Evolution's 2024: Year in Review, Part II

What the annual report reveals

Market Share Wins & Losses

Global iGaming statistics are famously inaccurate due to the opaqueness of the unregulated sales channels. However, it is clear that Evolution has been successfully defending its market share lead in the Live Casino space despite the many challengers. On the other hand, it is also clear that the company’s €2+ billion foray into the RNG field has lost large swathes of the market to the competition over the years.

Between 2021 and 2024, Evolution released 321 new games in RNG and 55 new games in Live Casino. In return, the company’s sales in Live Casino have more than tripled while any organic net growth in RNG has been minuscule at best.

Management Shake-Up

New senior executive with a familiar name

Evolution seems to have replaced its Chief Strategy Officer in the last month. The new CSO, Jesper von Bahr (a relative of the founder?), also acts as the secretary to the board.

An interesting detail, sure to cause speculation regarding future relisting and M&A scenarios, is that his latest position is listed to be based in the US.

A Tighter Circle

The senior executive team has been shrunk from a 5-person group that included head of product as well as head of human resources to a 3-person one where CEO Carlesund is joined solely by the new CFO and CSO.

All other 14 heads of various departments are included in the extended management group that responds to this tight circle.

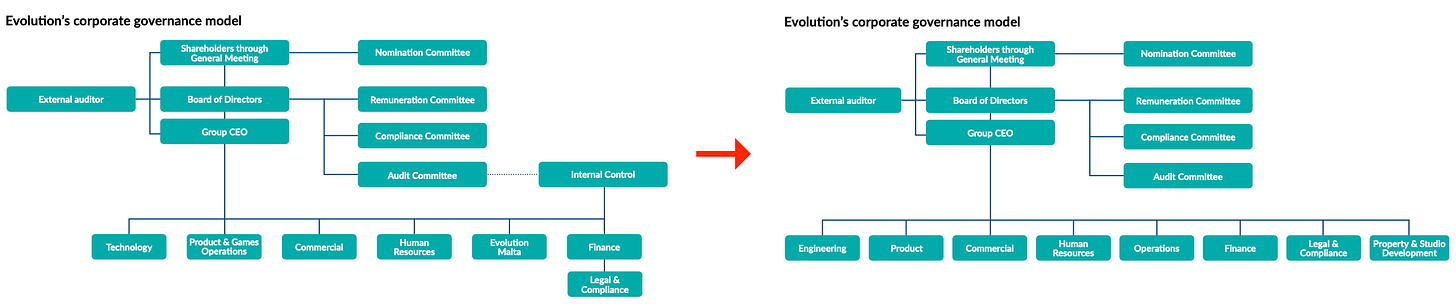

Corporate chart update

Evolution’s governance structure has also been significantly overhauled.

Company’s structure has been critized for not having its legal department answer directly to the CEO. With its new governance chart, Legal & Compliance now reports directly to the CEO instead of the CFO.

Additionally, Product and Operations divisions have been separated. A new division for Property & Studio Development has also been created. All divisions answer directly to the CEO.

These changes hint that CEO Carlesund wants a more direct hand at areas (such as regulatory compliance, studio management and expansion) that Evolution has had hiccups recently.

A flat board

One area of governance that did not see significant reform has been the imperfect board structure.

Regarding the board committees, an obvious concern is that the compliance committee includes prior expertise in neither gaming or nor law.

Capacity Ups and Downs

Disclosures in the annual report suggest one market where Evolution may have down-sized and another where it up-sized beyond expectations.

Georgia

Back in October 2024, Evolution Georgia declared that it has set an overall capacity of 6,500 personnel as its downsize target from a high of 8,000. However, one table in the annual report suggest that the headcount in Georgia may have dipped below 5,900 by the year end.

Spain

Interestingly, possible good news regarding expansion can be gleaned among the disclosures about collective employee agreements.

By the end of 2024, Evolution’s headcount in Spain may have tripled to almost 1,400 employees in less than two years. If so, Spain now hosts Evolution’s 4th biggest studio after Georgia, Latvia and Malta.

Recruitment Drive

Below are my personal estimations for Evolution’s rough hiring levels for some of its studios.

