Evolution's Q2 2025: Quarter in Review

Company of two halves

KPIs below High-Water Mark

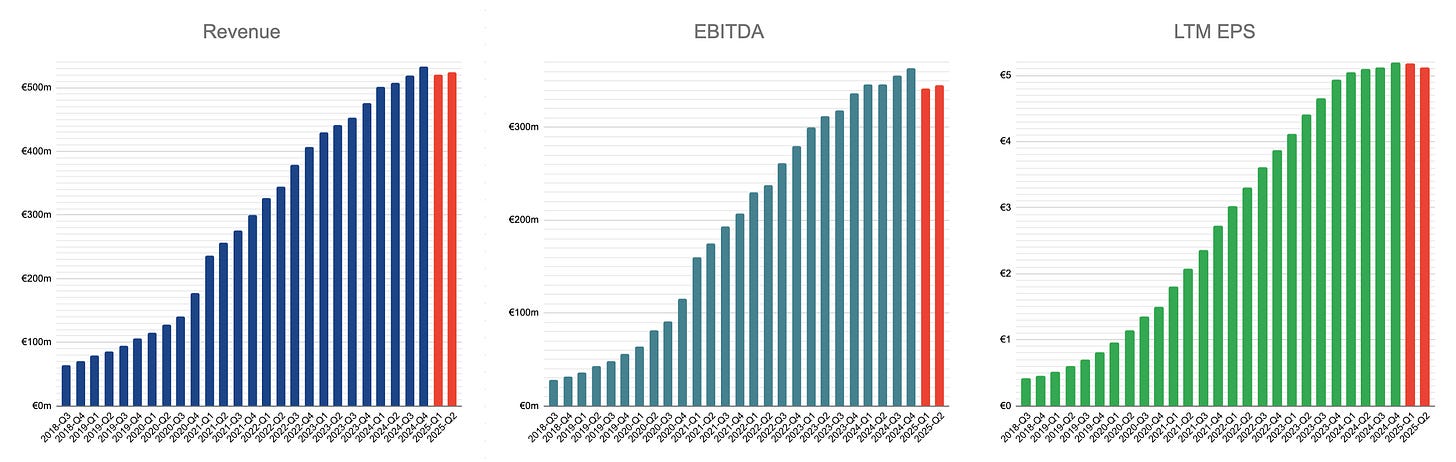

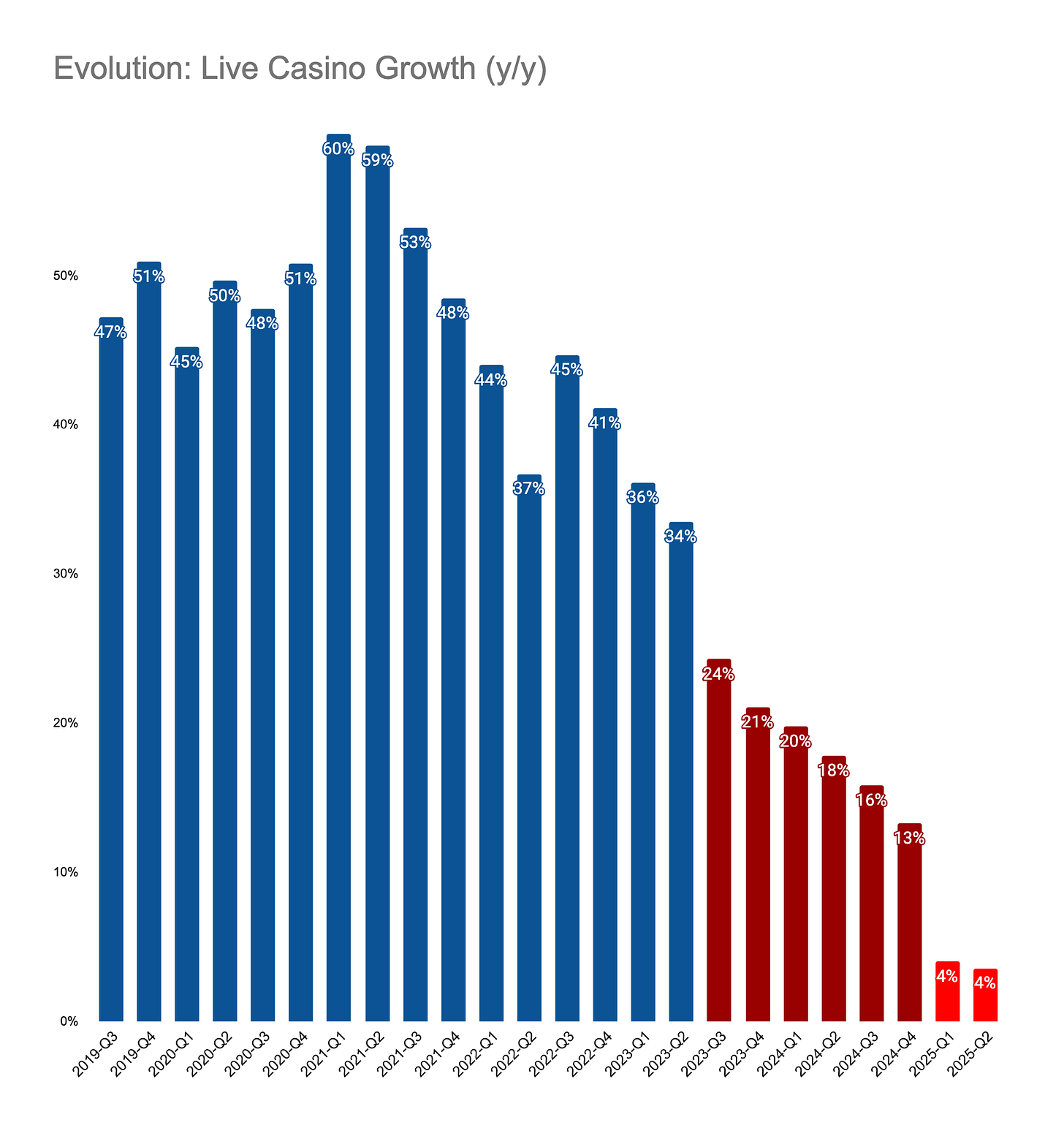

Evolution’s revenues and EBITDA recovered slightly in the quarter, yet they remained below Q4’s high-water mark. In fact, sales grew at its slowest pace of just 3% over previous year.

However, below this picture of a slow recovery after a sharp decline lies more complicated dynamics. Some of the company’s segments are performing surprisingly well, while others are underperforming and even further declining.

