Why I own Domino's Pizza

Can the EPS grow to the sky?

I have owned Domino’s Pizza (DPZ) for the last few years and hope to continue owning an opportunistically increasing amount of shares for decades to come.

I presented my thesis of ownership to a few friends last month. The following is a summary of that presentation.

Thesis

I think that the company can grow its EPS in a fashion halfway similar to its past decade.

Business Owner’s Overview

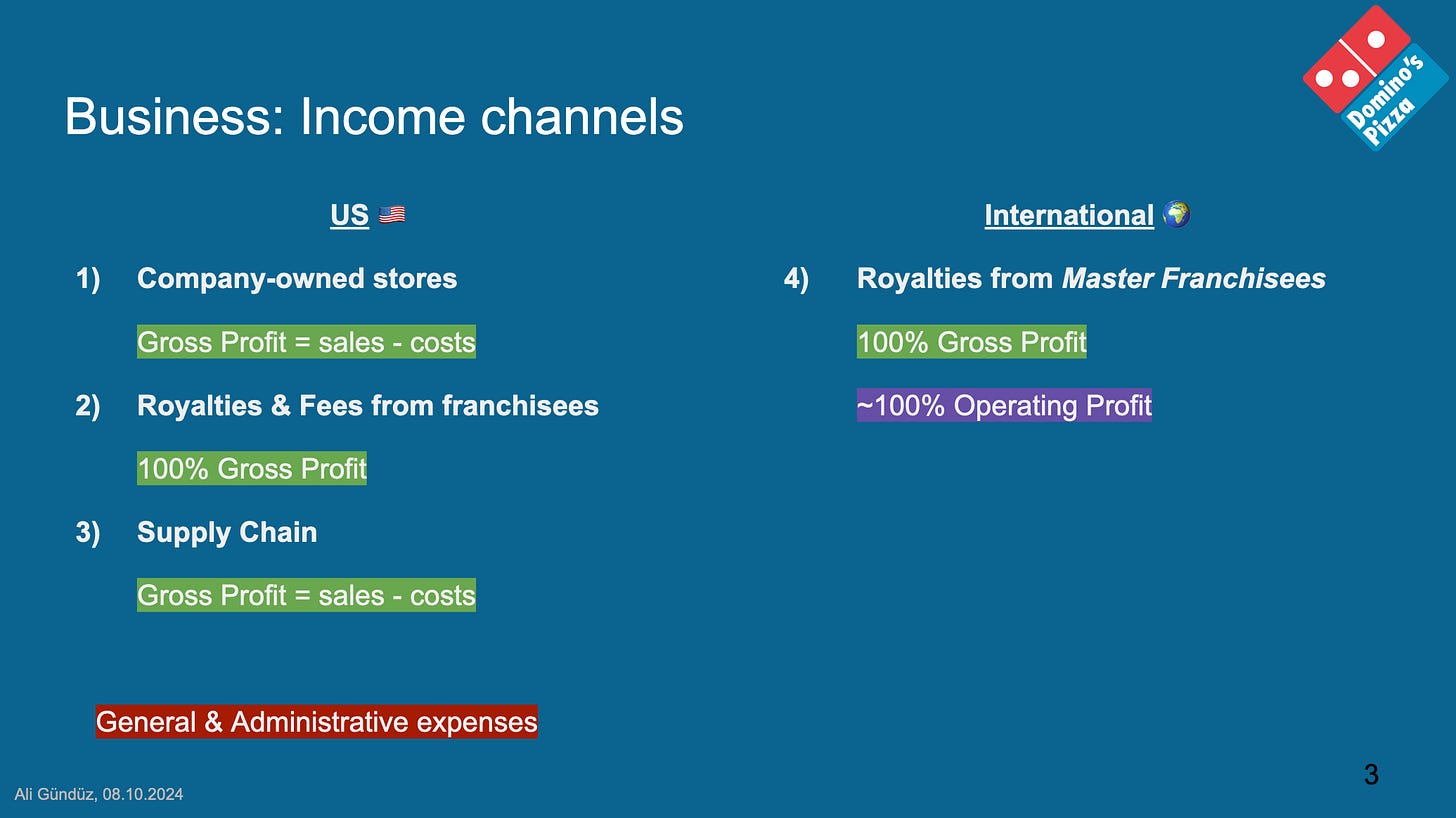

The company has 4 channels of income:

Retail sales from company-owned stores in the US

Royalties and fees charged to franchisees in the US

50/50 profit share from the supply chain of food and equipment sales in the US and Canada

Royalties and fees charged to the international master franchisees

These channels come with wildly different levels of profitability. Retail sales from the company-owned stores are largely “empty calories” while a royalty check from a master franchisee is almost completely pure profit.

