Evolution and the Doom of Playing It Safe

Why becoming "a little bit better every day" does not always work

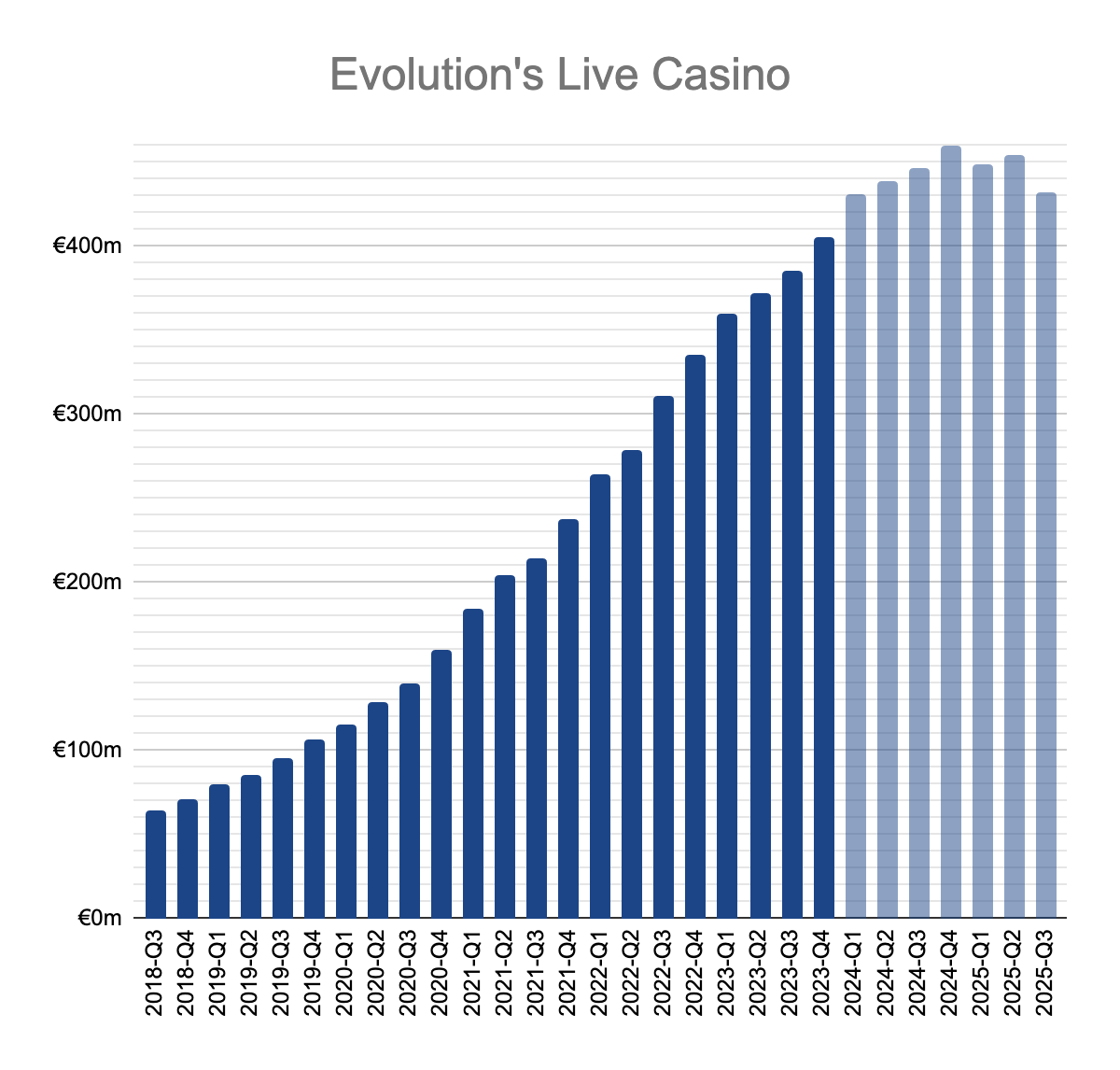

From its founding in 2006 until 2023, Evolution grew at an incredible pace.