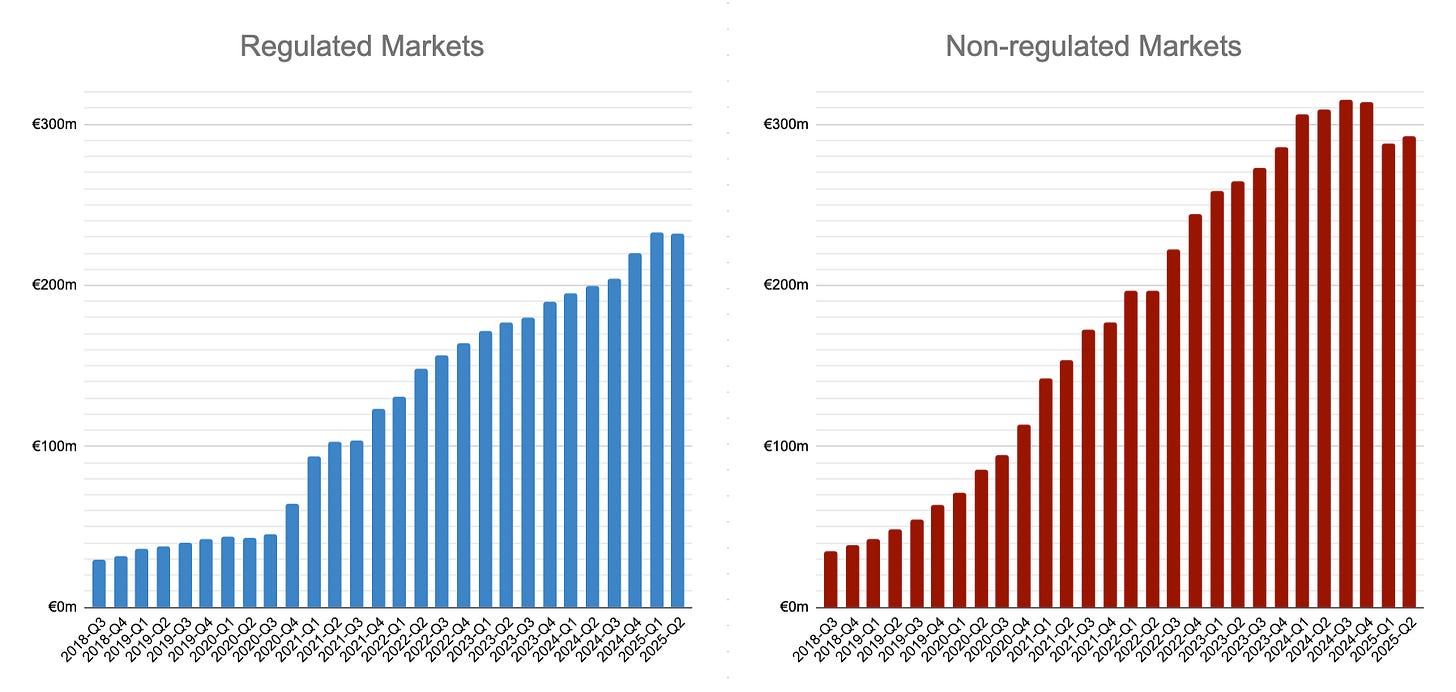

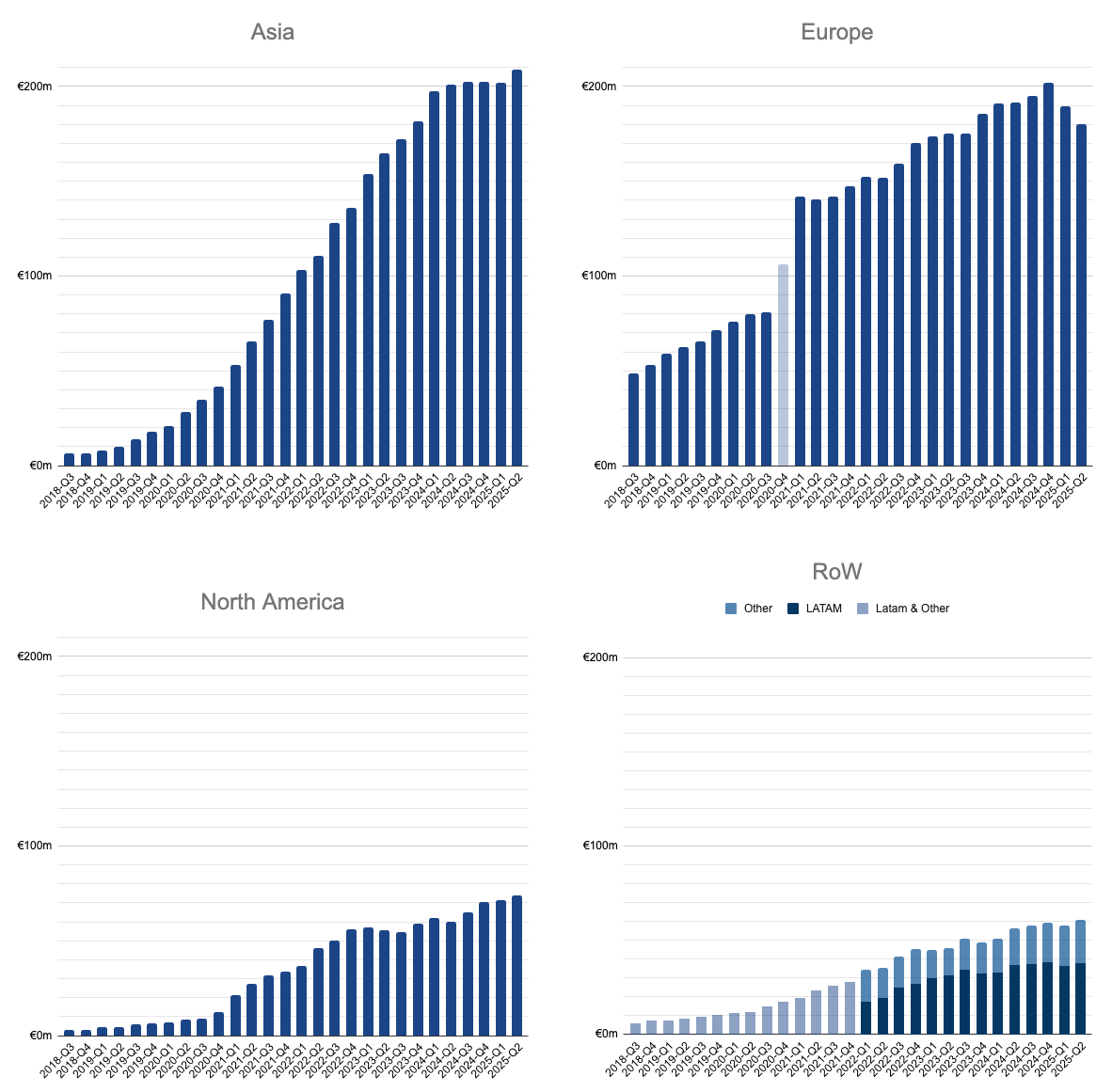

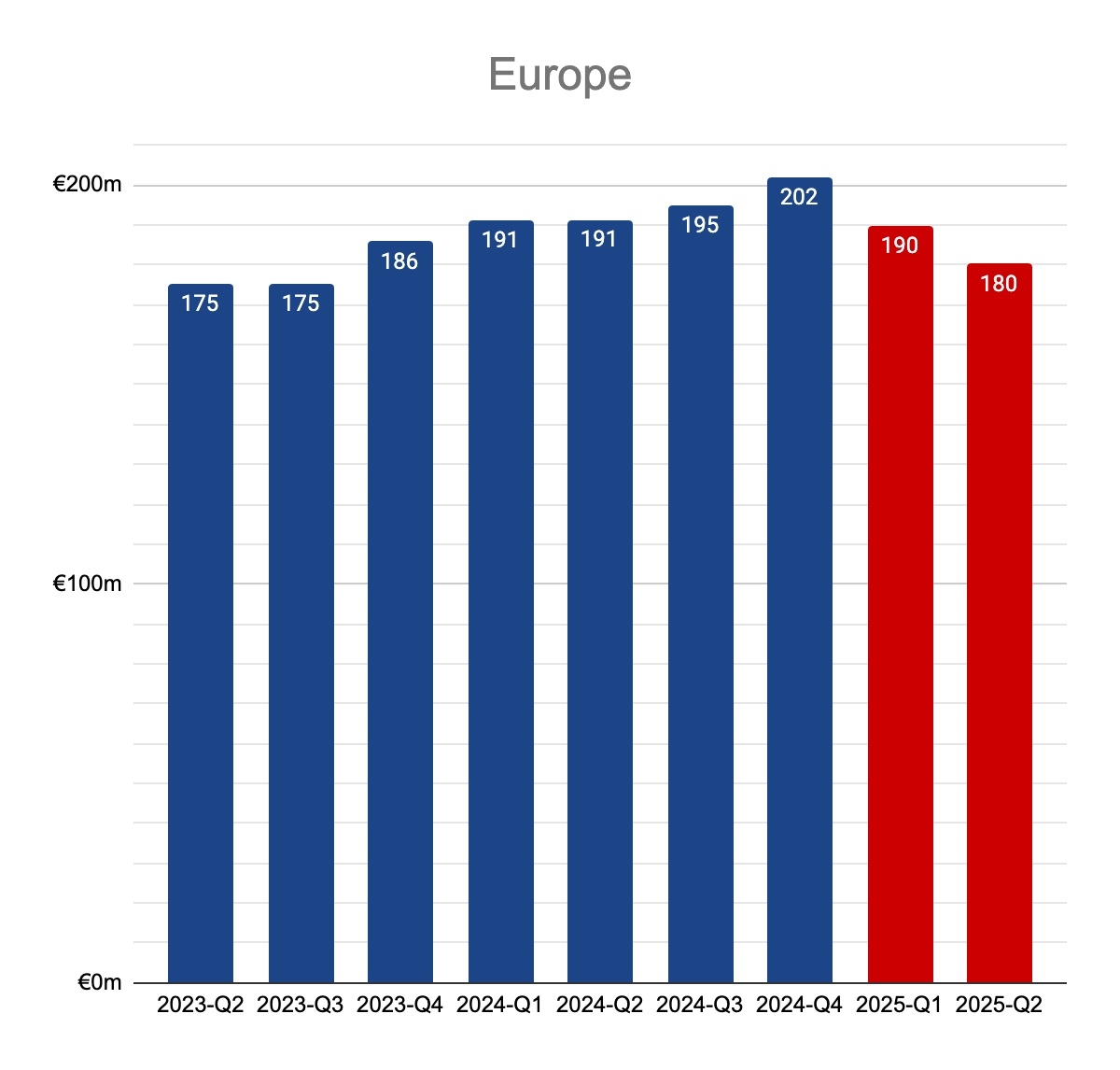

Due to their market size and profitability, Asia and Europe will likely continue to determine Evolution’s overall financial performance for the foreseeable future. These were also the two markets that were struck with headwinds lately, namely piracy in Asia and ring-fencing in Europe.

In Q2 2025, Europe and Latin America performed below their high-water marks from Q4 2024. So much so, growth in Asia, North America and Africa was not enough to compensate for them.

