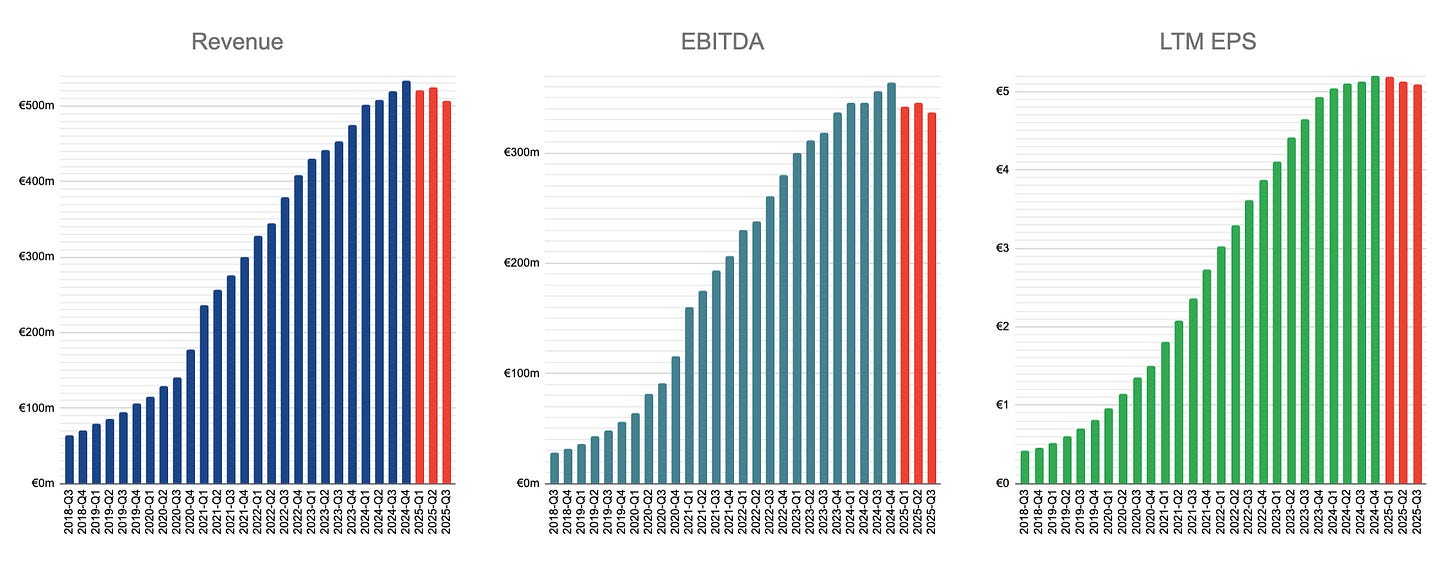

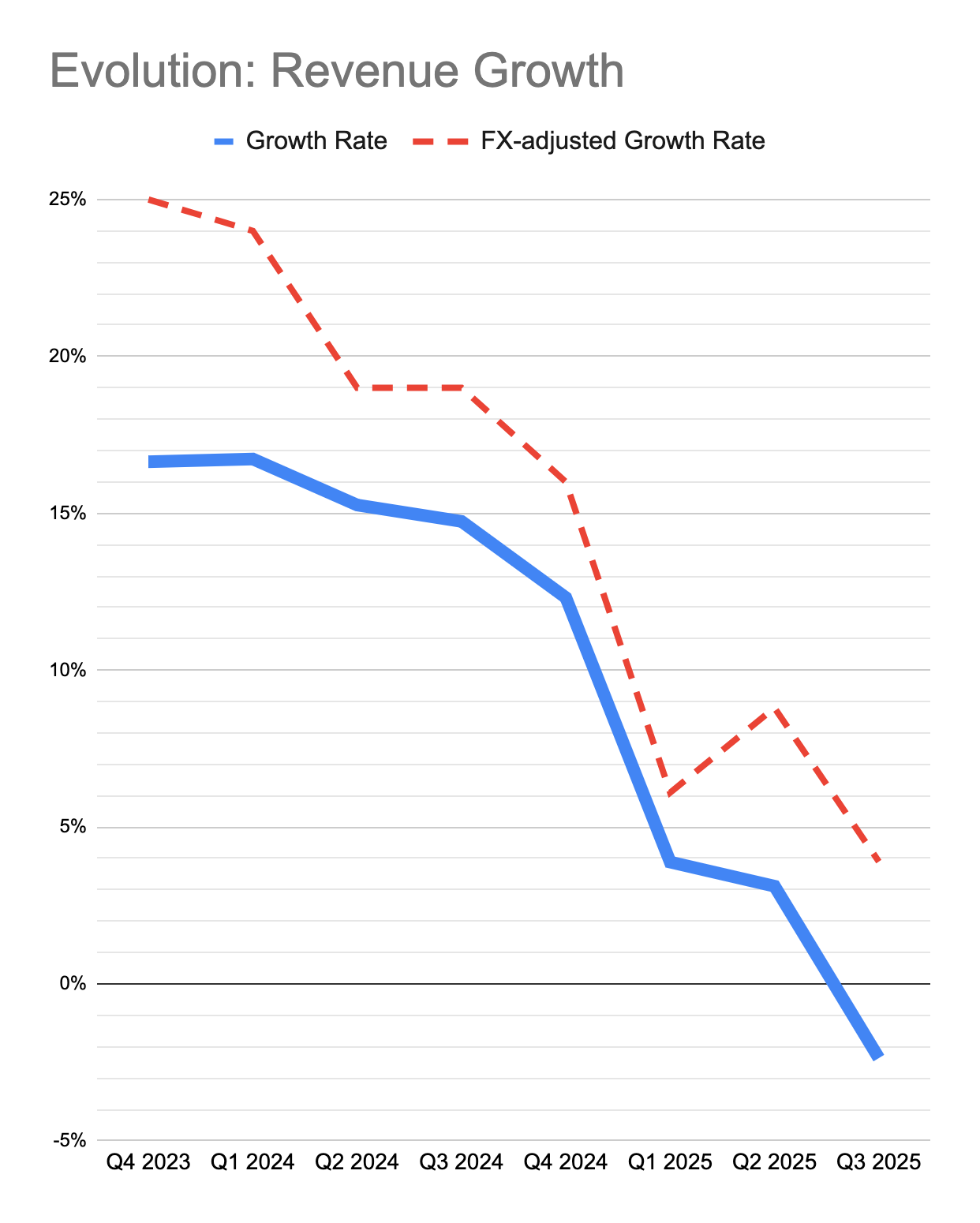

Quarter in Charts

For the quarterly results, I will mostly let the charts and quotes speak for themselves.

🚩

“For the first time ever, our RNG offering is outperforming Live in terms of growth, a great achievement from our slots studios” — CEO Carlesund

