Evolution's 2024: Year in Review, Part I

Eye of the storm

I hope that you enjoyed my brief review of Evolution’s Q4 2024. In this piece, I will have a deeper look into the multi-year trends of the business.

The most difficult year

2024 (including the first few weeks of 2025) was possibly the most difficult period in Evolution’s publicly listed history.

Company’s tax rate was more than doubled

Its mega studio responsible for close to half of the company’s profits was thrown into turmoil and forced to downsize

Company’s most lucrative market responsible for half of its extraordinary growth mysteriously came to a sudden halt

For the first time, a US regulator has requested an upfront accounting of the company’s sales channels in all international markets without point-of-consumption licensing

The UK regulator has started investigating Evolution for supplying into the country via operators that lack a local point-of-consumption license

Beloved CFO of 8+ years announced an unexpected resignation with a hasty handover period

Big Picture

Over the last five years, Evolution grew its revenues by over 5x, profits by over 7x and EPS by over 6x.

However, it’s hard to look at the annual values and not notice a big change in growth over the last year in which the profits grew by only 2%!

Earnings per share rose slightly faster due to buybacks.

Choosing a beacon through the storm

On the one hand, companies, especially in young industries, routinely rise and fall. In such cases, no valuation discount based on an assumed earnings stream can provide a true margin of safety for investors. After all, the world doesn’t owe any company a minimum level of profits in a future year X.

On the other hand, every great business occasionally goes through rough patches. It is the human nature to overly concentrate on the bad news as the market’s perception becomes more pessimistic.

Which of these is the case for Evolution? In such extreme uncertainty, I prefer to focus on a single business metric as a clarifying yardstick and see which external factors are likely to truly determine its future path the most. (I am focusing on external factors because I believe that the company’s internal execution and management are fairly good.) The metric of my choice: profit growth. I believe that this is the measure that could possibly let me focus on a single business result, ignore the stock market’s not-completely-irrational mood swings and still come to a satisfactory investment result on a long term.

What really matters

I have picked three active headwinds as well as three areas of dormant risks on Evolution’s future profit growth prospects. My intent, as a shareholder, is to have a set of factors to keep an eye out for, as we get further company results in the future.

Active Headwinds

Note that the first two of these three big factors are not even under the company’s direct control.

Headwind #1: iGaming slowdown

As most areas of entertainment, gambling is evolving into an online activity, and Live Casino is its most promising segment. Evolution’s organic growth in the segment also seems to confirm this view.

However, both the rate and the incremental additions to the company’s segment sales seem to be quickly slowing down.

Moreover, amid the usual quarterly fluctuations, a significant and consistent change of tempo seems to have happened in mid-2023.

One way to interpret this sudden shift is that the post-COVID boom in player demand (and the concurrent gold rush by suppliers) seems to have come to a saturation. Since I don’t see a competitor surpassing Evolution in a sudden and drastic way neither in my anectodal observations nor in the few pieces of tracker data I have come across, I assume that Evolution’s slowdown is happening as a part of the iGaming market’s overall slowdown.

To get a sense of the slowdown’s scale, we could have been seeing low-twenties percentages of growth, instead of the low teens, right now, if the post-COVID boom was still progressing.

I am finding it difficult to imagine that the current market slowdown will be permanent. Evolution is also very well positioned to be a primary beneficiary in the case of an iGaming boom in most markets. However, being too early is also not easily distinguishable from being wrong. Just ask the e-commerce and telecom suppliers of the dot-com bubble.

Headwind #2: Tax hike

Evolution’s tax rate has more than doubled. Yes, it has been communicated well in advance. And, yes, I have beaten this dead horse more than once!

However, just as a dollar of investment return is worth the same regardless of the thesis’ originality, the introduction of a perpetual headwind is just as powerful regardless of the novelty of the insight.

