Evolution's Q3 2023: Quarter in Review

A penny not allocated is an opportunity lost

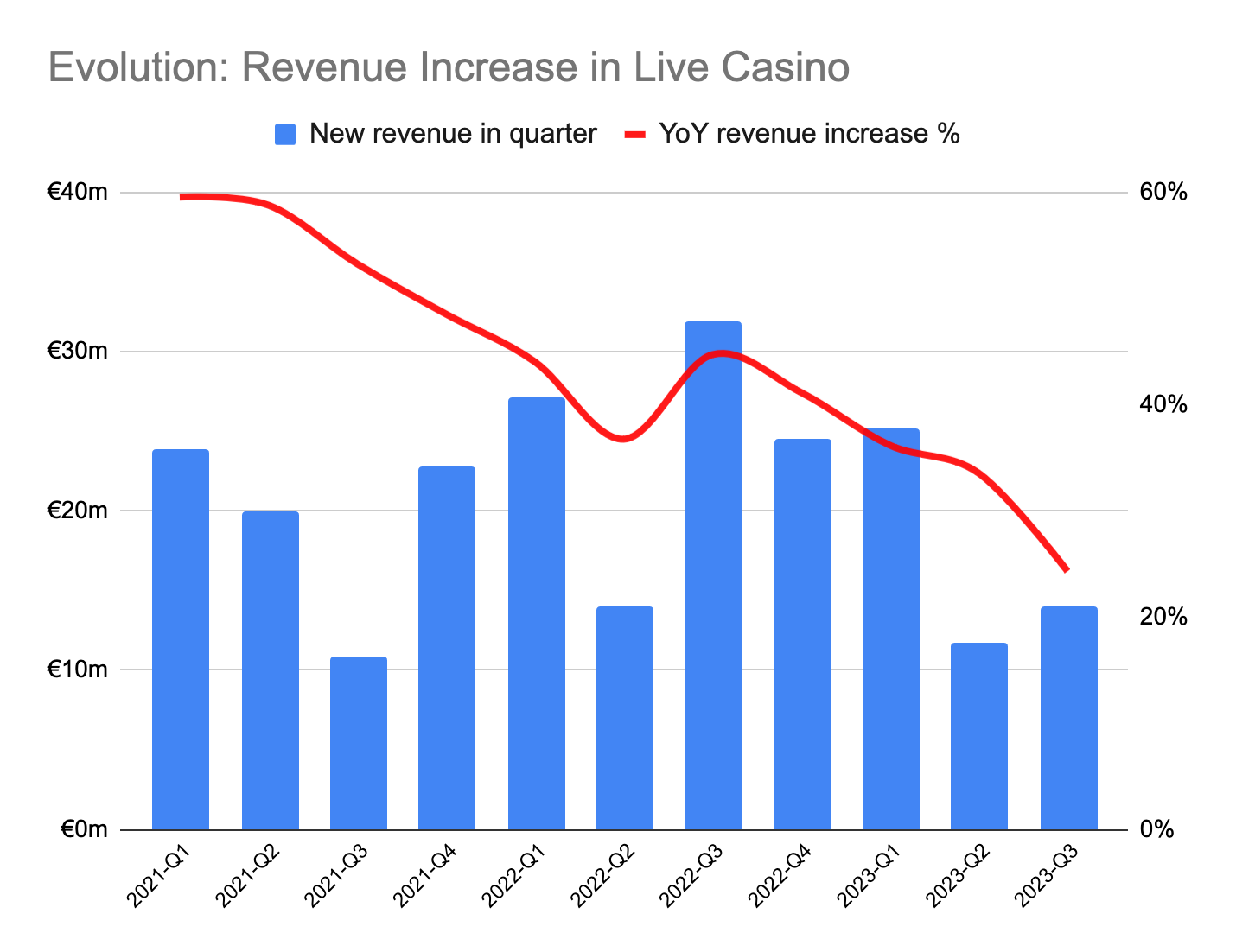

European and North American markets continued their stagnation over the last quarter.

Growth exclusively came from Asia, Latin America and Africa.

Growth Markets

It can be guessed that the newly regulated and expanded-into Latin American markets provided the lion’s share of the growth in regulated revenues, and Asia provided the unregulated majority of the incoming growth.

