Evolution's 2023: Year in Review, Part II

Tidbits from the annual report plus some comments on gray market risks

Games Portfolio

Evolution’s game shows have become the company’s biggest game category by player count this year.

As Todd Haushalter mentioned in a talk, Evolution’s top 5 games by player volumes are all game shows. The increasing popularity of these proprietary games over classic table games can only strengthen Evolution’s competitive advantages over other suppliers.

Another interesting bit from the annual report explained how Evolution’s scale enabled the quality of player experience that would be uneconomical for a smaller rival to strive for.

Although it is hard to measure or compare, I suspect Evolution’s internal culture of mindful experimentation had a big role in how the company ended with the world’s leading portfolio of innovative Live Casino games.

Similar to last year, the industry growth rates for Live Casino and RNG draw a picture of two vastly different performance levels inside the company.

In the last 5 years, while the Live Casino market grew at a rate of 24%, Evolution’s Live Casino sales grew at 44% annualized! However, Evolution’s organic growth in RNG was close to flatline, while the RNG market grew at a not-so-slow 21%, as a sign of vast market share losses in RNG for Evolution.

And, the losses didn’t come due to a lack of effort.

In the last 3 years, Evolution launched no less than 226 new games in RNG in contrast to 44 games in Live Casino.

Now that the once much discussed strategy of flooding the market with game launches has proven ineffective, the future of Evolution’s RNG strategy seems to depend on the effectiveness of OSS (One Stop Shop) and the promotional channels it enables.

With the completed OSS integration of the games portfolio, Evolution promises to offer a number of RNG improvements.

Smarter analytics: smarter lobby for players and better player tracking for operators

Simultanous playing of Live and RNG games on the desktop

Livespins: social betting along with streamers

Spin Gifts: player promotions paid by Evolution

One of the defining features of Evolution’s business model has been that the marketing-to-players costs are left to the operators. Although I don’t expect it to be a big impact on finances initially, Spin Gifts seems like a significant departure from Evolution’s model so far. This is probably an unavoidable result of competing in the cutthroat RNG market where suppliers like Pragmatic spend significant amounts on various marketing schemes.

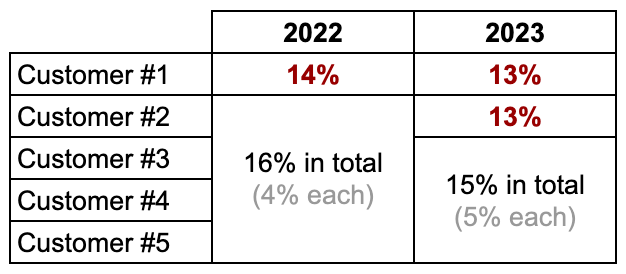

Top-2 Customer Concentration

Annual report gave important color on the nature of increased customer dependency.

It turns out that Evolution now has 2 big customers that each generate 13% of its sales.

