Evolution's Q3 2024: Quarter in Review

Barriers to success

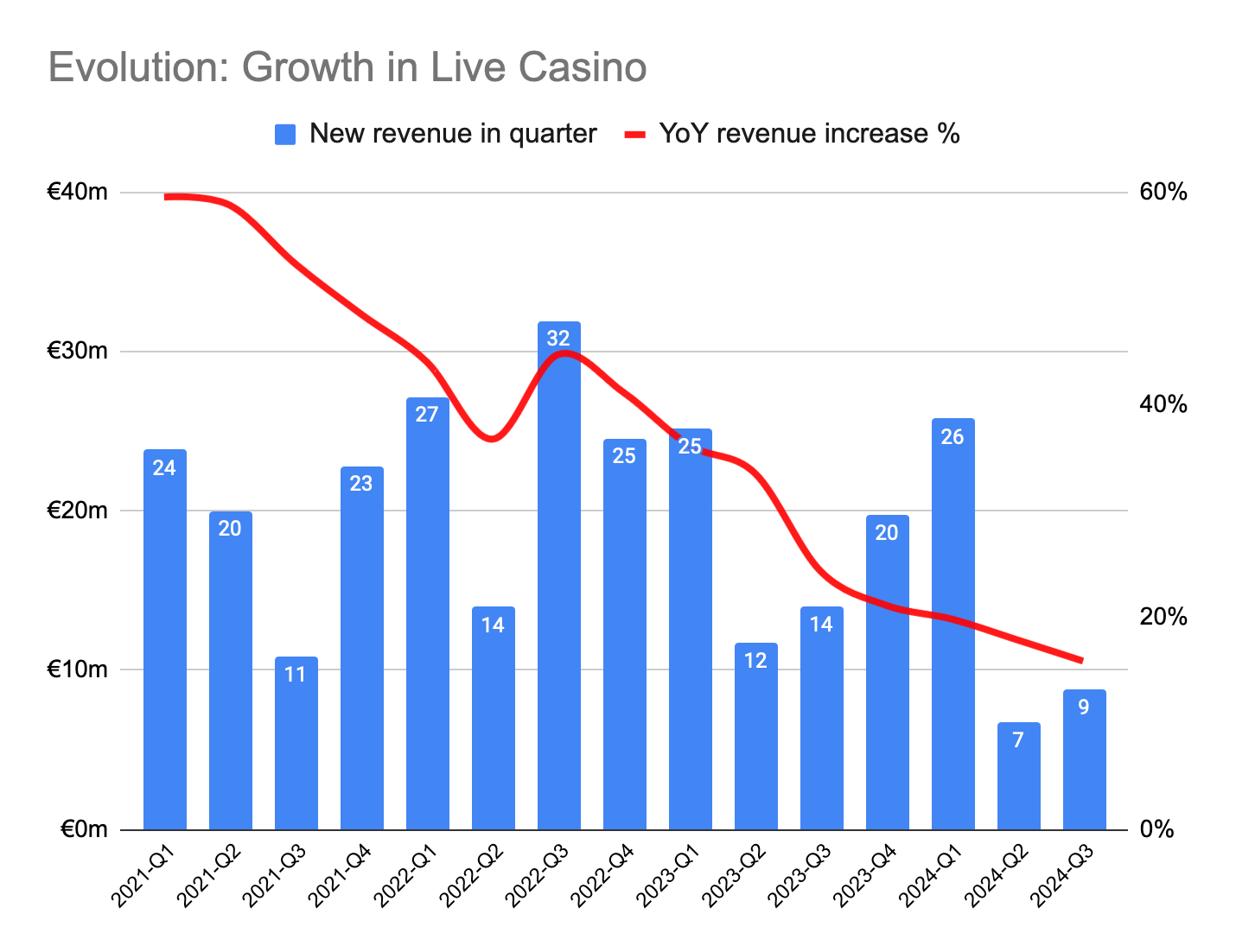

Evolution has been growing slowly lately. This has not been news for some time now.