Post-Slowdown Winners & Losers

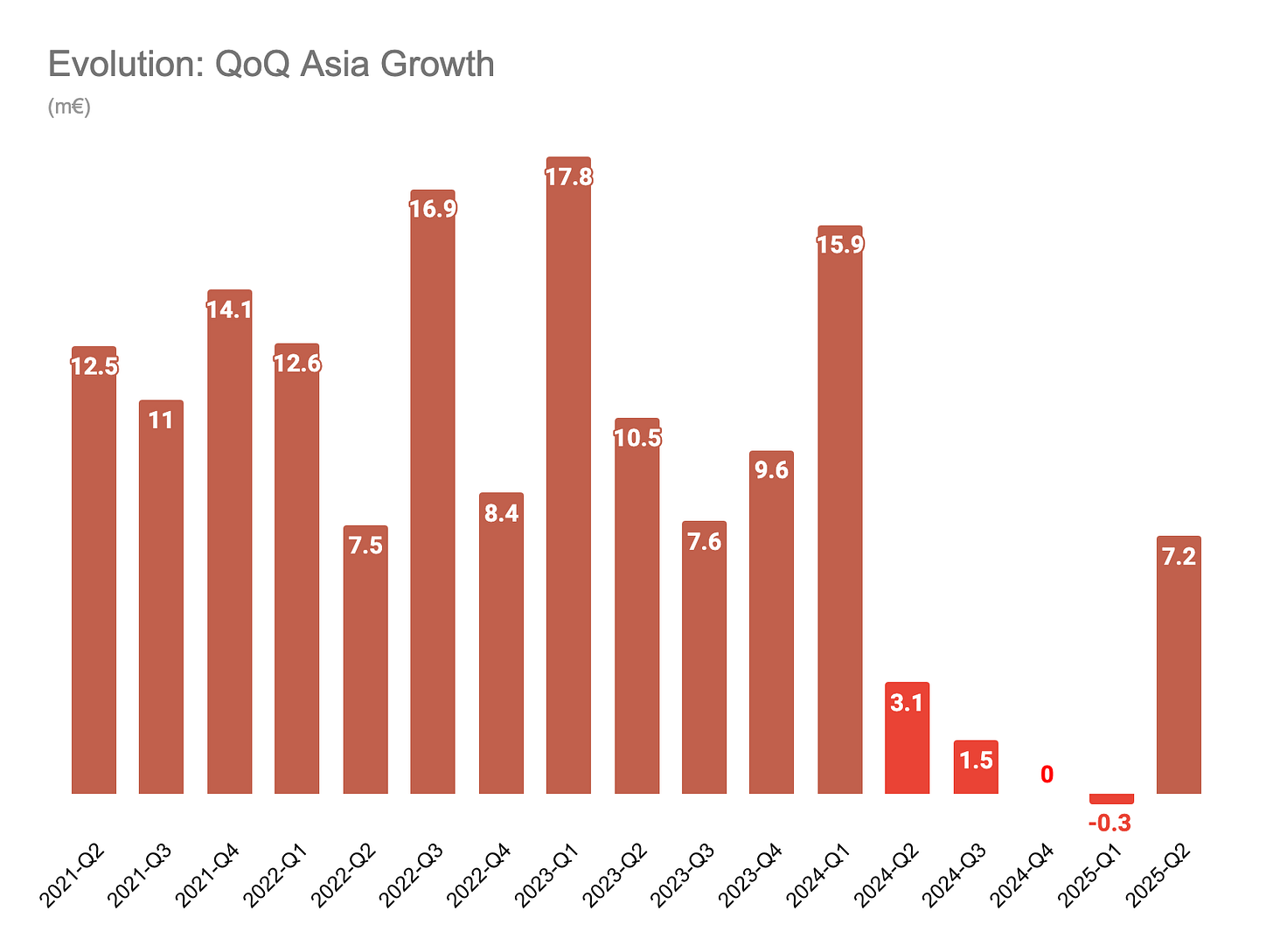

As you may already be familiar, I have a pet theory that Evolution has been caught up in an overall iGaming slump since mid-2023 following the post-COVID boom. (As it follows, the more recent Asia cyberattacks and European black market exits only exacerbated the already critical headwind for Evolution.)

If this theory holds any truth, it would be useful to inspect how Evolution’s different markets have been performing over these two years of slowdown.