Therefore, I consider the company’s revenue by itself completely devoid of any useful signal. Instead, this is how I assess the company’s overall performance:

I take the Domino’s system sales as the true top-line figure.

From this top-line, DPZ effectively earns a surprisingly consistent yet slowly increasing 10% commission on US retail sales and 3% on international retail sales as its main gross profit sources.

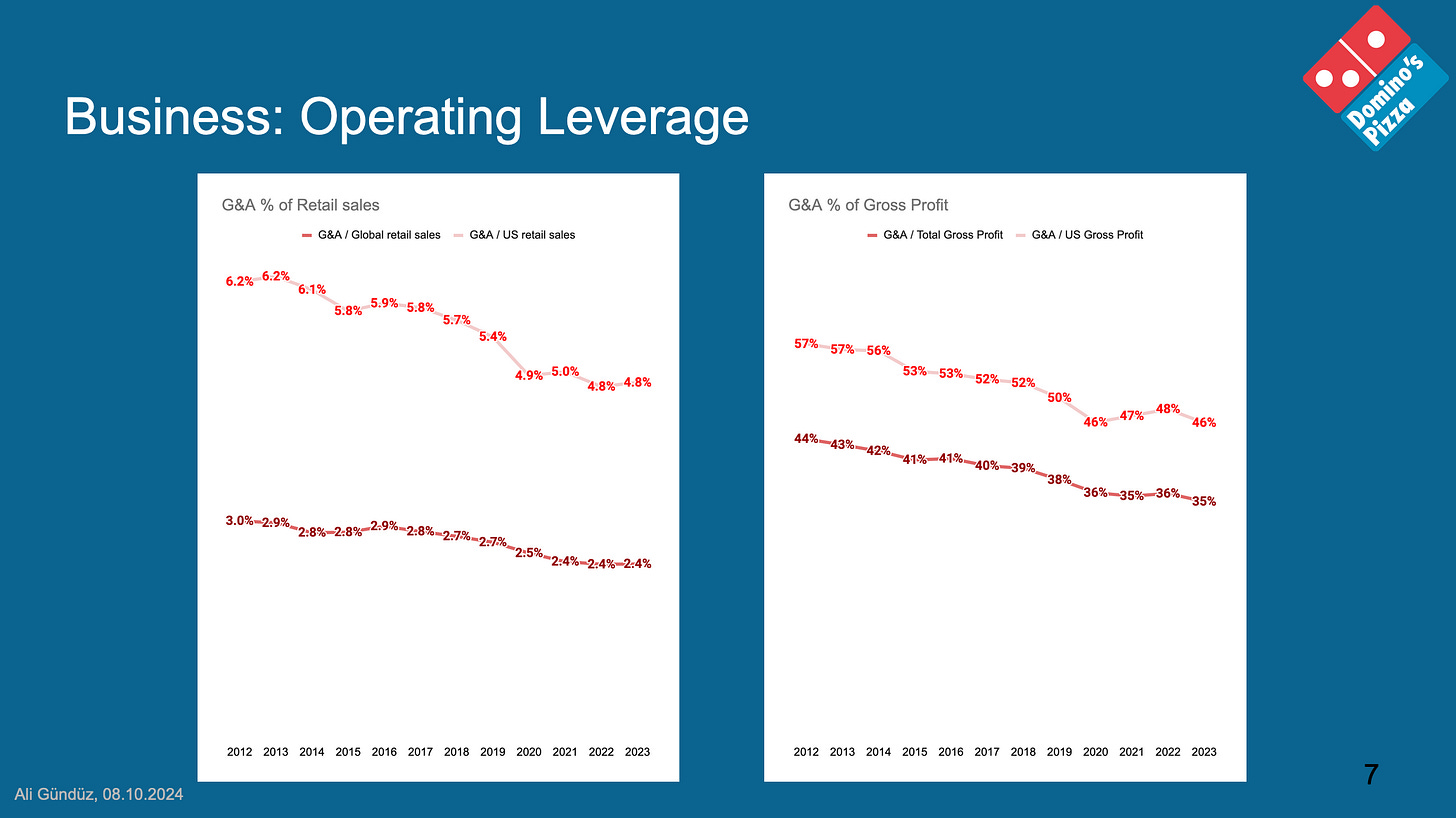

Finally, despite rising corporate expenses and interest payments, an ever increasing portion of the gross profits flow to the owners’ bottom line.