Margins

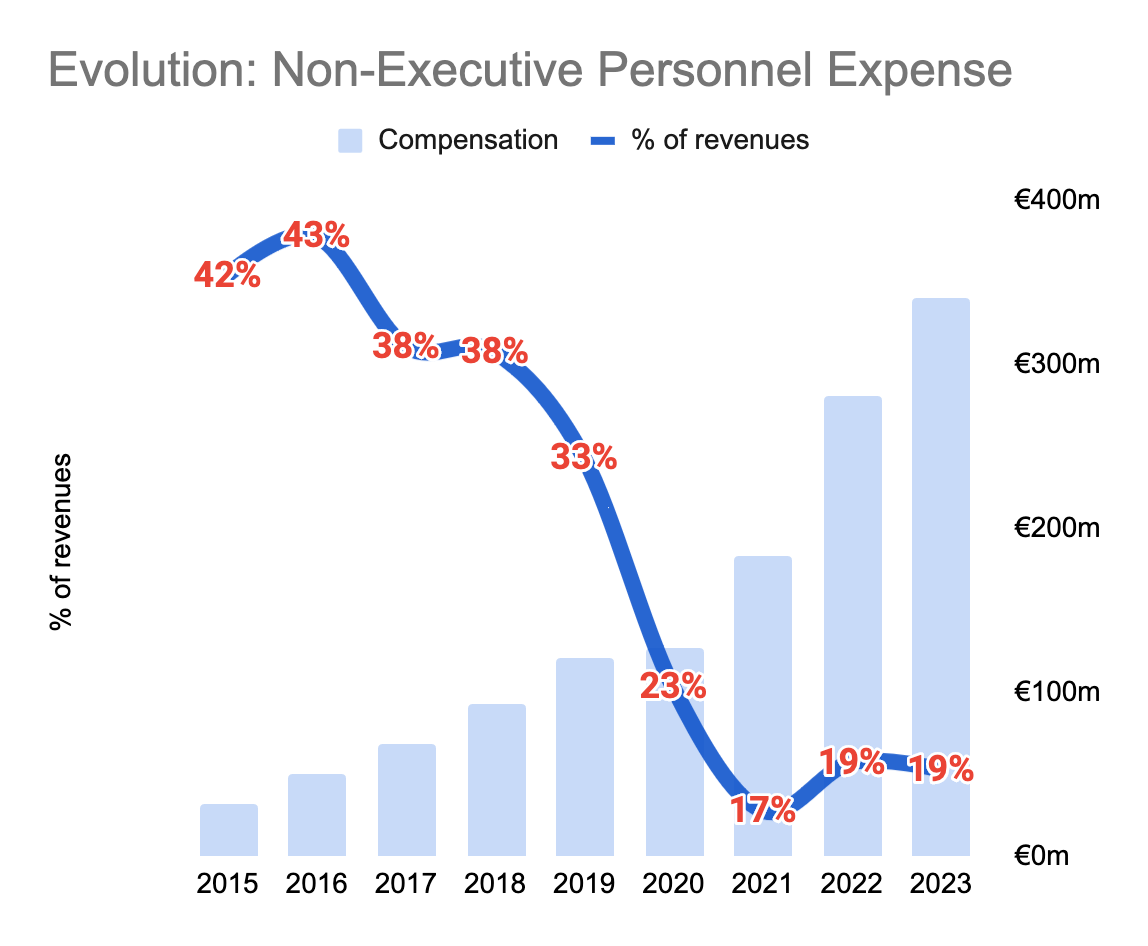

In the last decade, Evolution’s personnel and other operating expense margins were halved thanks to increasing scale of sales with the business model’s operating leverage. This resulted in profit margins that more than doubled in the same time frame.

