Evolution's 2025 AGM Documents

One shareholder's comments

Evolution has released documents related to its 2025 shareholder meeting. Quite a varied collection of news was packed inside them. So, let’s unpack!

Contents

Shareholder Returns

The simplest stuff first: The company will pay the proposed dividend of €2.80 per share in 20 May.

More interestingly, the board aims to cancel all shares that the company currently holds, equivalent to 3.5% of all shares. Unlike previous years, the board is not leaving even a single share in its treasury for corporate purposes. This could indicate that the buybacks are likely to continue shortly after the Q1 earnings with the remaining €350 million budget.

New Incentives

Longer term shareholders may remember the troubles surrounding the last stock-based incentive program for 2023/2026. In 2023, that program was cancelled and rewritten twice, once for being too lavish (5 million warrants) and once for losing too much value (due to the stock price dropping from ~SEK1,400 to ~SEK1,000 in a few months).

That 2023/2026 program is currently also the only active incentive for the management and will gain value only if Evolution’s stock price appreciates well above SEK1,300 SEK (i.e. 75% above today) by November 2026.

Now, the board proposes a new incentive program for 2025/2028. It is scaled down to 2.05 million warrants that correspond to a maximum dilution of 1% or €4 million (less than 1% of 2024’s personnel expenses.)

Similarly, the employee coverage has also been limited compared to the previous incentives.

The threshold price (above which the warrants will start gaining value) will be calculated as 30% above Evolution’s average stock price traded between 2-8 May, a period starting 2 days after the company’s Q1 earnings release.

