Evolution's 2025

A Year in Decline

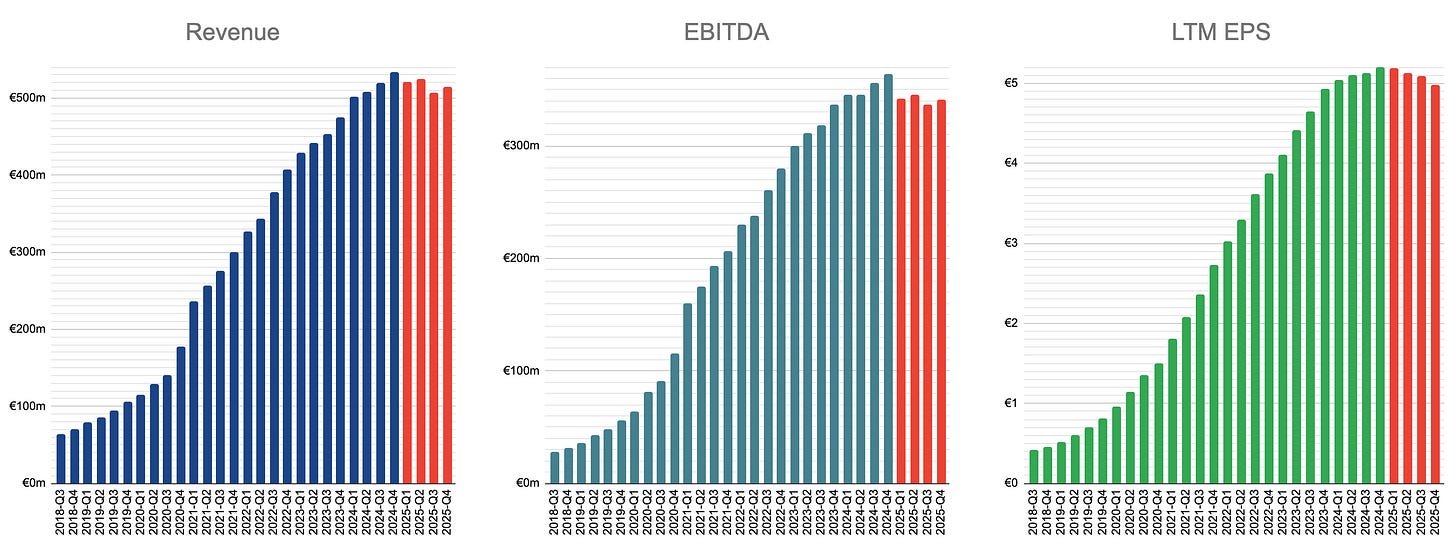

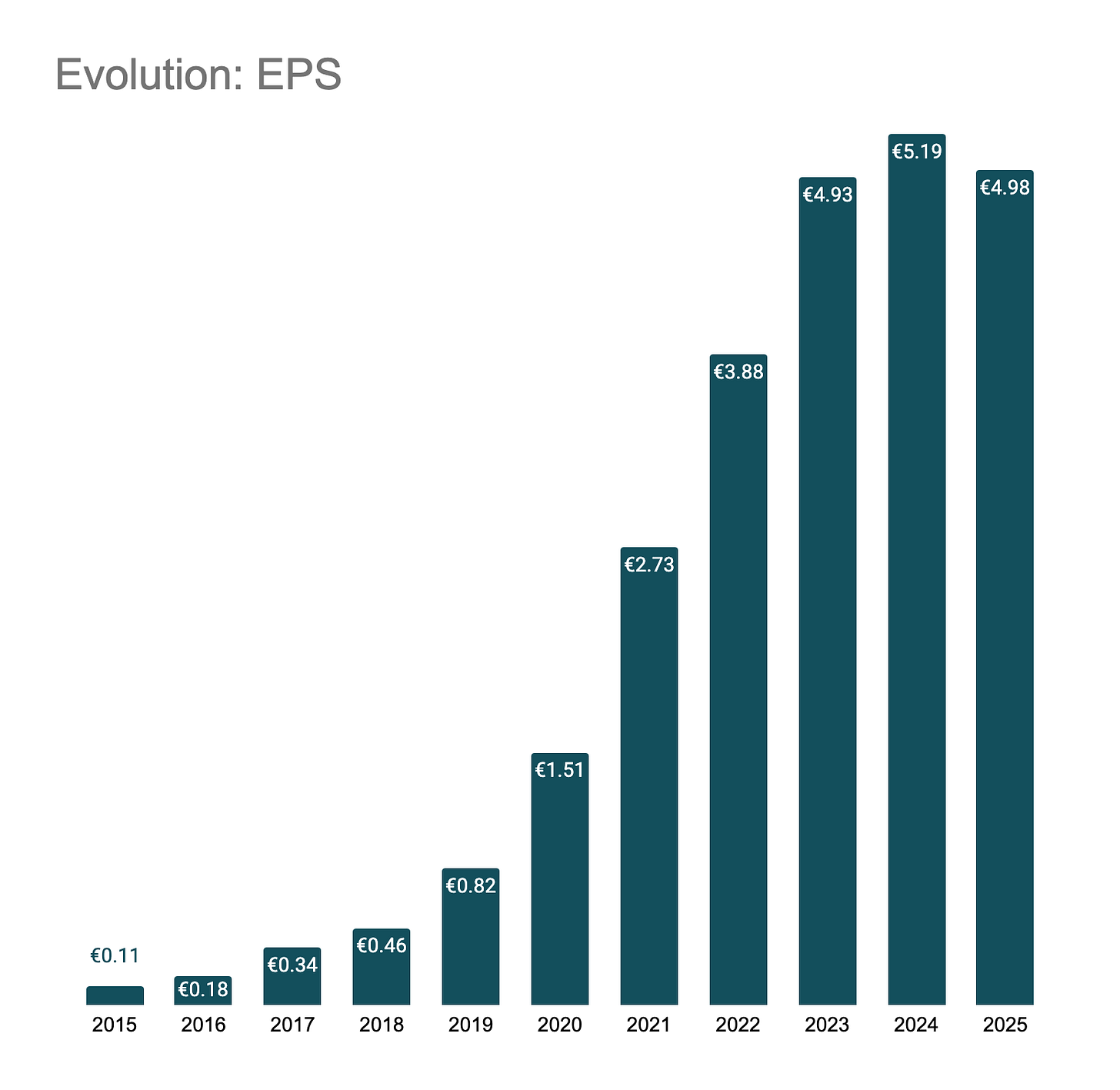

If 2024 year was the most difficult year until then, 2025 may very well prove to be the best of the years to come for the foreseeable future.

