Having gone over Evolution’s big picture trends in a previous post, this time, I wish to extract some smaller picture tidbits from the recently published annual report.

Moat in a Shop

For any current or prospective Evolution shareholder, finding signs of a durable competitive advantage is always at the top of their mind. After all, how else will the company keep such an extraordinarily profitable business growing against constant competition?

On an operational level, the newly added section about the Evolution Job Shop was definitely the most interesting part of the annual report for me to read.

Instead of solely relying on external manufacturers, Evolution internally prototypes and produces custom equipment for its live casino tables. This capability lets Evolution come up with unique solutions for its design ideas. It further lets the company to source prototypes or replacements much quicker. Finally, it makes it just harder for any competitor to copy Evolution’s quickly evolving portfolio of original games.

Margins and how to attack them

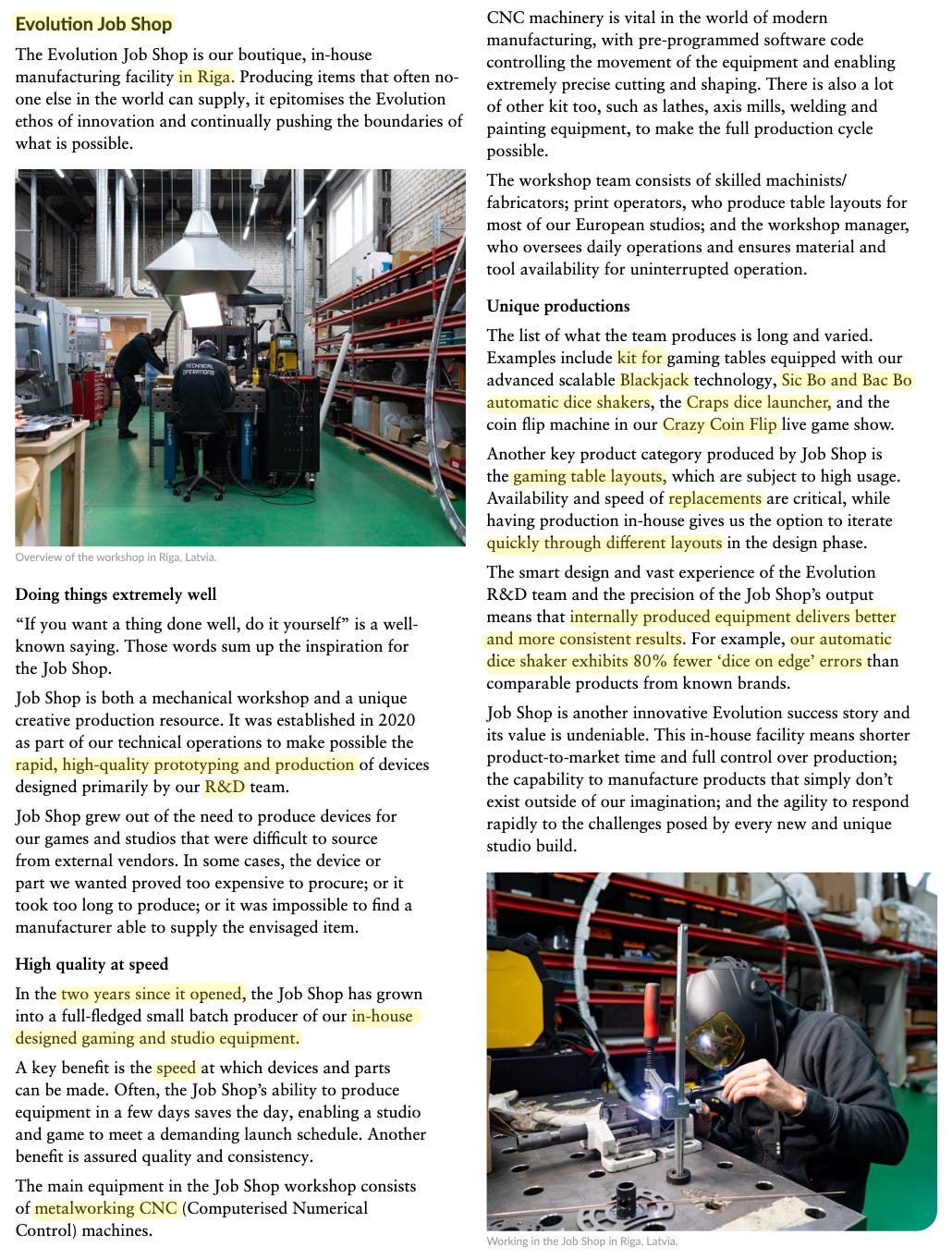

The overall transformation of Evolution’s margins as it outscales and out-innovates everyone else in the space is a thing of beauty.