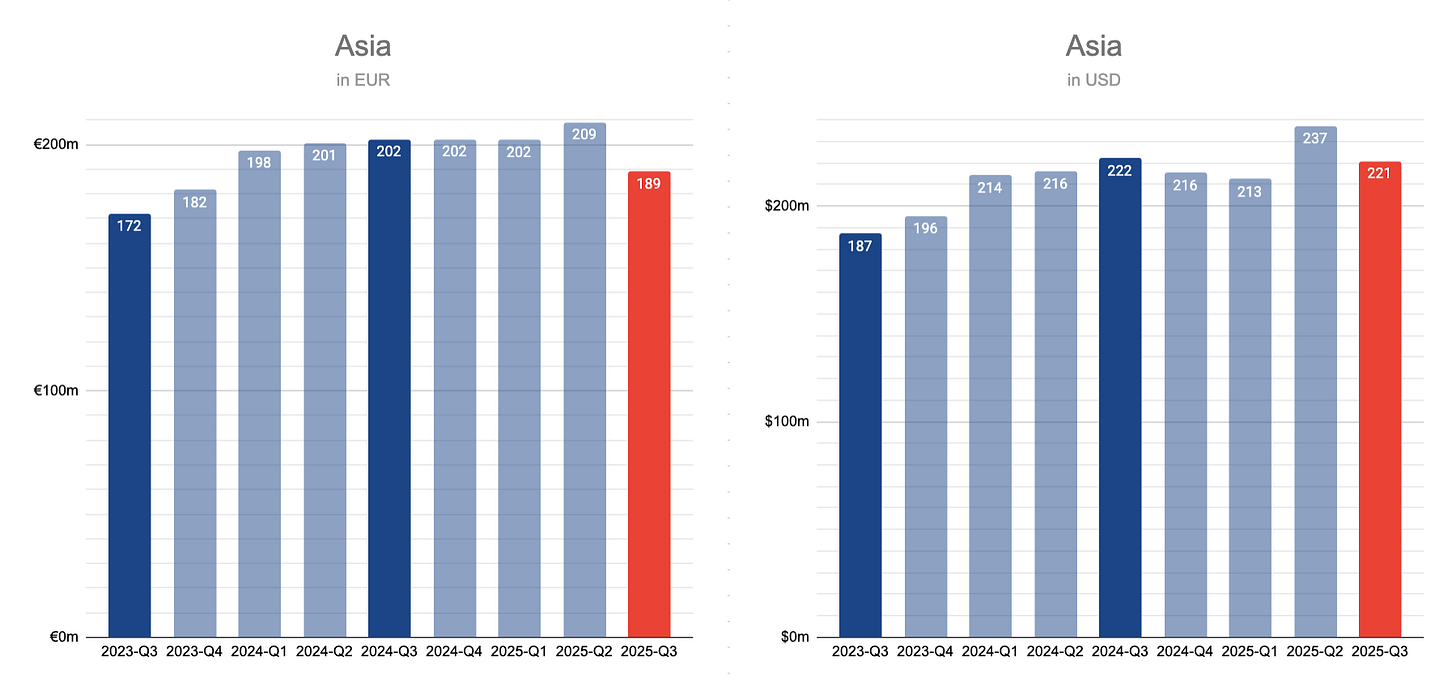

Geographies

Asia

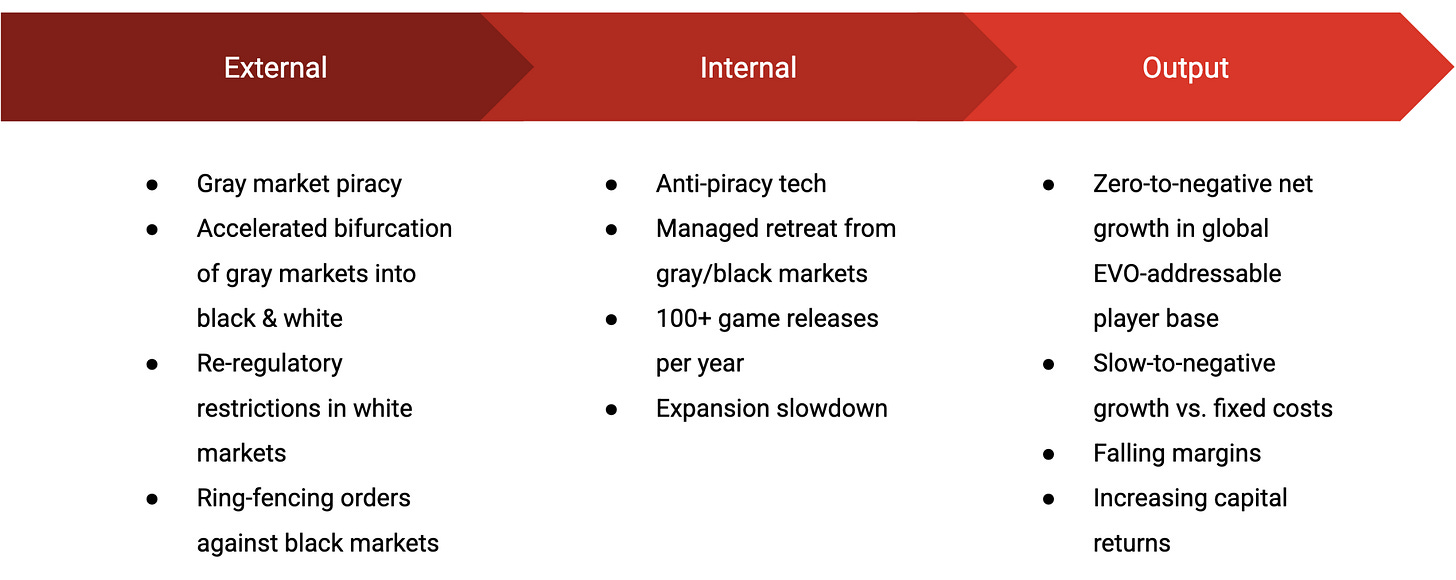

Unstoppable piracy and the India ban contributed to the most drastic quarter-on-quarter fall in Evolution’s primary market.

