Evolution's Q4 2022: Quarter in Review

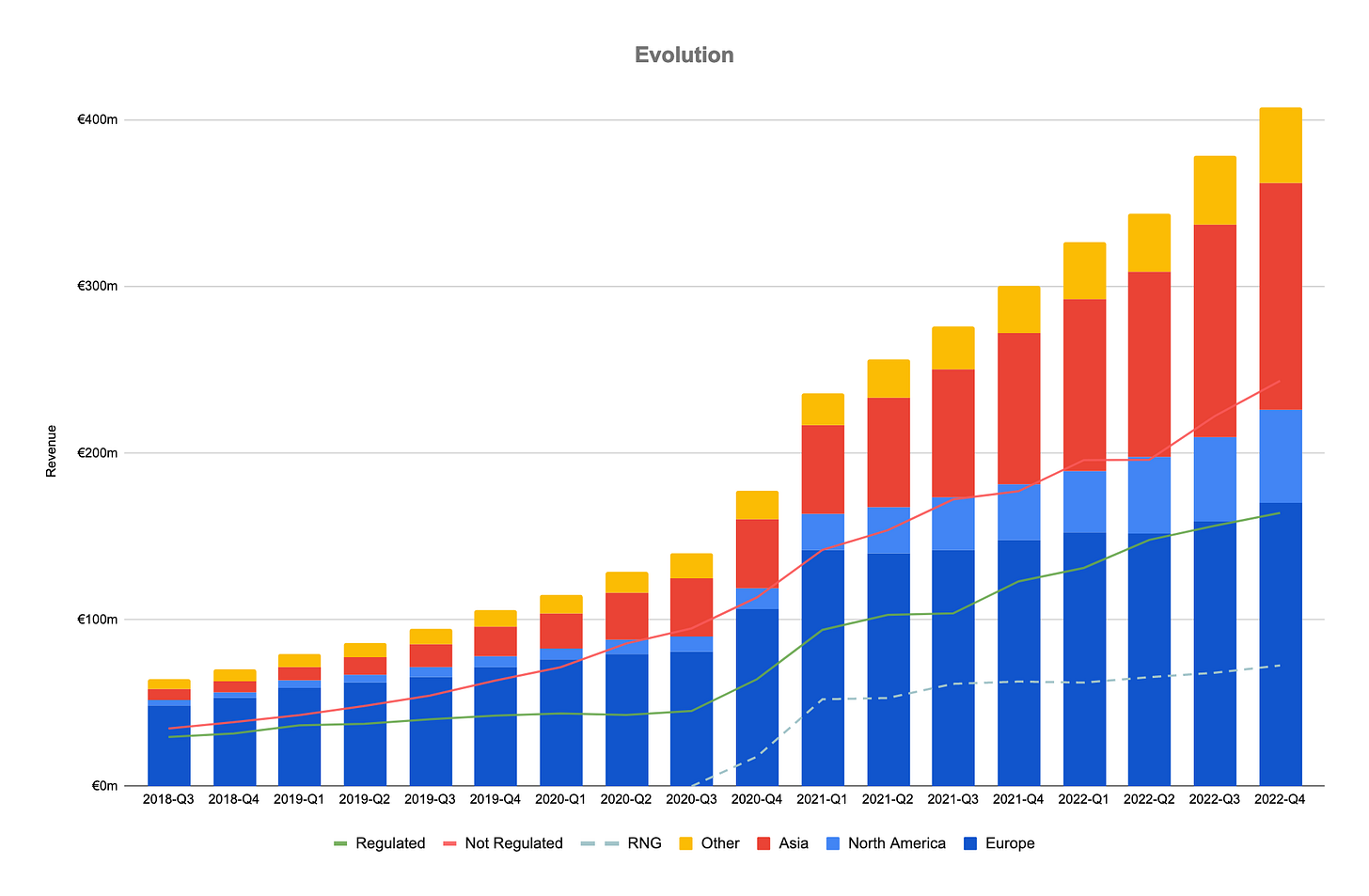

Let’s start with the 10,000-foot view of Evolution’s quarterly sales.

Evolution continues to be a story of two businesses. The Live Casino segment organically grew at a nice 8% over the previous quarter and an impressive 41% over last year’s Q4. The RNG business, on the other hand, continued its crawl of below-inflation growth.

As for where the growth came from during the quarter: Asia was not the dominant growth driver this time. And, Europe proved that it can still offer very significant growth opportunities, if stars align.

Margins seem to have found their ceiling for the foreseeable term.

