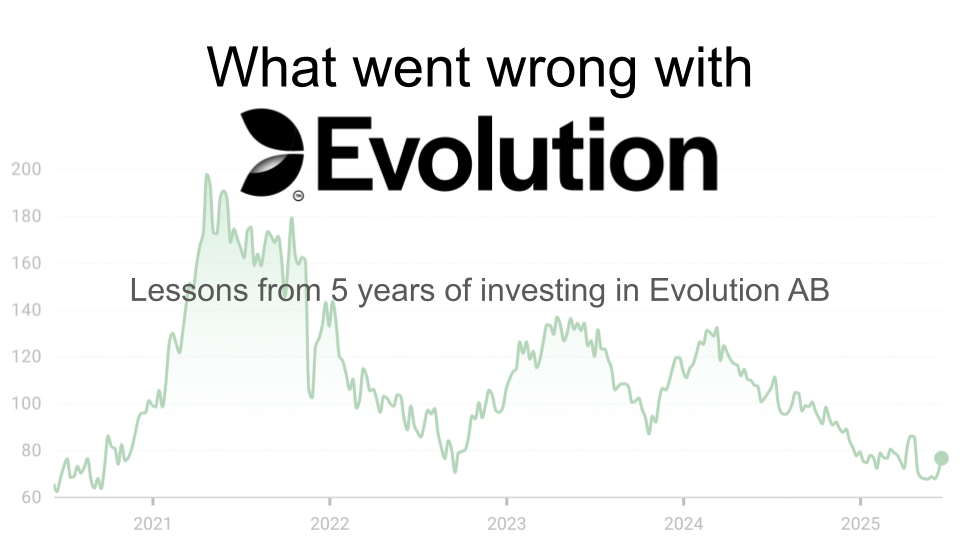

What went wrong with Evolution

A 5 year retrospective

Last month was the 5 year anniversary of my becoming an Evolution shareholder. I wanted to mark the occasion with a retrospective on my experience so far.

David Barbato was kind enough to host my ramblings on his YouTube channel.

Below is a small recap of my main points. I hope that things go well from here and I do a 10 year retrospective, too!

I believe that an observation period of 5 years begins to give an early indication of how a business is actually performing. The last 5 years have certainly been colorful and instructive for Evolution.

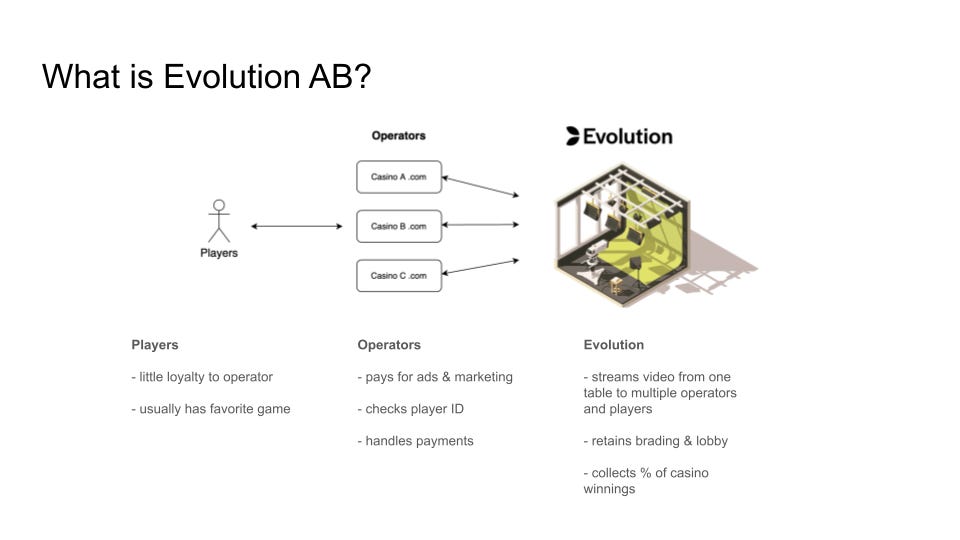

Evolution’s business model is positioned in such a way that it reaps most rewards at the highest stickiness while avoiding the biggest hassles and expenses of the ever changing landscape of online casinos. The key to its durable success is that the players tend to favor Evolution’s games.

