Evolution's Q4 2024: Quarter in Review

A tale of two markets

In the fourth quarter, Evolution continued its overall subdued growth but with a few twists.

Growth Sources

Europe and North America provided almost all of the growth over the previous quarter.

On the other hand, company’s traditional growth engine, Asia, completely stopped its incremental growth.

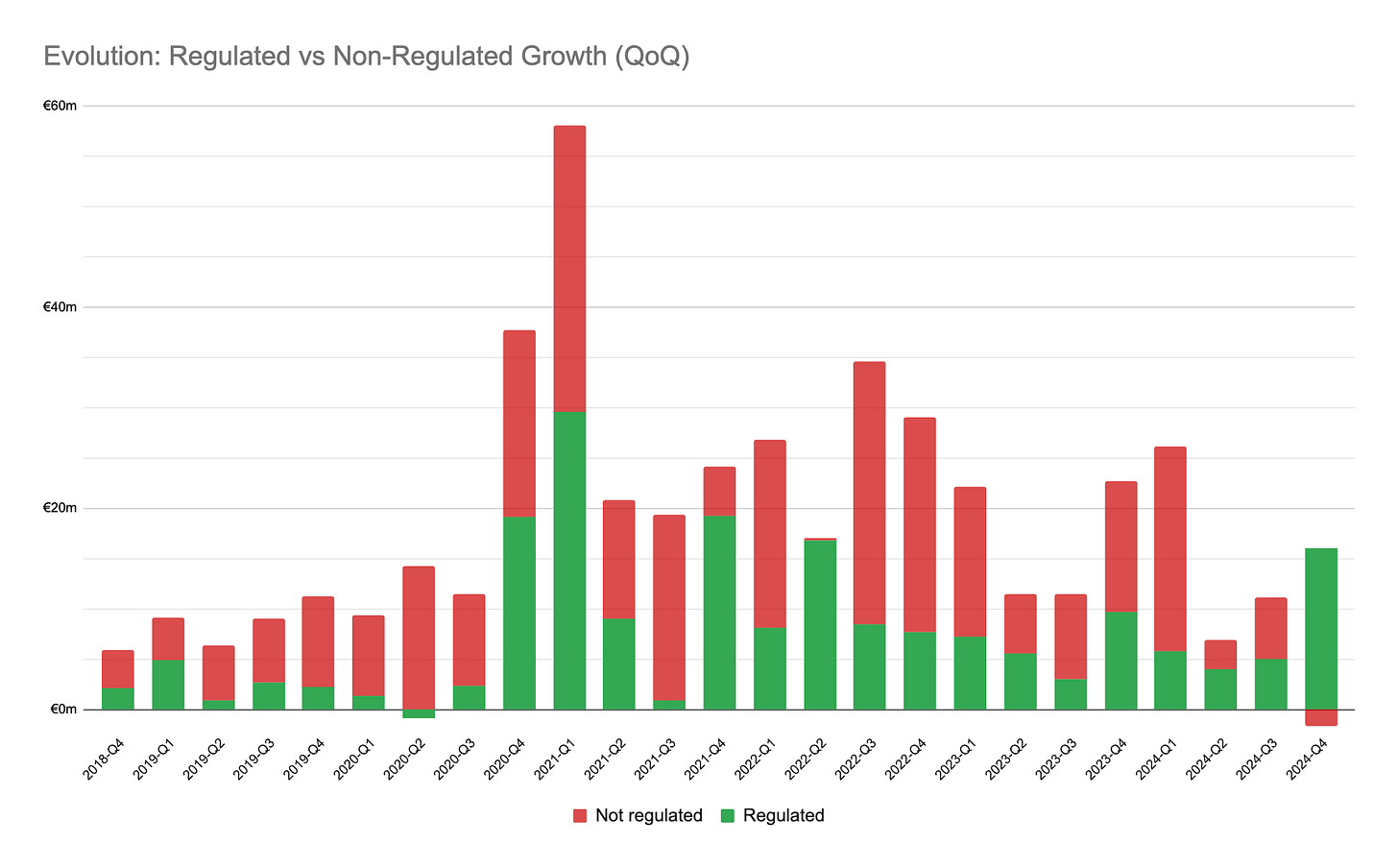

Maybe even more abnormally, all of the quarterly growth came from regulated markets, and the company’s revenue from unregulated markets actually declined.

Both year-on-year rate of growth as well as the quarter-on-quarter incremental revenue ended up smaller than the same quarter last year.

RNG Growth, Finally

After over 2.6 billion euros of acquisitions and 4 years of efforts, Evolution’s RNG segment finally grew beyond its post-acquisition high mark.