This is an oversimplification, as management reminds that the Philippines is a newly regulated growth market in Asia.

“Earlier this year, the Philippines became the first country in the region to have regulation for online gaming in place.” — CEO Martin Carlesund

However, it is clear that Evolution’s growth in over a year has been mostly coming from unregulated markets.

Valuation Effect

Although it’s the outcome of a more complex picture, investors’ valuation generosity seems substantially correlated to the regulated portion of the incoming growth.

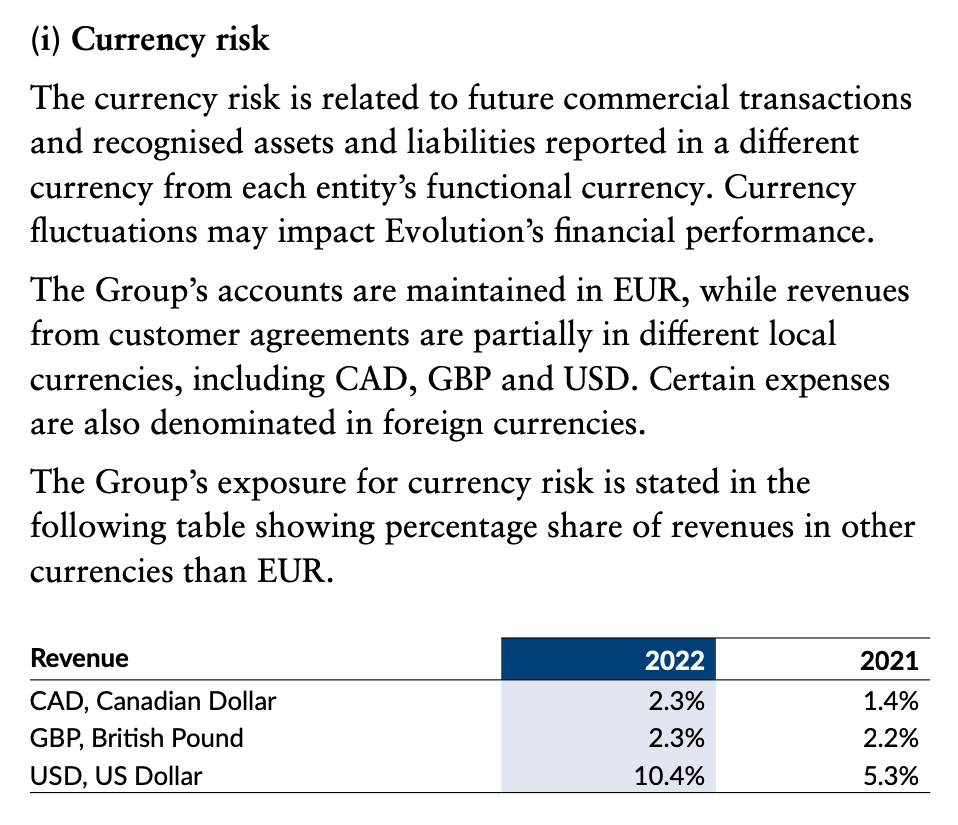

Currency Effect

Evolution invoices its operator customers in the developed market currencies of EUR, USD, GBP and CAD.

However, this doesn’t mean that the company is not exposed to other currencies. Ultimately, those invoices are calculated from the local currencies that players deposit and wager on their operator accounts.

An oversimplified aspect of the past year’s over-reliance on the unregulated markets for growth has been that a big part of this growth probably originated from emerging country currencies.

What is important to note here is that, as Evolution grows beyond its traditional developed market economies into the emerging market customers, currency effects will keep playing a bigger role. This remains true even if those markets get regulated.

Deafening Silence of Re-investments

The first 9 months of the year have been extraordinarily slow in studio expansions.

Management has confirmed that they will not be reaching their CapEx guidance for the year and have not been successful in expanding studio capacity in a timely fashion.

“Our increase in the 2 most recent quarters is much lower than the average for this period. […] We are not expanding our table capacity as we would like to, and that’s affecting our revenue growth.” — CFO Jacob Kaplan

This streak of studio expansion hiccups has created a rare chink in the management’s execution track record in the Live Casino space. In an effort to dispel further pessimism, management has committed to launching multiple studios globally.