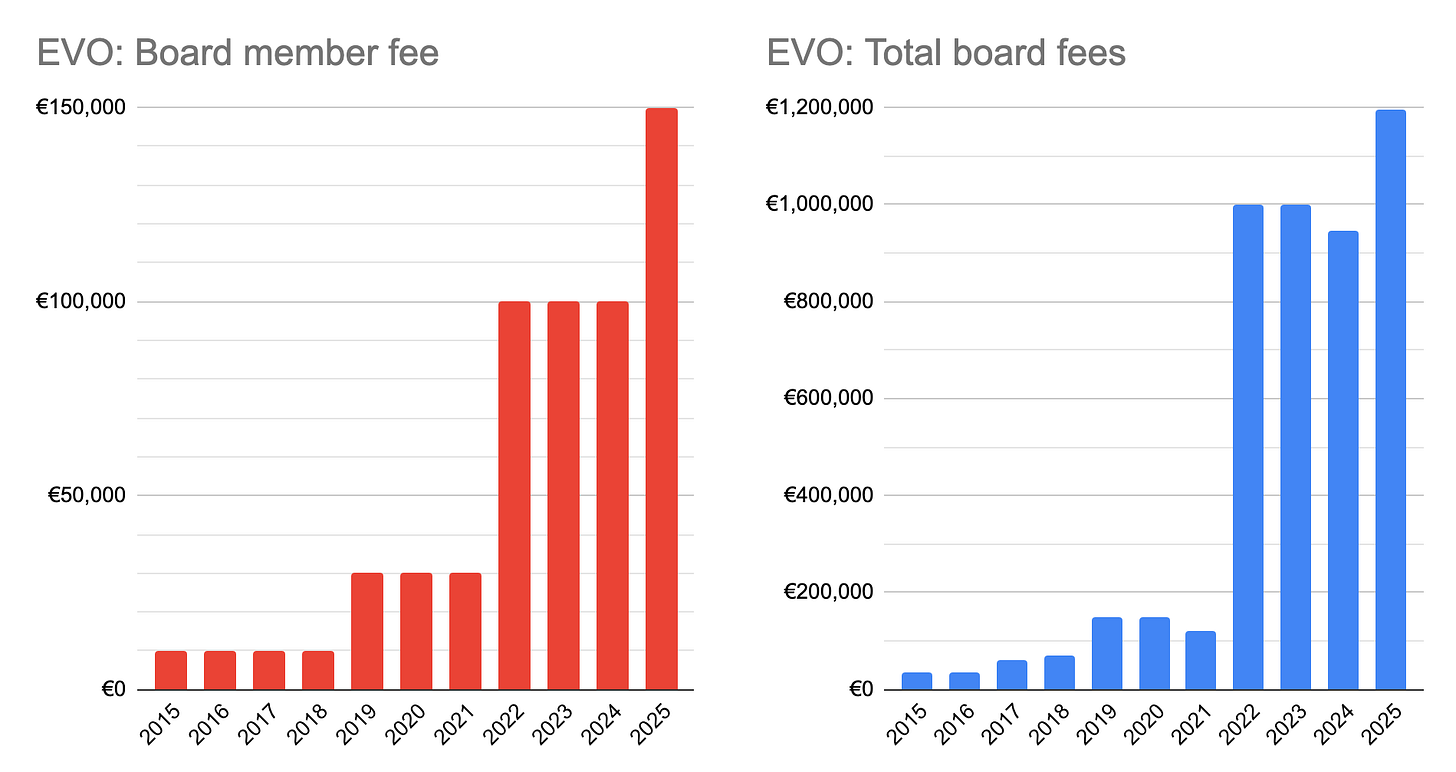

Board Weakness

It is a common complaint among some shareholders (including me) that Evolution’s board composition is not as beneficial as it could be. Other than the founders, the board does not emanate significant expertise in guiding a large public company in the gaming, entertainment or technology space. In fact, the board has also recognized this situation last year and committed to finding valuable new blood by this year.

Unfortunately and despite contacting the largest shareholders, the board seems to have failed in recruitment and has pushed their objective until next year.

The nomination documents also confirm the case that Kenneth Dart (the newly arrived yet likely largest shareholder) does not intend to seek board appointment despite the open call.

It can be argued that Evolution’s board is suffering from a lack of constructive membership where the biggest outside shareholders (mainly Dart and the big institutions) are not taking an active role and the main weight still seems to be carried by the founders. Under the current circumstances, I personally see two ways forward to recruit value-adding board members:

1) smaller yet enthusiastic shareholders

2) luminaries in related industries.

Fortunately, solutions to either way may actually be found in this year’s shareholder proposals.

Shareholder Proposals

A New Candidate

Unlike most of the biggest shareholders, a smaller shareholder has put his hat in the ring.

I happen to know Gabor and think that his unconventional background, experience in the gaming sector and truly deep enthusiasm for the company would make an excellent addition to Evolution’s board.

Road to America

Another smaller shareholder, Jaswinder Kaur Nagra, seems to have come up with a most colorful and ambitious set of proposals. You can read them yourself and make up your mind.

Below are my humble comments:

Proposal #1 and #2: I find the idea of a domicile and primary listing move very intriguing. Although Evolution remains a culturally Swedish company, it is no longer a mainly Swedish-owned one.

Jaswinder points to the USA’s competitive corporate tax rate as well as better alignment with capital markets and government support as reasons for such a move.

I think Philip Morris International could provide an apt example for Evolution in balancing this move. PMI is a US-domiciled company that until recently did not have any sales in the US and remains operationally headquartered in Switzerland. Thus, PMI has a great access to the US capital markets while keeping its distinctive international character.

An immediate benefit of this setup is that neither the US-based nor international investors pay a witholding tax on dividends (35% in Switzerland and 30% in Sweden).

Even if the company earns more than 20% of gross profits in the US, international investors would face 15% witholding tax (instead of Sweden’s 30%) and US-based investors will continue paying none. By policy, Evolution distributes half of its profits as dividend. The dividend corresponds to almost 30% of its revenues! The difference between a 30% and 0% witholding tax on that dividend for the majority of its investor base would make a big difference in the long term.

Proposals #5: I disagree with using buybacks as a tool to shape the company’s stock price. I don’t think that Evolution should try to act as the market maker for its stock. Buybacks should be treated as a long-term investment opportunity by the management.

Proposal #6: Although I am not against leveraged buybacks in principle (I am a Domino’s shareholder after all!), I disagree with it for Evolution for now. As a long-term shareholder, I would rather trade the possible leveraged investment efficiency for the company’s guaranteed long-term durability, due to Evolution’s specific position.

AGM Week

I will be in Stockholm for the week of the AGM in 5 - 9 May. See you there!

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Looking forward to your update from AGM!

Much appreciated !