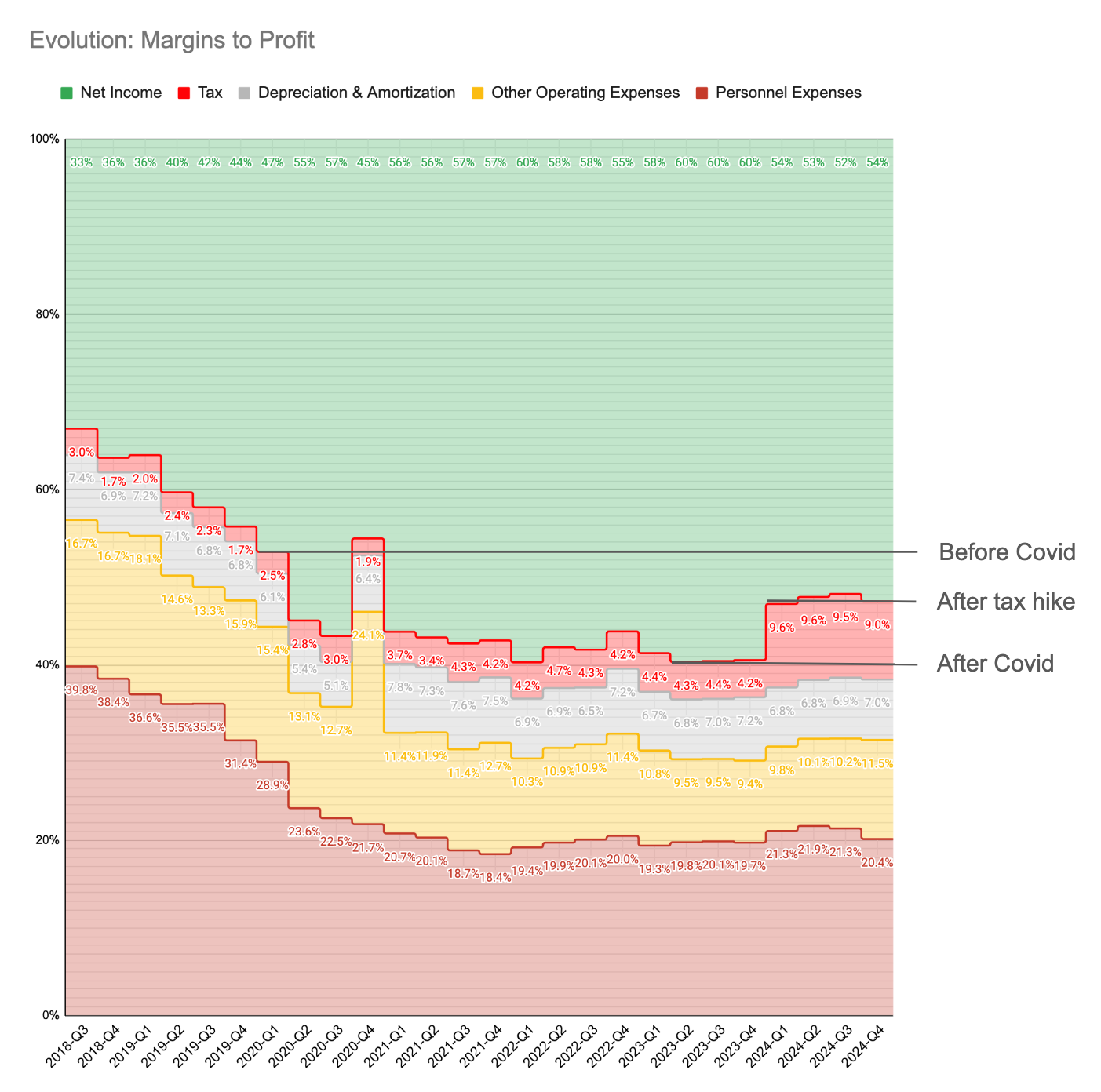

Evolution transformed its business in the post-COVID period by boosting its operating leverage not only due to the surge in player demand but also by focusing on more scalable games, such as game shows. The Pillar II tax hike seems to have reversed a majority of the company’s post-COVID profitability gains.