Despite successfully supporting an innovative brand, product line and tech stack, the corporate expenses needed for that support is increasingly becoming a smaller portion of the system.

And, just in case there is any doubt: Yes, those earnings are based on real cash flows.

Can the EPS grow further?

The future of the company’s EPS growth depends on how you answer 3 questions:

Can DPZ grow domestically? 🇺🇸

Can DPZ grow internationally? 🌍

Can DPZ handle its debt? 🧨

Can Domino’s grow domestically? 🇺🇸

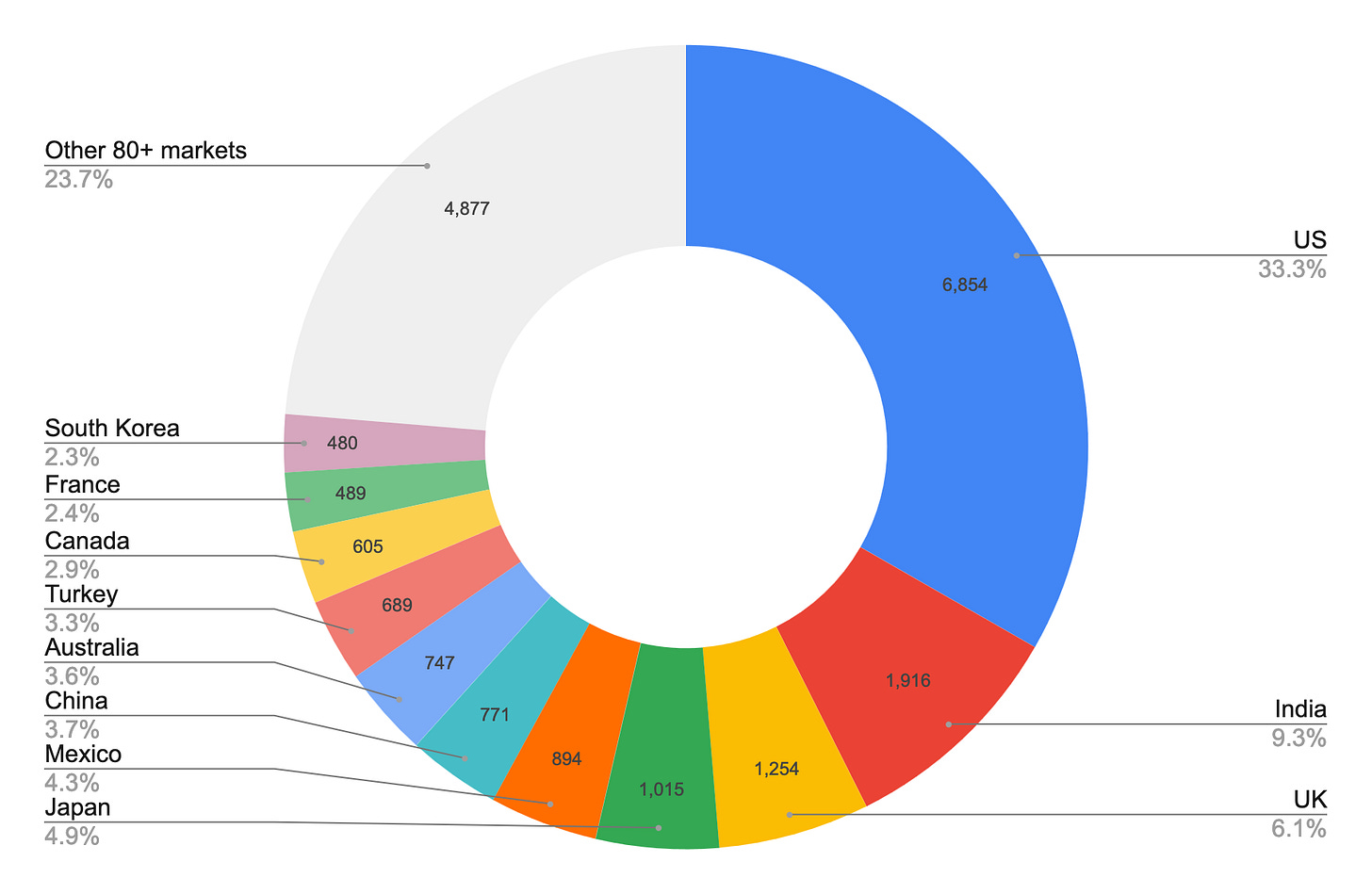

Incredibly, USA makes up almost half of the world’s pizza market.