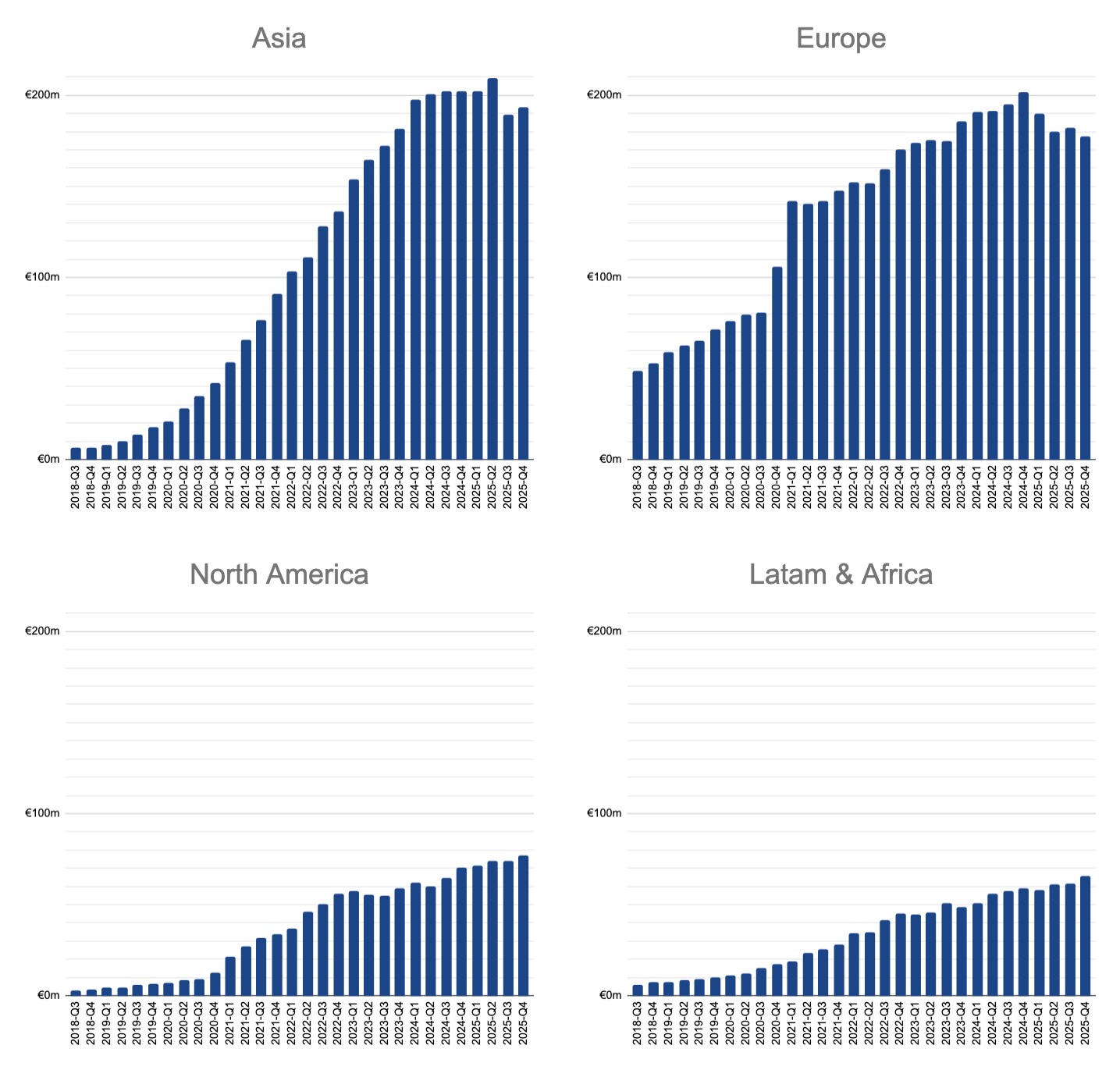

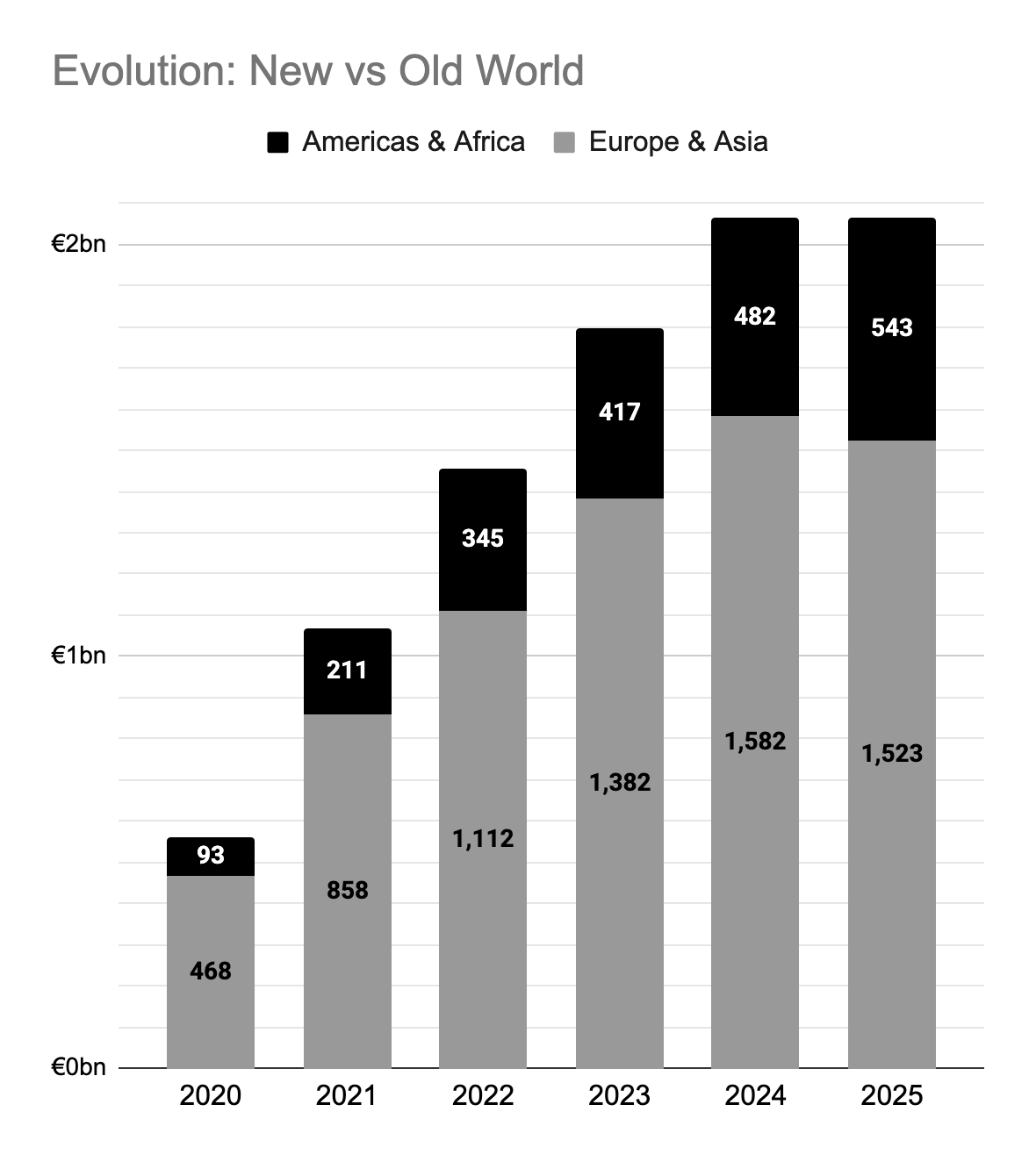

New World vs the Old

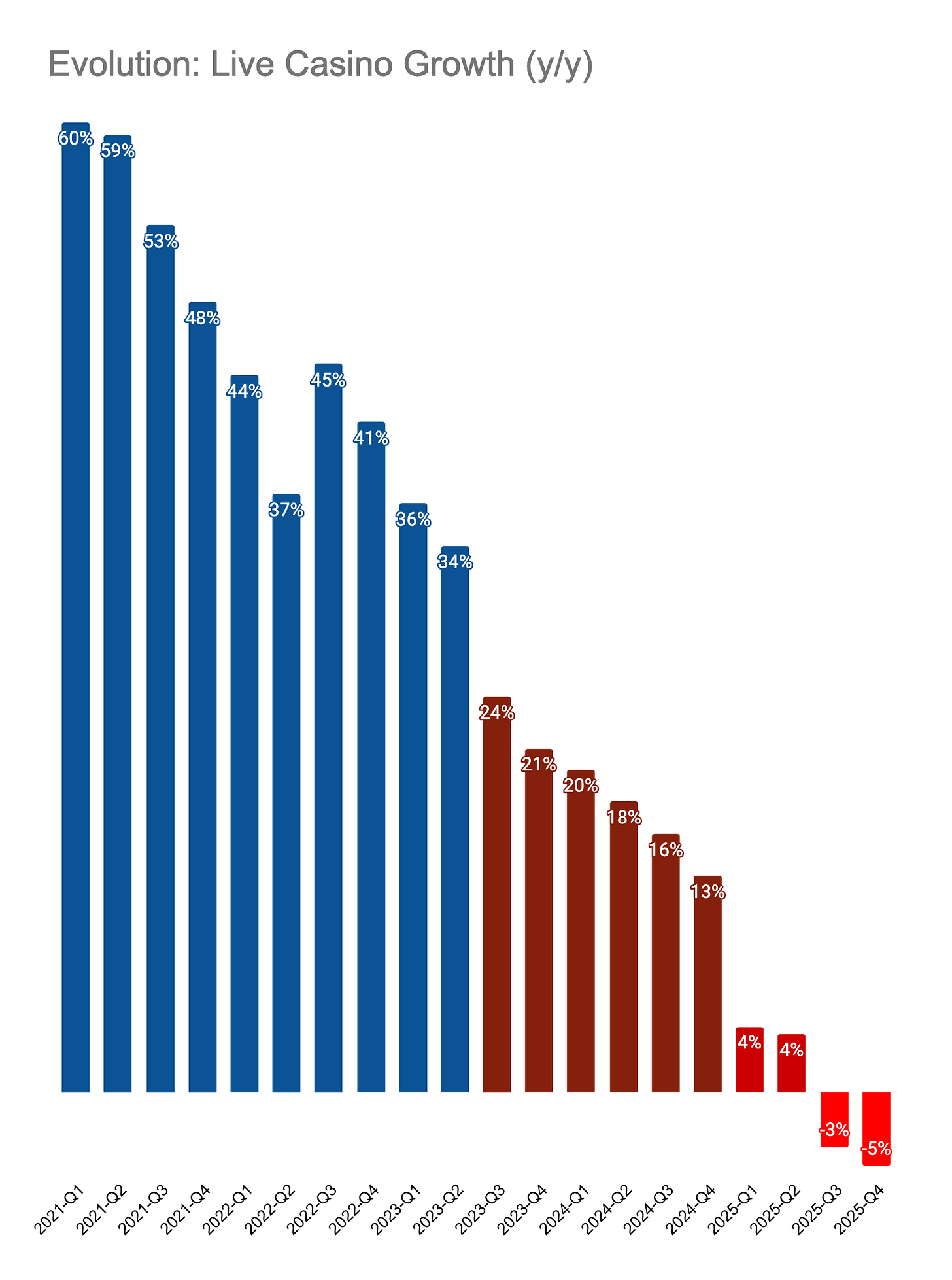

Evolution is facing a clear bifurcation of fortunes in its markets: Sales from the (in iGaming industry standards) older markets in Asia and Europe face stagnation and even decline. In the meantime, North and Latin Americas as well as the emerging Africa continue to provide much a needed growth.

I prefer to follow the regional growth trends in the local reference currencies. This is Euro for the European region and US Dollar for the rest of the world.

