This quarter, Evolution’s sales grew by the smallest nominal amount over the previous quarter in 5 years.

“Most regions are showing a bit slower development in the quarter. Nothing outside the usual cycles within the sector, but like I said, the results on the regions are not quite what we like to see.”

— CEO Carlesund

Europe pretty much did not grow. North America shrank. But, probably the biggest surprise was the small growth in Asia. Latin America was the one bright spot.

Latin America seems to have also provided this growth in regulated markets.

Focusing on the organic Live Casino side of the business makes the disappointing growth clear.

RNG is not yet showing any external signs of growth, despite the seemingly popular Nolimit City releases.

Low growth seems to have also come with low margins.

Evolution’s operating margins (i.e. even when disregarding the tax hikes) have hit 3-year-lows this quarter.

Let’s dive into what may have caused the dip in profitability.

The missing margin

Since the primary costs of Evolution’s main business of Live Casino are the personnel expenses, this area should likely give us hints for the underlying causes to most margin shifts.

Personnel expenses that Evolution spends per employee have stayed remarkably stable over the last few inflationary years, but with a very slight increase in the last couple of quarters. A much bigger shift seems to have been happening in the amount of sales the company is generating from its average employee.

This means that the company has been losing on the pseudo-gross profits it generates per employee.

I can see two approaches to asses this decline.

Approach #1: Temporary cost of investing for the future

Evolution has just concluded a very large and seemingly overdue expansion phase in its studio capacity. It takes some time for the incoming capacity in headcount and tables to get into full gear and produce the record-breaking profits of the future.

For example, back in Q4 2022, the big expansion then had also caused a temporary dip in Evolution’s operating margins. The returns on that expansion have likely been very favorable for the company with even higher profitability in the following year.

Approach #2: US is hurting the long-term operating leverage

Evolution has been expanding in the regulated US states well beyond the sales growth those markets have provided so far. (In 2023, North America provided roughly 10% of Evolution’s annual sales growth but made up over 40% of the company’s net hiring.) What makes US peculiar compared to Evolution’s other big markets is the limited scalability afforded by the state-by-state studio infrastructure. With the addition of the local popularity of the unscalable traditional blackjack, this reduces the amount of sales (and operating leverage) the company can generate from its average dealer in a US state.

Note that the amount of revenue Evolution generates per its average North American employee (not adjusted for full-time equivalent) has been significantly declining over the past couple of years.

If we crudely separate the company into two parts, Evolution International and Evolution North America, we can see the sales-per-employee have been increasing internationally almost as fast as they are declining in North America.

A further crude assumption of evenly distributing cash-based operating expenses shows how big of a margin difference this can lead to.

It is then conceivable that an Evolution live dealer in Eastern Europe may be generating close to double of the profits generated by a dealer in the US.

This divergence in profitability was initially not a big deal, since the North American operations were a small part of the global studio capacity. In simplistic terms, European and Asian profits were covering up the lower returns in North America. However, now that North American studios have grown to a substantial part of Evolution’s fixed cost base, any slowness in international sales growth leads to a sudden decline in margins for the company. Considering that the company plans to surpass 4,000 employees in North America by year’s end (compared to 3,349 by the end of 2023), North American margins can decline even further if the second half of 2024 produce results similar to the first half.

To put things into perspective, this doesn’t mean that Evolution’s expansion in North America is hurting the company:

The company is earning dollars of profits that it wouldn’t have earned otherwise by staying out of North America.

It is keeping oxygen from the Live Casino market for any local champion to sustainably develop in or a competitor to profitably expand to.

It is developing relationships and mind-share with the American regulators and consumers which can lead to prestige and “soft power” in other parts of the world.

It keeps holding the primary option call on the profits of an eventual US iGaming boom.

However, it also means that Evolution is likely to face margin headwinds in the upcoming years unless Asia returns to its highly profitable growth trend.

Capital Allocation

Evolution made three important announcement regarding the allocation of its capital.

Galaxy Gaming

This acquisition is somewhat comparable to the Big Time Gaming acquisition in that Evolution is buying a feature (Megaways in Big Time’s case and side bets in Galaxy’s case) supplier to game creators. Compared to Big Time, Galaxy Gaming comes with the additional valuable relationships to regulators and land-based casinos in the US that Evolution doesn’t have a previous contact with.

Compared to Big Time’s 2021 purchase valuation of 16x EBITDA, Evolution is buying Galaxy for 10x 2024 EBITDA. To play out the bull case, we can take a Galaxy shareholder’s view of 80% operating margin potential which leads to the purchase price’s being equal to just 5x potential operating income.

Capital Allocation Framework

Evolution’s announcement of a comprehensive Capital Allopcation Framework completely overlaps with my pitch to management at the last AGM. (I had asked for an explicit and predictable policy of what to do with the excess cash rather than just one-off buyback decisions. Though, I doubt I was the only one.)

It is good to see that the board and the management is open to shareholder suggestions.

