Evolution's Q1 2025: Quarter in Review

A historic low, plus an update on North America's impact on margins

It had to happen one day: Evolution’s business shrank from its previous quarter.

Still, I was not expecting it to happen so soon or so drastically. For the first time in Evolution’s public history, both overall revenues and Live Casino revenues as well as EBITDA and last-twelve-months earnings-per-share declined quarter-on-quarter.

Growth Bottlenecks

While no geography provided a significant QoQ growth, there was a slight decline in Latin America and a major drop in Europe.

Evolution seems to be at a particular market position where it is facing multiple growth headwinds simultaneously.

Bottleneck in Unregulated Markets: Asia

It has now been one year since Evolution’s main growth engine hit a sudden wall.

The company is still in the process of blocking potential pirates from its network.

“The actions we take in Asia is, of course, partially shutting down and partially growing. And then the sum of that right now is coming out as flat. We're in that process. We're doing the right thing. And then the actions that we take will eventually move to a greater increase than what we take away.” — CEO Carlesund

The fact that the evident effects of the video stream piracy (and the efforts to counteract them) have endured so long means that the return of this crucial source of profits is now a show-me story rather than a tell-me.

Bottleneck in Regulated Markets: European Black Market

In response to the UK regulator’s investigation of Evolution, the company has proactively exited from various black markets in Europe by ringfencing.

Adjusting for the fact that the measures were active in only the last 2 months of the quarter, Evolution’s sales declined 9% from Q4 to Q1 in Europe. With this, the company gave back 1,5 years of growth in the market. (To give a further comparative sense of the loss, the adjusted decline is nominally worth the last 2,5 years of incremental growth in North America.)

As CEO Carlesund warns, all impacted players will not simply switch to locally licensed operators after Evolution’s exit.

“We are not really affecting the channelization in the country. The channelization in the country is dependent on the parameters that the regulators set up. […] So, the players, they need to want to play on the regulated side. We can't do much about that. […] So, the players when they are ringfenced, they don't return because of the -- they don't return if they can continue to play on other providers outside the license. So there is a bit of stiffness.”

— CEO Carlesund

As things seem right now, black markets inside regulated European markets are likely to continue to thrive while Evolution will be permanently excluded from the growth in the exited channels.

I see only three factors that can possibly limit Evolution’s long-term disadvantage from exiting the black markets:

Regulators rationalizing their responsible gaming restrictions

Governments effectively blocking player access to black markets

Evolution increasing its branding power on the consumer preferences

Only one of these factors is likely and in the company’s control, I believe

Regulated Markets in Europe, North America and Latin America

Obviously, the locally licensed operators in Europe did not immediately receive the black market activity abandoned by Evolution.

In Latin America, Brazil provided disappointing results following its much-expected regulatory opening at the beginning of the year. Although this market provides a nice incremental optionality, Latin America’s to-date market size, discretionary spending power and lack of casino gambling tradition make me doubtful that the market will ever provide more than a sliver of the company’s profits. (This is more a comment on the size of opportunity in Asia, Europe and North America rather than a derision of opportunities in LatAm and Africa.)