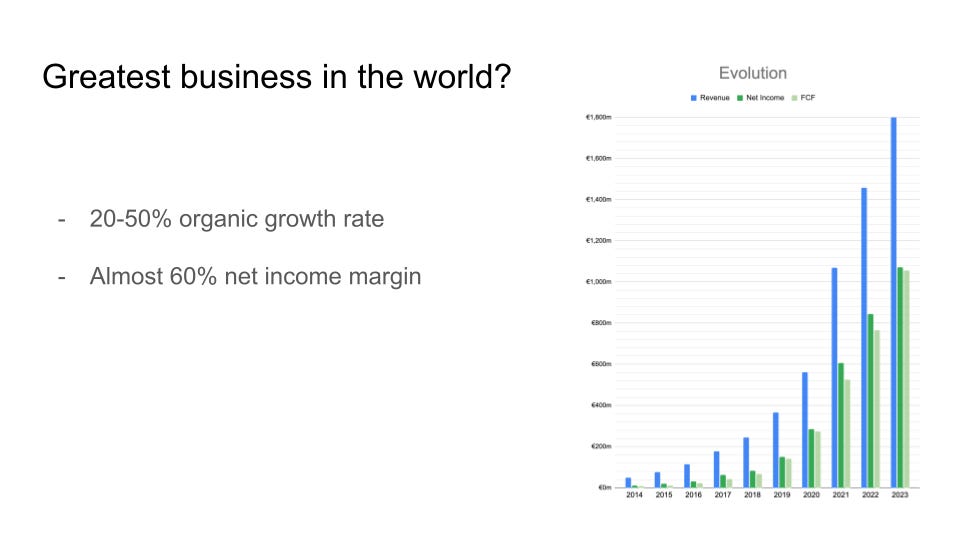

Until recently, this was a business that was organically growing at incredible rates with a seemingly unlimited runway and a surreal after-tax profitability.

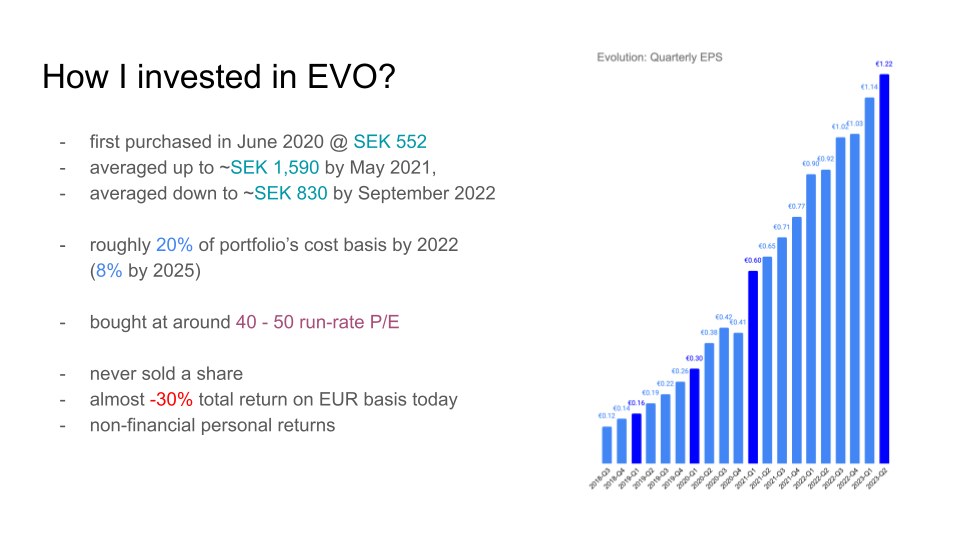

As to my personal story with the company, between 2020 and 2022, I accumulated shares into an inadvisably large chunk of my portfolio at around 40-50 run-rate P/E through the ups and downs of the stock price. Note that that the company was doubling its EPS every year or two around that time.

To this day, I have never sold a single share and am facing a not-so-pretty total return on my investment, especially compared to the opportunity cost. However, I have also enjoyed returns that are not financial in nature. I used the company as a deep learning experiment to gain invaluable experience in following a public company as closely as public filings allow and in breaking into a completely foreign industry as an outsider. My knowledge of the company let me interact with investors, analysts and institutions of much higher caliber than mine.