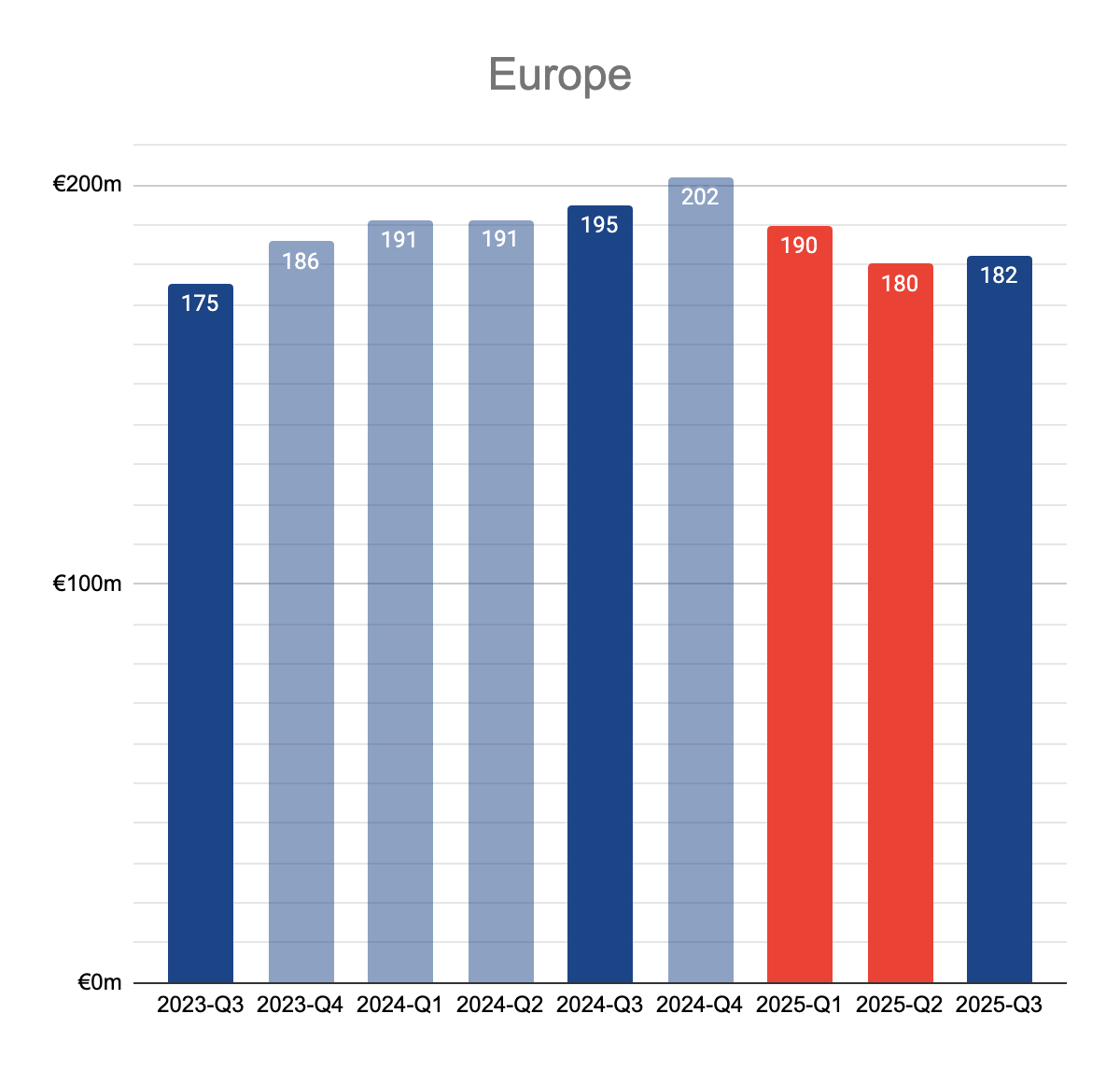

Europe

After ring-fencing the European regulated markets, the long-term headwind to Evolution remains the scenario where white markets get squeezed by governments and black markets receive the sustainable growth without Evolution.