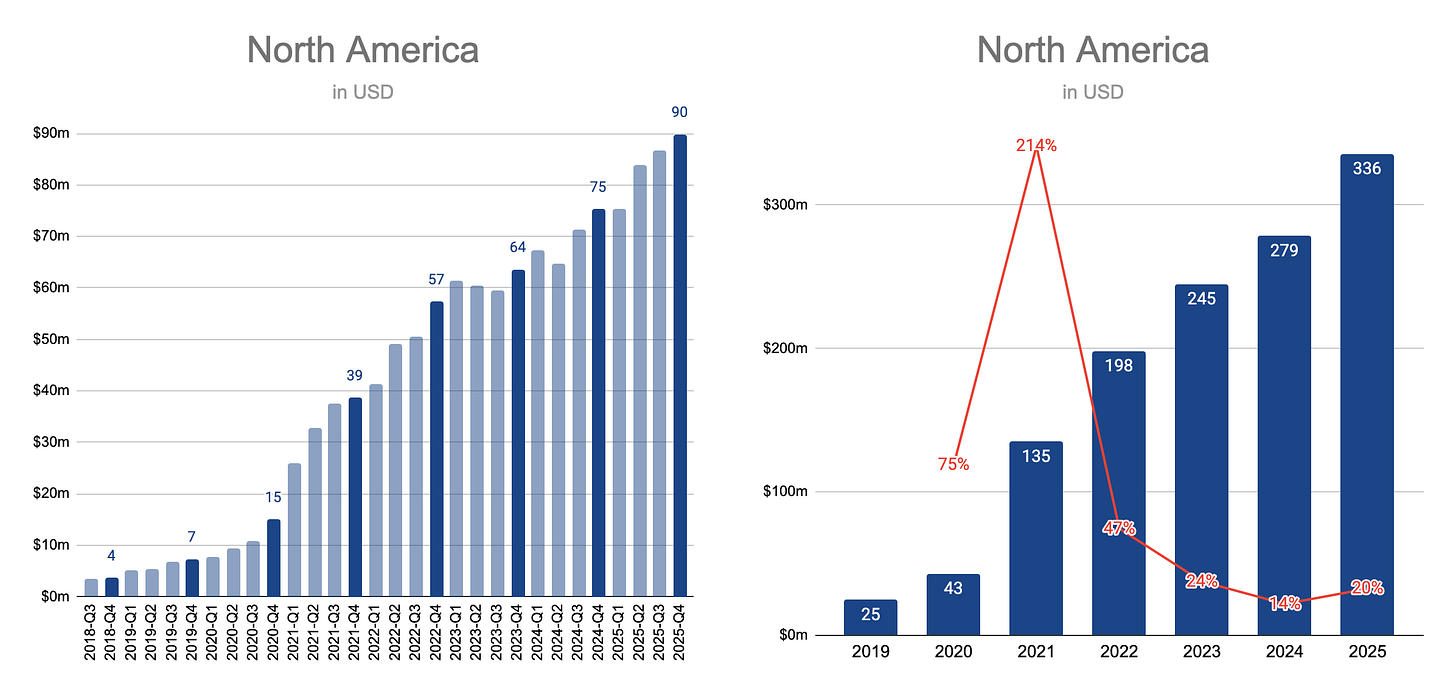

New World: North America

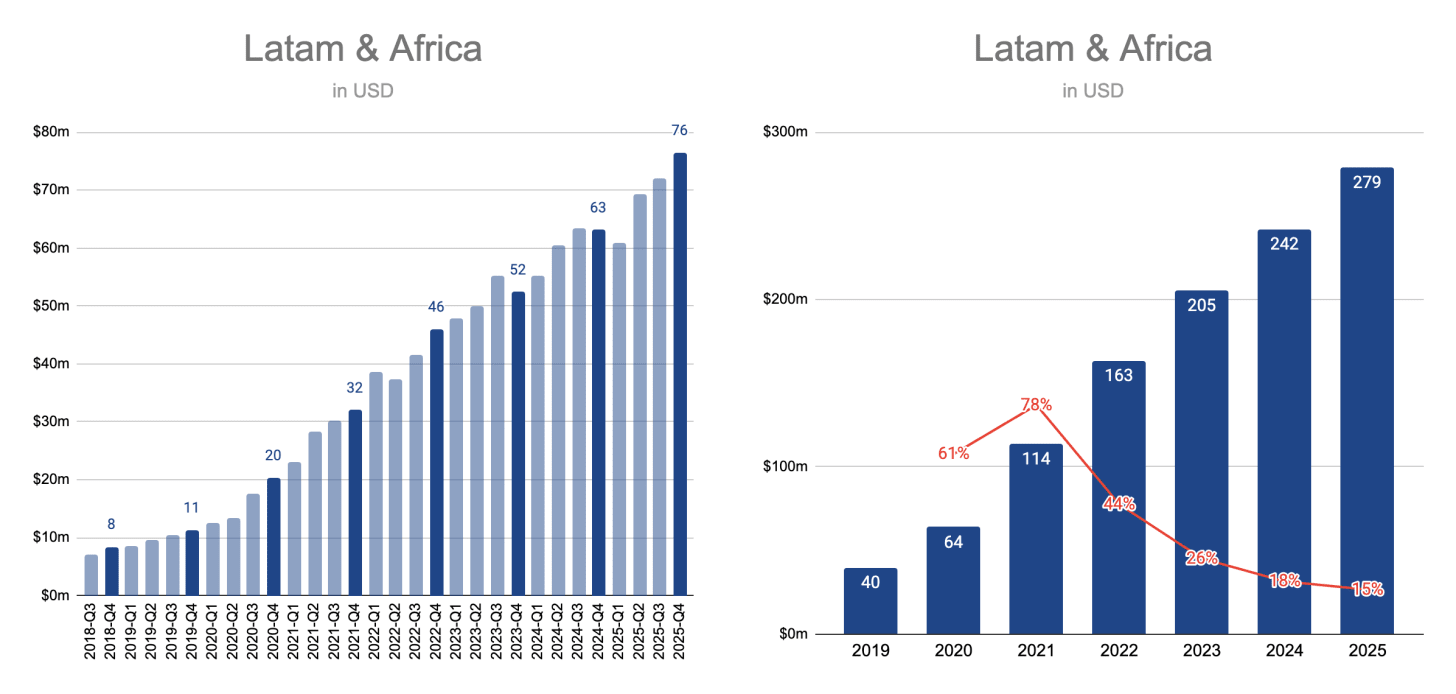

New World: Latin America & Africa

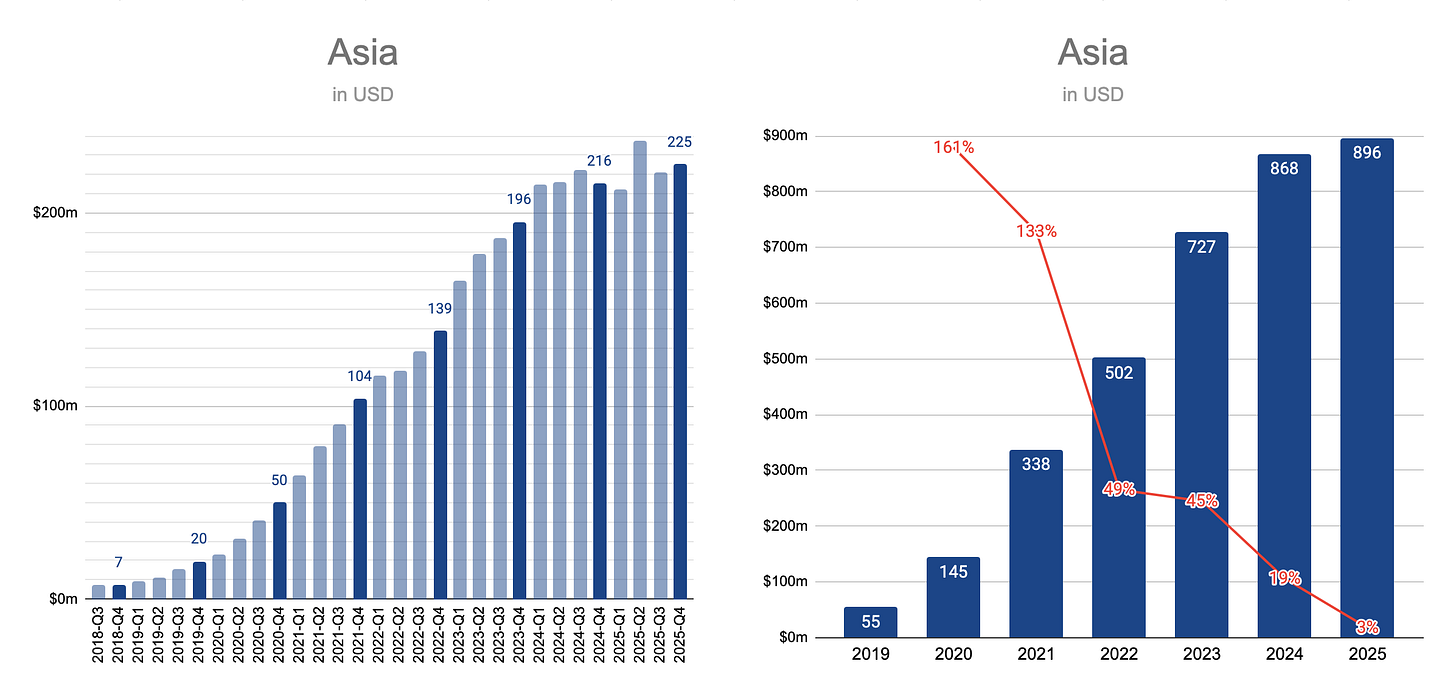

Old World: Asia

As more time goes on, it becomes more apparent that the real headwind against the growth in Asia is player-side saturation rather than piracy, in my opinion. After all, when asked directly, the management admits that they don’t know Evolution’s market share in Asia and hence can’t estimate a true financial impact of piracy. This ambiguity plus the prolonged slowdown suggests that the demand growth for Evolution’s products is likely much lower than it was just a few years ago.

