Evolution's Q1 2024: Quarter in Review

Sales in, profits out

Sales

Evolution continued its reliable growth trend with 5% QoQ and 17% YoY growth rates.

The incremental growth originated 60% from Asia and almost 80% from unregulated markets. As a result, portion of sales from regulated markets dipped to 39% in the quarter.

While North and Latin Americas (somewhat justifiably) continue being the “next big thing” in management discussions, Asia and Europe remain the growth engines.

For the past 7 quarters, unregulated markets provided the decisive upside of growth on top of a more muted but steady basis of regulated sales growth.

A tale of two businesses

Live Casino continued its steady growth of nominally-bounded amounts with slowly declining growth rates as a result.

And, RNG continued remaining an upside *potential*.

A potential that is becoming a smaller and smaller part of the business.

As a side note, I find it telling that management stopped introducing individual pure-RNG launch titles in earnings presentations.

Margins

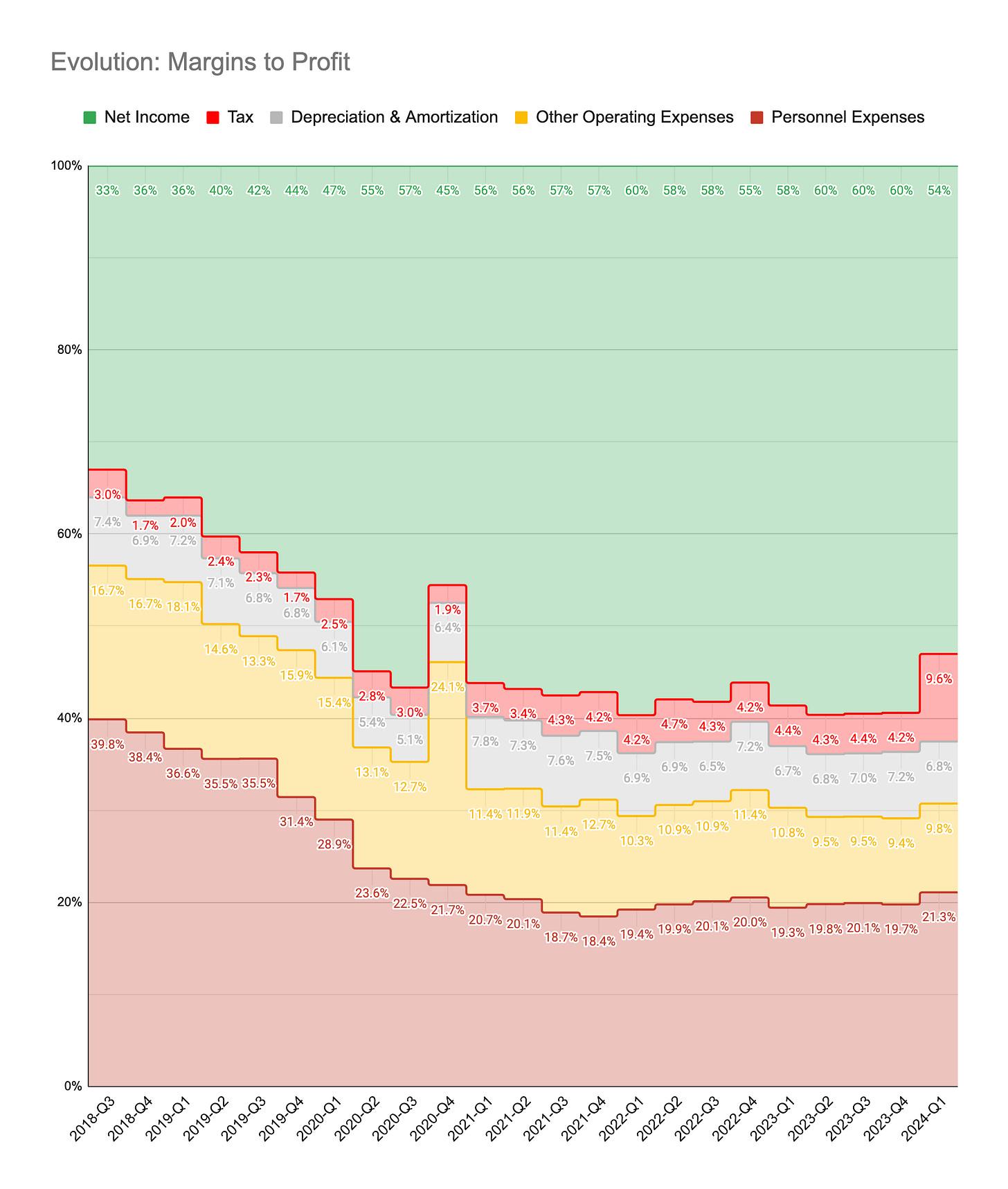

Margins took a significant dip during the quarter.

The margin decline came as a result of two factors: one good and one bad for the shareholders.

The Good: Investment Boost

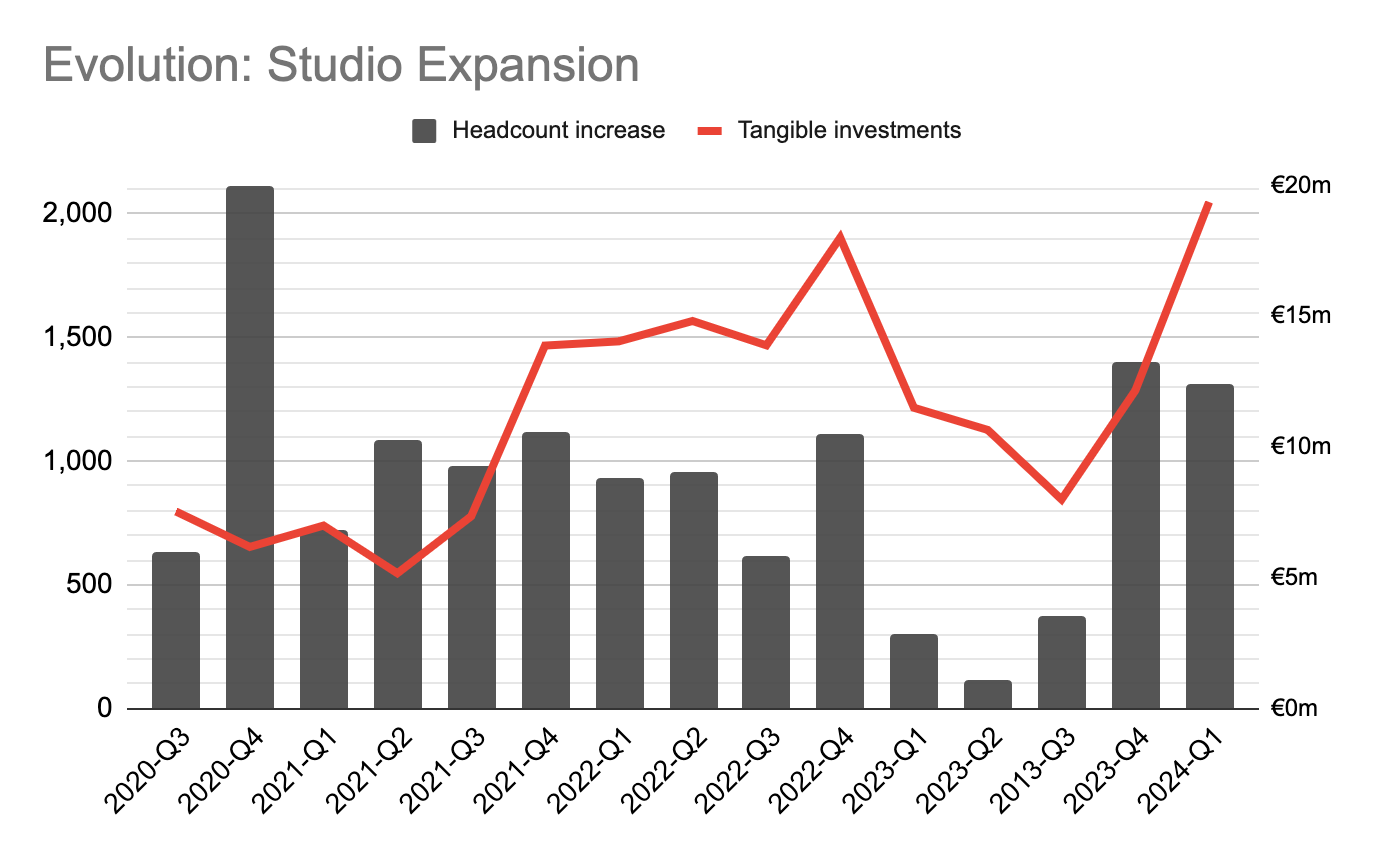

In the last two quarters, Evolution hired an impressive amount of 2,700+ people and grew the headcount by 15%. Moreover, the company surpassed the targeted CapEx cadence that it struggled to catch last year.