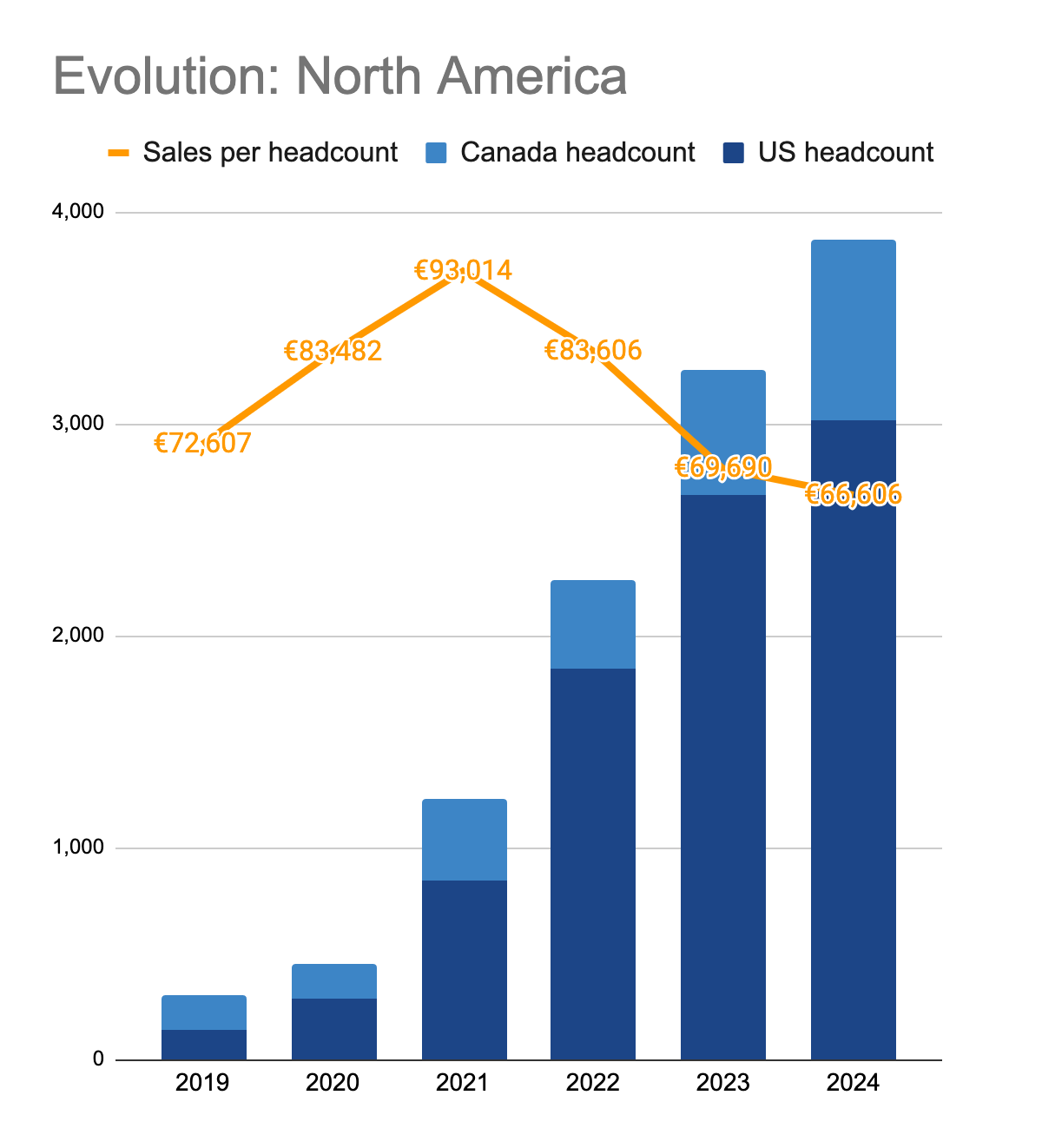

North America is where Evolution has been executing close to flawlessly on B2B relations in Live Casino. European ringfencing impact makes me wonder whether Evolution has a similar time bomb in the US in the form of sweepstakes. Company’s future prospects will be determined by two main factors, I believe:

Regulatory openings and restrictions in US states

US consumer adoption of Live Casino in general and Evolution’s game shows in particular

Again, only one of these seems to be in the company’s control.

Sales from Regulated vs Non-regulated Markets

Sales from regulated markets now make up 45% of Evolution’s overall sales. This is the highest portion of such sales since the start of the Asian demand boom in 2019.

Quarterly results showed a jump in sales from regulated markets and a big drop in sales from non-regulated markets.

To be honest, the underlying reason for the move is not completely clear to me. The ring-fenced exit in European black markets should, by definition, affect as a decline in regulated market sales. The fixed fees to operators in exited black markets, the blocked-off Asian sales channels and the regulatory conversion of Brazil revenues may have made the difference here. I’d welcome any clarification on this.

RNG

As a collateral damage of the European ring-fencing, RNG continued its disappointing stagnation.