In his earnings call remarks, CEO Carlesund noted that the company sees a player shift toward game shows. This could possibly be taken as a sign that Evolution is facing increasing competitive pressures on its traditional table games, a category with lower barriers-to-success and a particular popularity in Asia. Another possibility is simply that the demand in Asia is maturing just as the demand in Europe did (but hopefully without a similar ringfencing needed for a long while.)

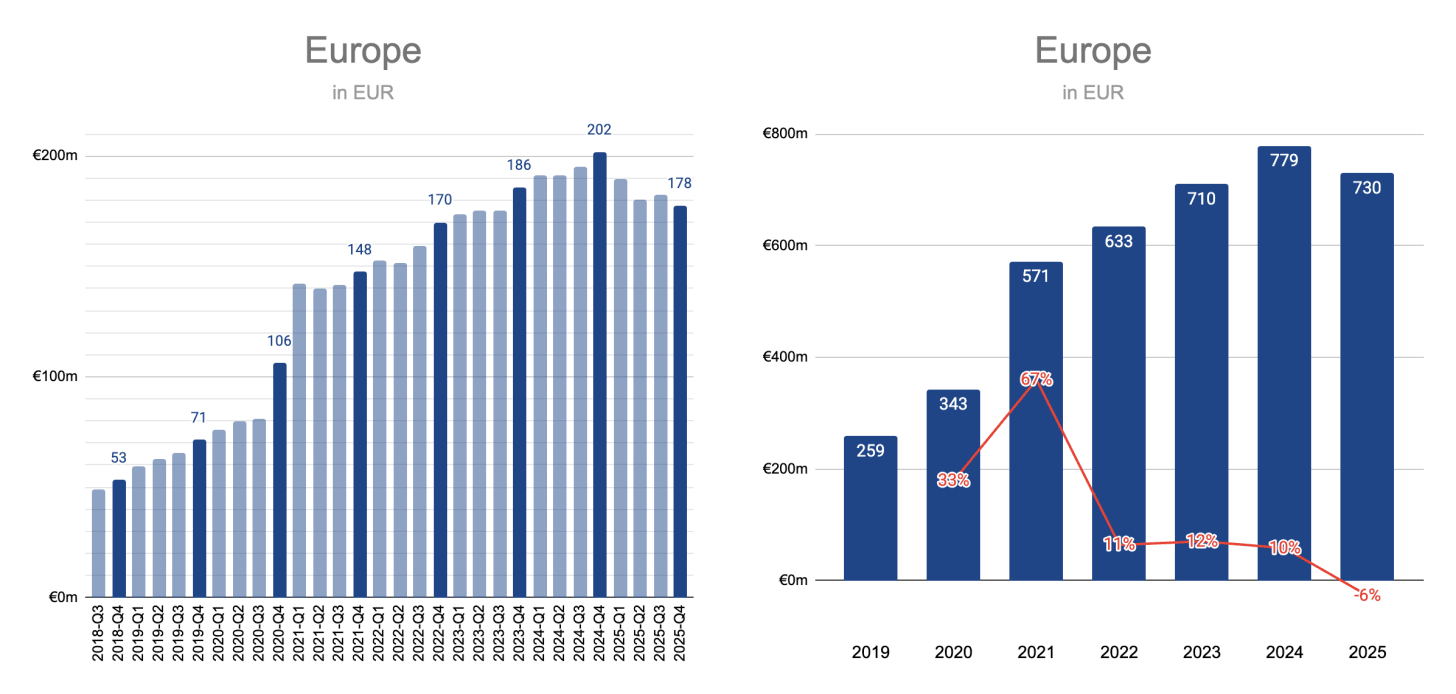

Old World: Europe

As feared, ringfencing seems to act as a fundamental barrier to growth and a base for further decline.

Outlook: Managed Decline

“Our primary focus will be on the USA, Latin America and new innovative games. We will also invest in Europe, but slightly less aggressively.”

