Evolution's Q2 2023: Quarter in Review

Margins Up, Investments Down

Sales Mix

Compared to previous quarter, sales from the Americas as a whole shrunk very slightly while Europe provided a small growth.

Over 90% of Evolution’s net sales growth during the quarter came from Asia.

What’s suprising here is that, despite almost all of the growth’s origins from the notoriously unregulated Asian markets, share of regulated markets in the company’s sales held at 40%.

Such a one-sided growth from a notably intransparent geography reveals a suprising aspect of the regulatory makeup of Evolution’s markets.

Either a substantial portion of the incoming growth from Asia was sourced via regulated channels or Evolution is actively replacing unregulated sales with regulated ones in its other geographies.

Company’s organic (i.e. Live Casino) growth rate decline doesn’t necessarily imply an end to Evolution’s fantastic growth opportunities as long as one accepts that the growth may be coming at nominally even amounts rather than as a perpetual percentage of the company’s growing sales scale.

Record Margins

Evolution’s margins hit all time highs this quarter.

Although still a perfect picture of operating leverage, personnel efficiency didn’t make the difference this quarter.

Rather, it was due to another source of operating leverage: Other operating expenses, operations-related expenses that are not directly linked to salaries or capital investments, hit a record low as a portion of company’s sales.

Although CFO Jacob Kaplan named a lack of major marketing events and reduced outside consultants as the short-term causes for the quarter’s efficieny, the long-term trend is apparent and encouraging in that the other operating expenses’ impact has been shrinking as the company’s scale is surging.

RNG

Evolution’s RNG business has continued shrinking slowly and losing market share rapidly. Having acknowledged some problems, CEO Martin Carlesund made some cryptic remarks about reorganizing the segment.

“We made a complete reorganisation in the delivery of new slots. We engaged a number of new responsible areas. […] There's quite big changes in the RNG setup within Evolution.”

— CEO Carlesund

Along with the fact Evolution ended the quarter with less full-time equivalent employees than the quarter’s average (similar to last quarter), I wonder if the management has been consolidating the various RNG studios it has acquired.

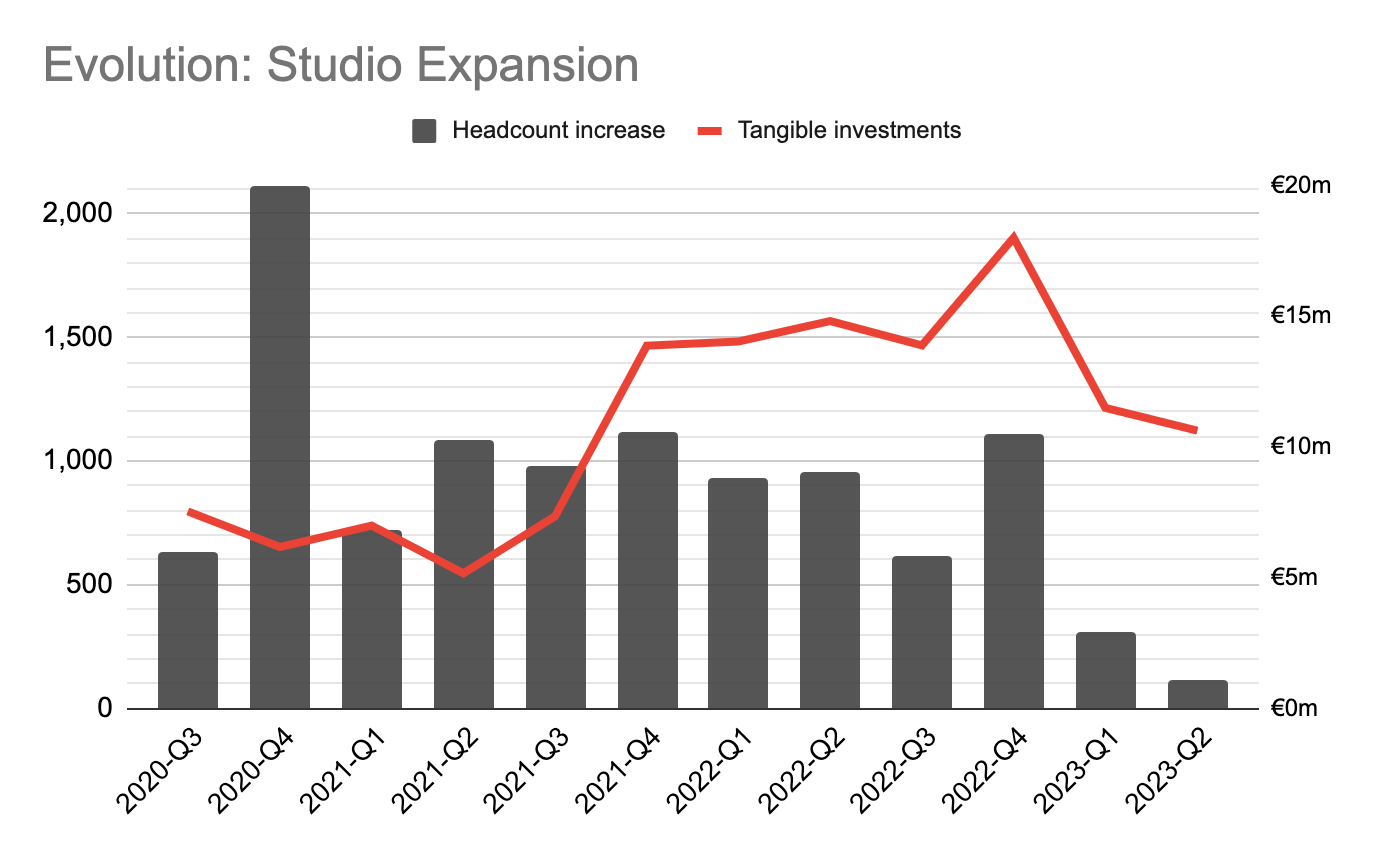

Lull in Investments

In the first half of the year, Evolution invested only a third of its CapEx target for the year and hired a minimal amount of personnel.

Considering the launch of a small studio in Argentina in the quarter, it is clear that the company has not performed a major expansion in its European studios that serve the majority of its world-wide customer base this year.

“We are a little bit undersupplying the market in several regions, as mentioned, Europe, and that's a lot connected with the headcount growth. So we hope that we can increase a little bit more on headcount during the second half of the year.”

— CFO Kaplan

Management seems to identify a few expansion routes for the rest of the year:

New tables at current studios in Europe

A new studio in Europe

Studio launch in Colombia

As a shareholder, I would want neither unnecessary investments for appearances’ sake nor leaving underserved demand to competitors. Management’s track record in its previous Live Casino investments makes me trust them to find the right balance.

Cash Pile

Despite a fall in its cash collections in the quarter, Evolution ended the quarter with a substantial cash hoard. Putting aside the cash needed for investments, dividend and earnouts, management will likely need to decide what to do with over 600 million euros of unallocated cash this year.

“In the long run, we can't have as much cash as possible in the company. So, there will be a time to take decisions regarding that.”

— CEO Carlesund

Results for the Shareholder

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thanks for the review. Here are some questions:

1. What are the business risks in both regulated and unregulated markets, and why should investors be concerned about them?

2. Is there a concentration risk present?

3. What is your opinion on the competition, considering the market is becoming more competitive?

4. Do you think the decline in RNG is a cause for concern, and if so, why?

Thank you for this well put resume Ali!