Personnel: Compensation & Hiring

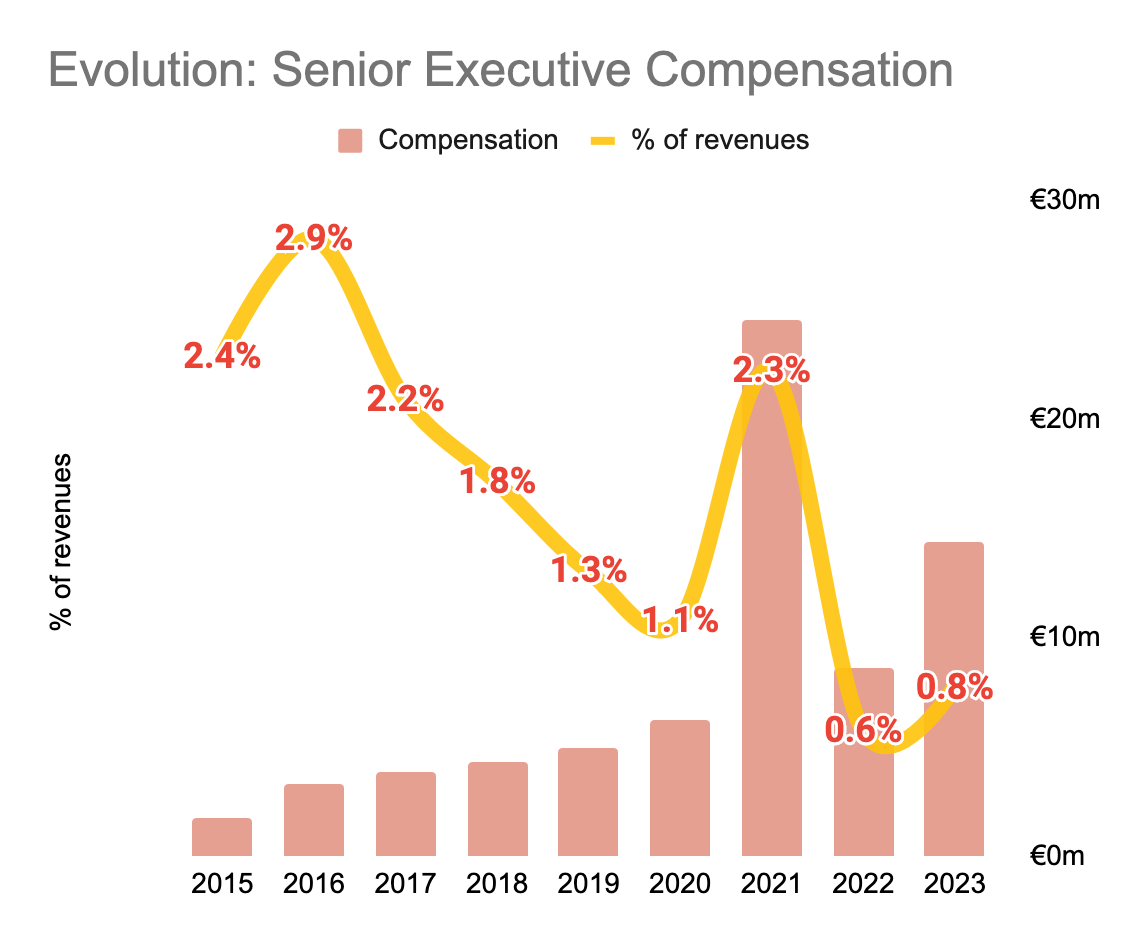

Senior Executives

Despite much activity on the determination of incentive schemes, senior executive compensation as a portion of sales continues its long-term decline trend.

Dilutions from the stock-based incentive schemes for key personnel have been limited.