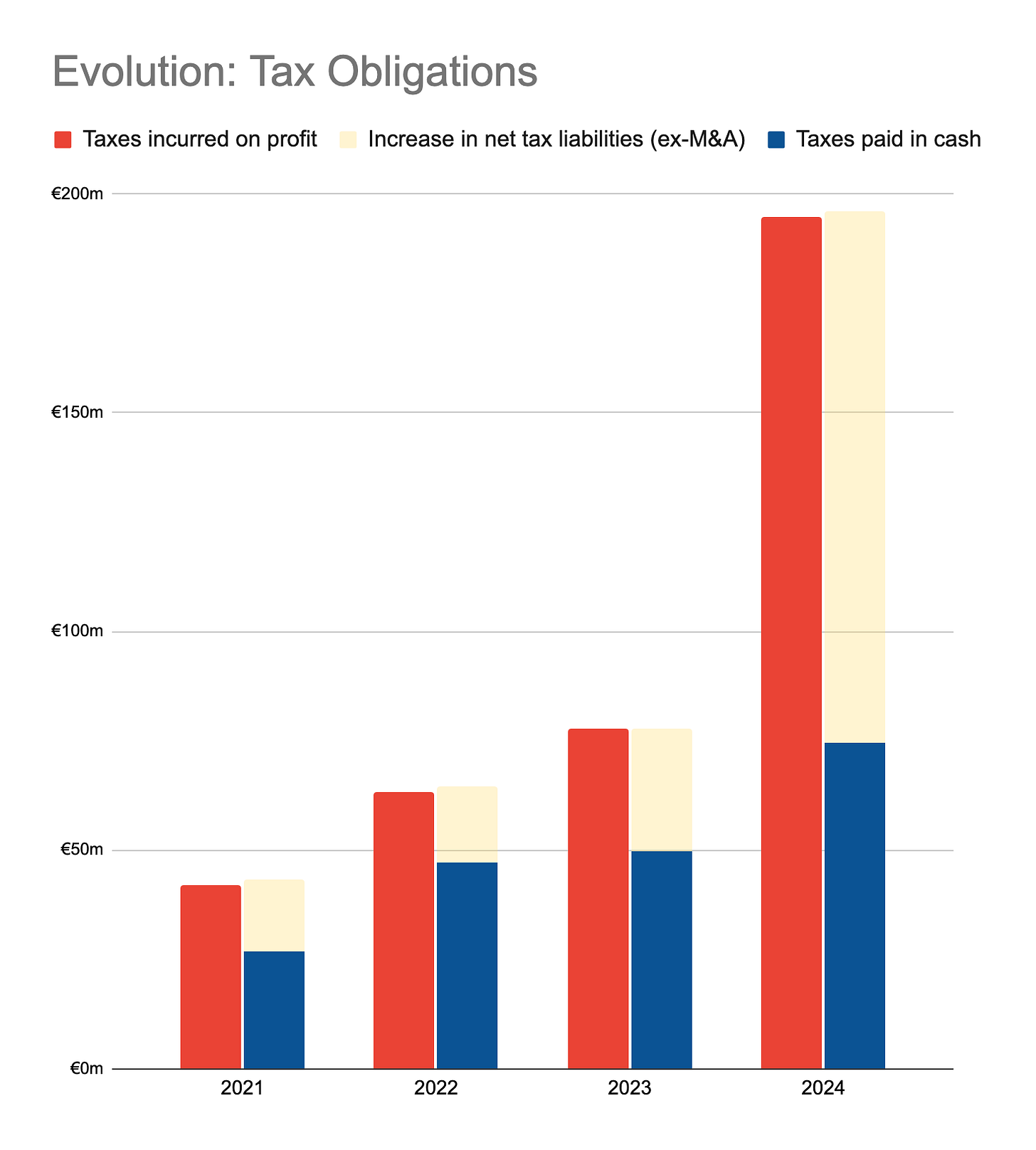

As a side note, Evolution’s cash flow metrics, such as free cash flow, remain somewhat misleading, at least until the first Pillar II top-up payments start in 2026. Evolution used to pay 2/3rd of its incurred income taxes in the same year (natural for a fast growing company). However, despite the slowing growth, the company paid out just 1/3rd of its incurred taxes in cash in 2024.