Although the US makes up just under half of Domino’s global retail sales, DPZ sources 75% of its gross profits and over 60% of its operating profits from the country.

Domino’s has been THE pizza brand in the US for many decades now. Yet, the company managed to double both its market share and retail sales in less than a decade. And, it still barely makes up just a quarter of the market.

The company is counting on 3 main initiatives for continued growth in the US. Their common theme is the view that convenience, consistence and value will create ever growing demand from consumers.

Initiative #1: Carry-out

Carry-out has been a big growth category for Domino’s with a huge room for even further growth.

It’s a more profitable yet harder-to-scale sales channel. As a restaurant, you don’t incur delivery costs but have to be close to the customer.

Initiative #2: Fortressing

Domino’s has been dividing its restaurants’ service areas for a denser coverage efficiency with great results.

As you can guess, this has also been part of the secret sauce behind the recent carry-out success. As the company found out, the promise of a faster and more consistent service generates new demand from consumers.

One could expect the individual restaurant franchisees to be the losers in this area shrinkage. However, owning a Domino’s restaurant remains a license to print money.

Almost all franchisees originate from inside the Domino’s system (many of them as former kitchen and delivery staff) and run no other franchises. Considering that the average restaurant has a just 3 year payback period and the average franchisee owns 9 restaurants, the culture and incentives seem pretty well aligned in the system.

Initiative #3: Technology

Domino’s runs an in-store and consumer-side tech stack that is unrivaled in the pizza category, with very few equivalents even in the general restaurant sector.

US Growth Potential

The company justifiably expects the next few years to be similar to the last few.

Marketing Machine

Before moving on, I’d also like to mention that I see the current CEO, Russell Weiner, as a not-so-secret weapon for the company’s future success, especially in the US where DPZ runs the marketing. Weiner was the chief marketing officer that led the company's iconic "pizza turnaround" campaign back in 2009. Domino’s has had very effective marketing campaigns since he became the CEO in 2022.

The company’s US marketing specializes in turning consumer negativity on its head whether it’s the inflation, shrinkflation, tipping fatigue or simply not liking Domino’s.

Can Domino’s grow internationally? 🌍

Domino’s Pizza’s international system (run largely by its master franchises) has had a great growth track record.

The international system includes a diversified portfolio of restaurants growing both in the developed as well as the developing markets.

As a whole, developed countries come with hundreds of millions of consumers with purchasing power but (compared to the US) less developed pizza delivery markets.

Developing countries come with lower per-restaurant retail revenues, from which DPZ charges its 3% commission. (After all, one can buy a pizza from Domino’s for as low as $0.60 in India.) But, Domino’s is also positioned as the unrivaled pizza leader in these countries with huge populations and rising purchasing power. If operated well, Domino’s will likely never run out of growth runway in my lifetime.

Having said this, the international system’s growth story became murkier recently, with disappointing results from store openings in the developed countries with Japan and France as primary pain points.

I still think the company’s cancelled international growth guidance provides a valuable outlook if taken as a rough sketch.

The specific growth figures may get pushed to later years. However, with so many growth opportunities in so many markets where Domino’s is still a small player, it’s hard (but not impossible!) for me to imagine a decades long scenario where Domino’s doesn’t succeed internationally in the aggregate.