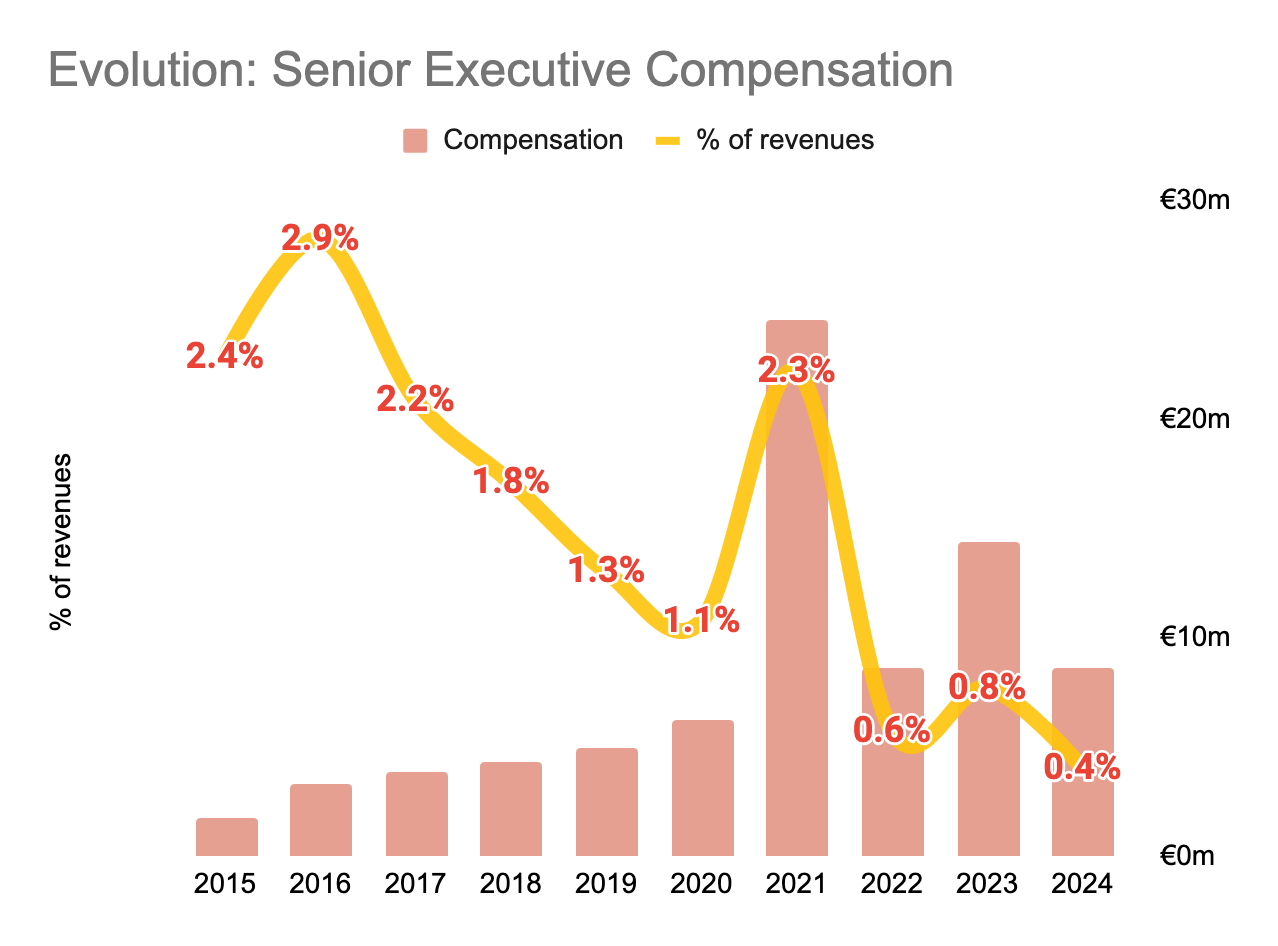

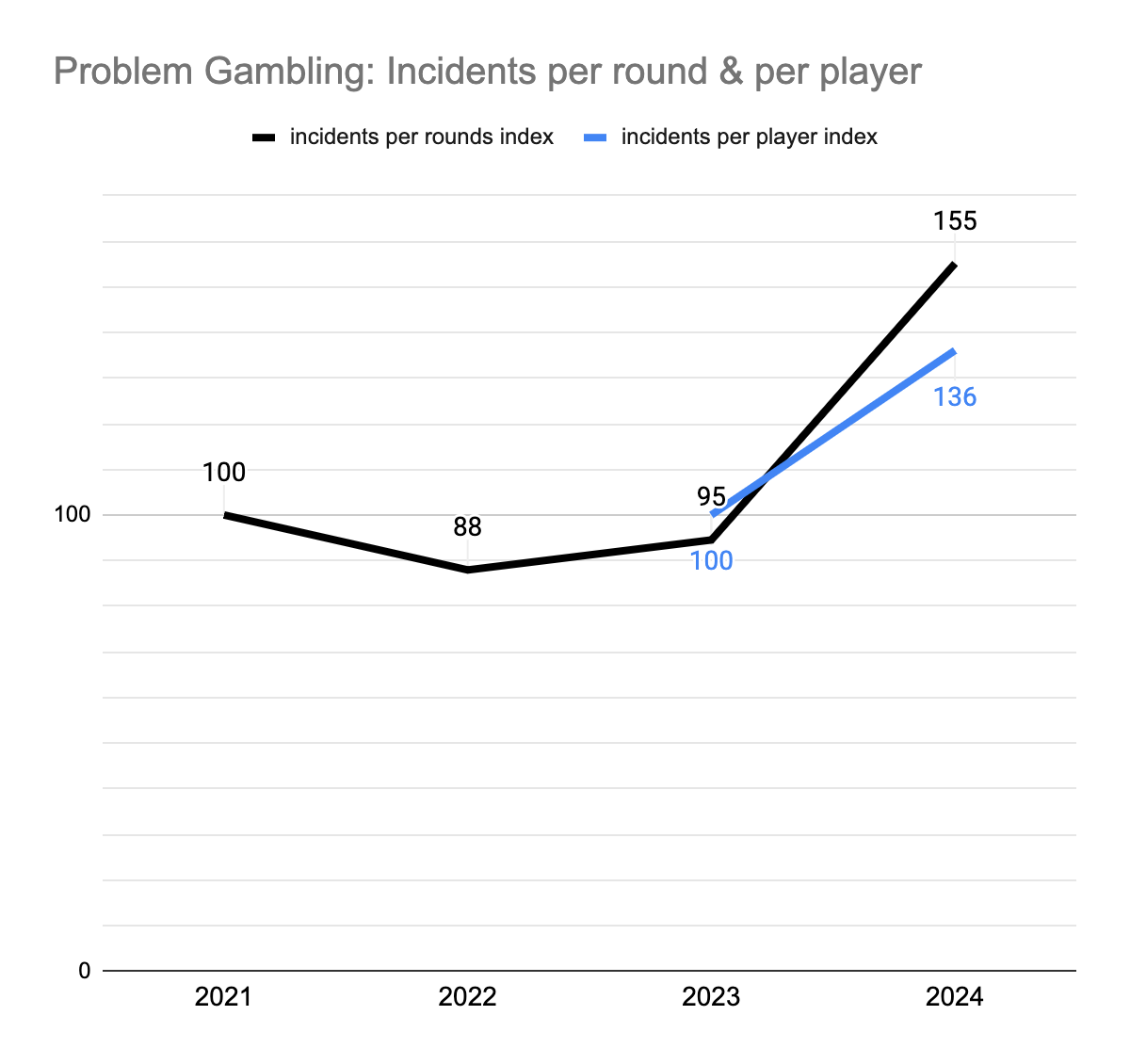

Executive Pay Down, Worker Salaries Up

In 2024, Evolution paid less to its executives and more to its common employees. Now, this is a sentence you don’t read about a large corporation every day!

The company paid a record low portion of its revenues for senior executive compensation last year.

The stock-based incentives (mainly targeted at executives) also continue to not cause a large dilution.

On the other hand, inflation as well as the disruption in Georgia that caused both expansion in costlier markets and a lower ratio of game presenters (85% in 2024 vs 87% in 2023) resulted in higher salaries both nominally and as a percentage of revenues.

The average full-time salary that Evolution pays to its common employee reached its record high in 2024.