Headwind #3: Piracy

The growth in the company’s highest sales and profit growth market came to a complete stop by the end of the year.

Asia is not only Evolution’s biggest market…

It is also the market that supplied half of the company organic growth over the last five years.

“You can look at it like someone having a movie downloaded on Pirate Bay”

— CEO Carlesund

Management’s Q4 comments as well as my conversations with them made the nature of the “cyber attacks” clearer in my understanding. Although the company refuses to provide many technical details, unlawful developers seem to have gained access to Evolution’s Live Casino video feeds (and possibly the games’ real-time meta data?) and built pirate games with separate betting systems on top of them. Although pirating seems prevalent for slot games including those of Evolution’s RNG studios, Live Casino was a much harder technical challenge that seems to have been cracked this year. Evolution’s Live Casino feed is meant to be directly and instantaneously distributed to millions of players. However, most of the identifying information of those players (beyond IP addresses) is not accessible by Evolution. Moreover, a player’s operator (who is supposed to gate-keep access) may not even be Evolution’s direct customer but a downstream actor with an aggregator in the middle, as is popular in the unregulated Asian markets. The wide-reaching yet opaque nature of the Live Casino downstream, especially in unregulated markets, makes it a big technical challenge for Evolution to secure its games against piracy without impeding legitimate users. Moreover, Evolution’s eventual development of a solution to the current attacks is liable to not be the end of the story, but just the beginning of it.

As is the case with other forms of IP piracy, Evolution will likely need to play an ever escalating game of whac-a-mole against the infringers in all unregulated markets that supplies the majority of its growth (as well as the black markets inside regulated ones), especially with the possible amounts of profits involved.

Dormant Risks

Risk #1: Focus on regulated markets

Do regulated markets lower margins?