RNG segment’s share of the company revenues seems to have stabilized over the last year.

Expansion

Studio expansions seem to have continued at a decent rate in the quarter.

Profitability

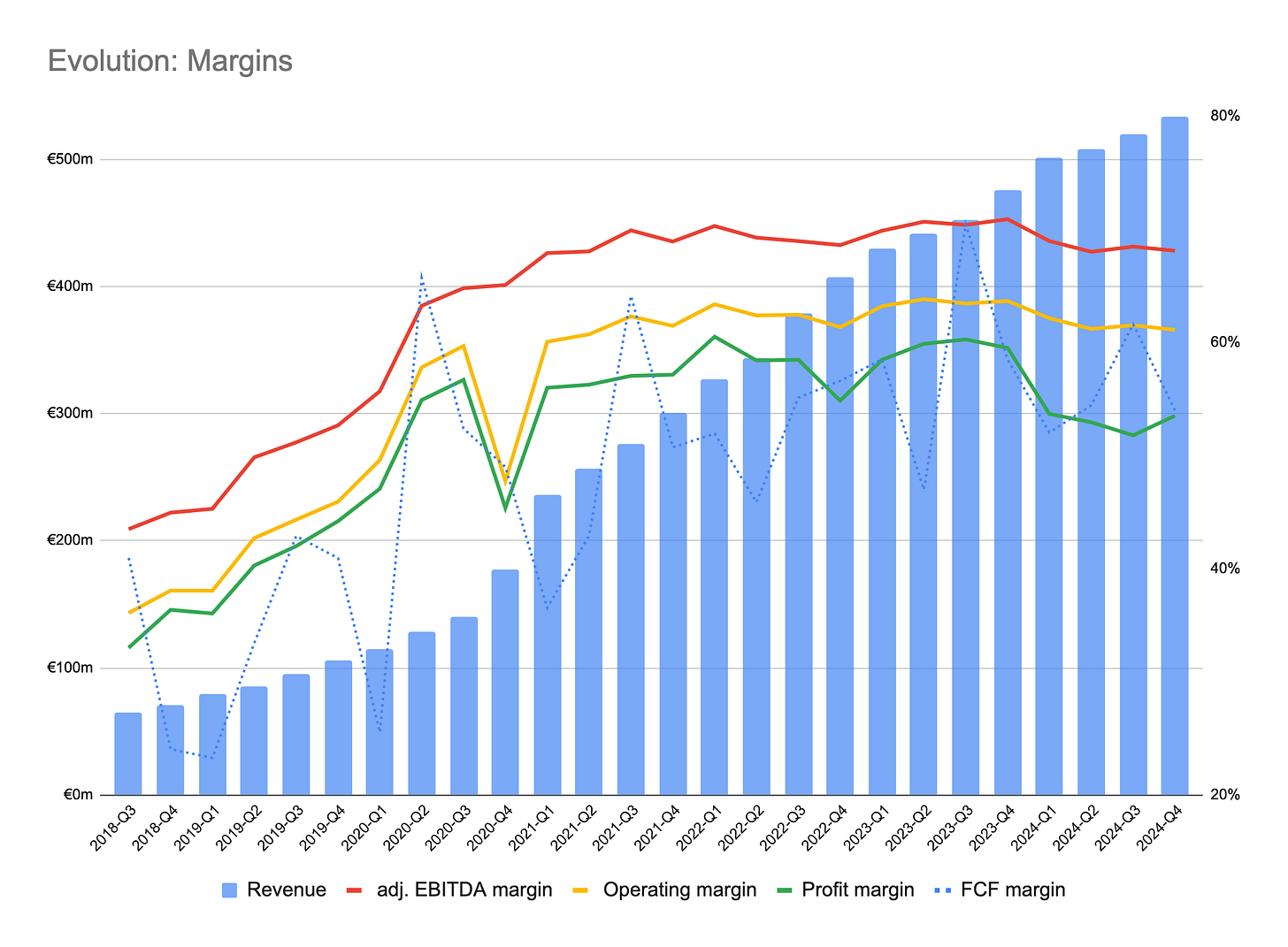

Despite one-off bonus reductions in personnel expenses, Evolution’s operating margin declined in quarter likely due to high consultation costs as part of other operating expenses. (I can’t help but wonder whether these technical and legal consultations are related to Asia cyber attacks or European regulatory troubles.)

Evolution’s average employee continued generating close to record high revenues.

Interestingly, the company’s incurred tax rate fell slightly below the Pillar II minimum of 15%.

Results for the shareholder

Next: You can find my review of Evolution’s FY2024.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Teşekkürler :)

Good analysis! There's nothing to do but just hold it.