Workforce

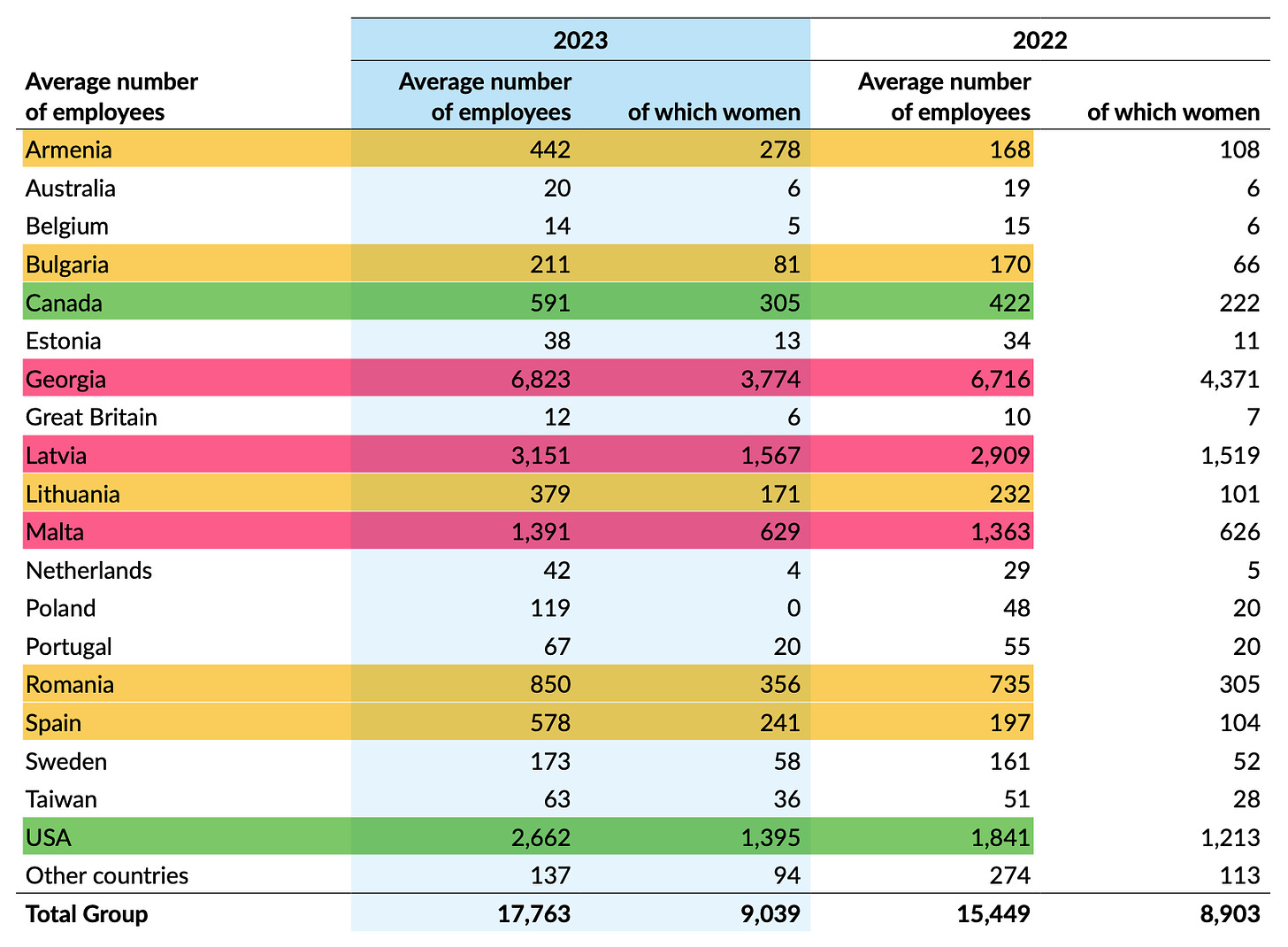

Company’s slower-than-expected studio expansion (with a final jump in the last quarter) has been discussed both in this newsletter and admitted by the management. However, the employee numbers by geographies gave details of not only a slower expansion but also an imbalanced one.

Evolution hired roughly 1,000 new personnel in North America, similar to the expansion in the previous year. (The company plans to reach 4000+ employees in the region by the end of the year.) The company also hired a respectable amount of roughly 850 employees in the peripheral European studios of Armenia, Bulgaria, Lithuania, Romania and Spain. However, the hirings in its three main studios has been a completely different story.

These main hubs hired less than 400 in the year. Even more poignantly, two main hubs with international language tables in Malta and Georgia (which hosts Evolution’s largest studio) hired only 135 people compared to over 2,200 in the year before.

Despite the overweight of hirings in North America (with higher wages and lower market scale), salaries of non-executive workforce as a portion of sales remained small.

Furthermore, a new disclosure also lets us calculate the average salary earned by a typical employee that works in front of the camera (€11K) versus in other company operations (€38K).

It’s important to note that many dealers work part-time.

Taxes

Similar to previous years, Evolution channeled 92% of its sales via low-tax jurisdictions of Malta and Curaçao.

The resulting tax rate for the company in 2023 was only 6.8%. However, the company estimates that the tax rate would have been 16% if Pillar II (of the global minimum tax initiative) was in effect. That’s a tax hike of 135%!

Sweden’s Pillar II top-up tax have come into effect this year. In other words, in Q1 2024, Evolution will need to grow 11% over Q4 2023 just to reach flat QoQ profit.