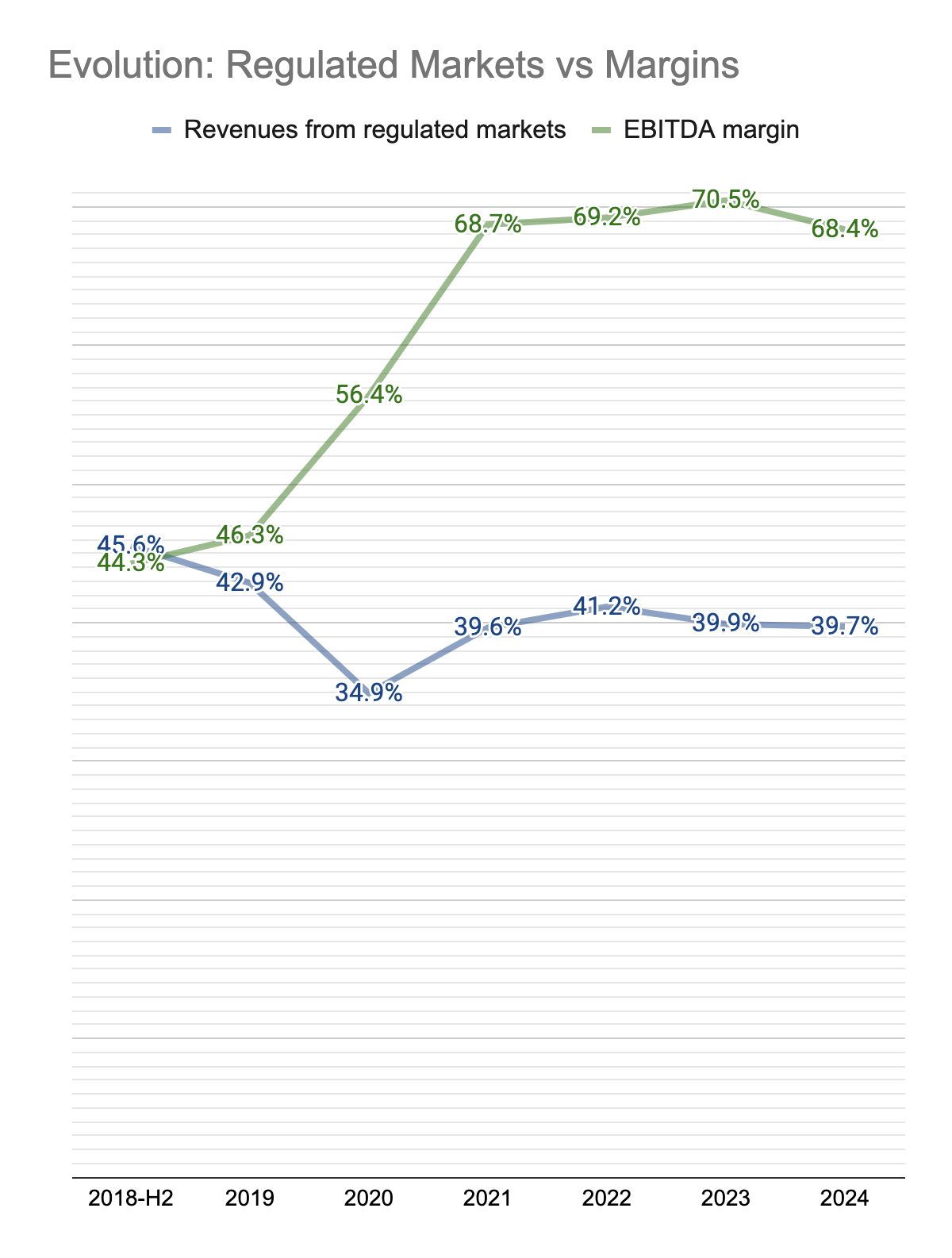

It has been argued that Evolution’s inevitable shift to regulated markets will bring down its profitability. On the face of it, the company’s shift to unregulated markets indeed coincides with higher margins.

However, the share of company’s sales from unregulated markets does not seem to have a strong correlation with its margins.

You know what has a strong correlation to the margins in the same period? The production scale of the company’s proprietary games.

Evolution’s profitability has risen as the company kept utilizing more personnel per game, both on the development side to create more sophisticated games as well as on-camera due to game shows’ higher personnel intensity compared to traditional table games.

As a rule of thumb, it can be assumed that more sophisticated games are more scalable and create more revenues per table.

A shift to regulated markets does not seem to necessarily bring lower margins, as long as the market’s scale is available. (The US with its state-by-state supply rules bring their particular economics whose effect I will try to address in the next risk section below.)

In fact, even the original example of Playtech doesn’t show a significant margin deterioration while it shifted its international focus away from unregulated markets to regulated markets.

Shifts inside regulated markets

Evolution’s regulated market sales include some amounts of black market channels. However, starting with the UK, European regulators seem to have started requiring Evolution to block this sales channel.

“We are working with all regulators in Europe constantly. And I think that there is a move to this that you want to restrict the Internet in one way or the other, block part of the Internet and so on. And, we are following that and it will be implemented cautiously over Europe.”

— CEO Carlesund

What management means with restricting (or ring-fencing) the Internet seems to be to block Evolution’s video streams to a whole country’s IP address range, then whitelist particular locally-licensed operators and only stream to that country’s players who are verified by those operators.

Many European regulated markets seem to consist of large portions of black markets due to misguided regulations. So, depending on how widely and effectively regulators enforce their supplier compliance, Evolution could lose, keep or even gain significant market share in those markets.

Risk #2: Resource mix

Evolution’s studio supply went through a big whiplash in the year.

Georgia studio expanded quickly in H1 and then downsized to pre-2022 levels in Q3.

Company has been scrambling to add studio capacity in other international locations.

In the mean time, the US studios that serve limited-scale markets continued their hiring pace.

Despite the mid-year turmoil, Evolution ended the year with a respectable headcount increase.

There seems to be two open questions regarding the expansion:

Can Evolution make up for the lost supply potential after the expansion freeze in Georgia?

Can the company keep its operating leverage after a more expensive personnel base internationally outside Georgia as well as in the US states?

Can Evolution acquire enough resources?