What is newsworthy is the nominal amount and the makeup of it in the last 6 months:

Quarterly incremental revenue is the lowest in the post-COVID era. (So, this is not a case of large numbers begetting smaller relative growth rates.)

Asia is no longer the growth engine making up for the other markets.

If anything, Americas and Europe are making up for the disappointing Asia sales.

Slowdown clearly came from Live Casino and from Asia.

On the back of Nolimit City’s apparently successful game launches, Evolution’s RNG sales in the quarter actually came close to breaking free from the €70±3 million euro interval in which they have been languishing since the acquisitions.

In fact, for the first time in Evolution’s history, the organic RNG growth rate was higher than Live Casino on a quarter-on-quarter basis!

In its annual report, Evolution characterizes Live Casino as a low-barrier-to-entry but high-barrier-to-success business. Along with the countless other challenges it is successfully overcoming, the company seems to be facing two barriers before its growth can return to its prior pace.

Barrier #1: Asia Slowdown

After providing the majority of the organic growth in the past 3 years, Asia has become Evolution’s biggest market at the start of this year. However, compared to both the market’s size as well as the company’s established share in it, Evolution’s growth in Asia seems to have come to a sudden stop in the last 2 quarters.

In Q2, management described the situation as “nothing outside the usual cycles within the sector”. This sounded plausible, especially given the large nominal growth in the prior quarter.

In this quarter, however, the company detected large-scale cyberattacks, where unauthorized operators seem to have accessed and distributed Evolution games.

“Cyber criminals use advanced technology to intercept our video feed, manipulate it and redistribute it without authorization which leads to loss of revenue. These kinds of thefts will always be a problem for a leading and multi-site product but we have during the last [quarter] have seen a more advanced and significantly increased activity. We have deployed several measures to counteract these cyberattacks but it has negatively impacted the third quarter.”

— CEO Carlesund

“Simply put, someone else is selling our product.”

— CFO Kaplan

The announcement seems to imply that the attacks themselves prevented Evolution from generating revenue. But it may be important to note that both the earnings report as well as the prepared statements mention the negative impact both after the description of the attacks and the corresponding countermeasures.

I can’t help but wonder whether these “attacks” were sources of some revenues in the past and have just come to a halt. (Maybe via an authorized operator/aggregator giving some unauthorized operators access to Evolution’s betting system?) If this was partially a factor, government crackdowns on shady operators and payment facilitators earlier in the year could be having ripple effects on Evolution’s growth in the region.

Regardless of the exact nature of the attacks, it may take the some time for the insatiable demand in the market to find its way to Evolution.

“will be a couple of quarters before we are back to our earlier growth pattern”

— CEO Carlesund

This comeback is probably a question of when, not if. Nevertheless, Asia remains an opaque market where even the management may not have clear visibility.

Barrier #2: Post-Georgia Supply Bottleneck

In case you haven’t heard: Evolution has been having some labor disputes in its biggest studio for a little over a quarter.

“First of all, it’s not material in any way.”