Another piece of news that gives me hope for future performance is Crazy Time’s looming release in the US. Crazy Time has been Evolution’s biggest hit game show internationally. Beyond battling incoming competitors for share in the so far limited live dealer market, Evolution has the potential to recruit a whole new set of players by launching game shows in the US market with such a strong IP.

“We are working hard to launch new games in the U.S., and we have a fantastic lineup for games, including Crazy Time, soon to be launched, and I have high expectations that they will perform well.” — CEO Carlesund

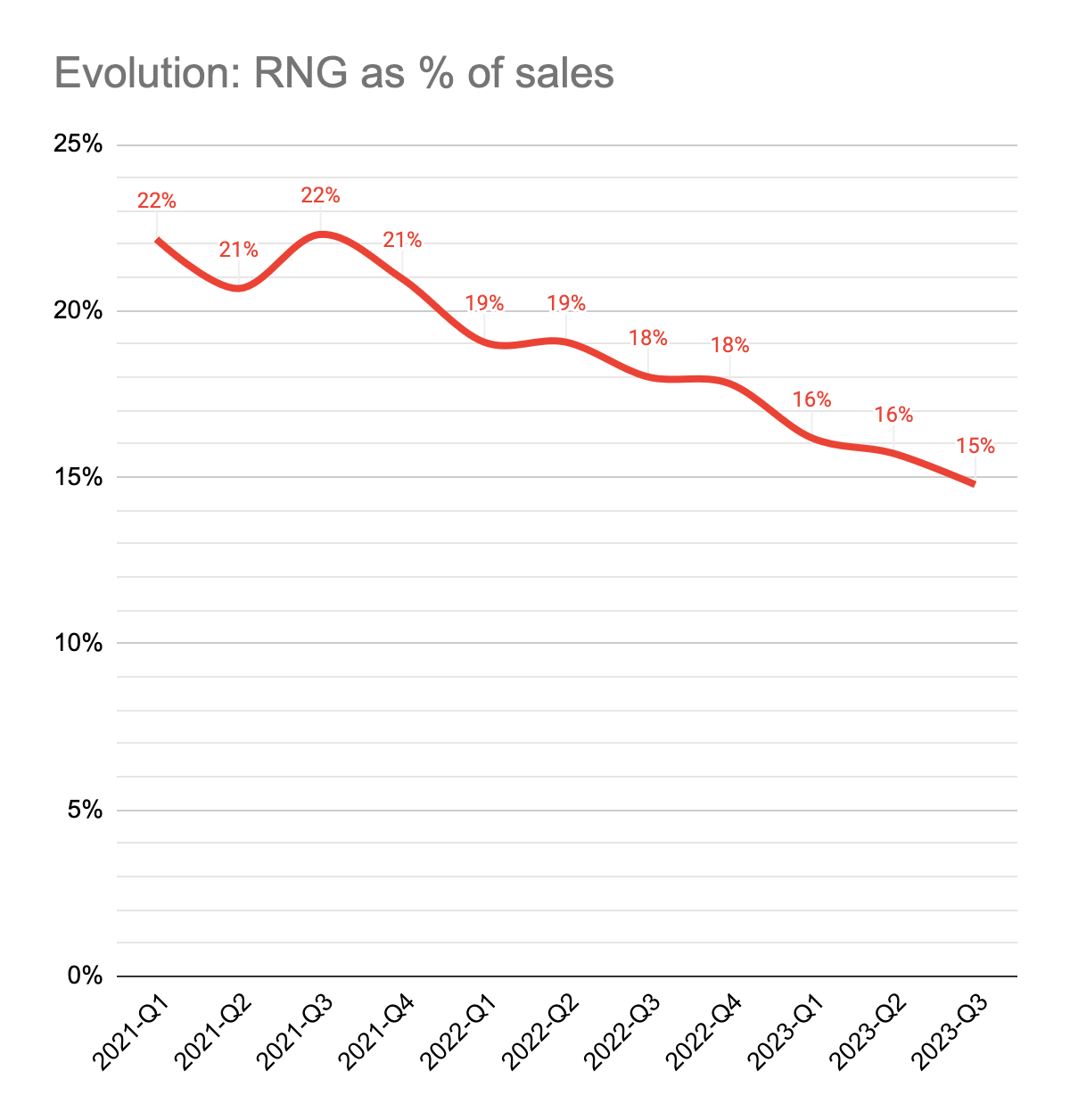

RNG and its Value

Between 2020 and 2022, Evolution made acquisitions of over 3 billion euros into the RNG space, at a weighted valuation of over 11 times sales, 21 times EBITDA and 46 times earnings. Target companies were seemingly purchased at or past their performance peaks and it should now be familiar to most observers that the returns of this segment have been abysmal for the shareholders.