The company seems to have done a good job on expanding its international studio capacity outside Georgia. Excluding the largely isolated North American studios, Evolution’s ex-Georgia headcount may have increased by almost 40% between 2023’s average and 2024’s year-end.

At first glance, the company’s net headcount increase in 2024 seems relatively muted compared to the previous years.

However, these results hide the huge impact of the early ramp-up and the subsequent downsizing in Georgia during the year. As a sign of the overall expansion activity during the year, Evolution’s CEO has commented that 2023’s table count of 1,600 would have increased to 1,900 in 2024, instead of the year-end result of 1,700, if it wasn’t for the Georgia downsizing. This hints that Evolution gross hirings were probably much higher than what can be discerned by the year-end figures.

Additionally, the simultaneous capital investments were at an all-time-high during the year. The increased capex in relation to hiring numbers can probably be attributed to bigger-scale game productions and the opening of disparate studios all over the world.

In fact, a common question among shareholders in such a capital-light and high-return business is whether Evolution is investing all it can into its business. While the expansion hiccup in Georgia and the current slowdown makes it hard to measure conclusively, the ratio of incremental Live Casino sales to previous-year capital investments hint that there is currently no obvious under-investment inside the company.

As for external investments, company’s track record has shown that outsized acquisitions of inorganic revenue growth have not worked well for Evolution.

Will the new resource mix support the profitability?

Despite the acquisitions of relatively expensive workforce in the US and ex-Georgia Europe, Evolution’s quasi-gross profitability per employee (sales less personnel expenses) is yet to show a weakening of the company’s legendary operating leverage.

Still, the company paid a slightly higher portion of its revenue to its employees which coincided with a slightly lower operating margin in the year.

And, the management is guiding for slightly lower EBITDA margins (66-68% instead of 69-71%) for 2025.

This is an area that bears watching. However, I am currently not very concerned due to three assumptions:

Company’s studio network infrastructure is truly global and flexible. For example, management has hinted that they may be turning the quickly expanding Colombia studio into a global hub of Spanish and English language tables.

The growing scale and scalability of Evolution’s proprietary game line-up should be able support its operating leverage at slightly higher wage costs.

The US expansion is bringing incremental profits and benefits without a downside to the profit growth. Possibly lower margins in the US does not limit or harm Evolution’s future prospects.

Risk #3: Customer concentration

Evolution’s customer concentration has increased greatly in the last three years.

“You want to work with big customers doing well. But, I think we might be on a little bit on high mark. It could come down a little bit in the future.”