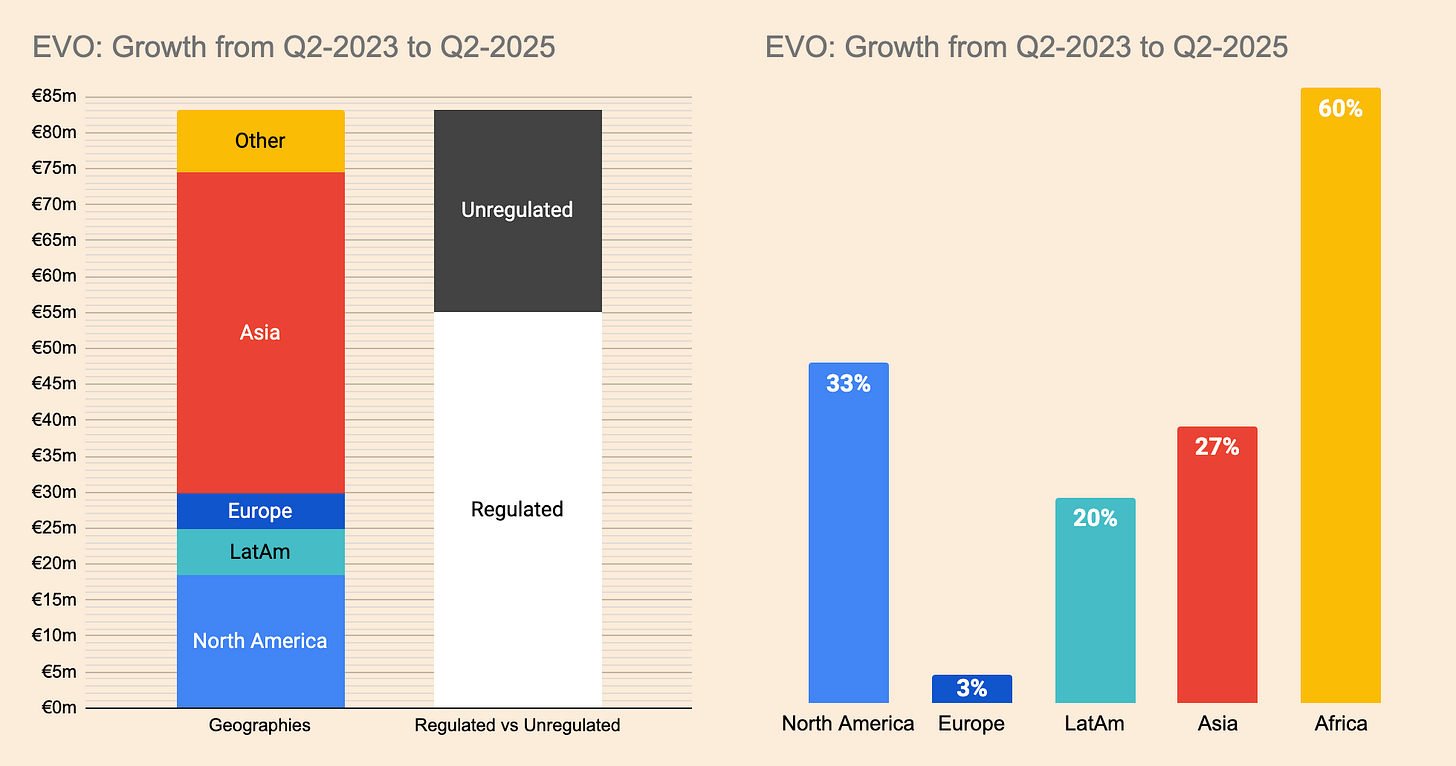

Comparing this quarter to the one just prior to the slowdown gives some striking insights. Since the slowdown:

North America grew at a faster pace than Asia.

Africa contributed more incremental revenue than Europe.

Majority of incremental growth came from regulated markets.

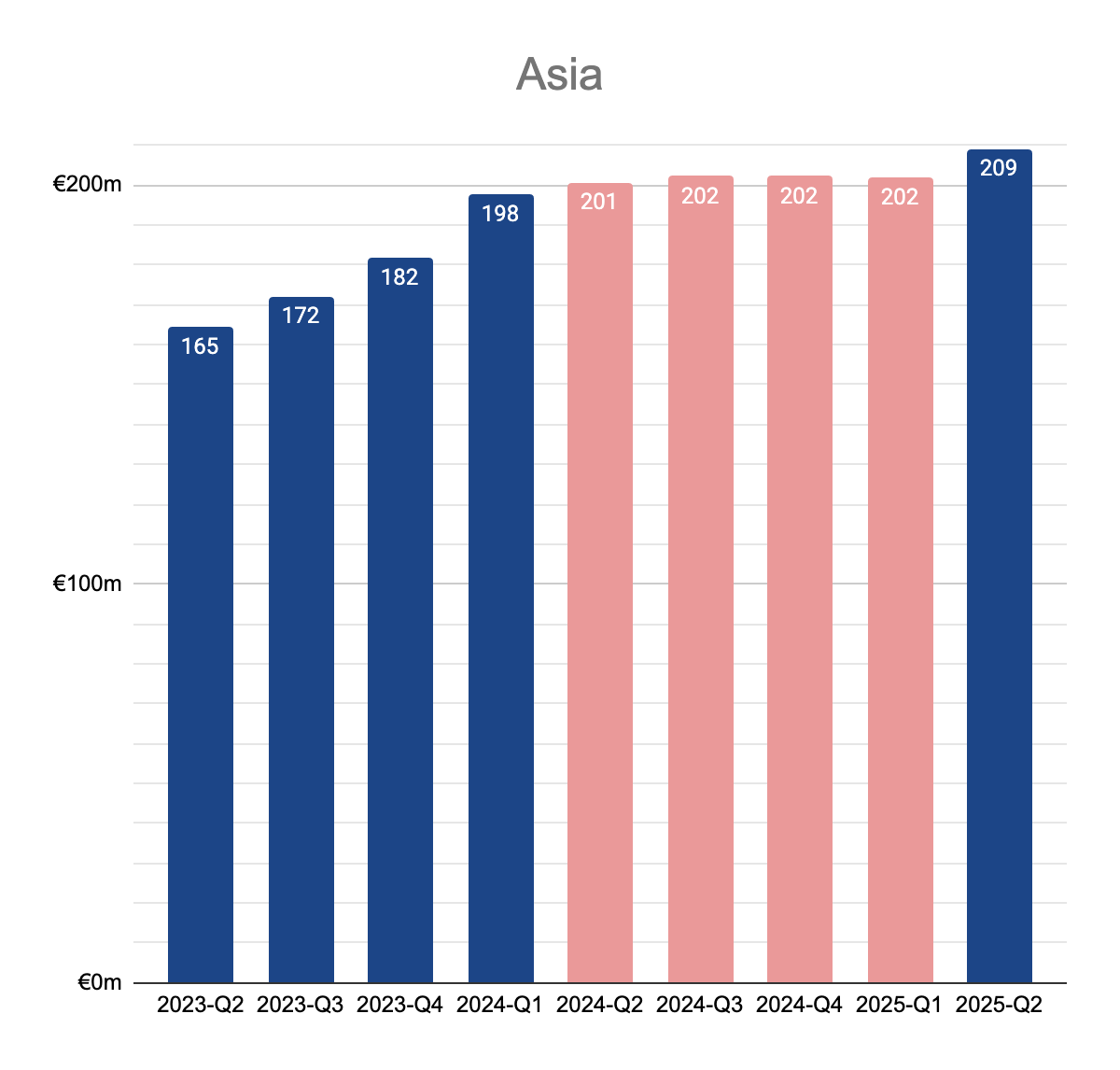

Winner #1: Asia

The big news of the quarter was that Asia returned to growth after a year of stagnation.

The incremental amount of growth at the beginning of this return was also not insignificant.

As a side note, management confirmed a critical aspect of their countermeasures against the cyberattacks.

“When we take measures, we take away a little bit of revenue that is good revenue and a little bit of revenue that is not” — CEO Carlesund

As I theorized back in February, Evolution seems to have designed its game stream architecture in such a way that the company supplies its real-time game feeds globally and quickly with a somewhat opaque awareness of its complete downstream in unregulated markets, as designed to limit regulatory liability. While great to sustain a high growth in extra-regulatory markets, this arrangement means that the company doesn’t have precise control on all users and any blocking to counteract estimated pirates potentially also blocks some legitimate demand.