Rapid Expansion

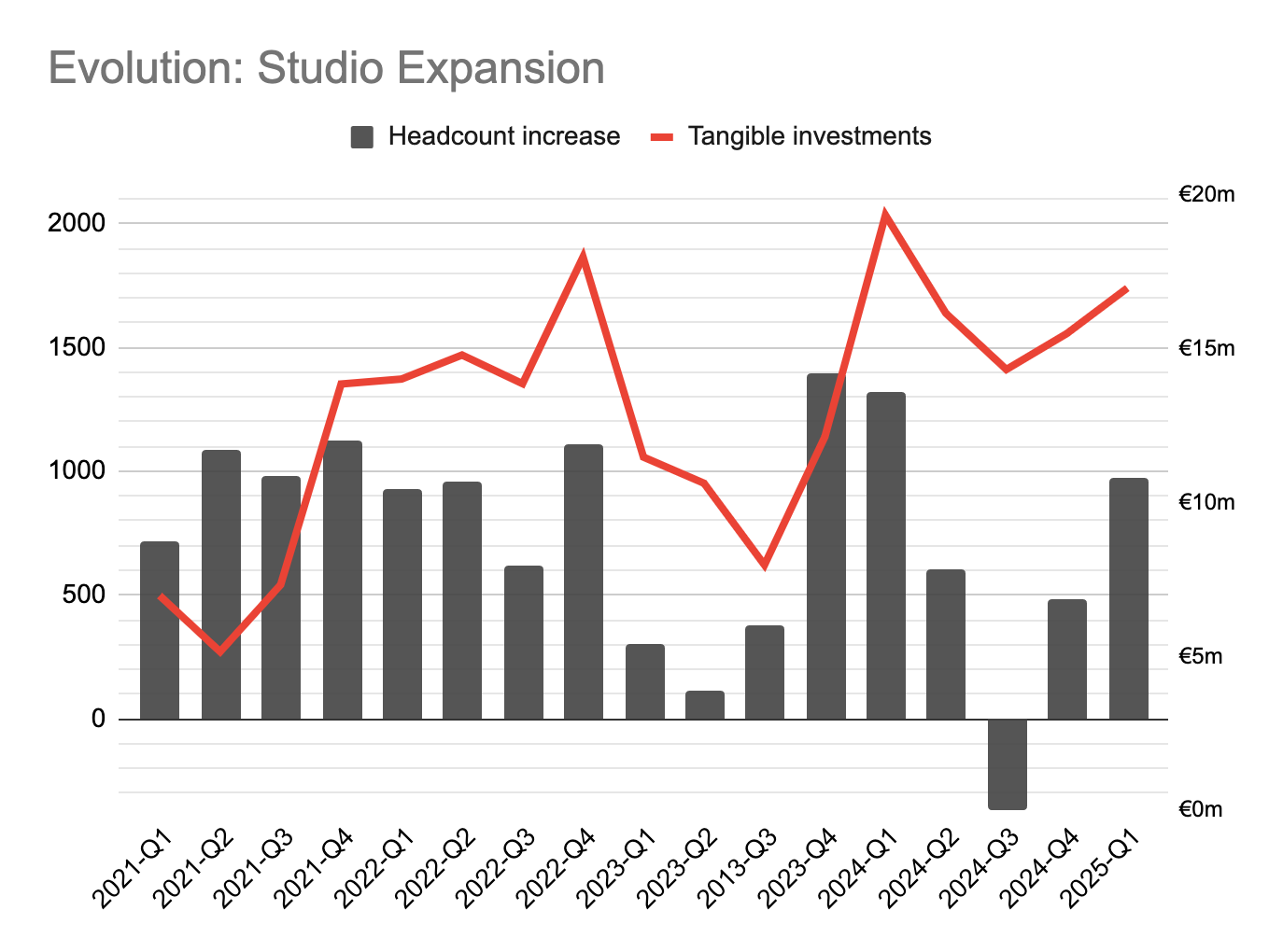

Evolution continued its laudable post-Georgia expansion at an increased pace.

High Expansion + Negative Growth = ?

The answer is lower profits at lower margins.

Company’s operating margins have hit their post-COVID lows.

In the quarter, Evolution generated the lowest amount of “gross” profit per employee since 2021.

