Evolution's Q1 2023: Quarter in Review

Limits of Growth vs. Vastness of Potential

Sales Mix

Evolution separated the much promising Latin American market from its “Other” geographic segment reporting.

LATAM has positive regulatory momentum and Evolution management is open about their plans to eventually launch multiple studios in the region.

Evolution’s RNG continued its rapid market share loss and shrank slightly in sales amount during the quarter. CFO Jacob Kaplan called the current RNG situation disappointing and doesn’t expect a turnaround for the next couple of quarters.

The only positive aspect of this 3 billion euro debacle is that the RNG portion of Evolution’s business keeps getting smaller.

Live Casino sales to Asia continued being the primary growth engine with the least amount of granular disclosure.

While Asia contributed almost half of Evolution’s organic growth in 2020-2022, Asia’s contribution reached 80% of the net growth in Q1. Asia has already been Evolution’s largest Live Casino market for a while. CEO Martin Carlesund said that he expects Asia to become their largest market in total sales within this year.

It is notable that North America almost didn’t grow at all during the quarter with no new markets or studio openings. Furthermore, the management has no immediate large expansion plans for the US, unlike their plans for Europe (which serves globally ex-USA) and LATAM.

The new geographic breakdown also made it clear that Africa is currently not a significant growth contributor.

Despite the ballooning sales volumes, Evolution’s quarterly organic growth has been remarkably consistent at around €20 million during the last 2 years.

This consistency is notable since the company’s Q1 Live Casino sales amount in 2023 was double of those in 2021 which led to almost half the growth rate in the end. This hints that the growth has been a function of execution rather total sales scale. As management also warns, shareholders should be ready for declining growth rates even though the realized growth amounts are likely to be pleasing.

Moaty Games

Among Evolution’s many game releases, two have been notable for their potential to create competitive advantages.

Management claims that Extra Chilli Epic Spins heralds a new category of games called “social slots”. In addition to its internally manufactured equipment, the emphasized aspect of social interactions between players means that a supplier with a scaled network of participating players gains an inherent advantage even if competitors manage to replicate the game itself.

Funky Time is Evolution’s largest scale development project to date, the money and human resources budget should be beyond the reach of most (if not all) other Live Casino suppliers. Furthermore, the game puts Digiwheel (acquired in 2021 for €1m) in the center space. This patent-protected technology should create yet another barrier to competitors from copying the game.

I personally have no prediction on whether these two games will gain traction with players, as Evolution constantly launches games to see which ones sink or swim. However, these games seem to come with inherent protections against competitors in case of success.

Taking a Breather in Expansion

Capex

During the quarter, Evolution underinvested according to its annual capex guidance of €120m. As can be seen in the below company slide, there was a notable lull in tangible investments used for studio expansions.

Yet, CFO Kaplan assured that this was simply a matter of project timings and studio investments will pick up in the rest of the year.

Hirings and firings

Evolution’s headcount increased by the smallest amount since COVID in the quarter. This can be explained in the context of previous quarter’s large hiring spree and this quarter’s light studio expansions.

Company’s employees can be very roughly categorized in two groups: presenters and others. Presenters are high-turnover, lower-wage and more likely to be part-time. They are also the direct revenue creators of the company. The others tend to be higher-wage and full-time. Though an essential part of the company’s growth and operations, non-presenters are usually cost centers.

Despite the overall headcount increase, this quarter saw higher *average* number of full-time equivalent (FTE) employees than *end-of-period* FTE employees.

The last time such a decline happened was Q2 2020 when the company laid off large numbers at the start of the COVID crisis. Combined with the headcount increase and the decline in per-FTE salaries in the quarter, the FTE decline from average to end-of-period makes me suspect that the company may have have laid off a number of higher-paid full-time employees.

“Our whole team has shown a great awareness to cost during the past two quarters.”