Before going into what went wrong, it’s important to underscore what went right: It turns out, a lot! Most of my bear cases for Evolution from the early 2020s did not actually materialize.

Nevertheless, the company is currently facing significant challenges in ways and scales that I had not expected.

The sources of these difficulties can be grouped into two:

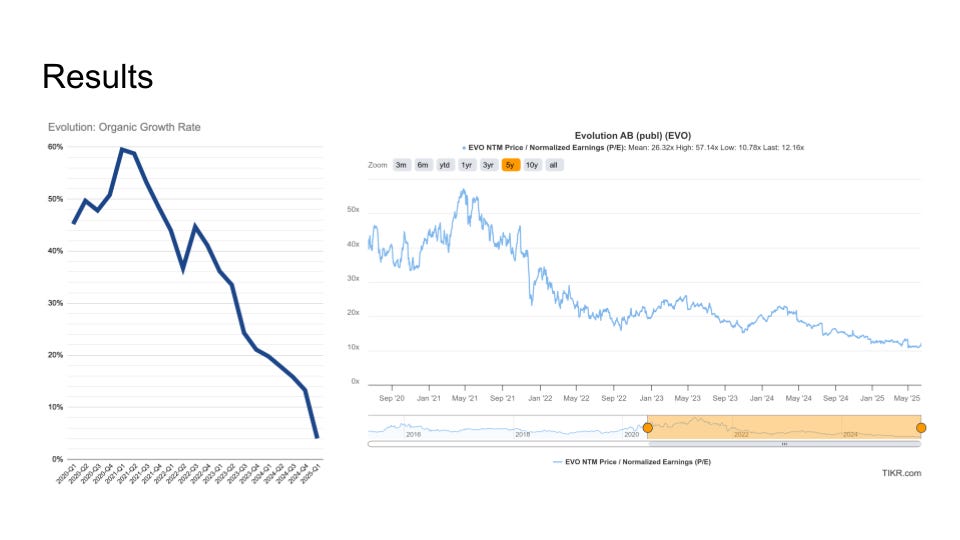

Post-COVID boom in iGaming gave way to a post-post-COVID slowdown and sobering of market demand and regulations

Evolution became too big in its space

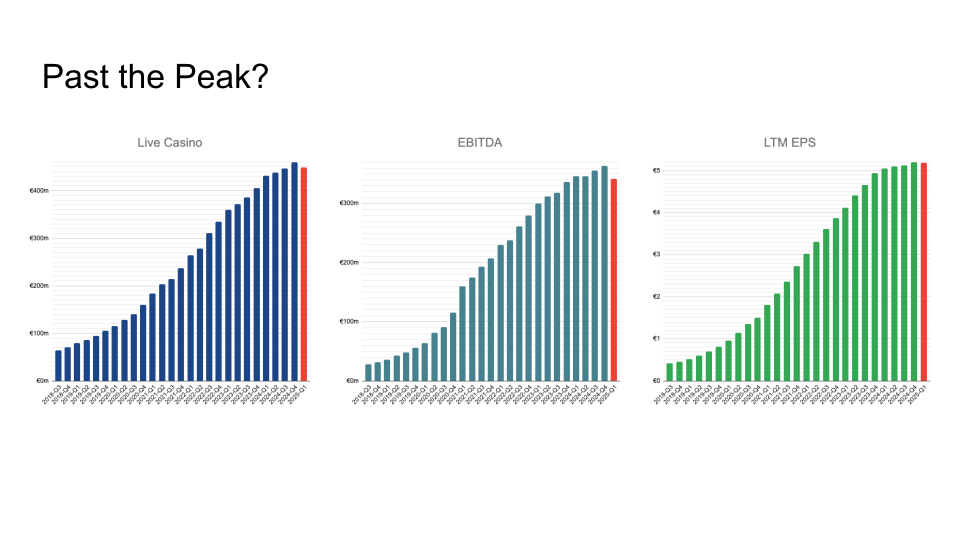

The result of these, as seen today, is close-to-zero growth…

And, even the apparent start of a decline after the peak.

One obvious lesson one could draw from this story is to never pay 40 P/E for a company. Although the painful journey down from those valuations is probably forever etched into my muscle memory, I refuse to take that simplistic lesson.

