EVO Tweets (2020-2022)

Feb 01, 2023

Here are some of my past $EVO commentary on Twitter going back to 2020.

Ali Gündüz@gnufs

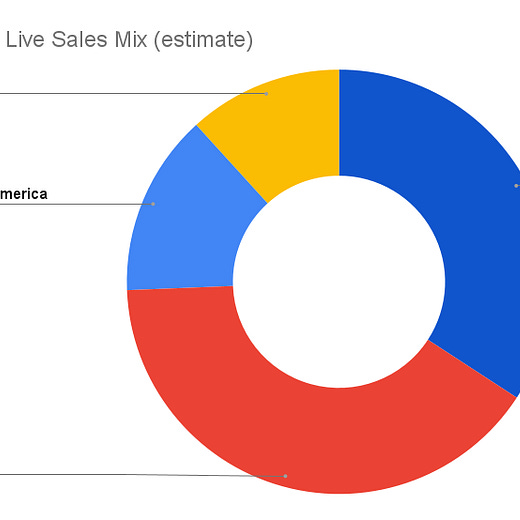

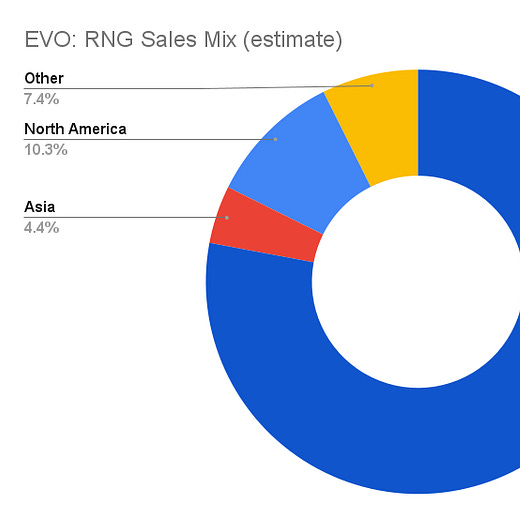

My estimates for $EVO's geographical Live and RNG market mix

Point 1: Asia is $EVO's largest Live market

Point 2: RNG is almost all Europe (could explain the slow growth?)

Note: numbers not meant to be precise, but as an overall estimate of the current big picture

2:01 PM · Nov 18, 2022

1 Repost · 26 Likes

Ali Gündüz@gnufs

$EVO achieved a higher growth rate in Q3 compared to Q2

So, let's revisit the annual growth rates, now with the midpoint values between the two quarters to find 2022's run-rate

1) $EVO's Total Growth

10:16 AM · Nov 1, 2022

1 Repost · 26 Likes

Ali Gündüz@gnufs

$EVO Q3 big picture in a few charts

...and some shareholder comments

1) Sales Mix

- pretty strong 11% QoQ organic growth in Live

- RNG continues to struggle with organic growth

7:37 AM · Oct 27, 2022

5 Reposts · 61 Likes

Ali Gündüz@gnufs

Let's test a regulatory bull case for $EVO:

Assumption 1:

Biggest reg. risk against $EVO could mainly come from Europe🇪🇺🇬🇧 & NA🇺🇸🇨🇦 regulators, rather than the ones in fragmented grey/black market of Asia+Others.

12:05 PM · Oct 15, 2022

22 Likes

Ali Gündüz@gnufs

$EVO Q2 big picture in a few charts

...and some shareholder comments

1) Sales mix

Headline: Slower but higher quality growth

- Slowest QoQ and YoY sales growth for >4 years

- BUT organic regulated revenue growing at the highest rate. Good news for the long-term.