Most of this time, Evolution had the best games, an outstanding execution and the largest scale, as it still has today. However, that extraordinary growth was mainly made possible by the continuous arrival of new players to online casinos.

Running out of Blue Ocean

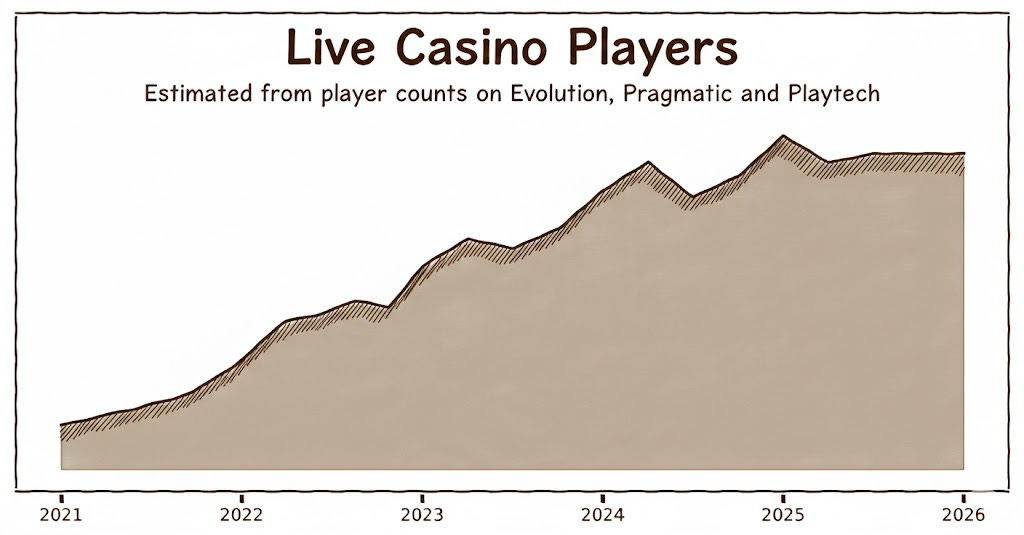

That chain of net player growth seems to have been broken in the last two years.

There are a few ways to explain this:

Most people in the world (outside China) have already been exposed to online casinos by 2023 thanks to:

easy global access to offshore casino sites that arguably offer a superior player experience with few regulatory restrictions on KYC, deposits or game mechanics

mainstream awareness about online casinos due to post-COVID marketing boom (with ads, affiliates, influencers and spam)

When offered casino-style gambling, only a certain portion of people tends to be interested in partaking. That demographic may have largely been on-boarded by online casinos by 2023 one way or another, regardless of local regulatory conditions.