You just need to look at a competitor to see how much of this boom was not just dumb luck but due to the company’s relentless execution. Even though an older company, Playtech’s Live Casino division is currently operating at Evolution’s 2016 scale and, thus, margins.

Evolution has proven that it has a virtually limitless upside potential, that seems close to pointless for me to try to forecast. Therefore, I believe an informed shareholder’s primary area of concern should be to watch out for possible downside risks.

Margins that go up can also eventually go down. In fact, the market’s invisible hand should be doing all it can to make them revert to the mean.

Let’s try to find a few ways that margins can go down in the coming future, so that we know what to watch out for in Evolution’s future operating results.

#1: Salaries

Looking at the above graph of Evolution’s margins, it is clear that the bulk of the profitability expansion came from generating more sales per employee.

For an online service business model, Live Casino is a relatively personnel-heavy operation. After all, the main differentiator of Live Casino as opposed to all other forms of online gambling is interacting with a live dealer.

Through the years, Evolution increased its studio and market scale, innovated on games that allowed for more simultaneous players and, consequently, increased the amount of GGR each dealer generated. Halving the proportion of sales paid as salaries doubled its operating margins.

Senior Executives

Compensation level of Evolution’s senior executives has been a hot topic recently. Although rising in euro terms, the proportion of it in terms of sales has actually been on a long-term downtrend, with the exception of 2021.

An important part of the compensation to executives has been the stock-based incentive plans. Thanks in part due to mediocre stock performance in the last couple of years, the dilution from these programs has been minimal compared to the business performance in the same time frame.

Between 2016 and 2023, the concluded total dilution hasn’t topped 2%, compared to around 5% of estimated maximum dilution originally estimated. Since the latest incentive proposal for 2023/2026 was scrapped at the last minute, the upcoming dilution from the one remaining program doesn’t look excessive.

Side note regarding the upper management: Two independent directors with finance backgrounds and no gaming experience were hired from the USA just weeks before the much discussed complaint to the New Jersey regulator and the subsequent turmoil.

I think it’s reasonable to conjecture that a US listing was probably in the works which was subsequently cancelled or, at least, postponed.

Workforce

Let’s come back to the topic of the work force. In 2022, Evolution’s headcount grew 27% (vs 36% revenue growth) to over 17,000.

Of almost 4,000 new hires in the year, roughly 3,300 were hired for studio operations, 2,000 in Georgia (the country), 1,000 in USA and 300 in Malta.

Live dealers make the bulk of Evolution’s work force. These are entry-level jobs with relatively low salaries and high turnover. However, one can guess that the definition of an entry-level salary varies significantly between countries. Together with the global inflation, hiring thousand employees in North America is bound to raise the average employee cost, even when we take out the compensation to senior executives from the equation.

2022 results have displayed a distinct increase in the company’s average salary, despite the expanding scale and thus growing proportion of lower-paid operations headcount in comparison to other employee groups.

Moreover, non-executive salaries increased their proportion to Evolution’s sales for the first time since 2016.

This can reasonably be seen as the cost of entering the potentially very lucrative US market. Nonetheless, increasing personnel efficiency has been the primary engine of Evolution’s decade-long margin expansion, and it is an area I will be keeping an eye on.

