Notes from Evolution's 2024 AGM

From Sweden with love

I am in Stockholm for Evolution’s 2024 Annual General Meeting since last week. The official meeting itself unfortunately took place in Swedish, but I also had the chance to gain a few insights from a conversation with the company’s CFO and Q&A with the CEO. To my eyes, the management seemed very confident about the business and this likely provides for the relaxed interactions with shareholders rather than a defensive and formal one.

Please note that I’m sharing the below recap from my imperfect recollection, so take them as my perception of the general character of the management’s responses. In case of any difference to official disclosures, feel free to disregard my depictions.

Conversation with CFO

Question: In the last quarterly call, you mentioned that there are some uncertainties to Evolution’s tax liabilities arising from Pillar II. Is there uncertainty regarding the amount of taxes Evolution will pay? Do you foresee tax relief from jurisdictions like Malta or a change to the the group’s structure?

Answer: The tax uncertainty involves the exact mechanisms of Sweden’s tax collection, rather than the amount of the tax. At the moment, we are not expecting a significant revision to the company’s tax outlook due to any other jurisdictions. We do not consider moving out of Sweden.

***

Q: Will top-up tax payments always come due at a 2-year delay to accrual even after 2026?

A: It’s not clear yet.

***

CFO: bet365’s 90 million users look like a very interesting target for Evolution.

(My personal observation: I get the feeling that the company expects a gradual ramp-up of sales through bet365 rather than a sudden jump.)

Q: What can be done to incentivize operators who have Evolution games but frequently promote competing suppliers’ tables to give a better positioning to Evolution games?

A: We use a variety of tools available to us. OSS (One Stop Shop) will also be helpful.

***

Q: Are Spin Gifts the first time Evolution is paying for player promotions out of its own pocket?

A: Yes, I believe so.

Q: Will Spin Gifts have a significant financial impact on Evolution?

A: It’s not out of question, but a popular promotional tool would be a good problem to have.

***

Pitch: As a gambling sector company, Evolution is likely to regularly trade at valuation discounts to its potential. This creates a long-term value creation opportunity not available to many other high margin companies. Evolution already has an explicit capital allocation policy regarding dividends. The company (and its long-term shareholders) would benefit from an additional commitment in its official policy that the board will regularly consider opportunistic buybacks with cash not needed for CapEx, dividends or acquisitions.

A: It sounds alright and will be taken into consideration. However, it should also be kept in mind that dividends are distinctive as a traditional shareholder return policy for Swedish companies.

***

Q: In 2023, you seem to have waited for 2024's dividend to accumulate first and then decided on a buyback budget later in the year with the already collected cash not needed for the dividend. Is this the timing of decisions we should expect in the future as well?

A: That is how it happened last year, but it doesn't have to happen in the same order this year. We may as well decide on a buyback program earlier.

CEO Presentation and Q&A

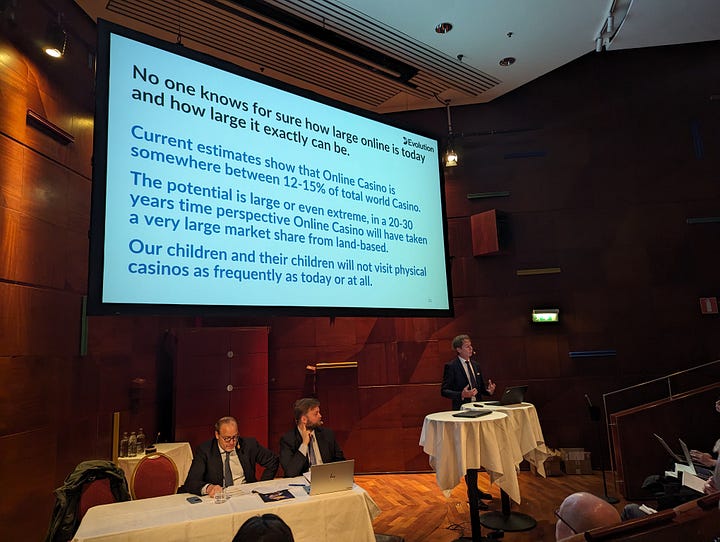

CEO Martin Carlesund made his presentation to shareholders in Swedish, so I could only get a general sense of it from the slides in English. The gist of it seemed to be: Evolution stands at the early stages of a tremendous global trend. The company is working tirelessly to improve itself and is the best equipped one in the world to excel at game and studio development.

***

Q: 2023 results showed a very slow hiring in Evolution’s main hubs in Georgia and Malta, unlike the company’s other European studios. Should we consider those two hubs as “mature” now or was it a temporary slowdown?

A: Sometimes, certain studios hit a limit to the number of possible hires in their local workforce markets. We support this with opening and hiring in other countries, such as the current ones in Europe as well as the one we are opening in Czechia due to regulatory reasons.

Q: Asia is an obviously very important market, and Evolution keeps releasing local language games for this market. Do you foresee a recruitment bottleneck in finding dealers who speak Asian languages in Europe? What is to be done?

A: We always work to find solutions as needed.

[2024-04-29] EDIT: added the buyback timing question to CFO

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thank you for this Ali!

Thank you! I hope they really consider stock repurchasing