🚩

“a clear positive” — CEO Carlesund

North America

Latam & Africa

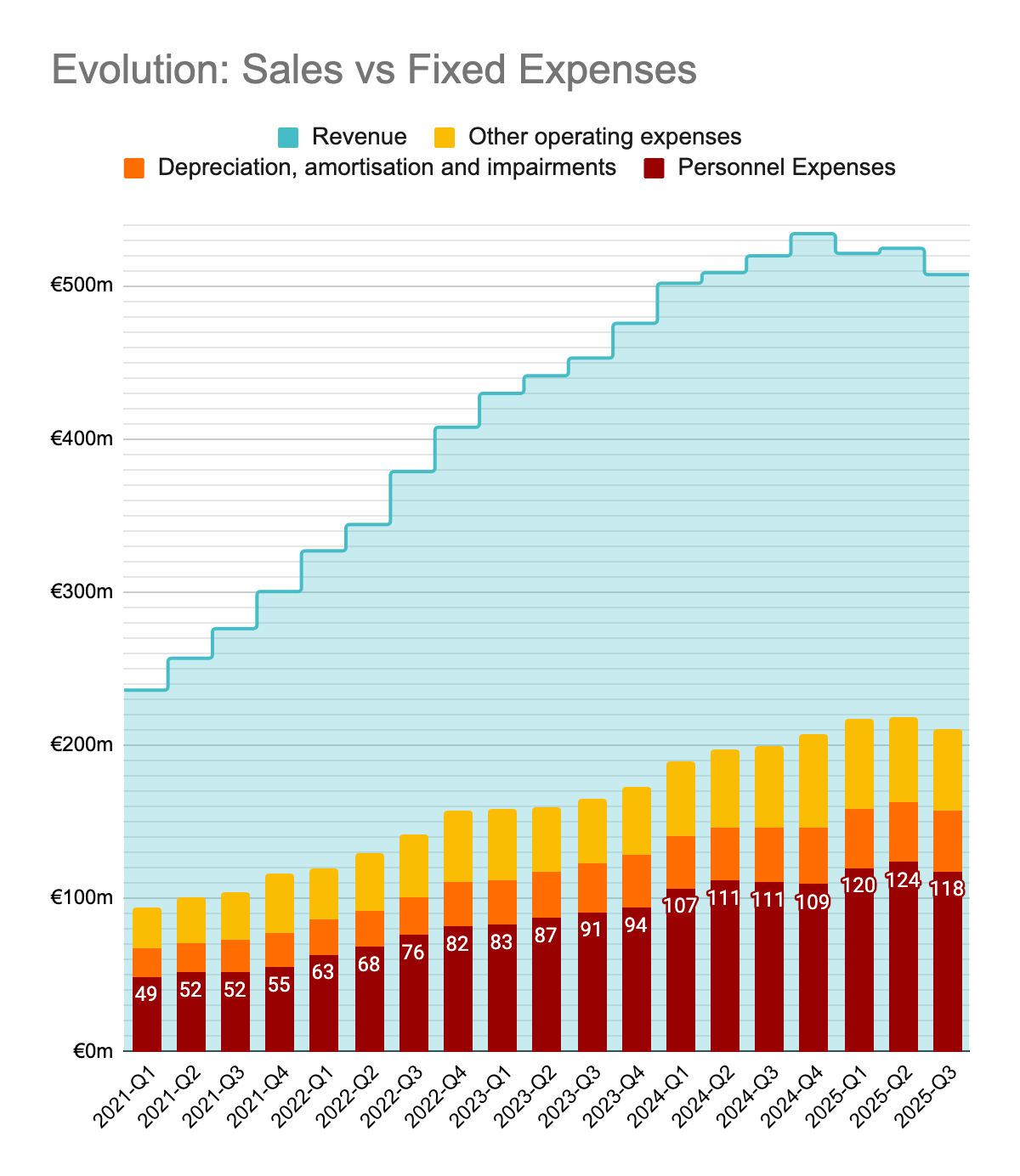

Management Capitulation

Evolution’s business model runs largely on fixed costs and non-recurring sales. What does this mean in practice? For any significant time period, the company commits to a base of fixed costs for a certain studio capacity and hopes that players will continue to return to its games and generate satisfying amounts of commission revenue for the company.

Among those fixed costs, personnel are the defining source of expenses, since Live Casino means employing actual human presenters 24/7.