— CEO Carlesund

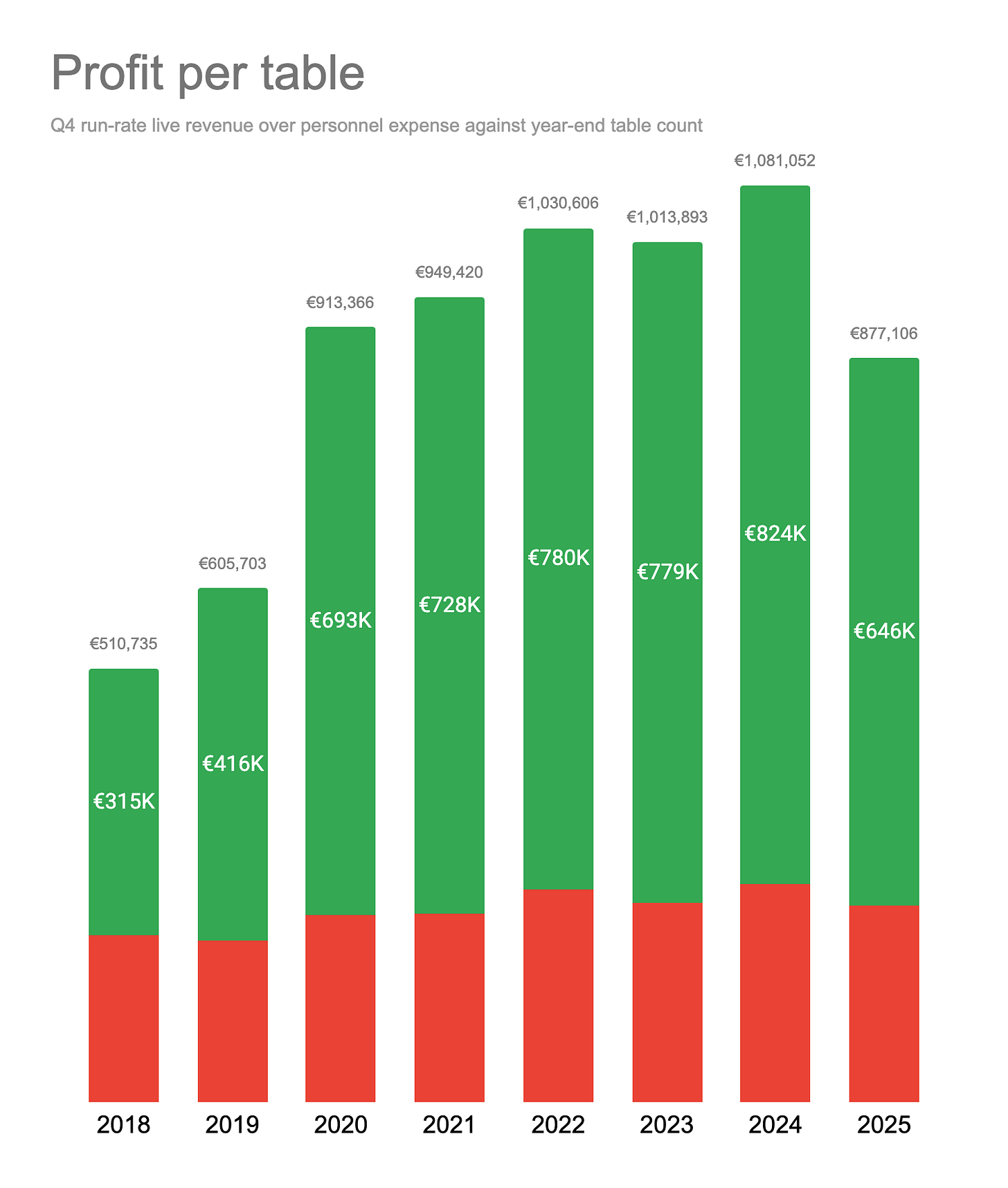

Management has guided for a clear shift in their focus for expansion away from Europe (which also serves Asia) and toward the Americas. Here, it is important to put things into perspective. Europe and Asia currently provide roughly 3/4ths of Evolution’s sales. Moreover, there is a fundamental difference in profitability between the business models of the old and the new worlds: For most of the Old World, Evolution streams from a few central studios in Eastern and Southern Europe to numerous markets. On the other hand, major markets of the New World limit such operating leverage by requiring local studios (by location in the US states and by language in Brazil). Thus, it is likely that the Old World offers much higher profit margins on those sales by design.

It is difficult to imagine a realistic scenario where growth in the New World markets would compensate for a decline from the Old World. This imbalance could be a serious obstacle against stable earnings for years to come.