One way to look at this saga is that the acquisitions are in the rear-view mirror and RNG is increasingly becoming a minuscule yet profitable detail in Evolution’s story.

However, shareholders may still need to ready themselves for further negative news flow about the segment. The generous purchase considerations of the RNG studios created massive amounts of goodwill in Evolution’s balance sheet. By last quarter, that goodwill amounted to over 2.2 billion euros, an amount that is greater than all FCF that Evolution has earned in the last 3 years.

So, at the risk of repeating myself, Evolution - a growing and profitable company that is trading at around less than 18 times LTM earnings at the time of this writing - is holding a plug asset that is valued by acquisitions made at 46 times earnings and actually makes up the declining segment of the company. I think it is not unreasonable to expect a goodwill write-down at some point.

A hint of the revaluation of RNG considerations was given in the footnotes of this quarter’s disclosures.

Considerable chunks of agreed purchase prices of BTG and NoLimit City acquisitions were set as earn-out payments in the following years depending on the EBITDA performance of those companies. This quarter possibly showed the first reduction in those earn-outs.

Evolution paid 67.6 million euros to BTG sellers instead of the 115 million maximum. Assuming that no further payment will be made to BTG this year and the next year’s earn-out is also similarly reduced, the total price of the BTG acquisition would decrease from 450 million to 355 million euros. (Such a reduction would also lower BTG’s acquisition valuation from 27 P/E to 21 P/E.) In addition to BTG, NoLimit City is also due an earn-out payment of maximum 50 million euros by the end of the year.

Having played my doomsayer role in the matter, I would also note that if the goodwill is actually determined to be impaired one day and a corresponding expense wipes out a portion of the accounting profits, it will be important to remember that the impairment itself is only the verdict of a past business decision with hindsight and not a present business disruption. My main concern regarding Evolution’s RNG segment is that the efforts to fix its growth may be distracting management, and the company as a whole, from fully focusing on maximising the unique opportunity in Live Casino.