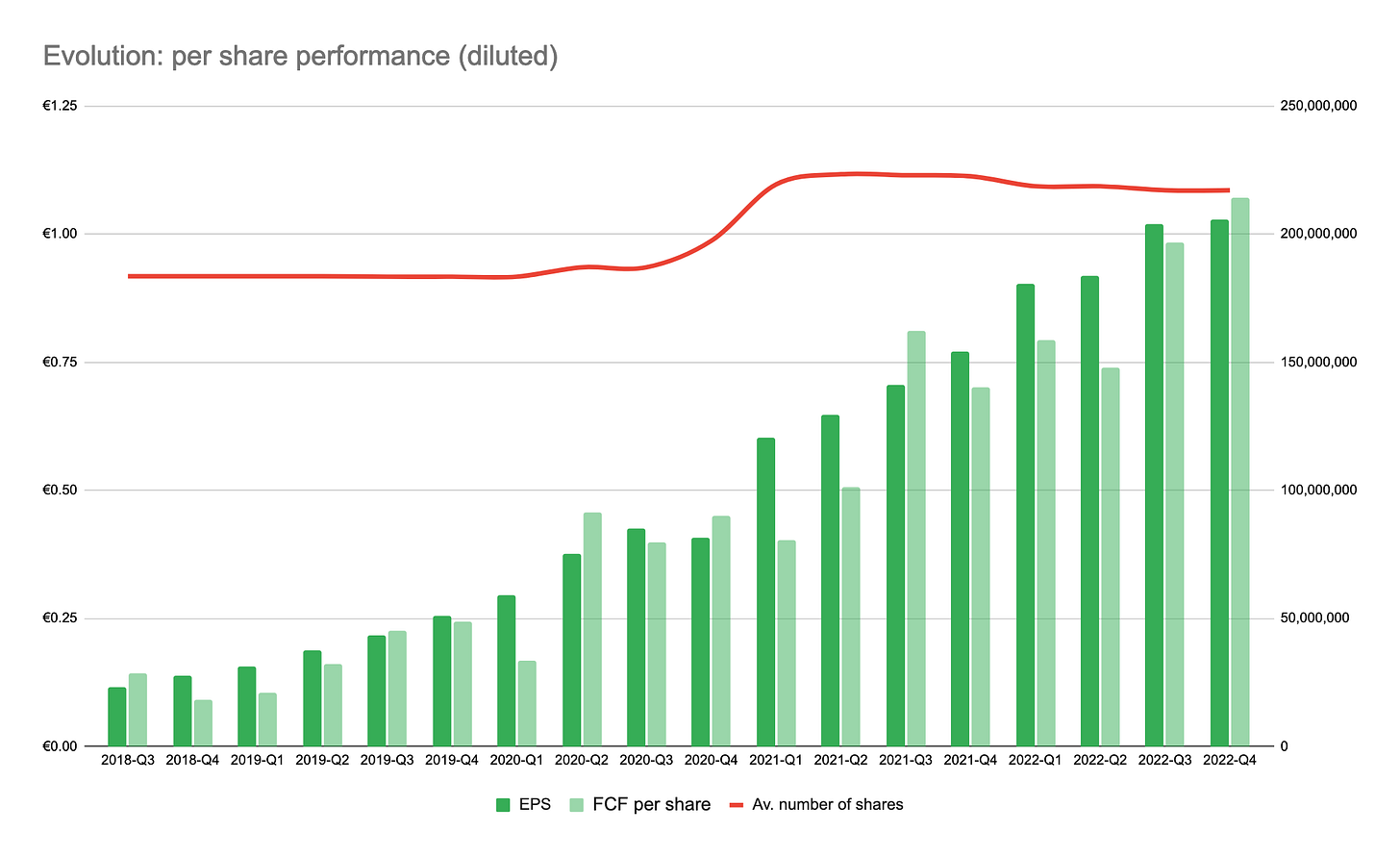

Below the operating income line, there was an amalgam of financial charges, mainly concerning changes in how leases are accounted for and the FX impact from Evolution’s non-Euro bank accounts. This lowered the net income margin. However, I don’t see a change in the fundamental profitability of the business.

Diluted EPS for the quarter (€1.03) was just one cent higher than the previous quarter’s. Again, I personally don’t see a fundamental cause for concern here regarding the core business operations, beyond the past M&A decisions.

Now, onto my favorite KPI of the business…

Evolution hired over 3,600 new personnel during last year and over 1,100 in the last quarter alone. Let’s put the resulting mammoth efficiency challenge for Evolution in context.

Hired game presenters usually arrive without job experience. Evolution puts each such new hire into 100 hours of training plus 3 months of trainee supervision. And, of those not hired as presenters, many were likely hired for the higher salary engineering positions, as part of Evolution’s “1000 new engineers” drive.

In light of these, one could easily be excused for assuming that the spread between sales versus salary per employee (the quasi-gross profit center of the Live Casino) had to be temporarily sacrificed for the sake of rapid expansion. Not so with Evolution!

During the simultaneous supply shortage and demand boom of the pandemic, the company managed to lower its personnel expenses from above 30% to around 20% of sales. And more amazingly, it has maintained this margin for the last 2 years while almost doubling its headcount. You don’t find this in a “tech company” everyday.

As a change of pace from singing the company’s praises, we can look into the latest RNG acquisition. Evolution has committed to paying up to €340m in cash to acquire the slot developer, Nolimit City. NLC has been a part of Evolution since Q3 2022.

Far from helping Evolution achieve its double-digit organic growth target in RNG, NLC has managed to shrink in the seasonally advantaged fourth quarter of a World Cup year. What’s more, if we take NLC’s FY22 earnings, we come to a whopping acquisition P/E of 27! (One can speculate that the undisclosed buyout terms could preclude the maximum earn-out amounts if such poor performance continues. Even in that case, the overall returns would be disappointing for shareholders.)

What can we guess?

One advantage of Evolution’s RNG acquisitions’ slow growth rate is that it lets us conjecture about their current geographic sales mix and separate them from total sales to find the Live Casino mix, as well.

It’s important to emphasize that I am only guessing here and my exact numbers are most probably incorrect. With that warning, I have come up with two big picture theories about the current sales composition:

Theory #1: Asia is now Evolution’s largest Live Casino market, even when all of Europe is taken as a single market.

Theory #2: RNG sales have been very much concentrated to Europe.

Next: You can find my review of Evolution’s FY2022 here.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thanks for sharing.! I would like to ask that are these achieved margins stable?