On the technical side, it is notable (and apt) that dividends are conditioned on net income while excess shareholder distribution is conditioned on cash at hand. It is also nice to see that buybacks are not left as the only mechanism for the excess cash distribution and special dividends will be preferred when the stock’s valuation is deemed too high to create shareholder value.

Buybacks

The latest 400 million euro buyback plan equals to roughly 2% of shares at the current price. One slight adjustment to the previous buyback plan is the inclusion of stock markets outside Sweden (think EVVTY in the US) as a potential source of purchase.

Cash Outlook

Evolution distributed roughly 560 million euros as dividend in 2024.

Given the above cash inflows and uses for the year, I am expecting neither a big dividend raise next year nor an additional buyback plan this year.

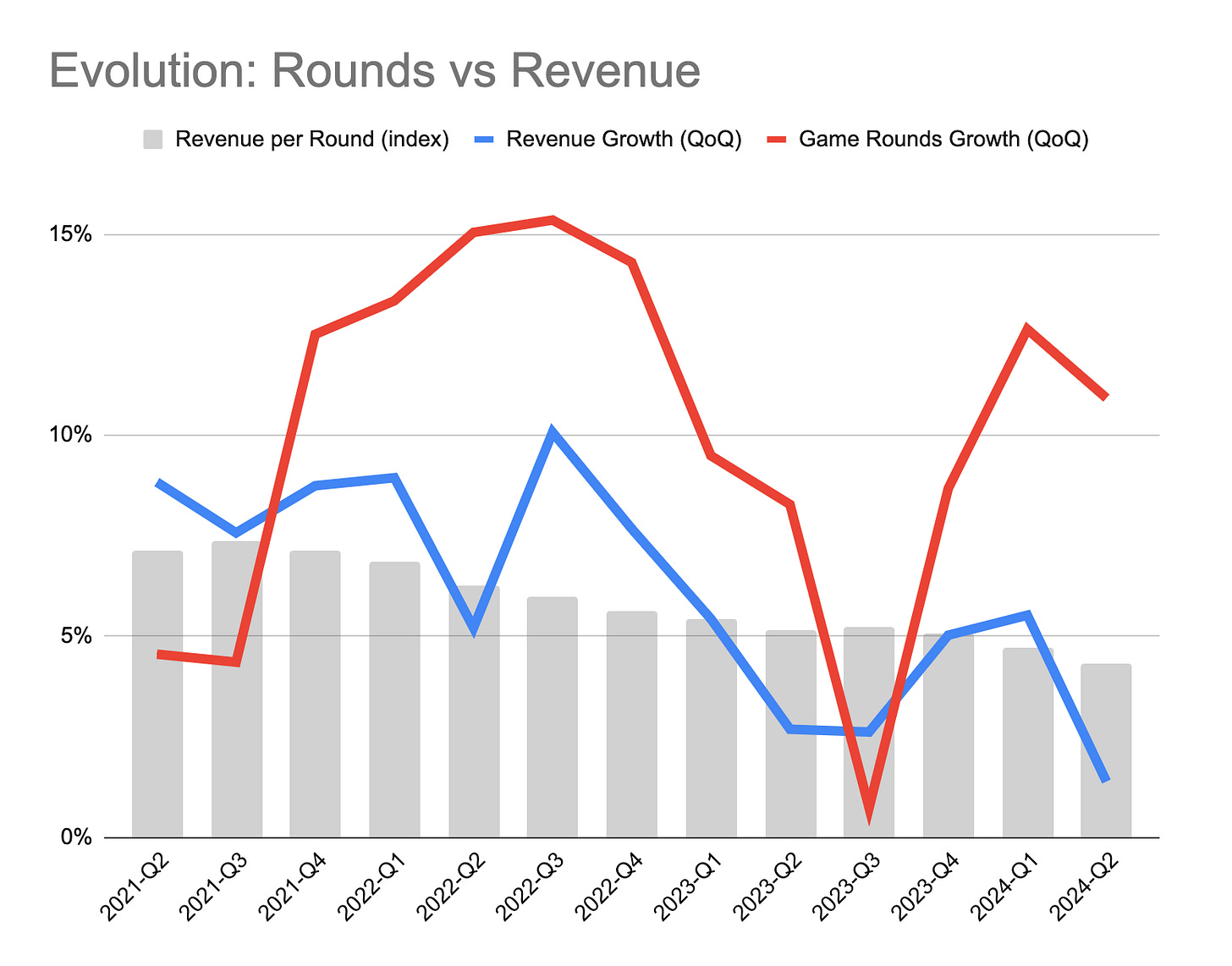

Bonus feature: Do Game Rounds predict anything?

I have always been puzzled about how to use the Game Rounds index (or its previous incarnation as bet spots) as an input for analysis. Now that some time has passed since this metric’s introduction, I wanted to see if trends in rounds precede trends in sales.

As far as I can see, growth in rounds is vaguely correlated with the growth in revenues. But, one does not seem to precede the other in a predictable way.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Smart, thorough and very informative as always. Thanks a lot for great analysis!

Thanks a lot for taking the time to write this