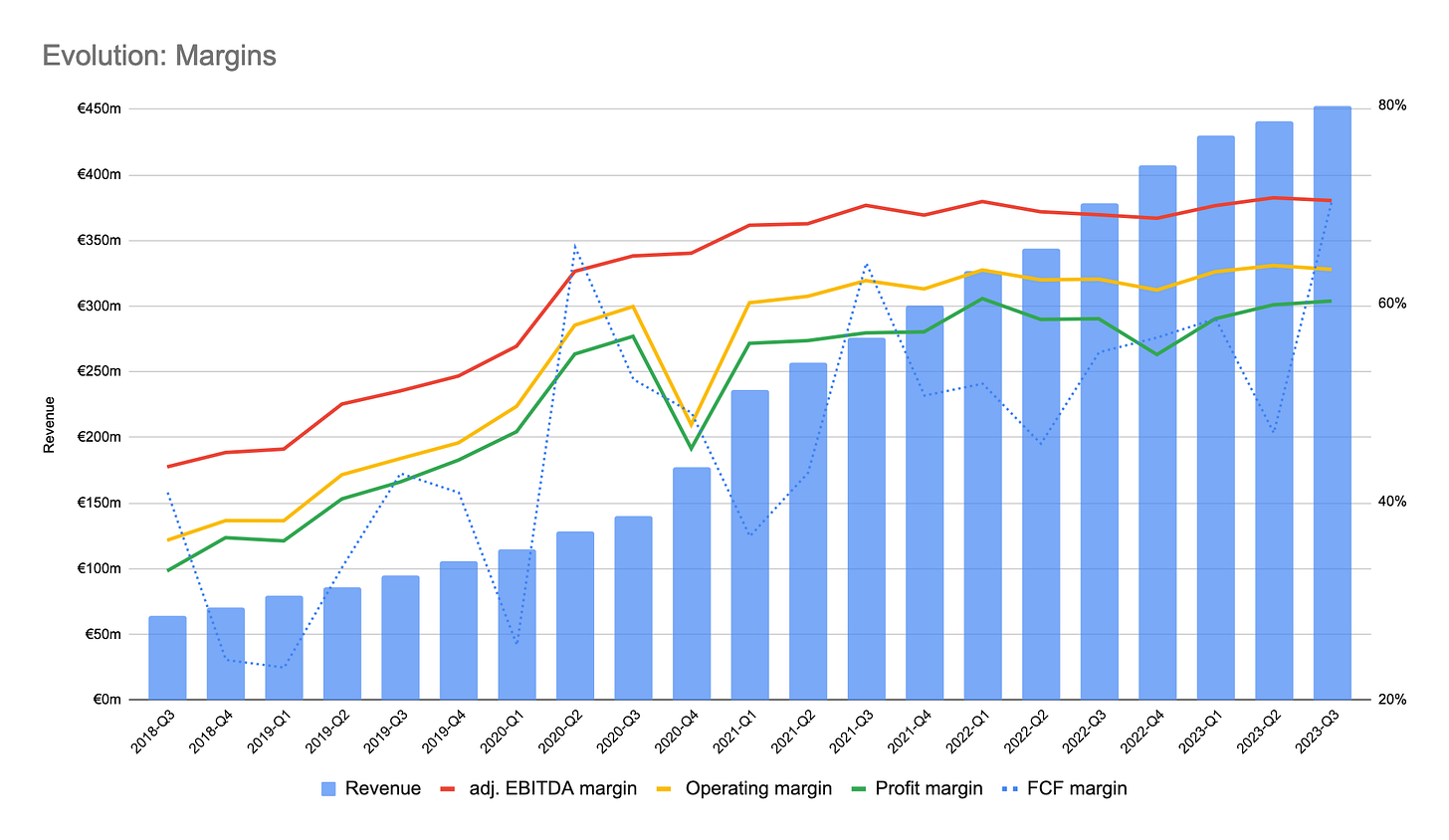

Margins

Evolution kept close to its all-time-high profit margins this quarter and, in fact, broke its (after-lease) free cash flow margin record by crashing through the 70% ceiling.