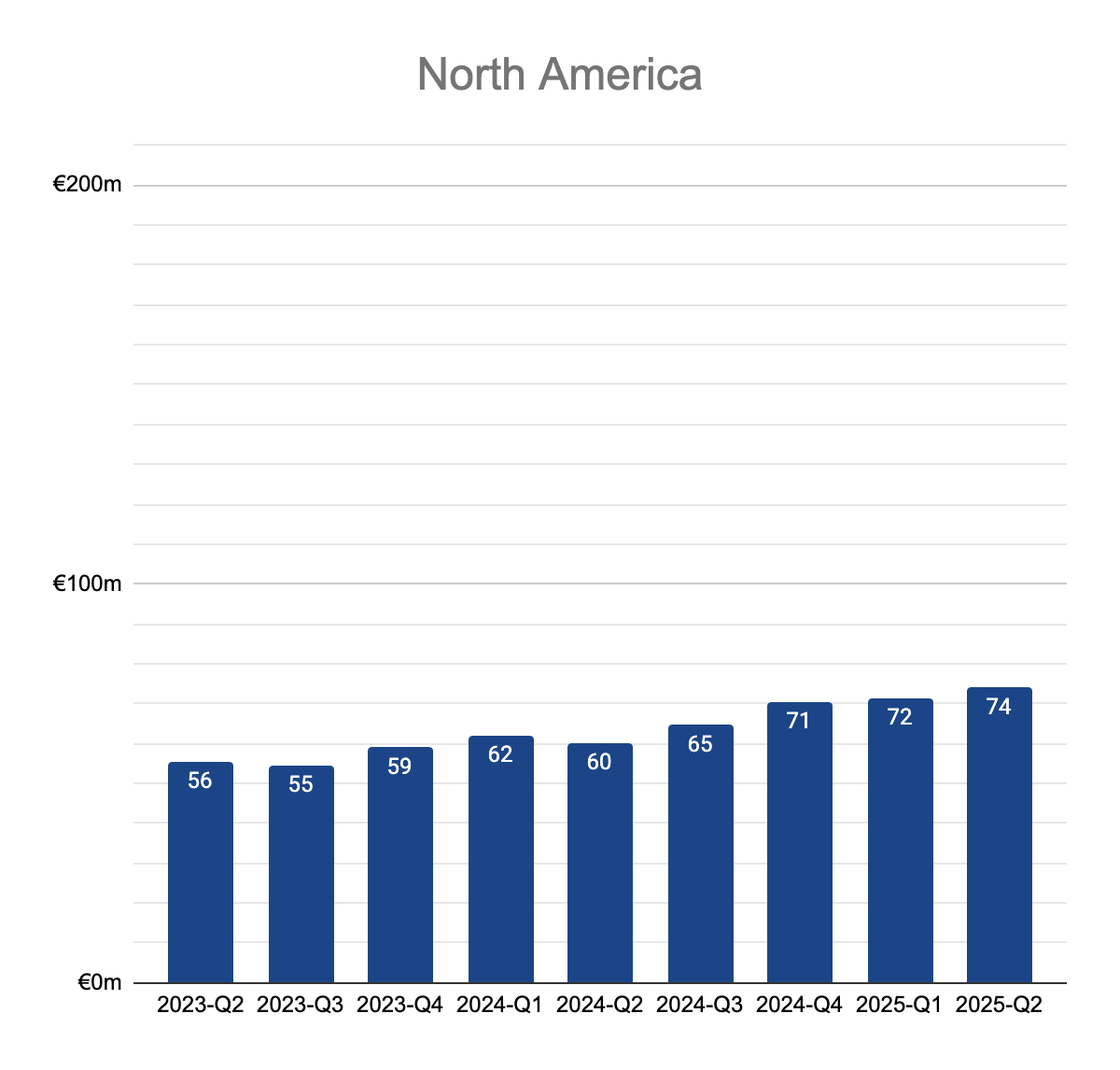

Winner #2: North America

North America has had a great growth run especially in the last one year.

Considering Euro’s appreciation over the last year, Evolution’s year-on-year growth rate in USD terms is currently approaching almost 30%!