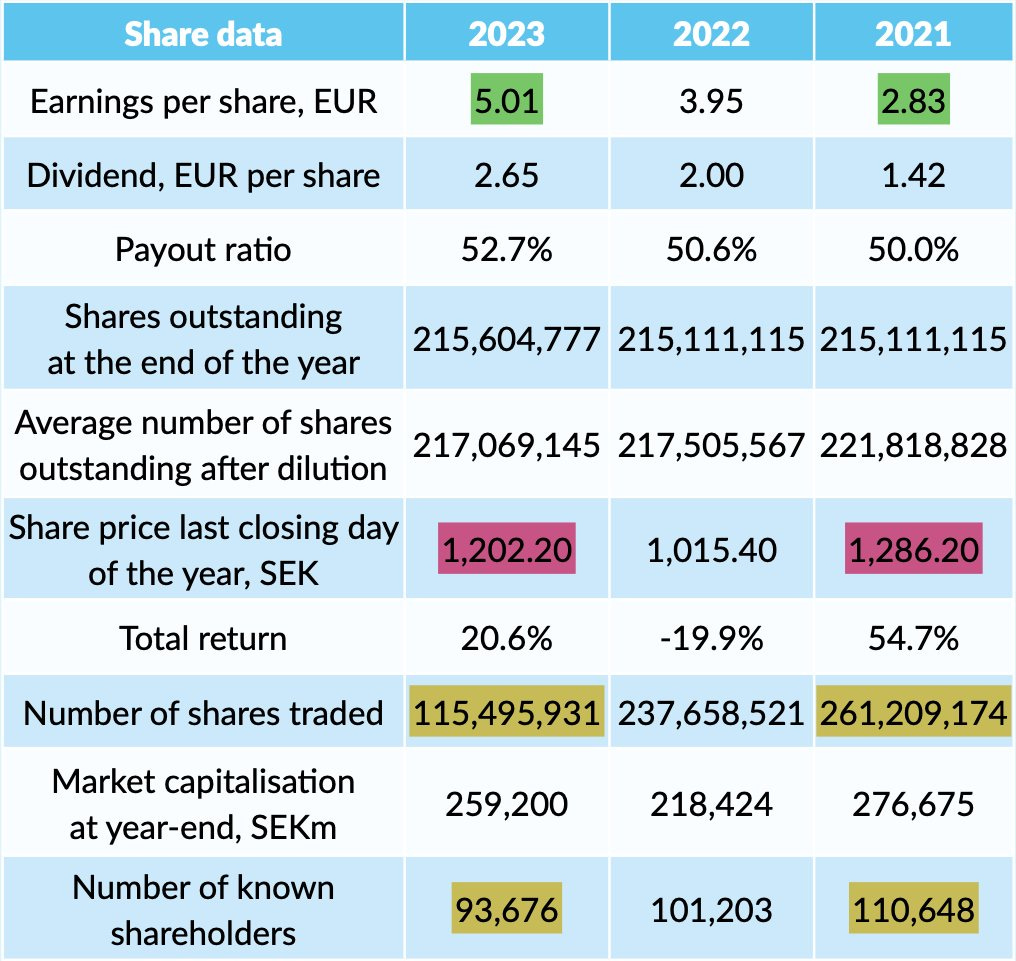

Shares & Shareholders

Foreign institutions own a majority of Evolution for the first time.

In the last 3 years, company’s fundamentals progressed nicely, while trading volume and the numbers of shareholders have dwindled.

Between November and March, Evolution bought back ~3.6 million shares at roughly 20 P/E with a €400m budget.

After issuing ~0.8 million shares last month and likely cancelling ~4.6 million shares this week, ~3.9 million shares (corresponding to ~1.8% of total share count) will be eliminated.

The Board

Board members directly represent over 12% ownership of the company. However, if we count those with nomination committee seats as well as those who waived their right to a seat, the board has the indirect backing of 44% ownership.