The hiring put pressure on company’s operational leverage from both ends. For average employee time, Evolution generated less sales and took on higher expense.

This shift can be explained with a few factors.

First, a hired employee doesn’t become productive on day-one. This is especially true for game presenters, a.k.a. dealers, that make up the bulk of Evolution’s work force. A new dealer receives a two or three week training before going in front of camera and then goes through a 3 month-long mentored trainee period. Thus, hiring sprees create initial drops in average productivity.

Further, Evolution faces inflation-led wage increases, and focused hiring in North America inevitably puts an upward pressure in average dealer salaries.

CFO Kaplan: “We have had inflation in many markets, and I think that’s partly reflected here”

CEO Carlesund: “Salary is increased.”

Another effect of rapid recruitment in the US is the state-limited reduced scale that each game table can address. In fact, considering the focused US hirings as of late, the relative stability of the margins in the last few years is a testament to Evolution’s impressive operational leverage in its other markets.

To give context, I think this dip in operating margins is nothing to be concerned about and is actually a sign of good results to come in the future.

The Bad: Tax Hike

The not-so-good pressure on profit margins comes from the long discussed implementation of Pillar II top-up taxes in Sweden. Company accounted for an eventual 15.2% tax rate on the quarter’s earnings, an almost 130% hike to previous quarter’s tax rate.

I say “eventual” since Sweden’s top-up tax on 2024 earnings will be determined and paid in 2026. Incidentally, the actual taxes paid during the quarter (not necessarily on the quarter’s earnings) were just 1/8th of the quarter’s tax accrual.

To further muddle any long-term expectations, the full picture of Pillar II’s implementation and impact doesn’t seem to be completely clear for now.

“Still not fully clear exactly how the Pillar II top-up tax will be administered, and the actual top-up tax will be paid first in 2026. We will, of course, follow this development closely during the year and continue to accrue tax to our best knowledge. We will naturally also look to adapt our operations to achieve a tax-efficient structure where that makes sense.”

— CFO Kaplan

However the end result exactly looks like, Pillar II will change Evolution’s shareholder returns for the long-term and for the worse. Moreover, Evolution’s smaller competitors with substantially lower annual revenues may be able to continue benefiting from lower tax rates due to the revenue threshold of the global minimum tax initiatives.

Hopefully, the future earnings opportunities lying before Evolution are large enough to make this tax hike acceptable as a cost of doing business, and maybe even result in an even stronger business sustainability as a major tax generator in the future.

The Result

One way or another, the latest margin profile looks not-so-pretty.

One can expect the personnel and other operating expenses portion of sales to come down as studio investments take effect and operational leverage kicks into gear.

“We had an undersupply, we needed to scale up, get capacity and get going. And revenue comes off that scale-up. There is no physical possibility to get the revenue first and the scale up after.”

— CEO Carlesund

The tax impact on margins, unfortunately, seems here to stay.

In the end, that one-time but permanent tax hike shaved off the last 3 quarters’ worth of growth from reaching the bottom-line.

Capital Allocation Déjà vu

The unallocated cash pile is again reaching €400 million.

Theoretically, a 50% dividend payout policy doesn’t prevent the board from buying back stock immediately (assuming it’s at a bargain valuation) and then start reserving cash later in the year for 2025’s dividend payout. I’m not keeping my hopes high, though.

“There is no change in the view on capital allocation.”

—CFO Kaplan

Annual General Meeting 2024

I will be attending (and generally haging around) Evolution’s AGM in Stockholm this Friday.

Don’t hesitate to say hi if you see me! 👋

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Steady ship!

Really well written