CFO Jacob Kaplan

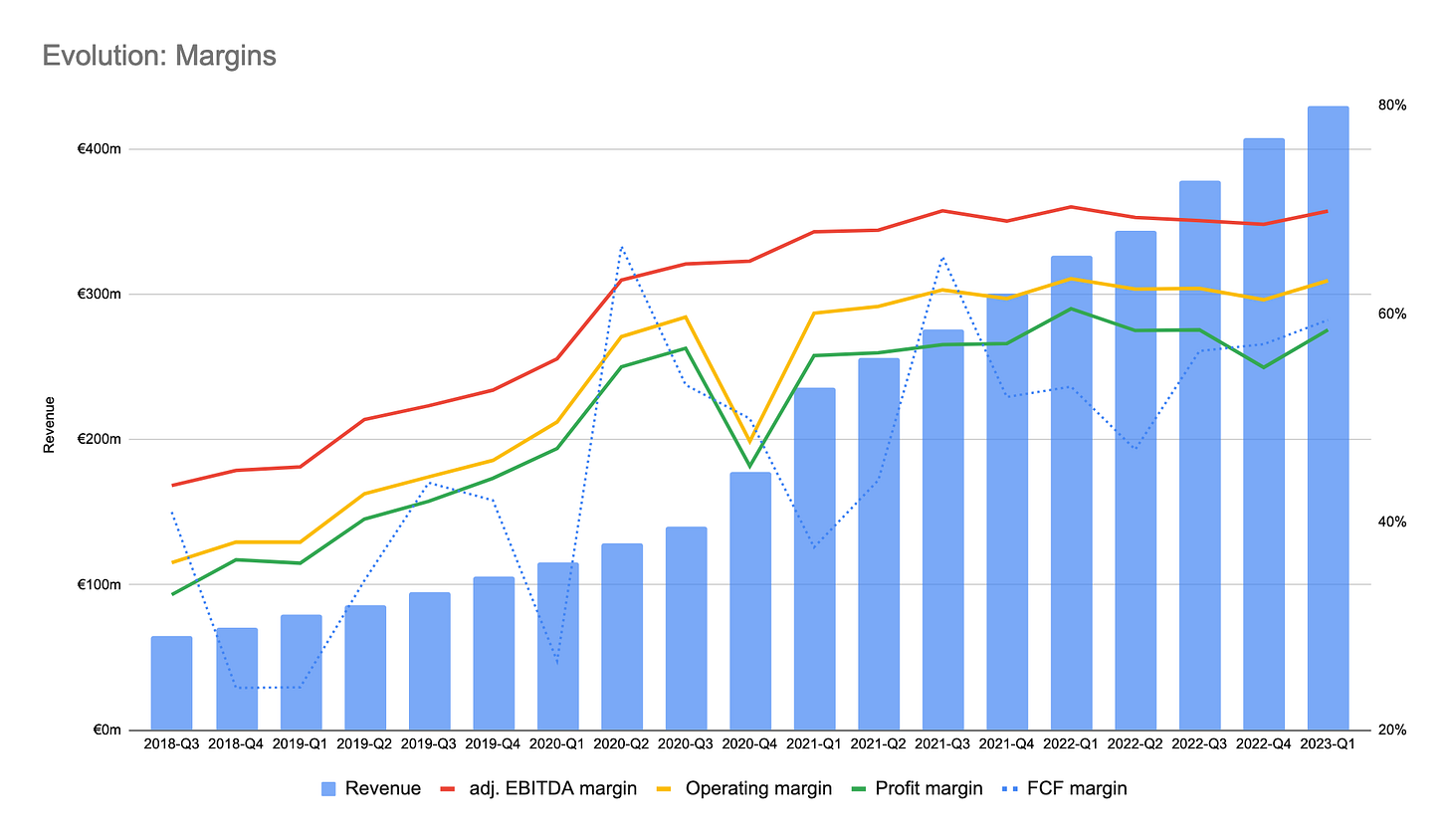

Operating Leverage on Display

During the quarter, Evolution generated slightly more sales while incurring slightly less personnel expense per employee.

As a consequence, the operating margin is near its all time highs.

Arguably, this quarter’s temporary lull in expansion gave us a glimpse of the underlying operating leverage potential of supplying Live Casino at high scales.

Results for the Shareholder

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Thank you Ali!