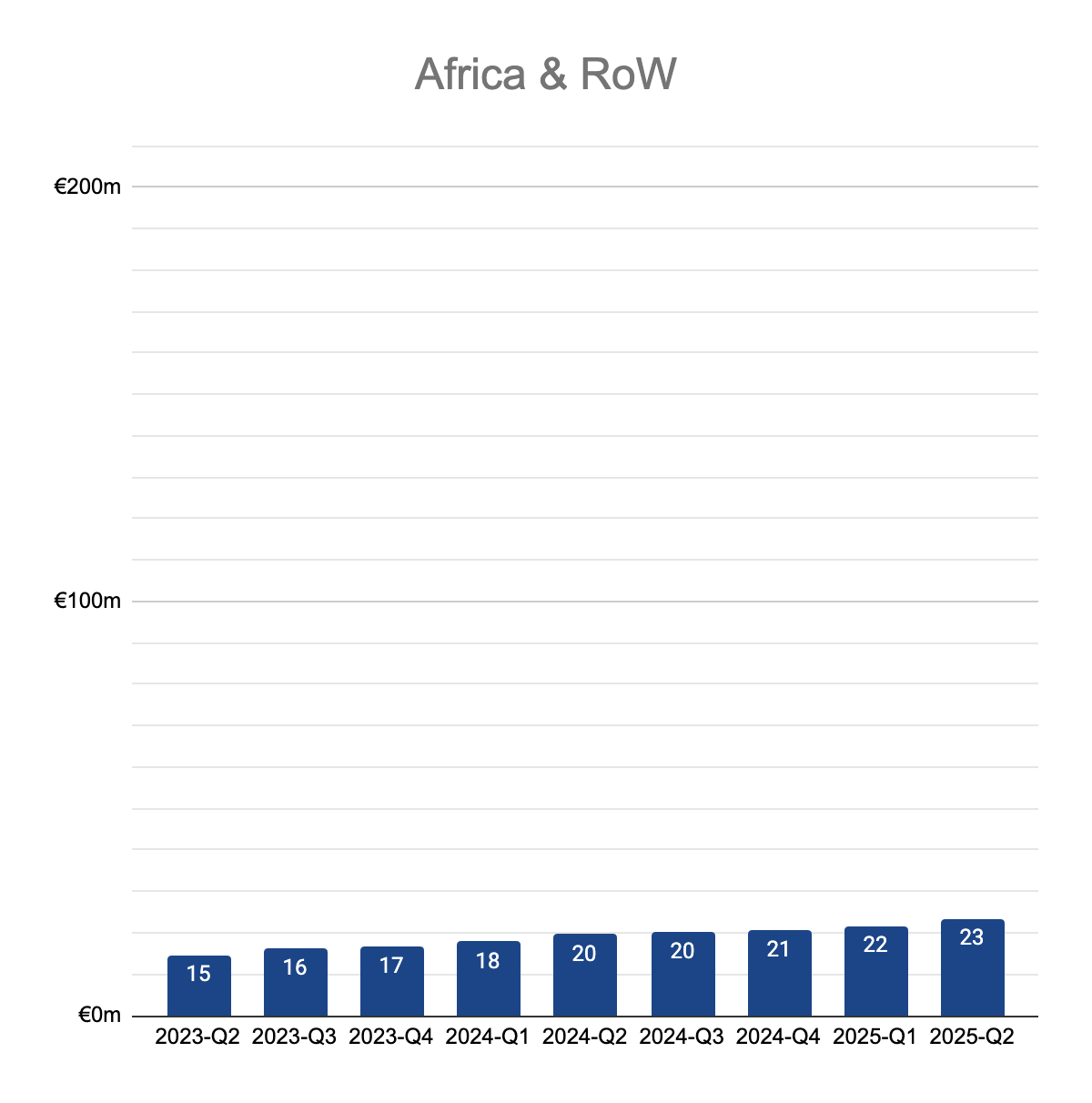

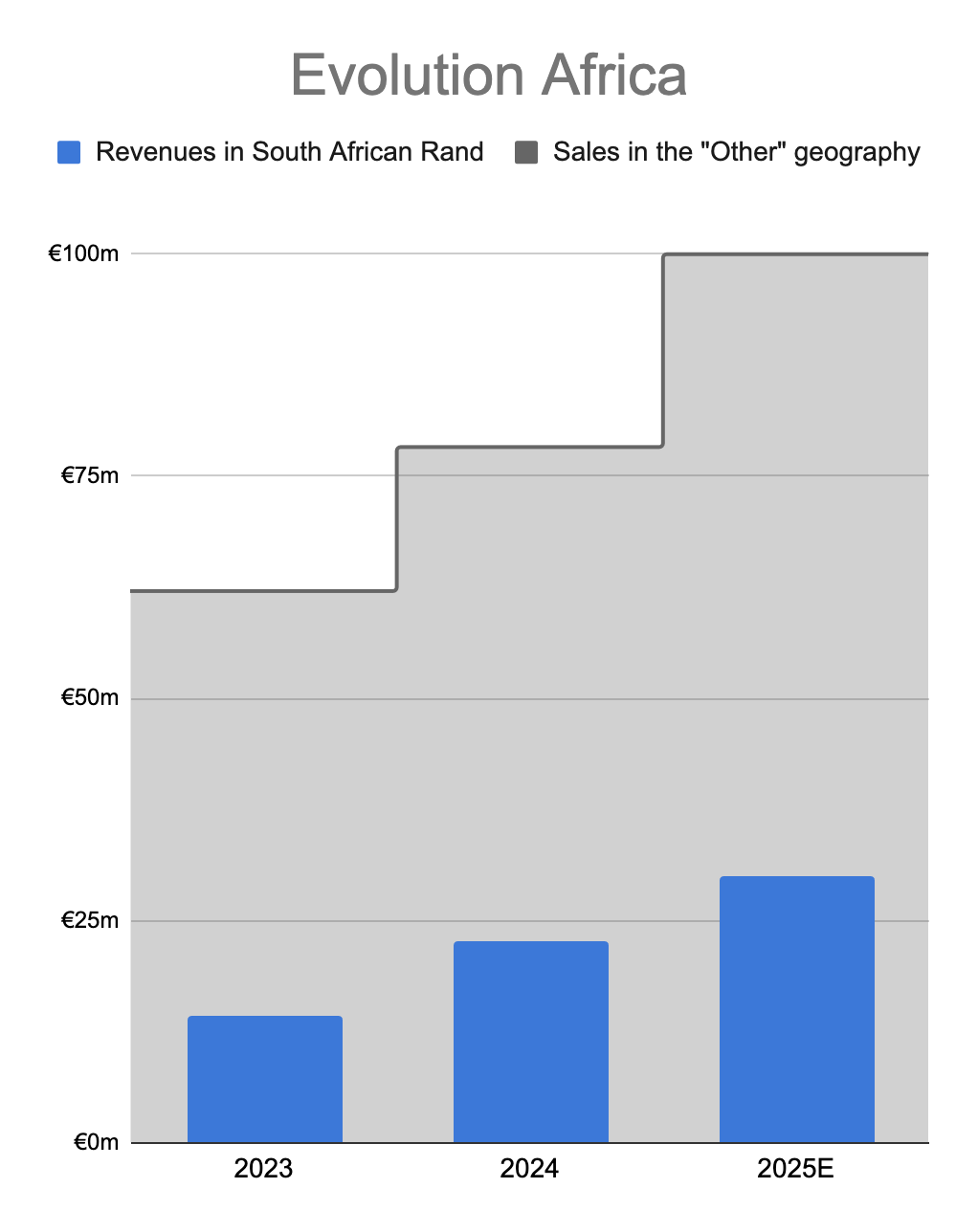

Winner #3: Africa

Despite its small size, Africa (largely constituting the “Other” geography in reporting) is distinguishing itself as a hidden champion among Evolution’s geographies.

In Africa, South Africa particularly seems to be a major source of growth.

Loser #1: Europe

As I feared, Evolution’s exit from thriving black markets in parts of Europe caused more than a one-off drop (even when considering the full 3 months impact of this quarter vs. last Q’s 2 months).

According to one estimate, Evolution lost 14% of its potential revenues in the market due to the ring-fencing.

Here is a further though experiment: Evolution is currently regulated as a licensed supplier in 10 main markets in Europe1. These countries make up roughly 1/3rd of European GDP. If we assume that blocking non-locally-licensed operators in these markets can cause an immediate 14% hit to Evolution (not considering the future lost growth opportunities), one can start comprehending the long-term risk in Europe if regulators continue singling out Evolution for enforcement.

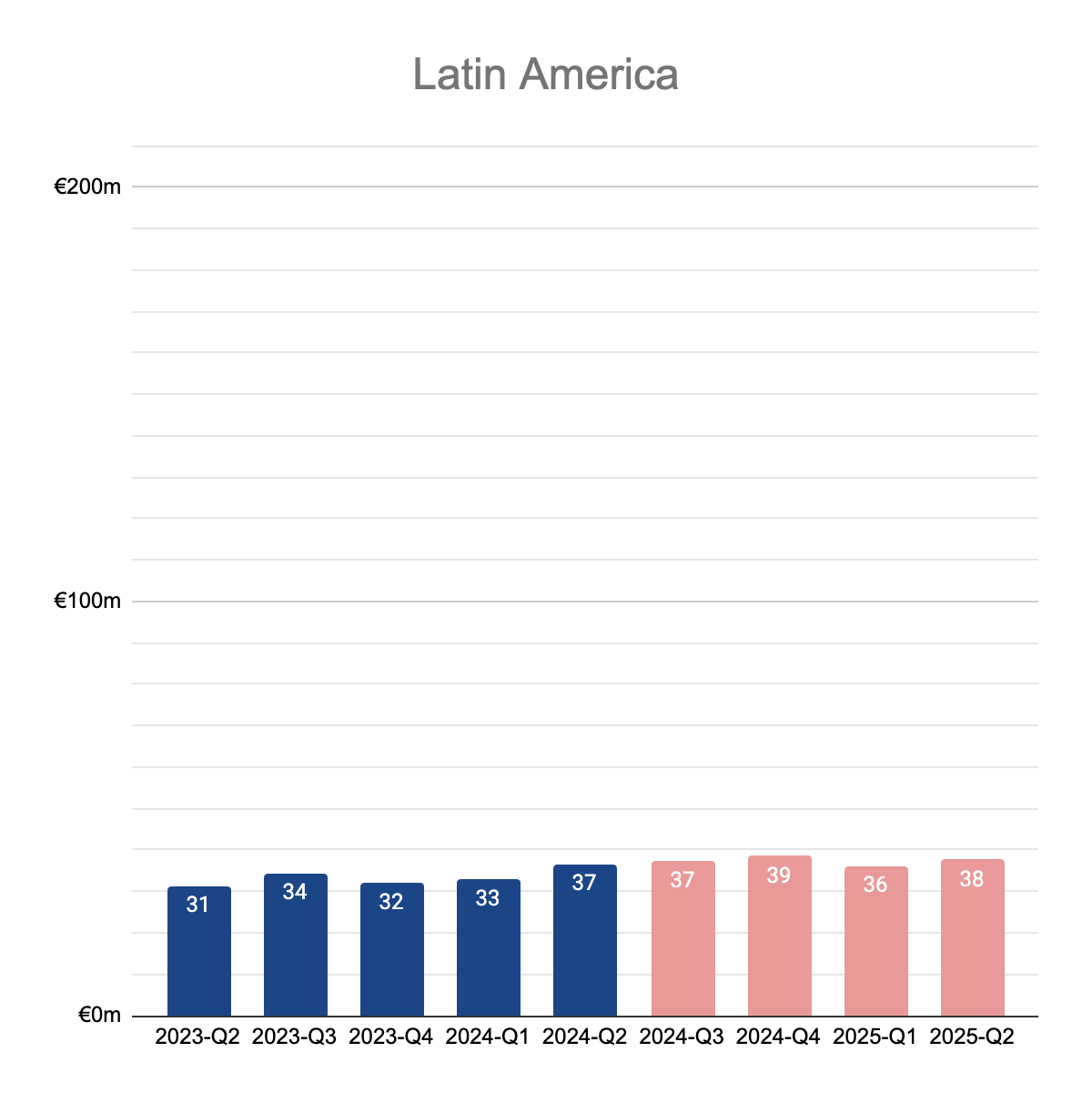

Loser #2: LatAm

Brazilian regulatory opening at the beginning of the year seems to have come with a big disruption and, subsequently, disappointment.