Can DPZ handle its debt? 🧨

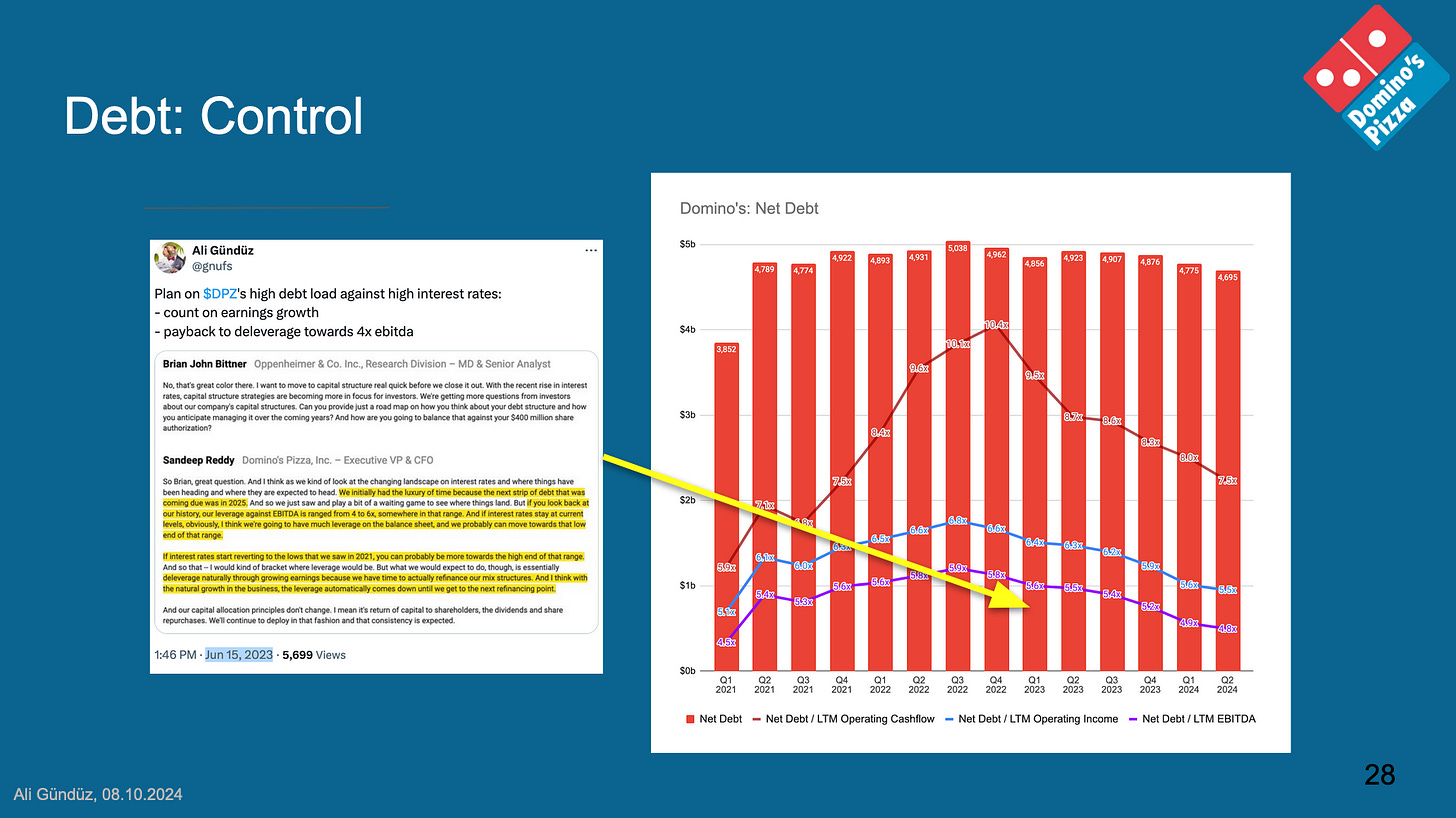

Thanks to its highly profitable and growing business, Domino’s earns enough cash flow (green area in the chart below) to re-invest in its business, pay a growing dividend and buy back a decent chunk of its shares. But, the company doesn’t stop there in its capital allocation.

Domino’s has leveraged a significant amount of debt (red areas above) between 2015 and 2021 to supercharge its buybacks. As a result, the company almost halved its share count over a decade.

If we subtract the annual growth rates of gross profits and operating profits from the EPS growth rate, we can roughly calculate how much of a role the operating leverage as well as the financial leverage played.

It is clear that the financial leverage played the biggest role in Domino’s Pizza’s rocketing EPS growth.

Furthermore, the temporary dip in 2022 exemplifies how leverage accentuates underlying results not only on the upside but also on the downside. A scenario in which the Domino’s brand and system slowly deteriorate can bring catastrophic results for the shareholders pretty quickly.

Although the amount of debt increased greatly in the last decade, the similarly increasing profits meant that the company’s leverage ratios didn’t rise in a similar magnitude.

Management is running a play book that looks rational but may not be to everyone’s taste.

Even more importantly, the company has been able to enforce this allocation policy not only during the “fun” times of levering up but also on the way down on the face of higher interest rates.

The company faces large maturities in the coming few years, but I currently don’t doubt its ability to refinance.

In the end, Domino’s Pizza’s allocation policy is a great example of how investing and portfolio construction are matters of personal choice and circumstance.

My approach: I don’t run debt in my personal finances and, so, welcome positively skewed opportunities like DPZ where I can have a limited-liability exposure to leverage on top of a growing, highly profitable and capital-light core business as a part of my portfolio.

This will not be true or preferred for everybody.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Very good writeup, thanks Ali. I am sure your friends were impressed by this one!

Nice writeup Ali. Any chance you could do a similar one for McDonalds which is your other holding?