6:41 AM · Jul 21, 2022

9 Reposts · 66 Likes

Ali Gündüz@gnufs

$EVO's Todd Haushalter gave a very interesting talk at @iGamingNEXT yesterday

First, how successful US operators will look like in 5 years:

- Generous RTP & loyalty programs

- No/low wagering req. + fast & easy cash-out

- Only quality games (not the widest variety) *wink wink*😉

9:55 AM · May 13, 2022

13 Reposts · 135 Likes

Ali Gündüz@gnufs

$EVO Q1 big picture in a few charts

1) Sales Mix

- stable QoQ growth

7:05 AM · Apr 28, 2022

13 Reposts · 112 Likes

Ali Gündüz@gnufs

@Benif84 Yes, the business-level bear cases for $EVO I've collected are material but weak sauce compared to the upside potential. (Hence, why I stay invested)

On the stock-level, the biggest issue could be it trading at "sin stock" multiples for the long-term. (Not a deal-breaker for me)

2:12 PM · Apr 26, 2022

11 Likes

Ali Gündüz@gnufs

Now that Q4 results are released, let's a have a look at $EVO in a few interesting charts.

1) SALES MIX

Putting aside the inorganic Euro RNG boost from NetEnt acquisition in 4Q20-1Q21...

- Asia is the clear growth engine

- US & Others come in 2nd

- Europe is stable

8:02 AM · Feb 9, 2022

4 Reposts · 31 Likes

Ali Gündüz@gnufs

$EVO had a very interesting showcase presentation with different department heads presenting their plans.

88 new Live & RNG game releases are planned for 2022.

Here are my notes:

6:40 PM · Feb 8, 2022

29 Reposts · 226 Likes

Ali Gündüz@gnufs

$EVO is accused in the US by private investigators of serving end-users

- in US-sanctioned countries 🇸🇾🇸🇩

- in countries where iGaming is illegal 🇸🇬🇭🇰

- via locally unlicensed operators 🇪🇸🇸🇪🇮🇹

11:14 AM · Nov 17, 2021

1 Repost · 13 Likes

Ali Gündüz@gnufs

💡 Live Casino provides trust factor to online gamblers

💡 $EVO's game tracking for security and service is much more advanced than land-based casinos'

→ Dealers are tracked for speed/execution/friendliness & bonused accordingly ("can double their pay")

4:00 PM · Oct 23, 2021

1 Like

Ali Gündüz@gnufs

Highlights from today's $EVO announcements at youtube.com/watch?v=0zWW-p…

1) Incoming games:

- bunch of new Asia-targeting games ("Fan Tan" looks childishly simple and fun!)

- new Starburst game with very high outcome volatility

- new IP: Hasselhoff's Knight Rider

...

youtube.com

New Games 2021 | Evolution

12:47 PM · Jul 15, 2021

7 Likes

Ali Gündüz@gnufs

Why China🇨🇳 is not a significant market for $EVO:

1- Pricing is too tough

Baccarat (most popular game) is low margin

Payments are black market and may involve moving physical cash

2- No CDN access inside China → streaming difficulties

5:58 PM · Jul 14, 2021

Ali Gündüz@gnufs

UK competition authority CMA published its detailed clearance on the $EVO + $NetEnt this week.

A few interesting bits despite the many ✂️'s due to confidentiality.

A thread 👇

1:01 PM · Dec 10, 2020

35 Likes

Ali Gündüz@gnufs

Evolution Gaming's idea man @toddhaushalter laid out his expectations from $EVO's purchase of $NetEnt & RedTiger in an interview yesterday.

His points:

1) Fusion of Live + Slot games are coming in 2021! ("How would a live Gonzo Quest or Starburst would look like?")

6:23 PM · Nov 11, 2020

1 Repost · 8 Likes

Ali Gündüz@gnufs

I took some notes from $EVO Evolution's Q3 results this week.

There are many things to like and a couple of things to be mindful about...

9:30 PM · Oct 24, 2020

11 Likes

Ali Gündüz@gnufs

Here are my initial highlights and notes on Evolution Gaming's Q2 report before the management's presentation today at 9 am $EVO

drive.google.com

2020-07-17 EVO 2020Q2.pdf

6:40 AM · Jul 17, 2020

3 Likes

Disclaimer

This is not investment advice. The presented information may be inaccurate.