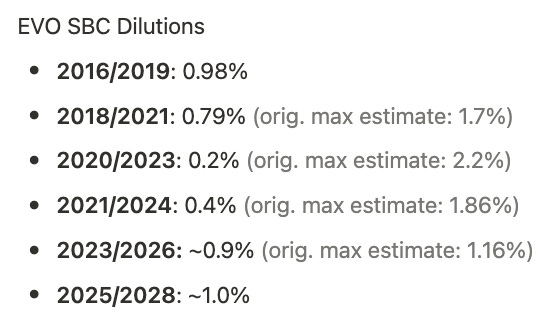

Problem Gambling

Suspected incidents of gambling addiction on Evolution’s games rose by a whopping 114% in 2024.

On the detection side, the company says that it employs a more sensitive AI and a 60% larger moderator team. Better detection is meant to increase the amount of detected incidents, after all.

Furthermore, when compared to the number of played game rounds, the growth in detected incidents is closer to 64%. Even more meaningfully, detected incidents per player accounts rose by 36% which could reasonably be explained by improved detection capacity.

Various Tidbits

In 2024, Evolution earned €1,288 million of “real” pre-tax profits. On this profit, the company incurred €66 million of regular taxes (5.1% tax rate) and €129 million of Pillar II top-up taxes (10% tax rate).

Despite the eventual top-up taxes, Evolution channeled 94% of its revenues through the low-tax jurisdictions of Malta and Curaçao.

Company’s legal team grew from 120 to 130 people. They now also have a dedicated (but not public?) email address for reporting compliance breaches.

The useful life of some tangible and intangible assets have been increased considerably.

Servers and network equipment from 2-5 years to 7 years

Patents from 5 years to 5-8 years

Platforms from 3 years to 3-10 years

Proprietary software from 3 years to 3-10 years

South Africa seems to provide a pocket of high growth for the company. In 2024, Evolution’s revenues derived in South African Rand (ZAR) grew by 52% on euro basis. Those revenues now make up 1.1% of all revenues and 29% of the revenues from the “Other” geography. Half of the growth in the “Other” geography came from ZAR-based sources in 2024.

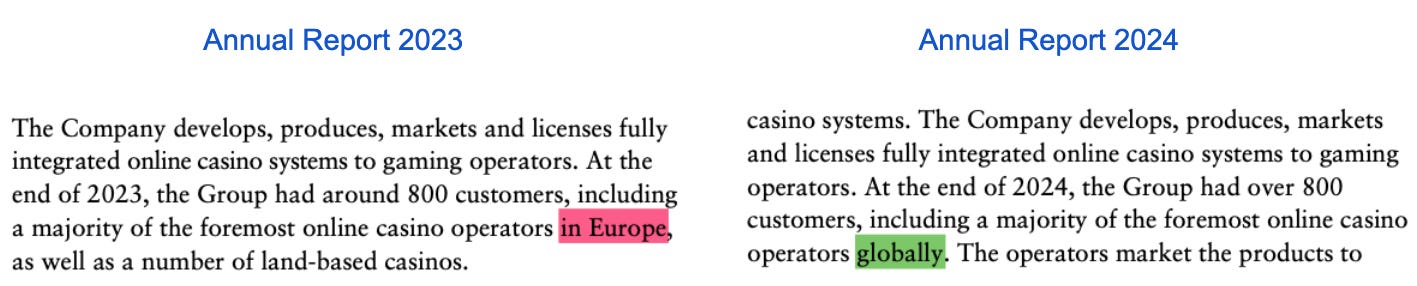

Currency breakdown may give a rough idea on how the US/Canada split in the North American revenues looks like.

Management is now confident enough to assert that Evolution is serving most major operators everywhere.

Partly in thanks to bet365?

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Spot on, thank you

Great write up Ali. Very detailed and insightful.

Very good analysis with cost per personnel trends. I think that is inevitable especially as they move to USA. One thing I am often a bit unclear and wonder if you could provide any specific reference - my understanding is for US studios, they can only serve their own states. But this might be US specific regulations? In other countries and Europe, studios can serve in other countries, is that correct? For US, due to the lack of flexibility, the operating cost will surely continue to grow with their revenue grow over time.