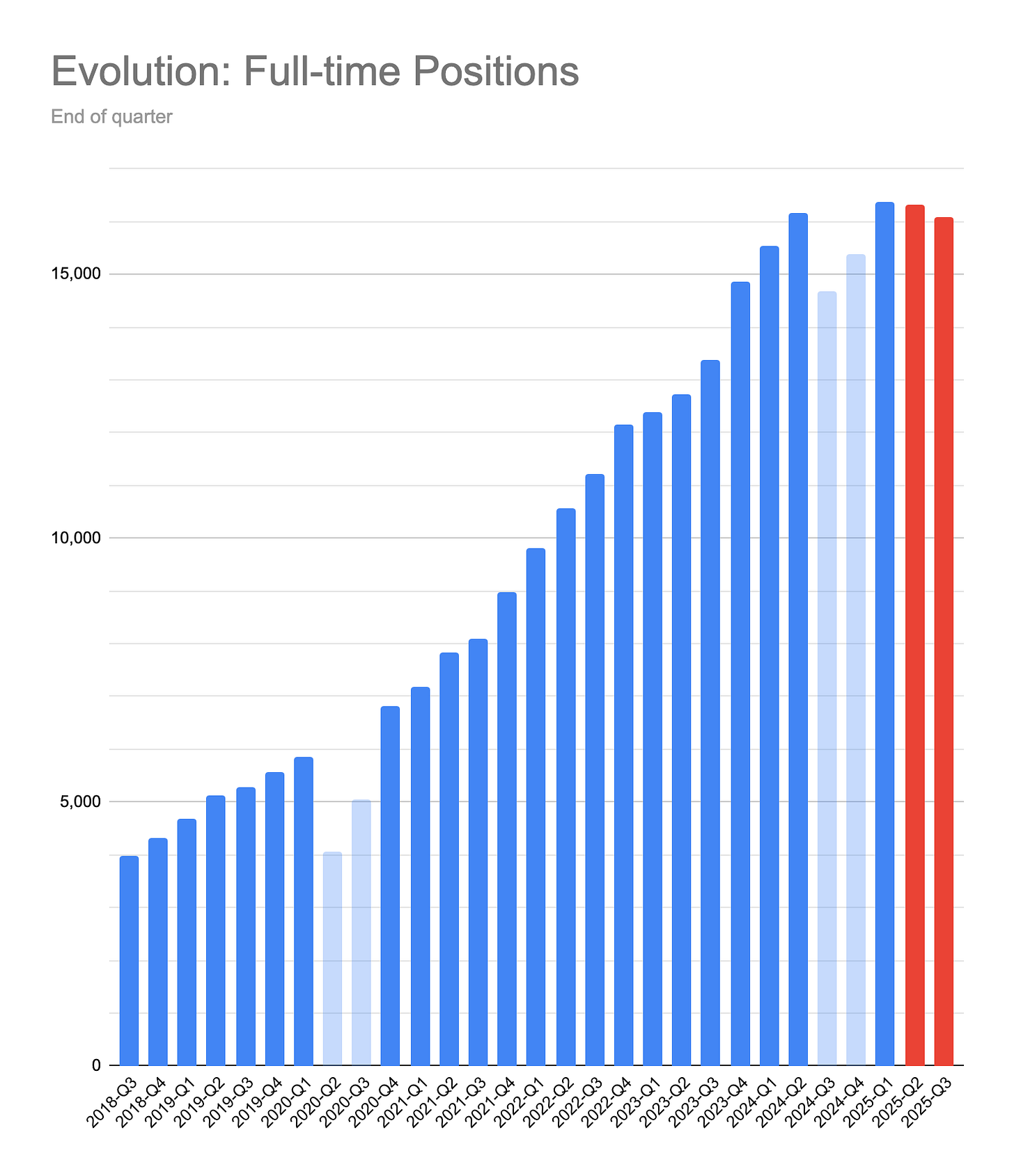

Until this year, Evolution reduced its workforce on two occasions, and never for the lack of growth:

in 2020 due to COVID measures in studios

in 2024 due to the labor strike in Georgia

So, this quarter marks the saddening occasion that the company committed to a downsized workforce for the first time, apparently as management capitulated to an outlook of low-to-negative growth.

In fact, in terms of internal job positions, the downsizing was in effect for the last two quarters.