Both before-tax and after-tax profits declined compared to any period from last year. Company’s net income gave back the last 2 years’ worth of growth.

Compared to 2 years ago, Evolution’s Q1 earnings grew just 1% while the diluted EPS grew 8% thanks to buybacks.

Nevertheless, last-twelve-month EPS declined quarter-on-quarter.

Capital Allocation Outlook

At a conservative estimation, almost all of Evolution’s cash flow for the rest of the year seems to be reserved.

Closing of the Galaxy Gaming acquisition has been pushed from mid-2025 to the second half of 2025.

Bonus Update: Margins vs America

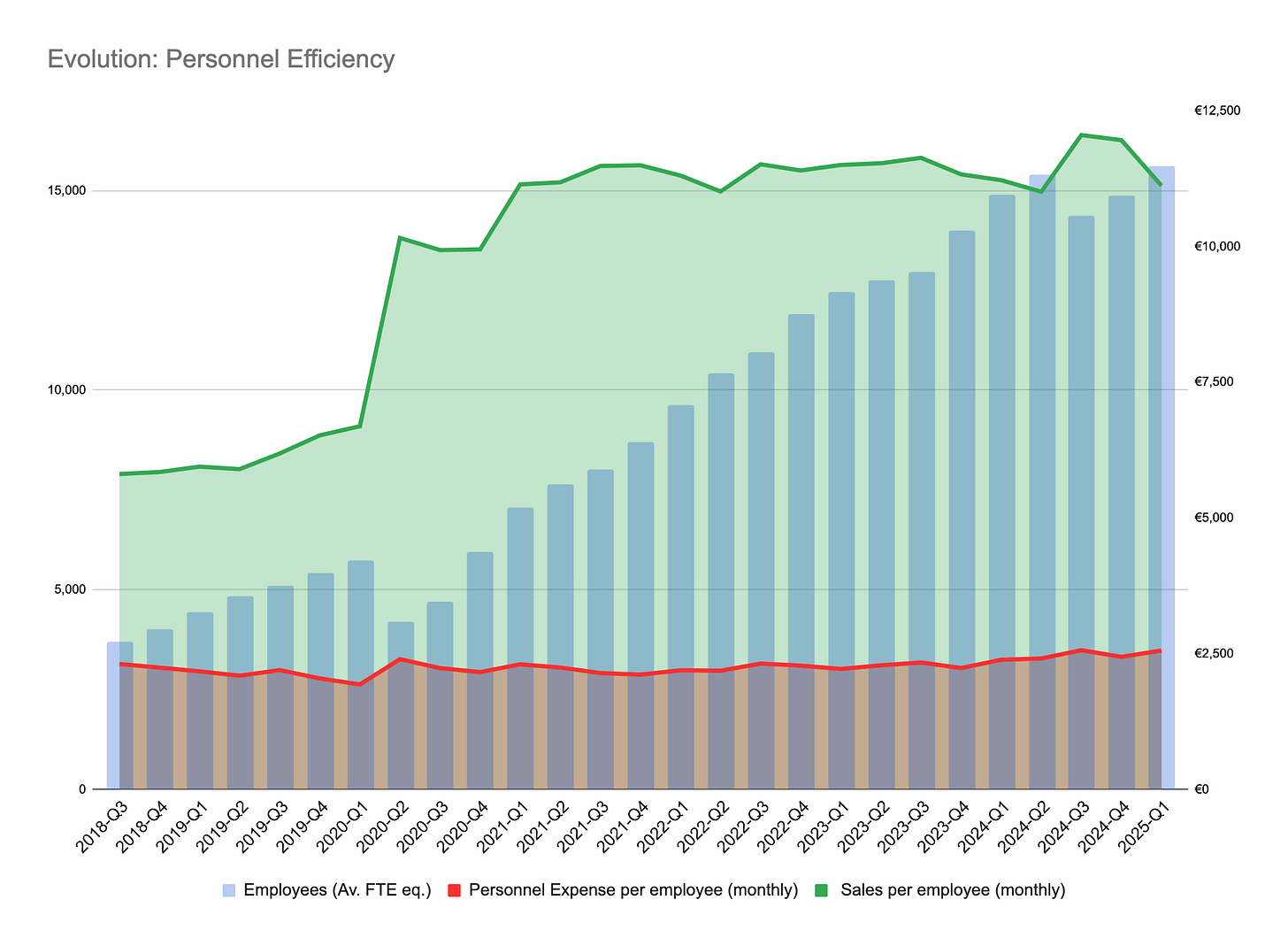

Last year, I estimated that Evolution’s low margins and wide expansion in North America meant that “any slowness in international sales growth leads to a sudden decline in margins”. This quarter showcased exactly that scenario: Year-on-year, North American revenues grew by 15% while Asia and Europe were largely flat. This resulted in EBITDA margins falling from 69% to 65.6%.

So, I find it useful to update that thesis with the 2024 numbers.

As Evolution continues to expand its studios in North America faster than the demand for them, average employee ends up generating less revenue. Yet, at a slight change of pace, the recently increased sales growth in the geography resulted in a slower decline.

The slowdown in international sales growth (against a renewed international expansion drive) resulted in some deterioration in the company’s operating leverage outside North America as well.

A set of very rough assumptions shows that Evolution could still be clinging to above 70% EBITDA margins outside North America while dropping nearer to 50% inside North America.

As I argued in my original piece, Evolution’s lower-margin expansion in the US could be very much worth the cost and effort. However, unless the growth in Asia (and now Europe) returns, the company faces the prospect of lower margins in the coming future.

Annual General Meeting 2025

I am in Stockholm for Evolution’s AGM on 9 May.

Don’t hesitate to say hi if you see me! 👋

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Hi. I'm also a shareholder in Evolution, and I saw your recent letter to management – great initiative on reaching out directly!

Since you have a direct line to them, I was hoping you could potentially convey some thoughts I have, especially regarding one of the agenda items for the upcoming shareholder meeting.

I'm quite concerned about the proposal from one shareholder regarding the idea of a significant donation to a current US administration to lobby for licenses. I understand the goal of US expansion is key, but this specific approach feels incredibly high-risk, potentially volatile, and quite frankly, gives the company very little control over the outcome for such a massive sum (SEK 1 billion is huge!).