Since Brazilian regulations require Live Casino games to be either presented in Brazilian Portuguese or muted, regulatory opening excluded the majority of Evolution’s tables. Evolution’s just launched studio in Brazil will hopefully recreate a lot the games (and game shows!) locally, but this may take time.

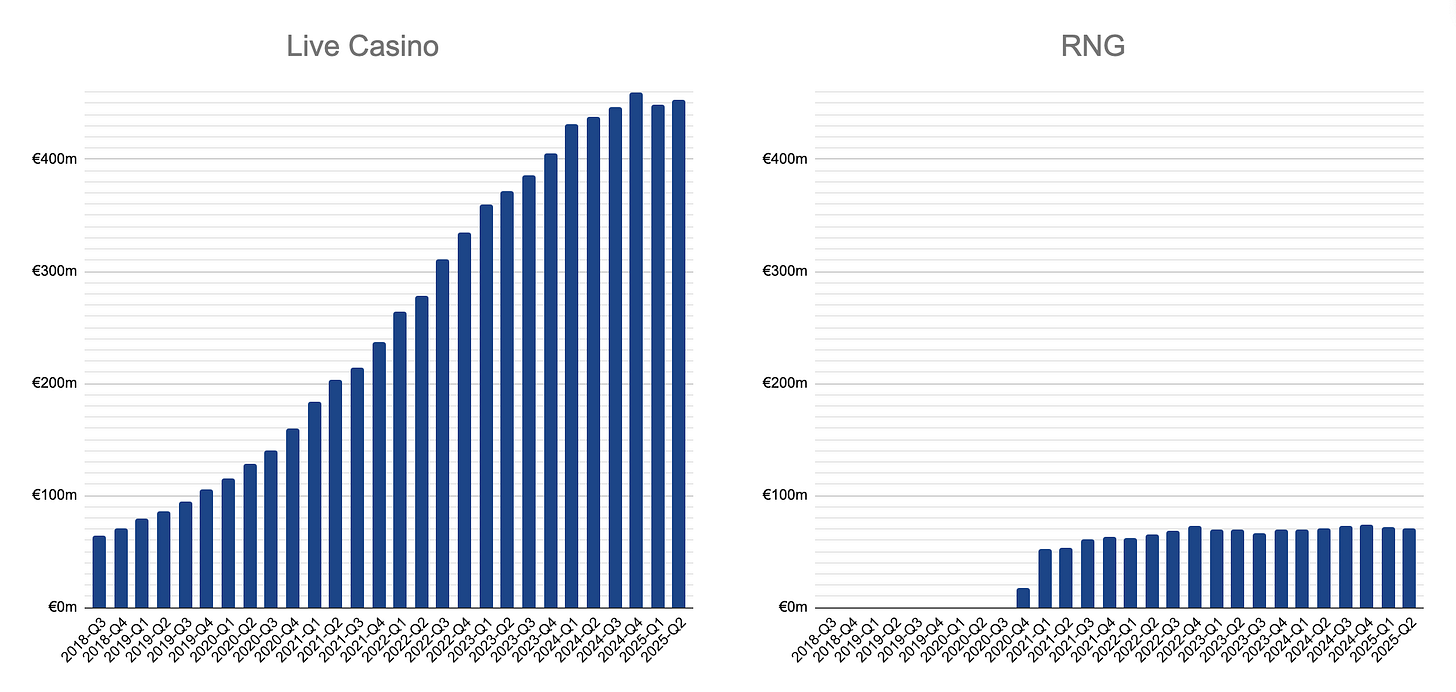

Loser #3: RNG

Despite all management comments and excuses in the last 4 years, Evolution’s RNG segment remains in its uncanny holding pattern.

Assuming an RNG-heavy growth in North America and Nolimit City’s apparent popularity, I fear to imagine how Evolution’s NetEnt, Red Tiger and Big Time Gaming studios (with a total acquisition cost of almost €2.5 billion in dilution and cash) have performed in their traditional markets in the last few years.