“We don’t hire unless we grow” —CEO Carlesund

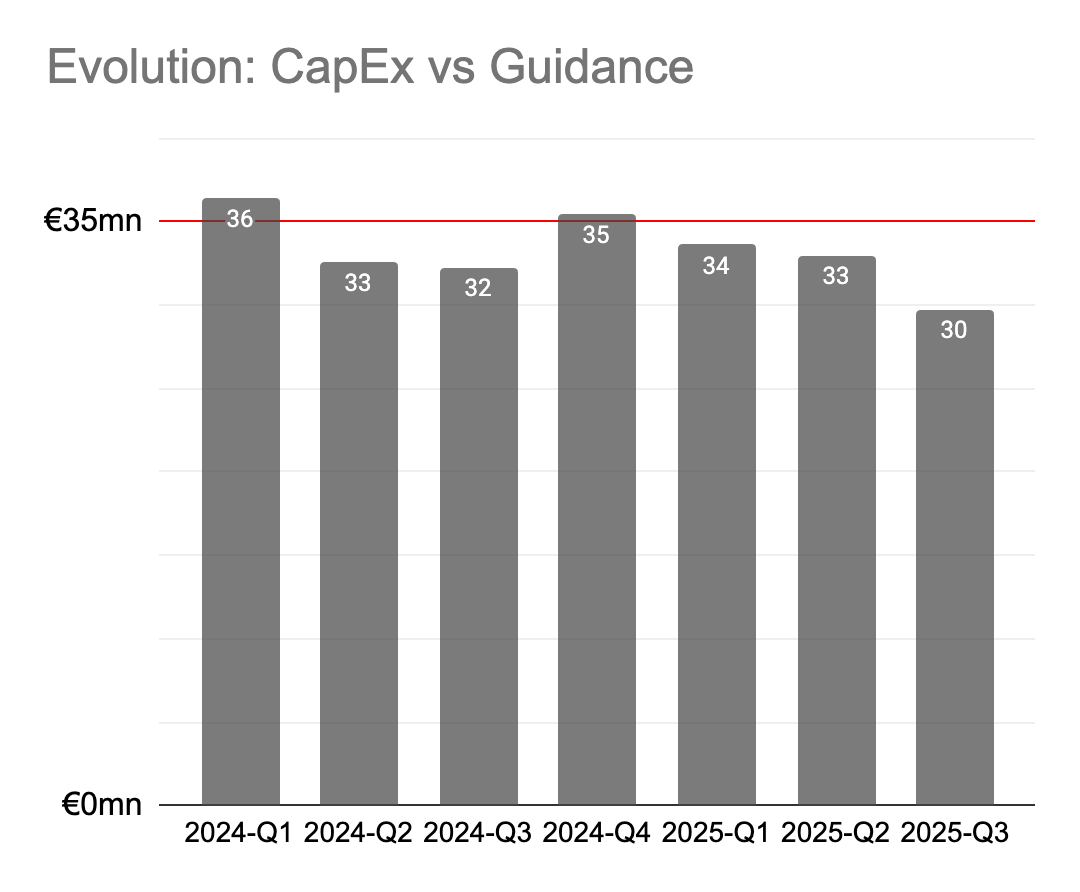

In parallel to the post-2023 slowdown, Evolution has been unable to reach its original €140 million CapEx guidance in both 2024 and, now, 2025. If anything, the investments seem to be in a slight downward trajectory.

Management seems to be prioritizing margins against (what in their eyes seems to be) an inevitable sales slowdown.

Outlook

Evolution has historically grown primarily by additions of new player cohorts rather than per-player spending trends. In the last couple of years, an apparent saturation of market demand following the post-COVID boom and the stricter regulatory trends are putting pressure on both of those factors.

Where to go from here?

From here, a shareholder could possibly expect two ways forward for a successful future:

An eventual re-acceleration of total iGaming demand in EVO-addressable markets

A re-thinking of the go-to-market strategy by the company

Personally, I believe that the second way is what one should expect from a proactive management. I have publicly shared some parts of my thoughts on how such a re-thinking could be realized.

Whatever the future may bring, one thing seems certain: The beginning phase of Evolution’s development is behind us. Time will tell how the company will manage its transition into a more mature business and market.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thanks for the great post. I was wondering what your plan is now. Planning to sell (a part of) your shares? To buy extra shares? Or to hold on to them? In case of the last option, what is the future plan? Is there a list of conditions EVO has to meet in 3 or 6 months, or else you’ll sell? What is the exit strategy? Looking for your opinion.

Pretty great article abi, I feel like I am in a toxic relationship with EVO. I cannot stop following it even though I do not own a share anymore :D

My comments,

- RNG makes up of ~15% of revenue, there is no moat there.

- They are in a "compliance trap", legal markets stagnate under regulation, while illegal markets keep growing.

- For piracy, the ceo said, "Someone is stealing our products". This is funny and it showed me how uncapable they are. Then later, he says, "caught a little bit off guard". Come on.

- I see contradiction in shareholder return. Share-buyback programme of up to €500 million + 50% dividend, when it comes to capex budget -> (~€140 million). It is acting less like a growth company but like a cash return vehicle.