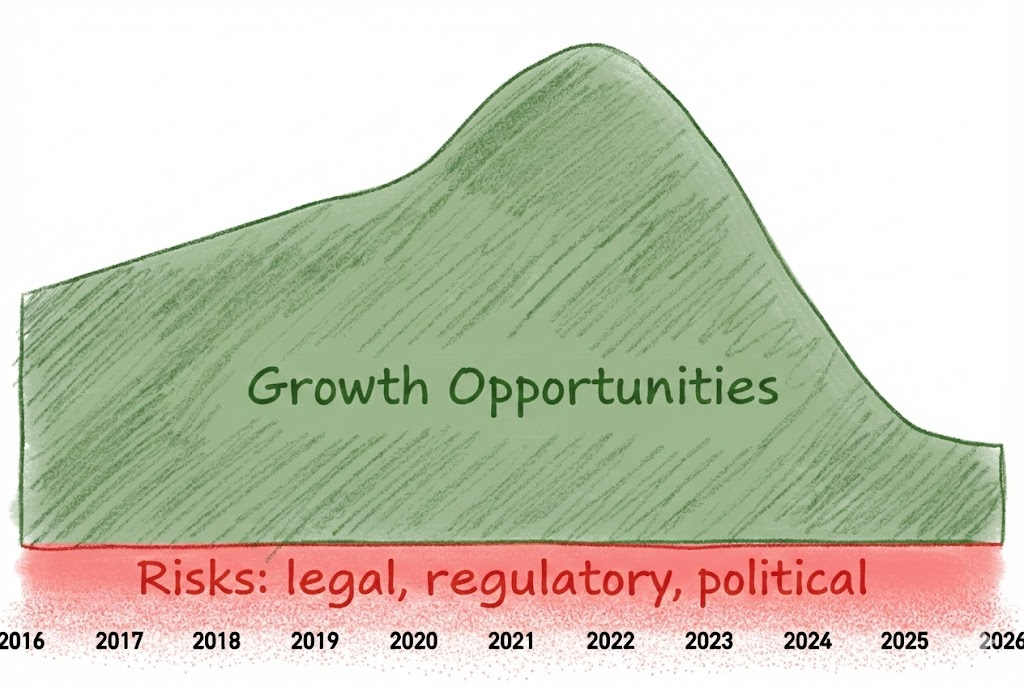

Most remaining pockets of potential net player growth (especially those with meaningful per-capita discretionary spending power) are inaccessible for large and visible suppliers like Evolution that have to maintain their licenses and reputations with various regulators who increasingly look at suppliers for enforcement.

Newer forms of online gambling (such as prediction markets and various crypto schemes) gain shares of online gambling spend, especially with younger generations.

This has left the owners with a peculiar company: excellently run but with few growth opportunities and ever-present risks. Those risks which have always been lingering used to be more than compensated by the enormous upside potential of the opportunity set. Not as much anymore.

On the one hand, other than its speed, Evolution’s market-forced maturation is nothing out of the ordinary. Every company grows and, then, matures at some point. So, it would not be unreasonable to accept the company as it is today: a mature best-in-class of a moderately cyclical sector with a conservative financing focused on steady shareholder returns. (Even a share cannibal.)

On the other hand, I can think of no other blue chip champion with so much of its consumer sales channel outside local legal frameworks. Simply put, the long-term survival risk of the business model takes up too much headspace for a slow-and-steady long-term ownership, in my opinion.

Is it possible to return to growth?

No prognostication of doom would be complete without a call for salvation. And, here is mine.

The Opportunity

Let’s start with a thought experiment. If we were to conduct a global survey and ask the following questions to the common person on the street, what would the responses will be?

Question #1: Are you aware that it is possible to bet on sports online?

Question #2: Are you aware that it is possible to play casino games like roulette, blackjack and baccarat online?

Question #3: Have you heard of Crazy Time? (Alternatively: Explain what a game show is and ask whether they are aware of such games.)

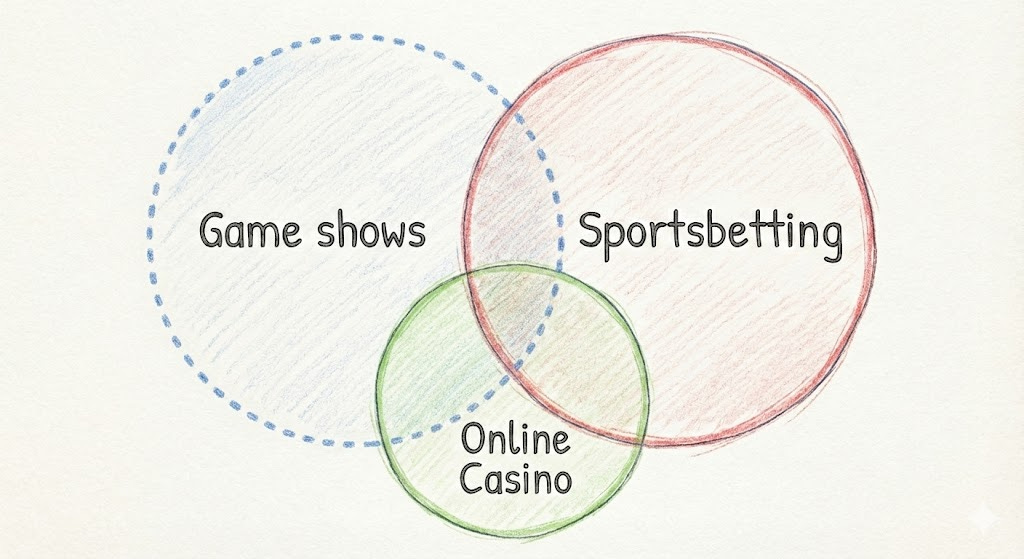

My guess is that you would get a positive responses of over 90% for the questions #1 and #2. I would also guess a low single digit percentage rate of yes to the question #3.