— CEO Carlesund

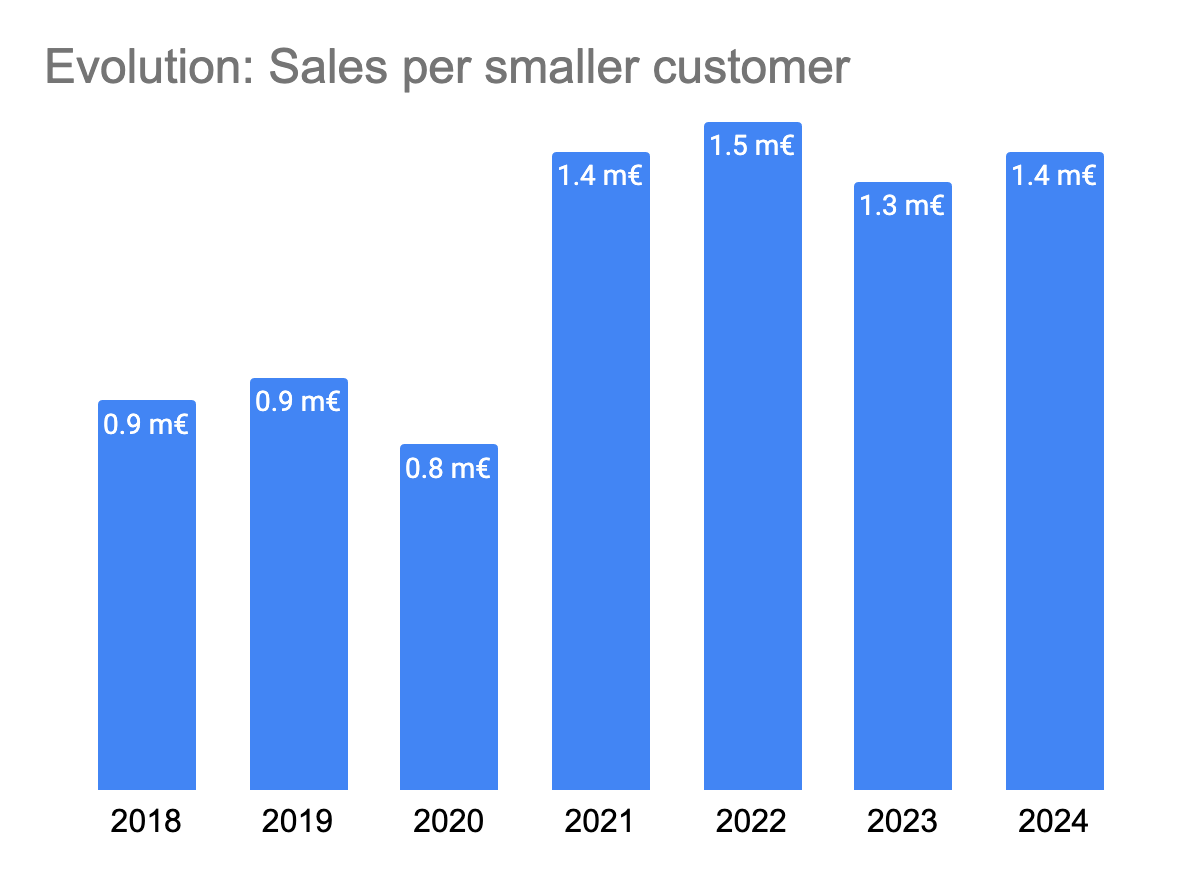

However, the big increase in concentration has emerged among the customers #2 through #5, rather than with the customer #1. Over three years, the average of customers #2, #3, #4 and #5 grew their revenues to Evolution by almost 6x and their share of Evolution’s revenues by almost 3x.

In the meantime, the average revenue generated by smaller customers (customer #6 to #800) didn’t move much.

In 3 years, over 70% of Evolution’s growth came from its top-5 customers. A small positive is that the peak concentration happened in 2023, not 2024.

Another way of looking at this is that Evolution’s top-5 customers are growing at multiples of the rates of its smaller customers.

Why should you care about customer concentration? Two reasons:

Does Evolution truly control its destiny with its cutting-edge products or does its growth actually depend on the marketing efforts of its big operators?

Will Evolution be able to keep its pricing power if so much of its business depends on just a handful of customers?

What we don’t know is the type of these customers. Unfortunately, the company is tight-lipped about who those top-5 customers are. And, the opaqueness of the unregulated markets (especially in Asia) make it close to impossible for me to guess the nature of these customers with confidence.

If these top-5 customers are mostly aggregators that resell Evolution’s games to operators in unregulated markets, the risks in question should be very small, I believe. After all, aggregators and operators in unregulated market tend to be largely interchangeable from the players’ perspective. However, on the other extreme, if these top customers are actual operators in regulated markets where operators may earn a higher stickiness with players, Evolution’s dependency risk definitely increases.

Capital Allocation

Having gone through all of the possible risks and headwinds above, I would like to close up this annual review on a more positive note: the gushing cash flow to Evolution and what the company does with it.

As can be seen below, almost all of the cash generated by business operations is being returned to shareholders.

Considering the company’s announced allocation plan for 2025 (€140 million capex, ~€570 million dividend and €500 million buybacks) and rough guesses on the accruing Pillar II top-up taxes as well as the traditional next-year dividend reserve, Evolution does not seem to have left a large amount of unallocated cash for big acquisitions or additional buybacks in 2025.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Excellent analysis as always. Many thanks!

Great job. I recently purchased just due to great balance sheet and pretty technicals, but your work definitely helped me to understand the business better.