— CEO Carlesund during the Q2 call, one week after the strike started

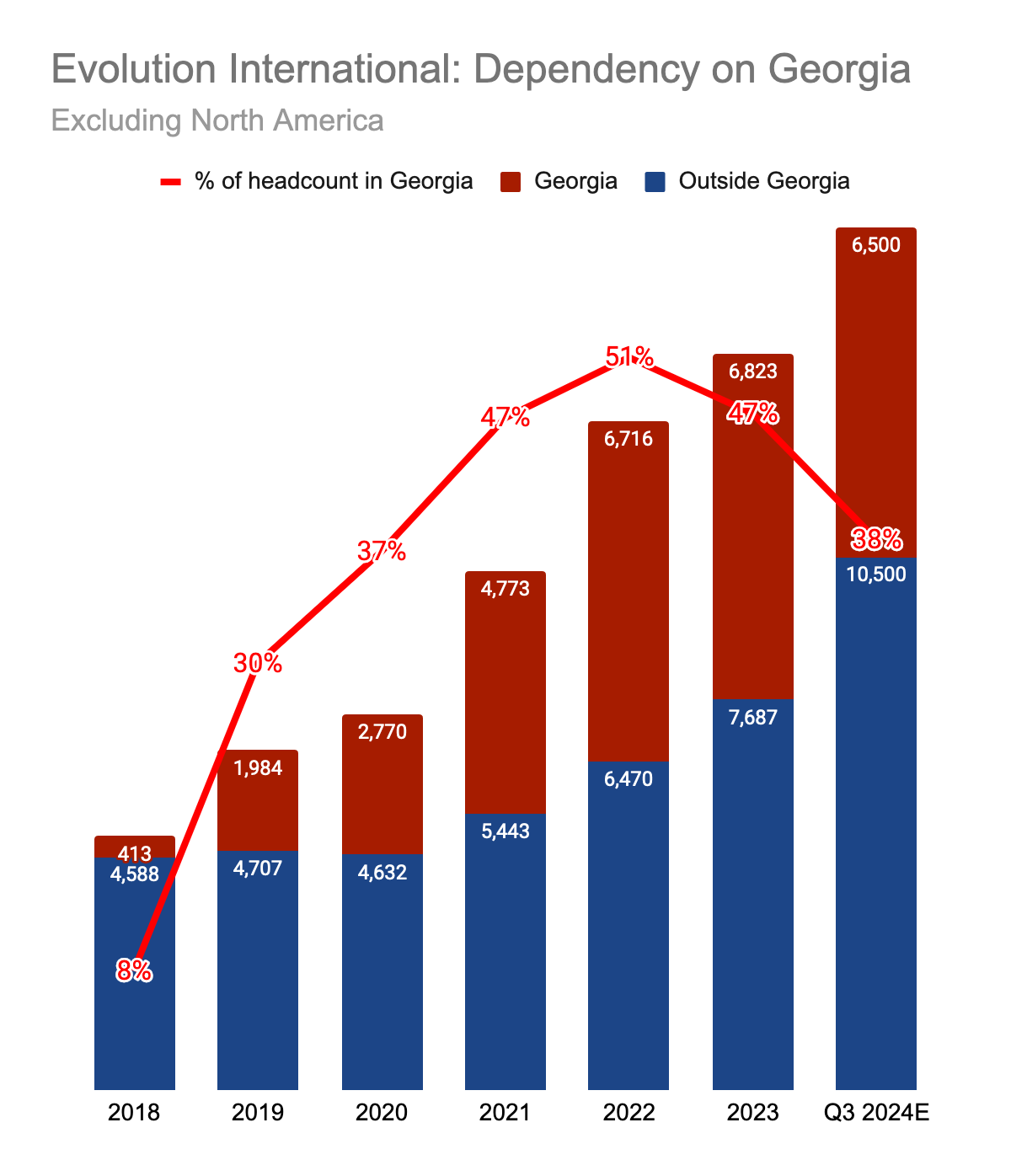

Thanks to its regulations, educated youth and low local wages, Georgia had been the backbone of Evolution’s studio expansion to serve the post-COVID boom in demand.

Thanks to the local subsidiary’s public records, we can see that the country provided a low-cost, high-margin international expansion opportunity in parallel to the company’s high-cost, low-margin North American expansion.

Evolution built a 600+ table megastudio with a tangible capex of just €30 million.

Let’s make a few back-of-the-envelope guesses to describe how good of a deal this has been: In its operating history, the Georgia studio probably handled hundreds of billions of euros of player bets (a multiple of the country’s GDP). From this volume, operators probably generated 10+ billion euros of gross gaming revenue. From these operators, Evolution probably earned a billion euros of operating profit. Not bad for a 30 million euro facility!

However, too much of any good thing can turn into a bad thing: Prior to the strike, Evolution depended on a single studio for half of its international capacity outside North America. Probably for a somewhat similar proportion of its profits, too.