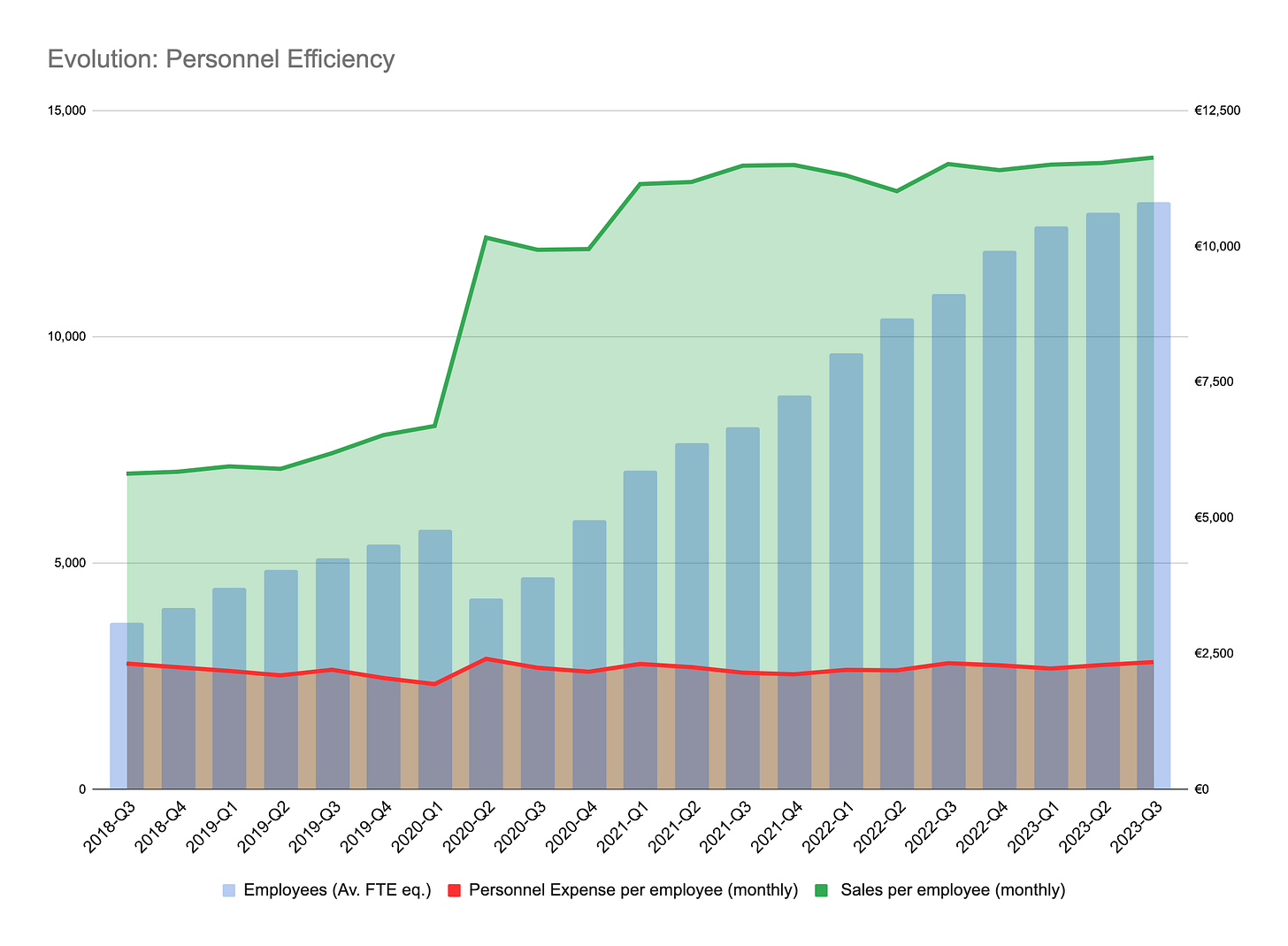

As mentioned last quarter, Evolution’s operating leverage has two main legs: other operating expense margins and personnel efficiency. During the quarter, the other operating expenses’ proportion to sales were at all-time-lows.

As usual now, Evolution kept generating high quasi-gross profits per employees while keeping salaries under control.

Nevertheless, it is only fair to note here that it relatively easier to keep record profitability margins when investments for future growth slow down.

Increasing Taxes

CFO Kaplan gave some specific figures on the expected increases in corporate income taxes starting to take effect in 2024.

“Tax rate for this year will be around 7%. […] And from 2024 next year, as has been communicated during probably the past 2 years, tax rate will increase with about 10 percentage points to 16%, 17% as Pillar 2 regime comes into effect.” — CFO Kaplan

How quickly and up to which percentage point the final tax rate will rise are still up in the air. However, it is important to note the scale of the effect in question: If Evolution’s tax rate rises from 7% to 17%, the company would need to grow its annual revenue by 12% just to maintain the previous year’s EPS, assuming same operating margins. This upcoming hurdle to profits becomes especially relevant as Evolution’s growth rate declines.

Cash Pile

Thanks to higher cash collections during the quarter, Evolution collected a substantial amount of cash in its coffers. It can be expected that the company’s cash hoard will cross the billion euro mark before the end of the year.

By way of tempering investors’ expectations on uncommitted cash amount, CFO Kaplan hinted at next year’s dividend payout.

“Out of that current cash balance, roughly 400 million is according to our dividend policy, that’s the accumulated dividend so far.” — CFO Kaplan

Reserving roughly €1.87 per share for dividends in the first 9 months suggests that the company may be planning to distribute an around €2.50 per share dividend to shareholders next year. This amount fits nicely as around half of 2023’s expected EPS.

Such a dividend still leaves a half billion euros of unallocated cash at the board’s discretion this year.

“We have done buybacks in the past, about a year ago, it was the last time. So, it is not ruled out in any way, but it’s ultimately a decision for a our board.” — CFO Kaplan

Results for the Shareholder

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

The best individual EVO analyst, hats off.

Very well written. Always enjoy your analysis!