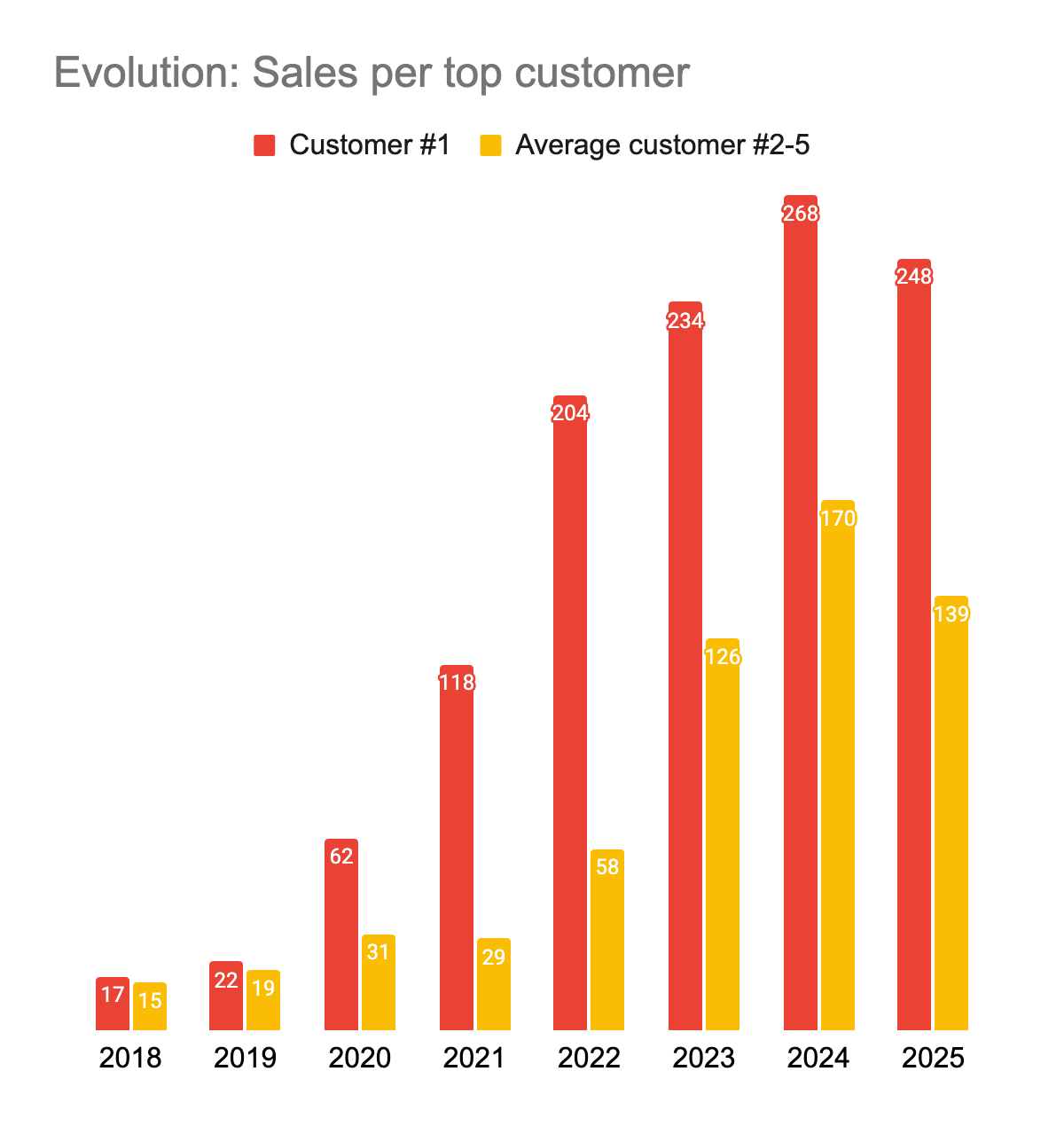

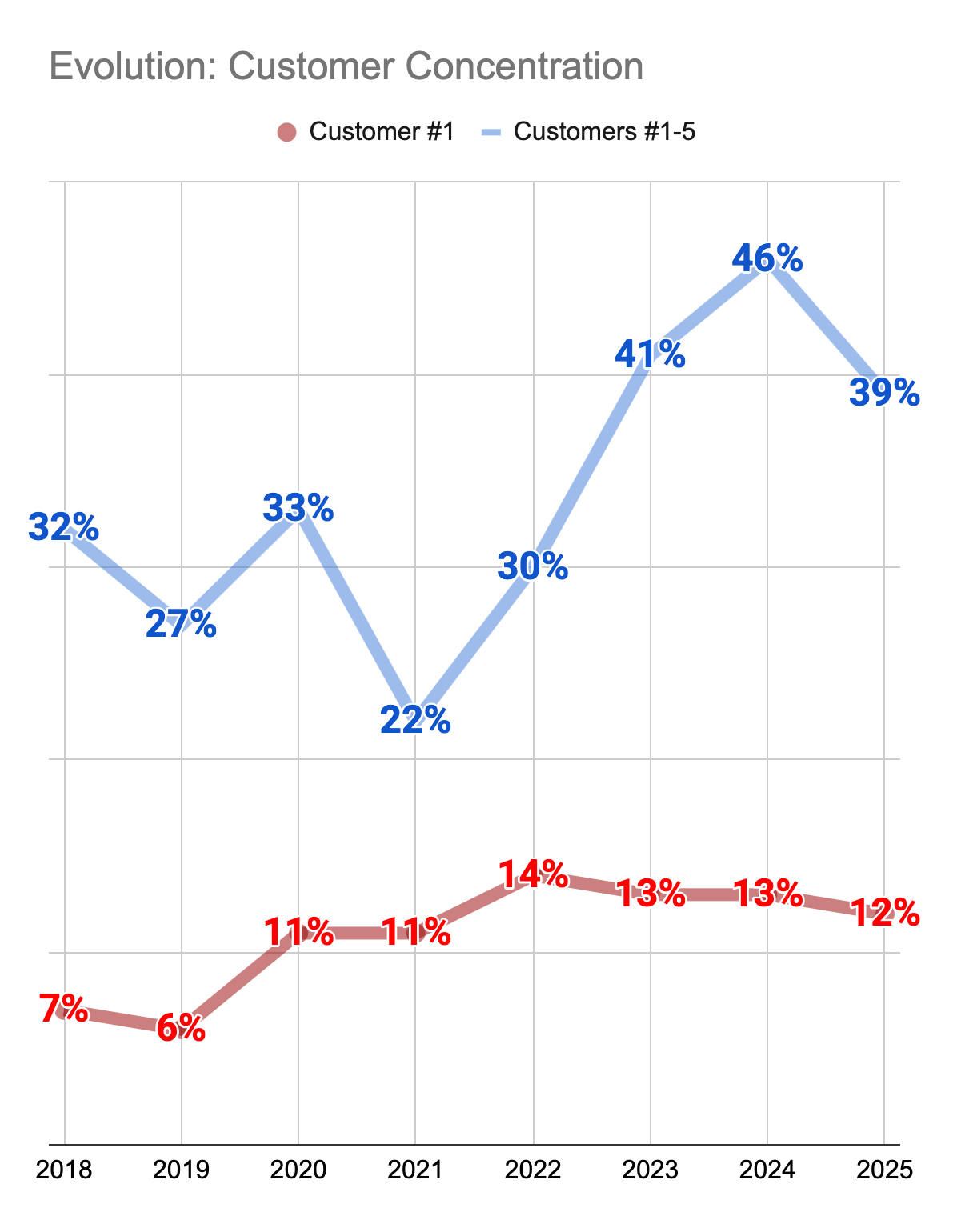

Losing Big Customers

At first look, Evolution’s lessening dependency on its top customers reads like very good news after years of intensified concentration on a few customers.

However, how this lessening happens matters. In this case, it has largely happened by declining sales to top customers. In 2025, sales to top-5 customers declined by a whopping 15%.