And, so, the decision to downsize the Georgian studio in light of local instability naturally brings out a critical question: How will Evolution serve the already under-served international demand?

A temporary solution has been giving priority to tables serving high value players.

“When we lose table capacity in the network, as has been the case in the quarter due to development in Georgia, we will adjust delivery to serve the most important parts of the network. This reduces the number of bets placed but will not affect revenues to the same extent.”

— CEO Carlesund

Additionally, Evolution also seems to have made admirable progress in expanding and diversifying its international capacity during the year. In the last 3 quarters, the company may have increased its international workforce outside Georgia by a third.

Obviously, some of this international expansion comes from the increased pace of hiring for the new studio spaces in Latin America. But, it is notable that management stressed that the capacity in Latin America can be routed to other markets. As the company was so far mostly routing European capacity to its other regions, this is both a novelty and a natural result of its sophisticated network infrastructure.

The little big news

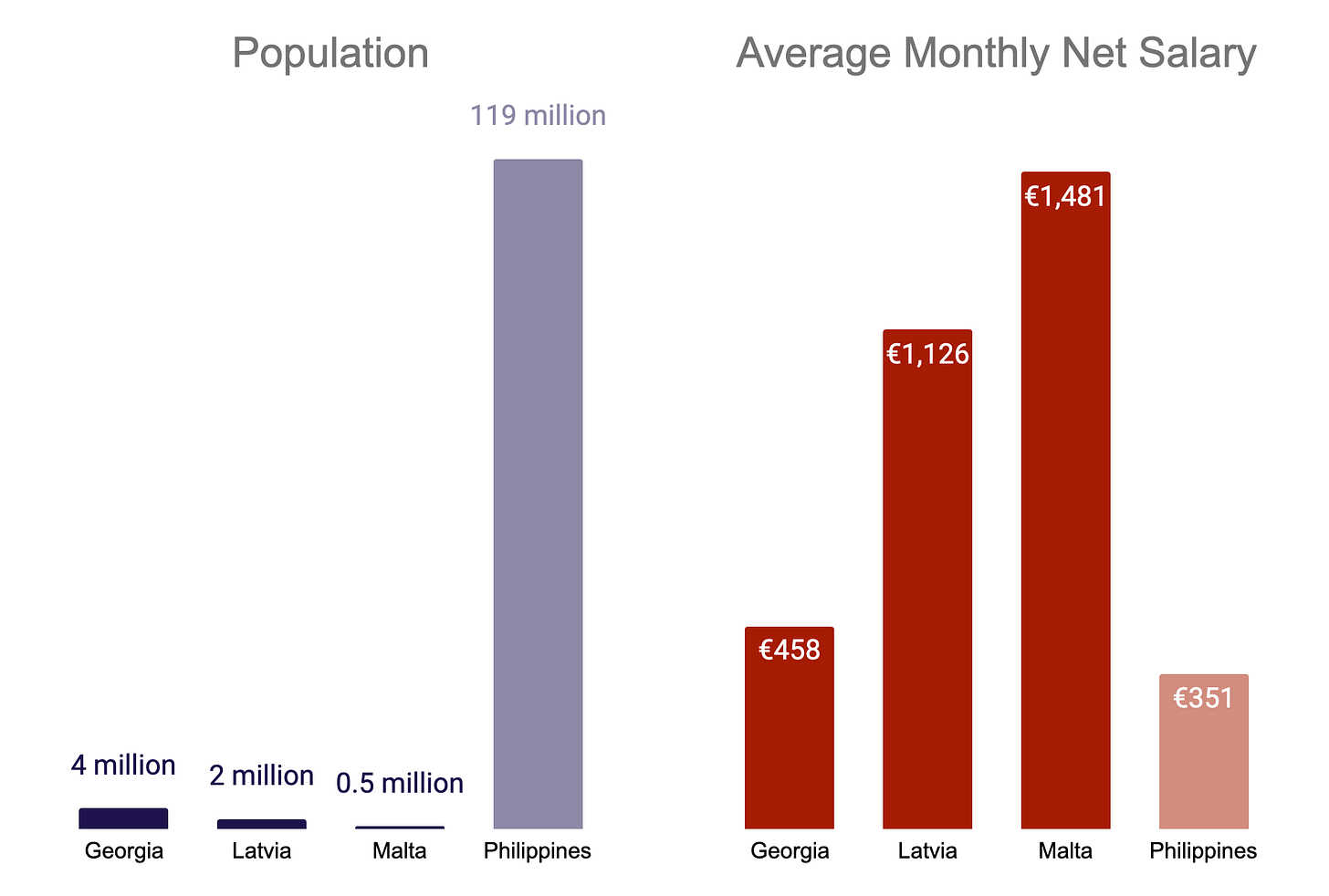

The biggest piece of non-financial news for me from this quarter was the brief mention of plans for a Philippines studio.

To give context, Philippines have been on iGaming news a lot this year due to the revelations of various kinds of criminality that the China-facing supplier/operator/facilitator organizations called POGOs brought to the country under a loose licensing scheme. As mentioned in relation to the Asia market, the government has recently banned and is in the process of dismantling them.

Evolution is already Philippines’ first properly licensed Live Casino supplier. In the earnings call, management noted that a local studio will be opened due to regulatory necessity. This implies that the initial plans call for a relatively small operation serving the local market.

Nevertheless, Philippines could make a very interesting candidate for Evolution’s long-term studio expansion. Its population is 20 times of the combined populations of Georgia, Latvia and Malta that hosted almost 80% of Evolution’s headcount outside North America in 2023.

After Singapore, it is the most English-proficient country in Asia. As the POGO experiment showed, the country has good access to the speakers of Asian languages which may be harder to find in Eastern Europe. Beyond being a deep pool of recruits, Philippines are also the first Asian market to regulate iGaming, and a successful story there could make Evolution the regulatory golden standard for the whole region. Furthermore, establishing a closer contact to regional players and a local game development team could greatly aid Evolution’s efforts to develop Asia-targeting original games. Possibilities here seem endless.

And, at this point, they are only that: possibilities.

Margins

Both the pre-tax and post-tax margins have been on a slump this year. After all, the strike-related supply bottleneck and the Asia slowdown have emerged on top of the low-margin North American expansion.