Capital Group now owns 1/6th of the company. Joel Citron (0.6% owner) took over the key man role of chairing all committees from Jonas Engwall last year.

Focus on Compliance

In 2023, the board doubled their meetings per year and created a new committee for compliance. As a further sign of increased attention to compliance, company’s legal team grew from ~100 (in 2021 and 2022) to ~120 people.

The Grey Markets panel from last month’s NEXT Summit New York is also an interesting watch on how regulators approach regulated market compliance in relation to unregulated market activities.

BONUS: Commentary on InPractice Risk Report

InPractice has been researching Evolution’s unregulated sales channels and recently published a report on the risks that could arise from their Asian end-markets and the usage of cryptocurrencies. Thankfully, they have publicly shared a summary of the risks they found.

I would like to share my humble personal opinions on the relevancy of these risks. As always, I’d welcome criticism.

Risk #1: Wide-spread crypto betting (”~30% of Asia GGR”) makes current performance unsustainable

I fail to see a major risk from players’ betting with crypto currencies, as opposed to various emerging market currencies. As Pratyush Rastogi expertly points out, Evolution continued growing its EBITDA and Asia revenues during the “crypto winter” of 2022. In response to the report, the company also disclosed that it sources only a low-single-digit percentage of its GGR from crypto-betting.

Risk #2: Stablecoin usage in parts of the payments channels between operators in unregulated markets and Evolution (enabling ”~50% of EBITDA”) creates disruption and counter-party risks

If stablecoins never existed, transfers of payments from unregulated markets (whether in the form of plain cryptocurrencies or more traditional financial channels) would still happen today, if maybe at a somewhat higher friction. The only proven way of effectively eliminating unofficial money transfers facilitating online gambling has been regulated online gambling.

As for the counter-party risk of stablecoins’ losing their pegs to USD, I think it’s best to consider the scale of the risk in question. Let’s assume that Evolution:

sources ALL of its unregulated sales (60% of revenues) via B2B stablecoin transfers

invoices on a monthly basis

collects on those invoices in around 2 months

In the extreme scenario that stablecoins disappear overnight, the most at risk for Evolution would be a one-time loss of 2 months’ revenue. In addition, it would take some time for operators to adjust their transfer systems and adapt to a possibly higher friction environment. However, I fail to see a long-term damage from even this most extreme of scenarios.

Risk #3: Concentration of distribution in a few Asia aggregators

In my simplistic view, players and their product preferences are all that matter in the long term. Aggregators and operators (especially in unregulated markets) are interchangeable. Just because an aggregator is a major customer of Evolution doesn’t mean that the they can afford to exclude Evolution games from their offerings and thus have a disrupting amount of negotiating leverage over Evolution. I also fail to see how a disruption in one aggregator’s operations could prevent players from accessing their favourite Evolution games from alternative channels.

Risk #4: Dedicated table fees are counted towards operators’ license country and hide additional exposure to unregulated markets

Majority of Evolution’s revenues come from commissions on operators’ GGR rather than dedicated table fees. I can’t imagine that the hidden exposure could amount to high enough to change Evolution’s big picture. The aggregator-serviced operators of unregulated markets should tend to use non-dedicated tables, anyway.

Risk #5: Unregulated market concentration in Korea & Japan (”~50% of Asia revenue”)

Although I appreciate InPractice’s whole effort to explore possible risk areas, this is the only claim mentioned in their summary that could possibly impact Evolution’s long-term business performance, I think. I will be keeping an eye on any news or disclosures related to South Korea and Japan.

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.

Great work

Great stuff as always, Ali!

My 2p:

1. Evolution published an industry-beating 5-year growth rate, but of interest to us should be their more recent growth rate. On a recent earnings call (the one where you asked a question) an analyst suggested their growth was lagging the industry, iirc.

2. the "cryptocurrency" risk, as I understood it, refers to the fact that a significant number of players are based in countries where online casino isn't legalized, but they manage to play thanks to certain technologies incl. crypto. The risk is that these countries take action and Evolution loses substantial revenue.