Evolution's Q4 2023: Quarter in Review

It's alive!

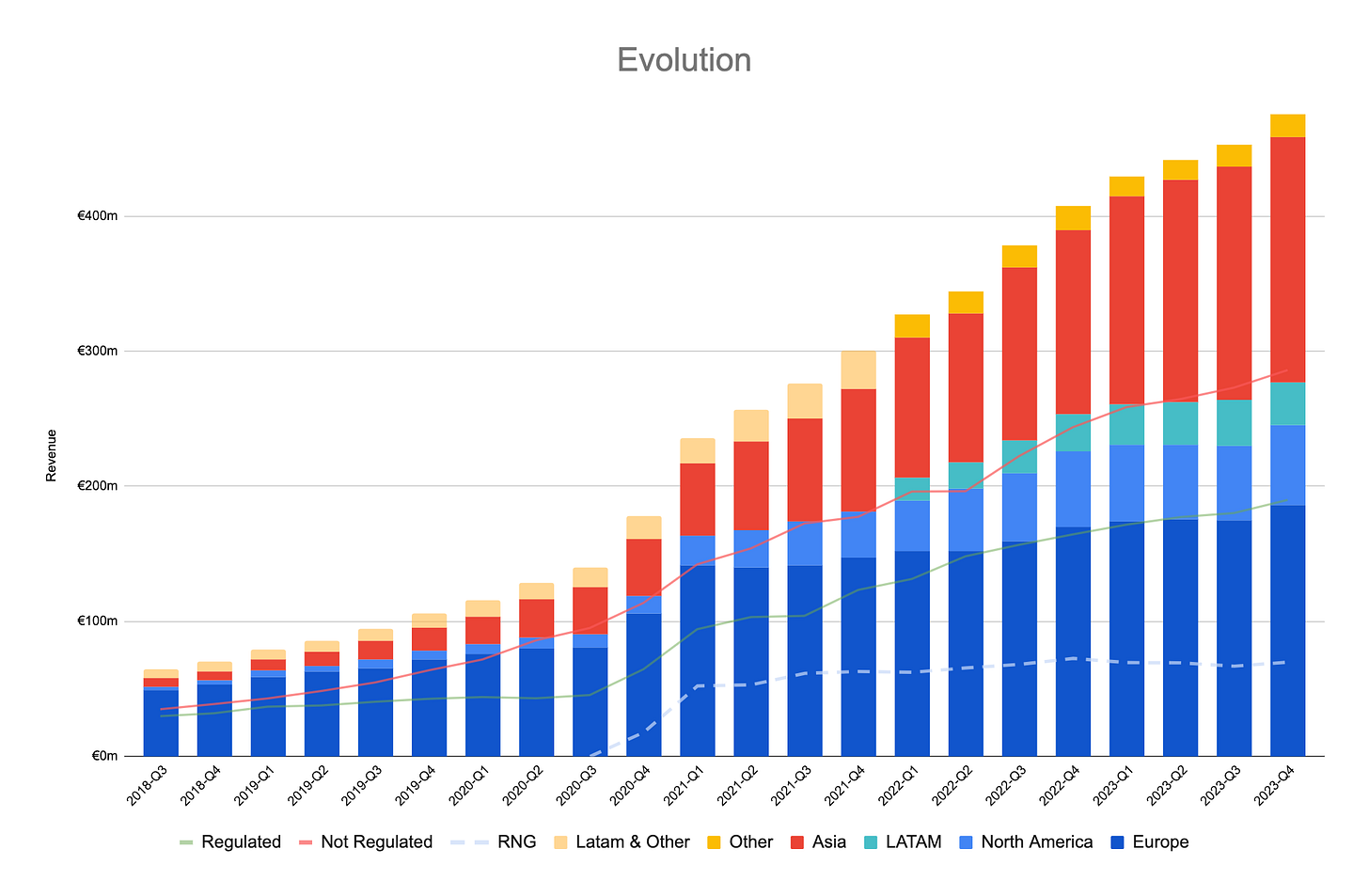

Evolution’s overall sales mix was as following in the quarter.

Growth Sources

Europe was the star of Evolution’s growth in Q4.

With the world’s 3rd and 7th biggest economies still in the early stages of iGaming maturation inside the region, Europe continues providing the core of Evolution’s growth along with Asia. North America, which actually shrunk in the aggregate of 2023’s first three quarters, finished the year with a positive 5% annual growth.

Possibly as a result of growing simultaneously in both Europe and North America, a good amount of the incremental sales in the quarter came from regulated markets.

Investments

The quarter’s big news for me was the revitalized studio expansion. Evolution achieved possibly the biggest quarterly recruitment in its history. Q4 was also the only quarter in the year in which Evolution reached the investment pace that the management guided for the year.

We will expand a little bit more and we will increase the pace and — a couple of quarters in — will probably be maybe even in oversupply, but we are close to a good place right now.