Operating Leverage in Reverse

Finances

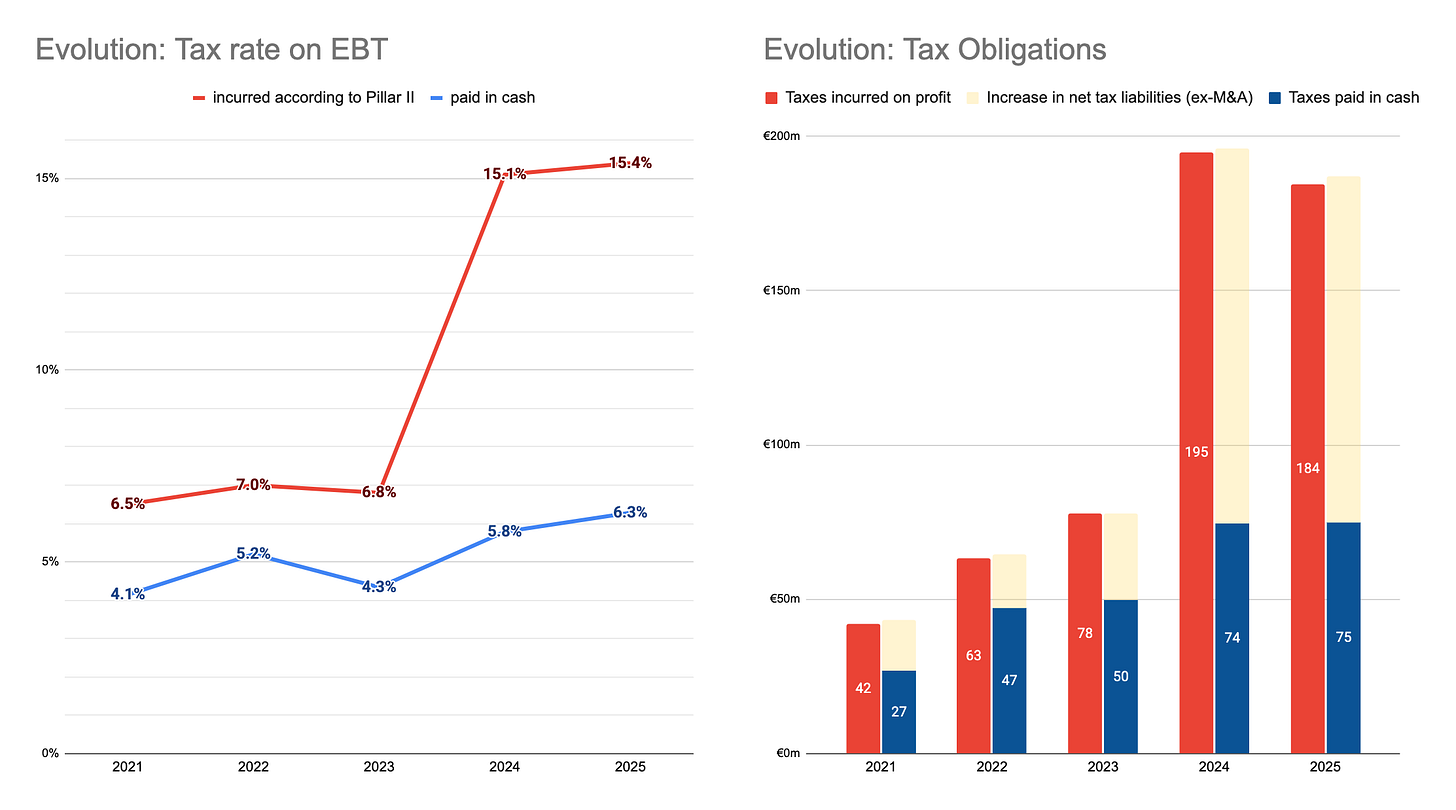

Tax Limbo

Over the last 2 years, Evolution has accumulated roughly €200 million of “ghost taxes”, incurred on the income statement due to the Pillar II minimum tax scheme but not actually paid in cash.

Theoretically, 2024’s top-up tax should be paid in 2026, but management was non-committal in their comments on if/when/how payments are to be made. If this €200 million is to be paid, it should be further deducted from cash-based metrics. If not, that would unlock the reserved cash to be allocated.

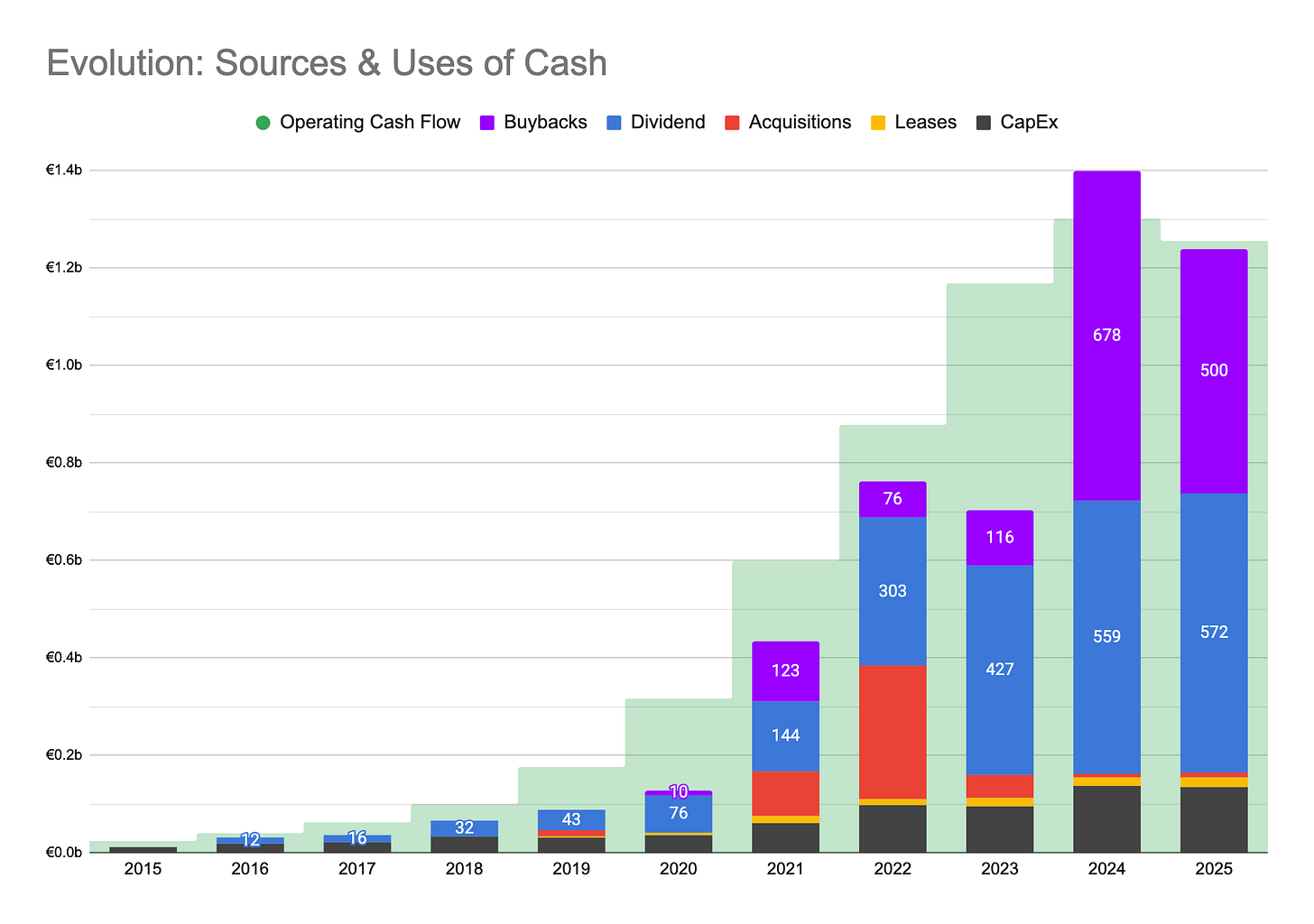

Cash: Sources vs Ambitions

The end of the seemingly endless growth and the uncertain outlook could force the company to face some hard choices with its cash allocation that it could avoid in the past.

Result

Note: All figures exclude accounting-only revenues from earn-out reductions and their effects.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

What is your take on capital allocation please? It is quite intriguing that the company postponed the announcement of dividend and share buyback to later this quarter.

amazing analysis, Well DONE!!!

unfortunately I am trapped for some time with Evolution.

I hope that could turn Asia business first and continue expand their Americas business.

but I am not confident anymore. probably they should remove dividend and focus in buying new companies and their own shares