#2: Taxes

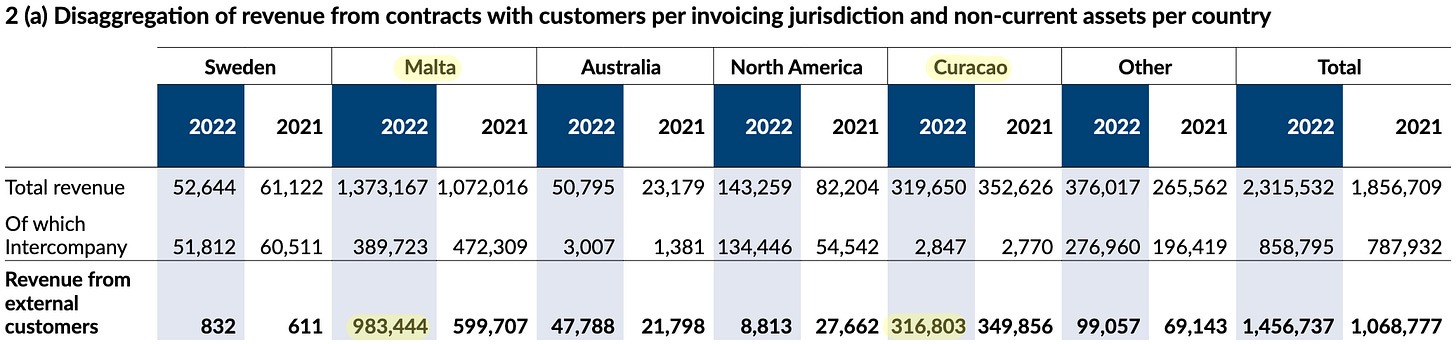

Evolution channels almost 90% of its sales through Malta (5% tax rate) and Curaçao (0% tax rate) to keep its corporate income taxes as low as possible.

Its total tax rate in 2022 was 7%.

As management has been warning for a while now, the coming implementation of the global 15% minimum tax treaties is around the corner.

Assuming that Evolution is already paying an around 25% tax rate in other jurisdictions, putting a global floor of 15% would easily push the company’s total tax rate to 16%.

To give a sense of things to likely come, applying such a tax rate on Evolution’s 2022 results would drop the company’s profit margin from 58% to 52%.

#3: Acquisitions

The last area of potential risk to profitability is more about common sense profits rather than accounting profits.

In the last 3 years, Evolution made acquisitions of almost 3 billion euros worth (in cash, stock and earn-outs) with the goal of expanding from Live Casino to RNG/Slots. To give a sense of scale, Evolution earned less than 2 billion euros of FCF in its entire existence.

Furthermore, these acquisitions were not made at conservative valuations. Evolution acquired NetEnt at 62 P/E, Big Time Gaming and Nolimit City at 27 P/E.

As a consequence of the high valuations, the overwhelming majority of these purchases were recorded as goodwill on the balance sheet and, so, are not regularly amortized from the profit figures.

The discussion of whether and how goodwill should be amortized in general is well above my level. However, in this specific example of RNG studios, everyone can make their own common sense judgement.

Here is a thought experiment: If one were to (generously, I think) assign the accumulated goodwill of €2.3B a useful life of 10 years, that would wipe out 1/4th of 2022 profits.

As for the concrete accounting figures, a write-down may be coming up. As part of the Big Time Gaming’s purchase agreement, Evolution now estimates that it will owe former BTG owners €80m instead of €115m as the performance-based earn-out consideration in 2023. A second earn-out of same size is due next year in addition to the outstanding earn-outs to Nolimit City.

Additionally, Evolution also added a new disclosure regarding the assumed useful lives of recognized assets to the annual report this year.

RNG: Beating a dead horse

Ultimately, my critique regarding the slots developer acquisitions arises from their subsequent abysmal business performance. One way to interpret this failure is to conclude that RNG is a structurally low-moat business where it is relatively inexpensive and straightforward to develop and run competing games even for small companies.

Yet, a table provided by management makes me wonder if there is more at play.

Evolution’s excellent execution in Live Casino is beyond reproach, and the table above proves that. In the last 5 years, while the Live Casino market grew at a rate of 22%, Evolution’s Live Casino grew at 46%!

What surprised me even more was how quickly the RNG market was growing. Moreover, the growth during the period seems to be more weighted to recent years, as the trailing-5-years RNG market growth was marked as 15% in 2021 and 9% in 2020. These growth figures make Evolution’s lack of almost any organic growth in RNG even more dramatic. Could it be that not only is RNG a bad business but Evolution is specifically badly situated to succeed in it for one reason or another?

Not to end on a sour note, a possible failure to grow RNG is a relatively limited risk to Evolution, as long as the management is perceptive to the concerns in question (and they seem to be) and doesn’t compound the risk with similar acquisitions. Either they accomplish a dramatic turnaround in slots and prove me unnecessarily pessimistic in this matter or slots simply remains an uninspiring side business in pursuit of offering a more complete portfolio of online casino games.

Thank you for reading.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

goodwill section made me think - very good writeup. thanks

Wow, thank you for this incredible information Ali!