Speaking of control and influence, knowing that Kenneth Dart is the largest shareholder, I strongly feel they should be consulting closely with him on their US strategy, especially concerning state-level nuances. Beyond just his significant investment, he likely has unparalleled connections and strategic insights into operating within complex US systems, particularly at the state level where gaming licenses are decided. His experience and network could be invaluable in navigating the regulatory landscape more effectively and perhaps less controversially than the proposed donation. I hope you could flag the importance of leveraging Mr. Dart's unique position and expertise with them.

Considering your excellent suggestion about direct marketing to boost brand awareness among players – that seems like a much more controllable and brand-building approach.

Building on that, another strategic direction I believe warrants serious consideration, especially looking at the recent Q1 results (where slow revenues grew, and expenses grew while squeezing profits), is for Evolution to invest in establishing its own direct-to-consumer mobile gaming division.

Imagine building mobile apps where players can experience Evolution's high-quality games directly (maybe free-to-play for limited hours increase game flexibility with in-game for more customize games experience ). This would achieve several things:

* Directly engage potential players and build brand loyalty.

* Provide a platform for market research and testing new game concepts.

* Create an alternative, controlled revenue stream (from in-game purchases or ads).

* Crucially, it could serve as a funnel to drive players towards our operator partners for real-money gaming once they are hooked on the Evolution experience.

Yes, launching a mobile division is a significant investment, but unlike the proposed political donation, it leverages Evolution's core strengths: building fantastic games and reaching consumers. It offers management direct control over the investment and execution, aiming for a desired long-term outcome with more predictable inputs, which is vital in the current market volatility and given the pressure on profitability shown in the latest report.

Any chance you could raise these points – particularly the concern about the political donation proposal, the importance of involving Mr. Dart, and perhaps the strategic merit of a direct mobile gaming push – in your communications with management?

Thanks so much for considering this, and seriously, appreciate you taking the step to talk to them!

Management mentioned in the call the increase of share in regulated markets relates to Brazil becoming a regulated market.