There are many forms of gambling in the world, both online and offline. Some people bet on sports. Some play table games or slots. Others play bingo. Some pay in to prize drawings. Some buy scratch cards or lottery tickets. Not every player is interested in every game type. Different types of gambling have different cohorts of potential players, and game shows are likely to have substantially distinct populations of potential players from casino-style games and sports-betting.

The unfulfilled opportunity arises from the fact that game shows are not (and will never be) overly marketed in the mainstream by those that are traditionally tasked with marketing: the operators. The typical operator mainly markets sports-betting in the mainstream with the hope of channeling some players to their more profitable casino sections. When marketing to already-gamblers, casino-style table games are also marketed to gain players from online or offline competitors. However, it is in no operator’s economic interest to dedicate a major portion of mainstream (aka the most costly type of) marketing to game shows due to a simple factor: Game shows are proprietary to their suppliers. It would be akin to expect Aldi or Walmart to market Coca-Cola. Sure, those chains would like consumers to visit their stores to buy Coca-Cola, but spending hugely to market a branded product available in all major competitors do not make economic sense as a priority.

Finally, my idea rests on one big assumption: There is a huge number of people out there who would never be interested in either sports-betting or casino games but would potentially love playing game shows. These potential players do not and will never know that their favorite game even exists, unless Evolution figures out a way to let them know.

How-to

Firstly, my assumption on potential game show demographics and their distinctiveness from casino games and sports-betting should be easy to study for a company of Evolution’s resources. (I personally suspect a big untapped potential among older women.)

As for marketing, I can think of endless ways how Evolution could create awareness of its game shows in the mainstream public. There are traditional ways like ads, billboards, sponsorships, celebrity collaborations, product placements. And, there are guerilla marketing tactics, numerous smaller-scale localized events. Then, there could also be wholly new, not yet invented ways. Just as an example, imagine Evolution’s lobby to host one-off time-exclusive events like comedian shows or boxing fights, similar to how Las Vegas draws in players.

The critical point in how to execute marketing successfully is taking it seriously. Just as I have no idea which game release by Evolution will eventually lead to the greatest success, I have no idea which marketing strategy would result in the best returns. As an investor, all I can say is that good products and good marketing can have great ROI with Evolution’s business model.

If the company decides to explore this opportunity, it would surely need a visionary leader to see it through. A second Todd Haushalter but for marketing, if you will.

Challenges

Any unproven opportunity comes with risks and challenges. Here are a few I can think of:

Marketing would bring an immediate hit to the margins. An imaginary €100 million annual budget means an immediate 5% reduction of the margin figures, regardless of whether it will bring satisfying future returns. Here, I hope that the management’s mantra of prioritizing growth over margins prevails.

Returns of any mainstream marketing campaign is likely to be difficult to measure, especially with any immediacy. Even though a long-term view is necessary, waste of capital is definitely a significant possibility.

“Half the money I spend on advertising is wasted; the trouble is I don’t know which half.”

— John WanamakerGambling products are not ordinary products and come with various restrictions for different venues and localities. Obviously, Evolution is bound to maintain its high compliance level, and this will limit its possible marketing tactics.

The last but, in my opinion, the most critical challenge in pursuing this strategy for Evolution would be building the right team for it. Even though Evolution enjoys the biggest scale of resources among its competition, I expect that - just as in product development - dedicating large resources won’t guarantee results, especially in such a novel product category.

Finally, I will end with the response I received from CPO Todd Haushalter after I personally pitched him an overview of this idea: “I would do it if it was just my company.”

Disclaimer: This is not investment advice. Please read the full disclaimer in the About page.