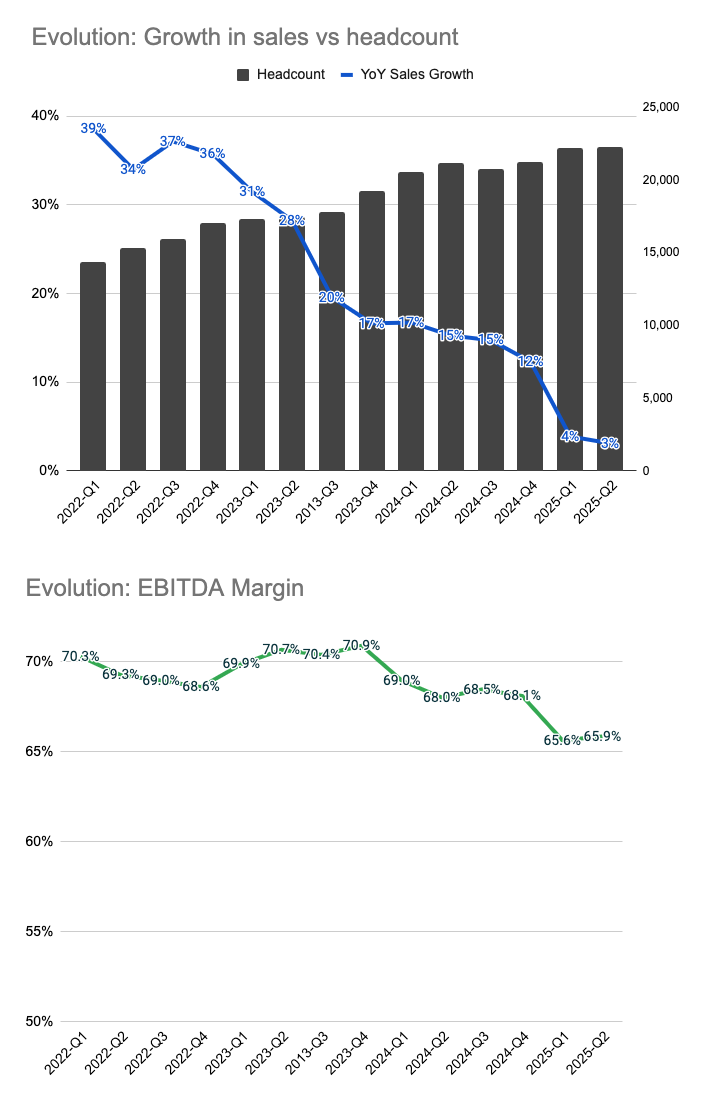

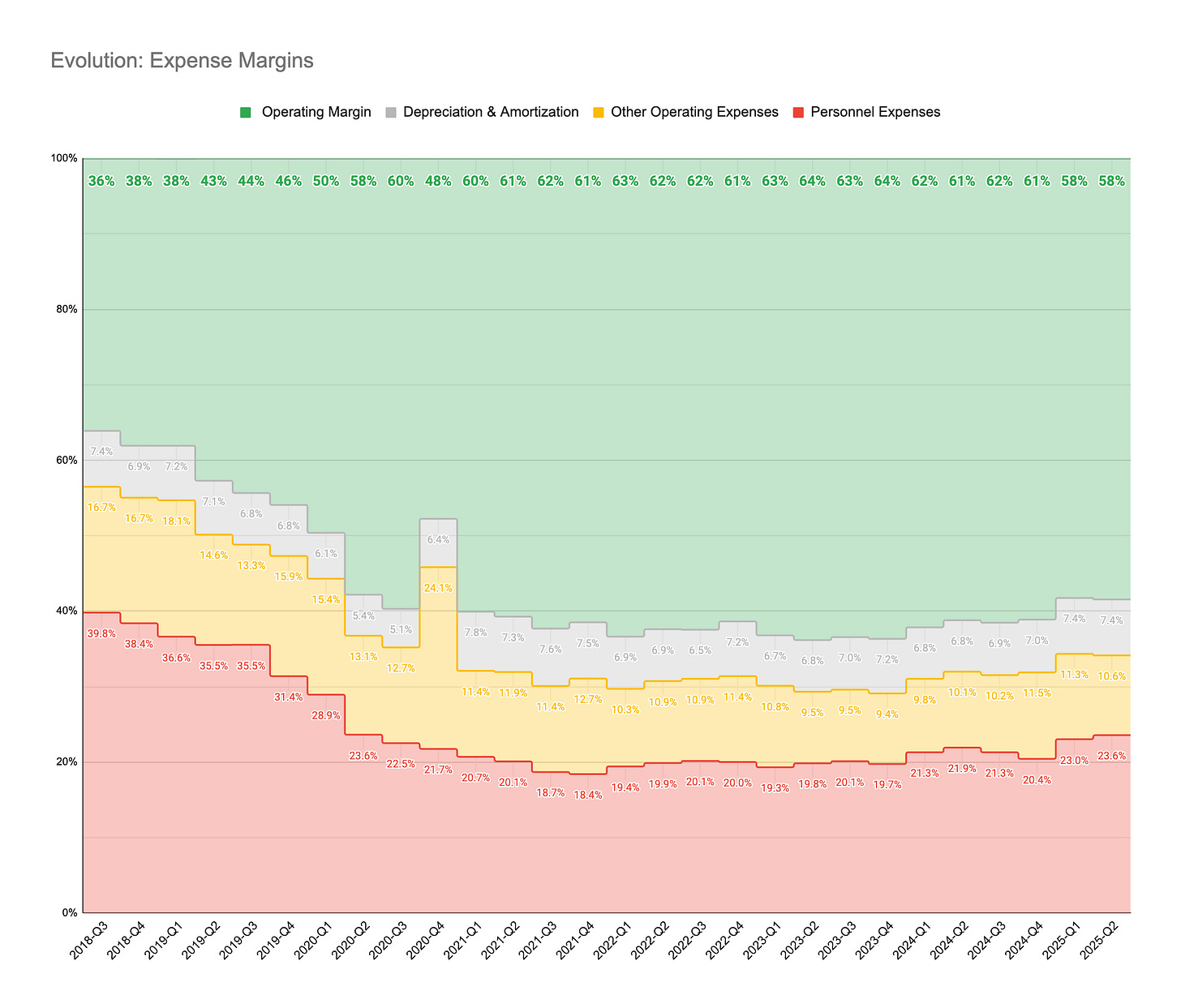

The Question of Margins

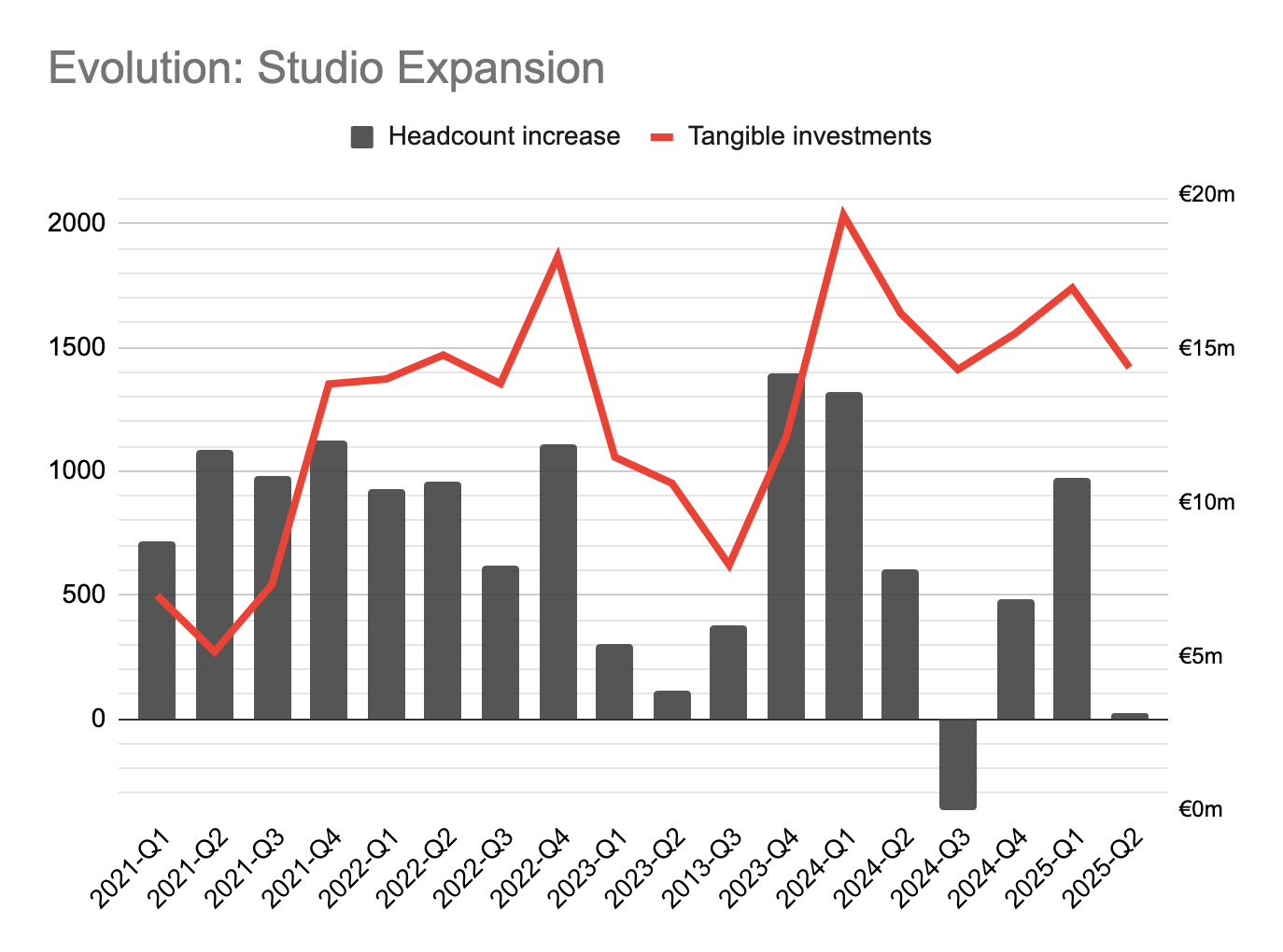

Evolution’s studio expansion during the slowdown naturally brought down the profit margins.

The proportion of sales spent on personnel is as high as it has ever been post-COVID.

Despite the low hiring in the quarter, management seems to target hiring in low “resource mix” countries like Brazil, Colombia and Philippines.

For the year, it seems to be sufficient for the management to just reach the bottom of their 66-68% EBITDA margin. However, if their lower resource mix is realized and growth returns to company’s sales, Evolution’s margins can easily rise from the current trough over the coming years.

As for the good news, Evolution is distributing almost all of the free cash flow of €1.1 billion it has collected in the last 12 months as buybacks and dividends. You don’t see a company every day where shareholders enjoy a FCF yield = Earnings yield = Shareholder yield.

Looming M&A Deadline

To be able to close its Galaxy Gaming acquisition, Evolution needs to get all necessary regulatory approvals by January 18, 2026. If not, Evolution will be required to pay Galaxy a termination fee of 5 million dollars.2 The acquisition was originally guided to be closed in mid-2025. However, management now targets the second half of 2025 for the closing date due to the hassle of “a lot of states, a lot of licenses, a lot of administration”. This sounds like cutting it close, but Galaxy Gaming has extensive regulatory relationships with its 131 licenses worldwide, including licenses in 28 U.S. states, as it likes to boast.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Belgium, Bulgaria, Denmark, Greece, Latvia, Malta, Romania, Spain, Sweden, UK

Thanks to Stocks and stuff for the heads up

Awesome. I have a question: Where or how do you calculate organic growth? Is there any info on that?

one of your best pieces on EVO yet.