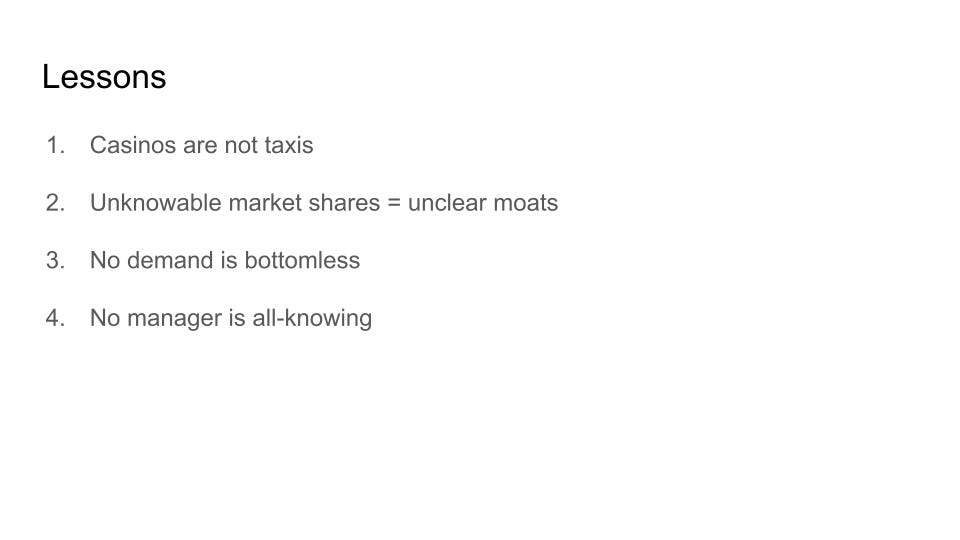

The lessons I did draw:

Regulations are, ultimately, politics. Sin sectors, even at unyielding public demand, can be irrationally regulated longer than one can expect for any other technological trend.

For the foreseeable future, online casinos will remain a largely opaque market as a whole globally. Market share is the ultimate measure of any company’s moat, and this will remain unknowable for Evolution. This means that, whenever the company announces disappointing results, its shareholders will lack that concrete data that can act as the North Star during times of turbulence: Do the consumers in the market prefer our products over the competition?

Gambling is becoming available on everybody’s phones 24/7. What can be a bigger blue ocean? It turns out that even the most obvious-sounding emerging growth trend can hit a period of slowdown.

When the tailwinds are blowing at historic speeds, it is easy for a management’s execution to look like magic. To be fair, Evolution’s managers executed through the high-growth years superbly and in a way that probably outperformed most of the competitors. Yet, the skills required to handle a high-growth rocketship differ from those required for a maturing giant of a still-emerging industry. Time will show the management’s skills for the latter.

And, what happens from here on?

If the business has truly peaked and it’s only downhill from here, then the investment returns will probably follow the business results down that hill.

However, the company’s shares trade at a relatively low multiple of its cash profits, and the company returns almost all of those profits to shareholders. If the company just stabilizes both of its earnings-movers of Asia and Europe, there could be moderately satisfying returns from here for the shareholders. If the company further manages to hit one of its prospective gold mines (a return to fantastic growth in Asia or a mainstream Live Casino boom in the USA) successfully and sustainably, those returns could be more than moderate.

Only time will tell.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Yes, regulations are politics, as you said, but let’s also look at the other side of the coin. Governments around the world are struggling with deficits—they need revenue, and gambling has always been a reliable revenue source. Hopefully, hypocrite politicians will stop treating these industries like forbidden fruit and make the rational decision to move casinos onto the whitelist.

Also, you mentioned that everyone will have access to casino games 24/7, but Evo is a unique player in the live casino space. Their games are highly entertaining and difficult to replicate.

Anyway, thank you for sharing your honest thoughts, especially given your significant stake in the company.

Thanks for sharing Ali!

Things always look easy in hindsight, but reflections like these are great lessions for all of us.

Hard to predict a multiple contraction as drastic as this one in advance. The multiple going first down to market averages and then cut in half again is nothing short of brutal.

I would be willing to bet revenues will reaccelerate again some time. That should be enough to warrant a higher multiple than 12x at least, but who knows. Time will tell