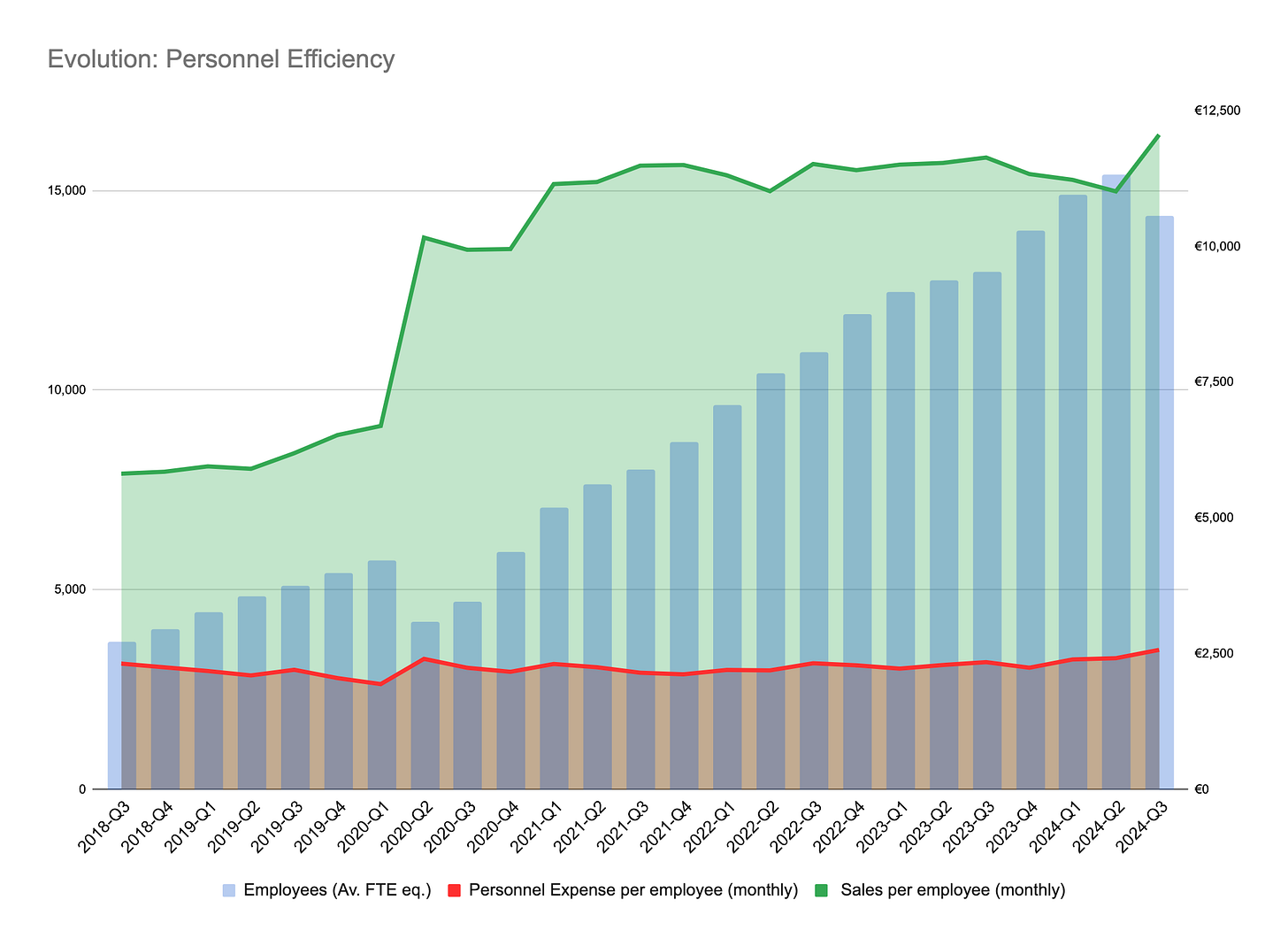

As previously hinted by the chart of headcount numbers outside both North America and Georgia, a significant international expansion seems to be underway. Even though its numbers have not been enough to counteract the sudden Georgian downsizing in the net headcount results, the tangible investments imply significant studio expansions outside Georgia.

For its average employee, Evolution both paid a record-high salary and generated record-high sales and “gross profit” in the quarter.

The increase in average personnel expense probably came as a result of the increasing North American headcount against the Georgian downsizing. The Georgian downsizing and Evolution’s prioritizing of high value tables also explains the sudden jump in per-employee performance. If Evolution succeeds in its international expansion plans, the per-employee performance metrics can be expected to go down in the immediate term. Not every performance dip is a bad thing!

As US revenues grow, Evolution’s tax rate is slowly increasing from the Pillar II minimum of 15% nearer to 16%, as signalled in the annual report.

Cash Pile: Solved for Good

Although the tax hike, the North American expansion and the Asia slowdown have been doing their best to keep the EPS flat this year, it has been a joy to watch Evolution take advantage of the stock market and buy back its shares.

The Capital Allocation Framework announced in the previous quarter has been a huge win for the shareholders in the long term. I personally consider the allocation of excess capital a solved issue at Evolution.

Unless management deviates from its tradition of preemptively reserving cash for upcoming dividend payouts, I think the next buyback program could come into agenda by Q1 2025.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Great analysis as always Ali! I am really hopeful for an aggressive share buyback plan announcement Q1 2025 to take advantage of the stock's weakness.

Many thanks for an excellent analysis. I couldn't help but detect an overriding bearish tone in the article. Is this a wait & see what happens over the next 12 months story for you?