— CEO Carlesund

Time will tell whether this increased pace of studio investments will help Evolution finally surpass its algorithm of nominally-bounded incremental growth.

Profits

The portion of Evolution’s sales that go toward its “other operating expenses” hit a record low this quarter. Although management is quick to warn that OOP will be “a bit lumpy” (ICE London this week will certainly be a bump up in expenses), the long-term trend shows signs that these expenses are not growing quite as quickly as sales.

Even more amazingly, the company held on to its personnel efficiency while hiring record amounts of people in such a short time frame. When you consider the amount of time it takes for each new presenter to be trained before being put in front of actual players, this is a clear illustration of Evolution’s operational quality that the company largely maintained the amount of revenue it generated per employee during the quarter.

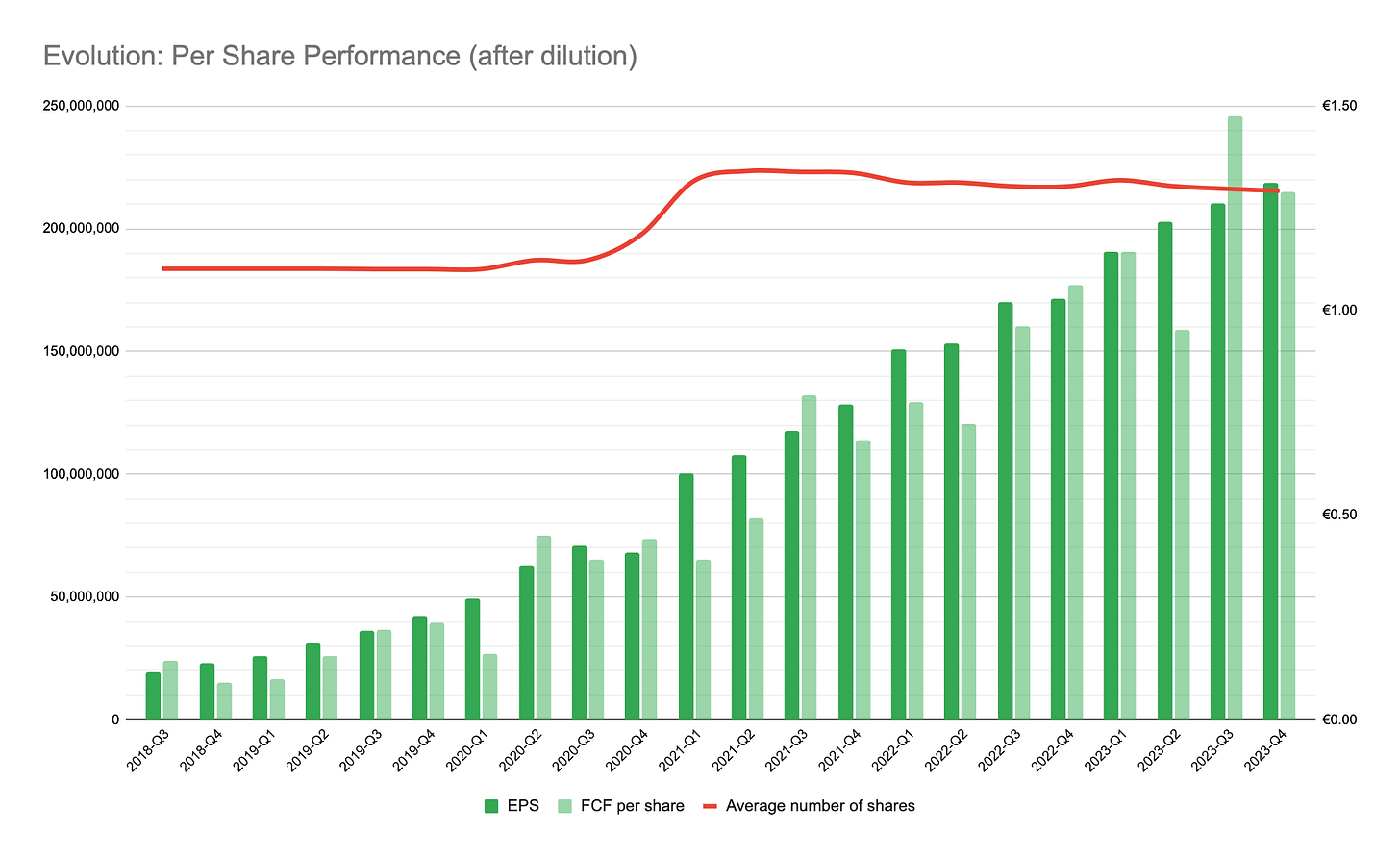

These results show that Evolution can achieve its all-time-high profitability metrics without sacrificing investments for future growth.

Results for the Shareholder

Next: You can find my review of Evolution’s FY2023.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Lovely updates, thank you Ali!